With seasoned investors like @LuckyInvest_AK sir talking about platform businesses I feel motivated to start a 🧵🧵 on discussing, analyzing & understanding platform businesses. Read on to learn more.

https://twitter.com/LuckyInvest_AK/status/1415887535675297793

Quick question before we begin. Would you rather :

I hope your answer was the 1st one because I am not a fish seller. Please don't expect my threads to **always** contain investment ideas. My broader goal is to empower each person learn to see reality a little bit clearly. To enable you to learn to fish.

This is also why most company threads start of with the very basics. So that you can apply the same way of thinking to other businesses. (see the mastek or idfc first thread).

Now the subject of platform businesses is a HUGE one. This is the very cutting edge of business development, i am myself still learning every day. This thread is not the know all and be all of platform businesses, this is a beginner's guide on how to think about such biz

What are platforms?

Let’s start with some basic definitions. The word platform is probably most abused in today’s day and age with everybody & their mom claiming to have a platform.

technically that thing in the GIF is a platform too.

Let’s start with some basic definitions. The word platform is probably most abused in today’s day and age with everybody & their mom claiming to have a platform.

technically that thing in the GIF is a platform too.

Is an auto-ancillary company a platform business?

The definition, if followed only in letter, might imply that auto ancillary companies (taken as an example) are in fact platforms. Let us see how:

The definition, if followed only in letter, might imply that auto ancillary companies (taken as an example) are in fact platforms. Let us see how:

Auto-ancs create a bipartite graph/network with raw material on one side of the graph and OEMs on the other side of the graph. They facilitate exchange between independent groups, & in fact also add value in the middle (which many other platforms do too).

Well, surely this must be wrong, right? How can an auto anc company be a platform? We’ll explore this question in the rest of the post.

Is YouTube a platform?

This is something which everyone can agree with with. Yes, youtube is a platform business, it facilities exchange of views between producers (channels) and viewers (general public).

This is something which everyone can agree with with. Yes, youtube is a platform business, it facilities exchange of views between producers (channels) and viewers (general public).

The graph above looks very similar for youtube except that on the right side are Channels or content producers and on the left are usual viewers like you and I.

What differentiates a general old economy company such as an Auto-anc from YouTube?

Let us discuss a term which is often used with Platforms.

Let us discuss a term which is often used with Platforms.

Network effects

Platforms create networks of entities, (#IndiaMart for example creates network of businesses). These networks then result in Network effects.

Text book definition 👇

Platforms create networks of entities, (#IndiaMart for example creates network of businesses). These networks then result in Network effects.

Text book definition 👇

Reframing it in simple terms, every incremental user of the network adds value to other existing users, and every non-user thus is incentivized to join the network. Let us see how this applies to Motherson Sumi.

Motherson Sumi

On the left side, every incremental end user increases #MothersonSumi’s scale, which enables motherson Sumi to become more efficient, which in turn allows them to pass on the gains in efficiency back to all users.

On the left side, every incremental end user increases #MothersonSumi’s scale, which enables motherson Sumi to become more efficient, which in turn allows them to pass on the gains in efficiency back to all users.

This maximum efficiency player then becomes irresistible for other OEMs. Similar scale or incremental user arguments can be made for Divi’s lab as well.

On the right side, every incremental capital goods supplier added increases Motherson Sumi’s scale and enables them to pass that on to rest of the users.

At some point in the scale journey, the incremental deltas become so large, that it not viable for motherson sumi to not be provided by other capital goods makers.

do consider that if MotherSon Sumi is a large network with monopolistic characteristics, there is no option for suppliers except associating with Motherson Sumi

That argument for the right side sounds a little less convincing, but lets hold on to that thought for now. And analyze YouTube instead.

YouTube

On the left side Every incremental user increases YouTube profitability and makes YouTube more profitable which YouTube is able to pass on to all users (lesser ads per user). This makes YT irresistible for any new user.

On the left side Every incremental user increases YouTube profitability and makes YouTube more profitable which YouTube is able to pass on to all users (lesser ads per user). This makes YT irresistible for any new user.

