Although question was addressed to Tariq, who answered it beautifully just wanted to add my thoughts:

Future belongs to those who specialise. Whether we look at doctors or engineers, everyone wants a specialist not a generalist.

Future belongs to those who specialise. Whether we look at doctors or engineers, everyone wants a specialist not a generalist.

https://twitter.com/nrockstars/status/1418918038187950092

Why should companies be any different?

Everyone in value chain has a specific function.

Cdmo does not do the research, so many innovators keep the research (discovery of candidate good enough for phase 1 trial) in house & outsouce the cumbersome development and manufacturing

Everyone in value chain has a specific function.

Cdmo does not do the research, so many innovators keep the research (discovery of candidate good enough for phase 1 trial) in house & outsouce the cumbersome development and manufacturing

Some others even outsource the research & become collaborators and move up the value chain. This is where syngene and similar CRO come into the picture.

As a junior engineer you start out writing thousands of lines of code every quarter.

As a junior engineer you start out writing thousands of lines of code every quarter.

As a senior engineer you design the overall system (including experiments) and collaborate with junior engineers to execute the design and experiment, the research.

Innovators would always have chief scientists and senior scientists who would closely collaborate with CRO

Innovators would always have chief scientists and senior scientists who would closely collaborate with CRO

But actual research can be outsourced to the CRO. why do this though?

1. It helps reduce costs because cros and cdmos have optimized for the specific function. Can pfizer create a cdmo in the future? It sure can. But the big bucks don't lie there.

1. It helps reduce costs because cros and cdmos have optimized for the specific function. Can pfizer create a cdmo in the future? It sure can. But the big bucks don't lie there.

CDMO is a very asset intensive business. Look at the asset turns for wuxi or samsung biologics. It is pathetic. The ROE barely makes any sense. Nobody is going to talk about this though, coz it goes against established narratives.

why would pfizer want to get into a lower value add business?

Their scientists have a century of experience (172 years to be precise) thinking about how to create a drug. They would want to become asset light, convert capex to opex, increase ROEs and ROCEs.

Their scientists have a century of experience (172 years to be precise) thinking about how to create a drug. They would want to become asset light, convert capex to opex, increase ROEs and ROCEs.

2. Other thing is innovators are a US or europe based organization. For them to maintain a CDMO in US is way less efficient than to collaborate with chinese/korean/indian CDMOs. Look at the asset turns for European CDMOs versus Indian CDMOs.

Value chain:

Idea for what drug can solve which disease developed over a 172 year experience curve.

>

CRO for vetting that idea (innovator idea)

>

CDMO for the drug (innovator idea)

>

Bulk production of API (non patent protected drugs)

Pfizer is right up the value chain.

Idea for what drug can solve which disease developed over a 172 year experience curve.

>

CRO for vetting that idea (innovator idea)

>

CDMO for the drug (innovator idea)

>

Bulk production of API (non patent protected drugs)

Pfizer is right up the value chain.

Btw Pfizer has 80% gross margins but only 25% operating margins. A Huge reason for this is the 20% R&D costs.

This of course includes R&D they do in-house.

This of course includes R&D they do in-house.

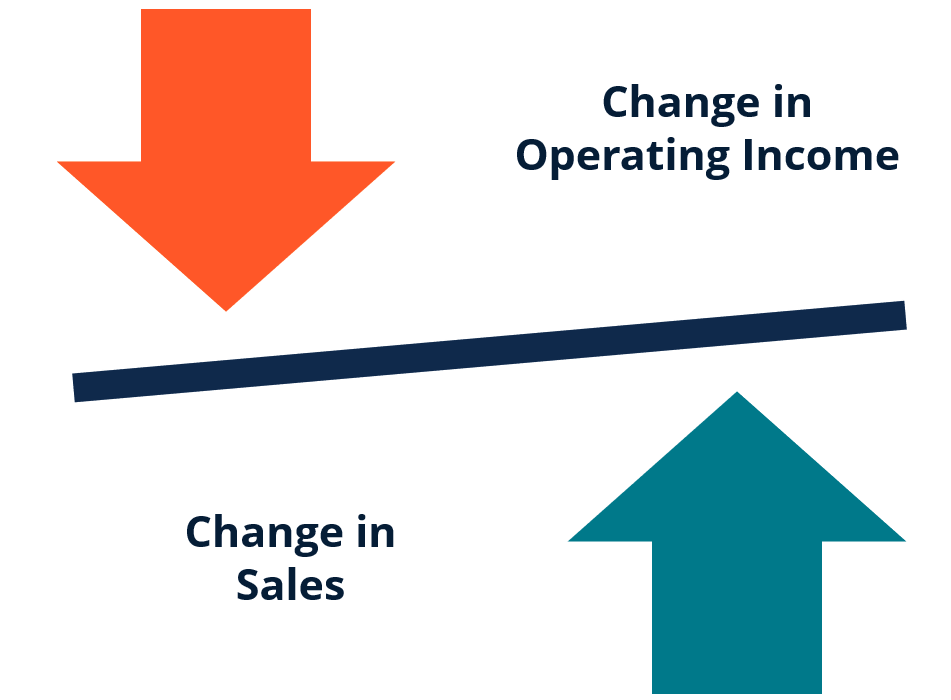

What will happen to Pfizer asset efficiency (asset turns) & operating margins once they are able to successfully outsource all manufacturing & get more efficient R&D done (the lower down the value chain tasks) from CRAMS players?

I leave it to the reader to think.

I leave it to the reader to think.

• • •

Missing some Tweet in this thread? You can try to

force a refresh