Here is a thread on understanding operating leverage.

https://twitter.com/sahil_vi/status/1414752431456489472

A lever can lift a large weight with help of a smaller weight because of the long arm. This is because of the balancing of torques. A small weight can lift a large weight. That is leverage.

Imagine that sales of a co went up 10% and operating profit went up 25%. Can we conclude that this is definitely operating leverage?

The answer is in the next tweet

No, we cannot definitively conclude that. Profits could have gone up for a variety of reasons. Example, better sales mix (better gross margins). One off reduction in any of the myriad costs a biz has to bear. Last but not the least, operating leverage.

What is operating leverage?

It is essentially the growth in costs of operations being lower than growth in sales. In other words, a “sub-linear” growth in operating costs with growth in sales is what provides operating leverage. Lets look at an example.

It is essentially the growth in costs of operations being lower than growth in sales. In other words, a “sub-linear” growth in operating costs with growth in sales is what provides operating leverage. Lets look at an example.

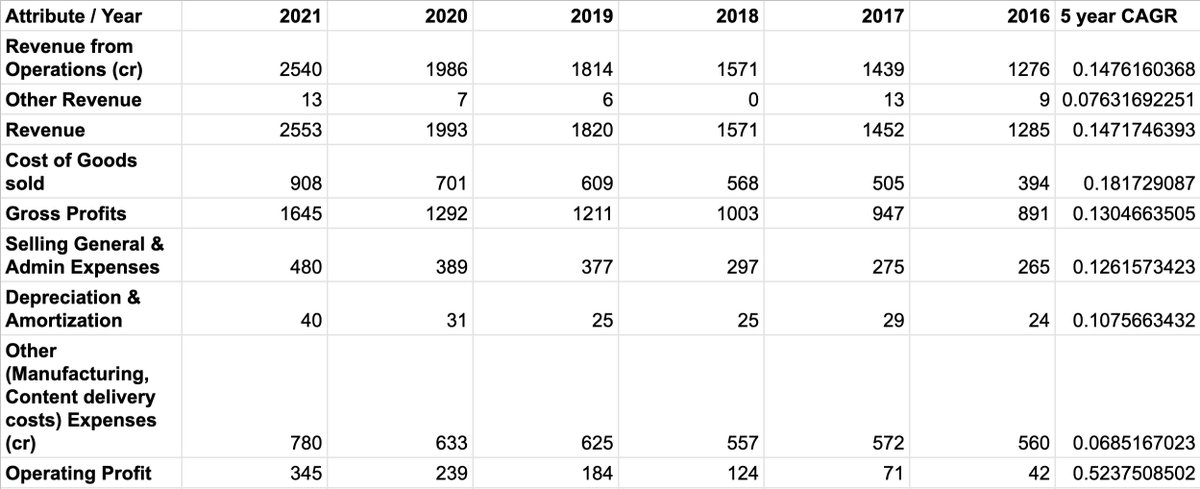

Here, take a look at VGL’s simplified P&L statement statement from tikr.com

What is the cost item most responsible for the large operating leverage?

The Answer is Other operating expenses.

Have a look at this same data as tikr.com in google sheets with 5 year CAGR for each line item computed.

You can see that other expenses are growing much slower than topline. 15% CAGR for topline versus only 7% for the other expenses. This is also one of the largest expenses in the P&L statement. So it should not come as a surprise that its slow growth will pump up operating profits

To a lesser extent, depreciation growth (11%) is also much slower than topline growth (15%). This is another source of operating leverage. What is happening here? That requires one to look beyond the P&L and listen to the commentary in the concalls.

Now one needs to think about *why* the operating leverage exists.

For example, if you break up, cost of goods sold, you see that cost of raw material has almost not grown compared to cost of purchased stock in trade.

If we break up the “cost of goods sold” line item & also by reading the annual reports, concalls, we realize that a lot of VGL’s goods sold are not manufactured in-house, they are contracted to small manufacturers. This will be useful later.

If we look into the notes to the P&L statement through the years (sample attached) we will observe one large cost: Content and broadcasting. This is growing very slowly.

Thus, There are 2 trends playing out in the biz which cause a large operating leverage.

1. If we break up the “cost of goods sold” line item, we realize that a lot of VGL’s goods sold are not manufactured in-house, they are contracted to small manufacturers.

1. If we break up the “cost of goods sold” line item, we realize that a lot of VGL’s goods sold are not manufactured in-house, they are contracted to small manufacturers.

Thus, manufacturing costs are low and this is reflected in the low CAGR of depreciation and also to some extent other operating expenses. Other key cost trend driving operating leverage is their sales medium.

2. They buy airtime on TV channels. Cost of airing content to a fixed # of homes is fixed. Think about the app they build. The operating costs of an app and backend do not scale linearly with # of users. Thus, the content delivery costs grow slowly compared to incremental sales

All these factors combined result in Operating Leverage.

It is the operations themselves which act as a 'lever' allowing a 'small' sales growth to result in a 'large' operating profit growth.

If you liked this thread, please follow this handle to learn such concepts related to investing including company specific threads (

Please retweet the 1st tweet for wider reach.

https://twitter.com/sahil_vi/status/1406848206181335046?s=20).

Please retweet the 1st tweet for wider reach.

• • •

Missing some Tweet in this thread? You can try to

force a refresh