On the right side, every channel added increases YouTube’s Content Library & enables them to attract more end users. At some point in the scale journey, the incremental deltas become so large, that it not viable for Youtube to not have a presence of some content maker.

However, do consider that if YouTube is a large network with monopolistic characteristics, there is no option for Channels except associating with Youtube.

Do the applications of network effects also sound similar now in YT and MothersonSumi? What is happening?

Terms matter

What i have been referring to as left side and right side, and what platforms refer to as producers and consumers do have terms in the old economy. It is: Supply chain and distribution.

What i have been referring to as left side and right side, and what platforms refer to as producers and consumers do have terms in the old economy. It is: Supply chain and distribution.

YouTube’s supply chain and distribution are YouTube platform. Motherson Sumi (MS) has physical processes for supply chain and distribution.

We are now ready to answer the question being posed (Is YT a platform, is MS a platform?)

We are now ready to answer the question being posed (Is YT a platform, is MS a platform?)

All businesses are platforms. Being a platform is not a binary, it is a spectrum. What matters is the scalability of supply chain & distribution.

(if you find something missing here, its on purpose)

(if you find something missing here, its on purpose)

YouTube has ultimate scalability. Most costs associated with distribution and supply chain scale sub-linearly with incremental supply and demand. This is why unit economics is beautiful and high.

Motherson Sumi has what is a linear Supply Chain & Distribution. More people, teams, meetings, only then can we onboard new producers or consumers. Thus, we must understand and appreciate all businesses in terms of scalability of supply chain & distribution.

Let's analyze a few well known businesses from this prism of scalability: This will also provide hints about how to think about zomato

1. #Google search: Ultimate scalability. Planet scale platform, low incremental costs for distribution (done by #Jio), low incremental costs for supply chain (everyone creates websites for their own selfish reasons, makes it indexable by Google for their own selfish reasons).

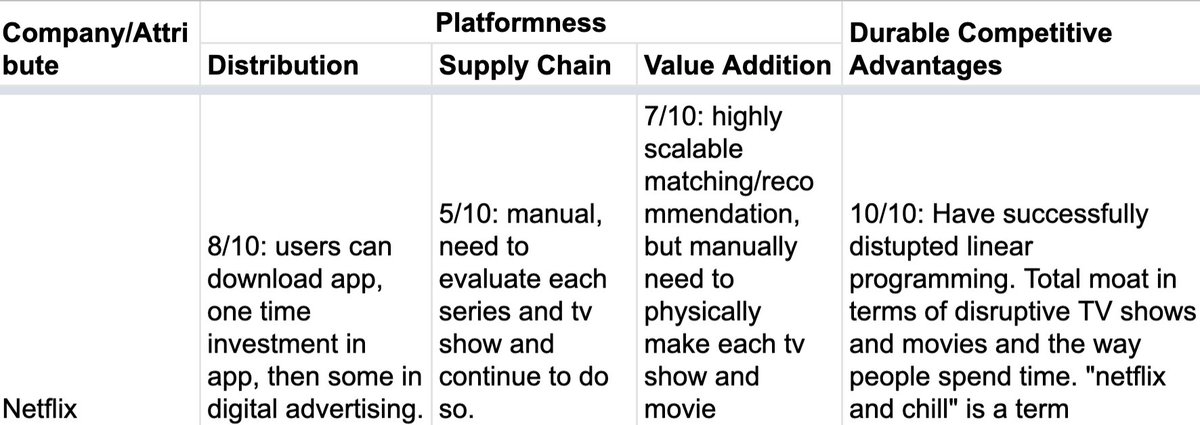

2. Netflix: Distribution is scalable because it is an app and once made, very little incremental costs on distribution. Is supply side costs low? No. If content was static, people would get bored & move on.

Need to continually investment in new content acquisition and creation. Process is also not very scalable because content still needs to be written, directed, shot physically.

3. Amazon: Distribution scalability is not easy coz amazon needs to deliver it physically to people. Amazon does outsource to 3P when possible but if they always did this, costs would be high, so they need to do self distribution (warehouses, distribution centers, delivery boys)

Is supply chain scalability any better? Nope, but definitely better than Netflix because amazon does not need to invest in product creation (unless it wants to).

Over the last 20 years, amazon has also perfected the distribution and supply chain so much that they are able to drive huge efficiencies which others are not able to. Look at delivery speeds for Amazon & compare to Flipkart.

4. #VaibhavGlobal: Distribution is somewhat similar to Amazon, supply chain is similar to amazon too. There are 2 key differences : (i) while #Amazon allows any seller to sell, VGL is seller of all products. (ii) VGL insists on making 65% gross margins on each product

This key difference is known as central planning versus marketplace model. VGL indulges in central planning of inventory, what to sell, how much to sell, how to display it. Amazon allows the ,market forces to dictate what gets sold on its platform.

Now this gross margin requirement limits the growth of the VGL platform compared to amazon who are even happy to make losses on some products in the name of market penetration.

VGL has chosen to operate at a different tradeoff point on the profit-growth curve. Their choice is different from amazon, & not incorrect. #Zara (#inditex) is another example of a co which is very similar to VGL.

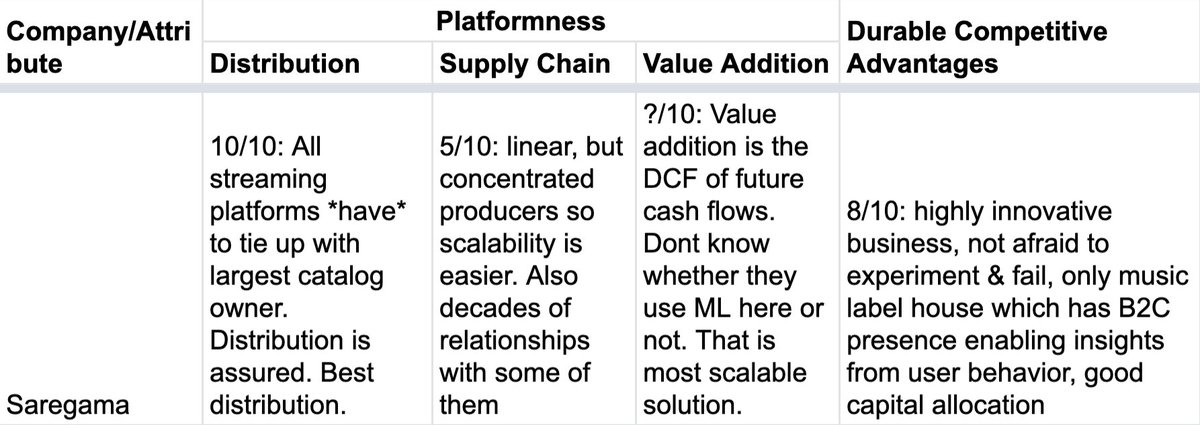

5. Saregama: My personal favorite to analyze in this framework. Effectively what Saregama does is it maps songs to listeners via the streaming apps. Given their huge catalog size, each streaming app has to integrate & thus only serve as franchises of the saregama IP.

The distribution is done by someone else & they take their cut for it. Key function performed by Saregama is aggregation & DCF of future cash flows into a present value, which they provide to the content creator & then take on the risks of the future cash flows not materializing.

The other problem for them is that scalability is limited by their own (internal) cashflows. If they only have 250cr, how can they acquire more content? If they dilute equity, then that results in worse profitability metrics.

This is an inherent challenge on the supply side for saregama given the uniqueness of the business model of the music IP industry. If content creators (eg: film producers) could be convinced to take on the risk of future cash flows, then saregama could become a scalable platform.

Understanding the business from these prisms also enables us to identify and anticipate future disruptions. MAAS (music as a service) is a key disruption to the business model where saregama might be reduced to a content aggregator not adding enough value.

In the mean while, what can saregama do to move up the value chain? They can try to eliminate human biases in the supply chain.

They have enough and more data on 2,00,000 songs to train Machine Learning models to compute DCF for each song and build a supply side UI/UX which completely eliminates the human.

Why would producers want to be onboarded on this? Its simple, time value of money. Saregama can analyze the video, audio, lyrics, metadata (singer, language) to give the producer instant cash for their song the moment it is made.

In fact using some advanced ML (known as generative modelling) they can even work with producers to optimize songs for streaming (end goal) helping them increase the value of their songs (key question is: what kind of songs stream more?).

6. #IEX: A simple exchange platform for enabling buyers and sellers to buy and sell electricity (long term as well as short term contracts). Supply chain & distribution are both very scalable. Clear network effects. More buyers, more sellers, more buyers. You get the gist

7. #BSE: Similar platform except it enables exchange of stock market ownership. Supply chain & distribution are both equally scalable.

What explains the difference in valuation with IEX? Network effects. They are working against BSE. NSE has the lion's share of marketshare

What explains the difference in valuation with IEX? Network effects. They are working against BSE. NSE has the lion's share of marketshare

To summarize:

IMHO, each business is a platform business, difference lies in supply side and distribution scalability. Some businesses are inherently very scalable (low incremental producer and consumer addition cost), others are not, and everyone lies on a spectrum.

IMHO, each business is a platform business, difference lies in supply side and distribution scalability. Some businesses are inherently very scalable (low incremental producer and consumer addition cost), others are not, and everyone lies on a spectrum.

Similar to valuation being a fuzzy concept which is net present value of all future cash flows, we should think of platformness as a fuzzy concept. YouTube and Instagram are a 1.0, netflix is a 0.7, Amazon is a 0.5, Motherson Sumi is a 0.01, VGL is a 0.5, saregama is a 0.7

Scalable Platforms = Modern Monopolies?

It is enticing to believe that once a platform has been created, users have been acquired, network effects would keep competition at bay and create deep moats around the business.

It is enticing to believe that once a platform has been created, users have been acquired, network effects would keep competition at bay and create deep moats around the business.

Unfortunately, IMHO, real life is not so simple. Consider many examples:

1. Uber had 1st mover example and yet lyft is competing successfully in USA

2. Yahoo! and AOL has search engines far before Google came on to the picture. And yet, Google search won.

1. Uber had 1st mover example and yet lyft is competing successfully in USA

2. Yahoo! and AOL has search engines far before Google came on to the picture. And yet, Google search won.

3. Google created app store much before apple did and yet both dominate. That being the case, there are only 2 app stores worth writing about. Nobody creates apps for Samsung app store. Why?

4. QVC (Qurate) has 93% marketshare in discount jewellery in USA and yet VGL has grown from 1.5% few years ago to 4% marketshare and continues to acquire marketshare. Why?

The answer to all these questions would enable us to analyze platform businesses (that i define as businesses with platformness >= 0.5 [arbitrarily chosen]) from the prism of durable competitive advantages.

Google is a powerhouse of platform businesses, Google search, Google ads, YouTube, Google Maps, Google Pay, Android, Google Playstore & it is a powerhouse that churns out platforms. Then why are its valuations so low compared to many other platforms?

Durable competitive Advantages (DCA)

The key takeaway of this section is that network effects in platform businesses by themselves only enables fast growth due to sub-linear scaling of costs. But what really keeps competitors at bay, or leads to disruptions are DCA

The key takeaway of this section is that network effects in platform businesses by themselves only enables fast growth due to sub-linear scaling of costs. But what really keeps competitors at bay, or leads to disruptions are DCA

Google

Google’s ads business **was** a monopoly due to their dominance over search. They continue to have dominance over search, but what has started happening slowly, is the emergence of verticals

Google’s ads business **was** a monopoly due to their dominance over search. They continue to have dominance over search, but what has started happening slowly, is the emergence of verticals

Key among these is Amazon. Amazon ads is one of the fastest ads platforms and rightfully so. When people want things, they amazon for it, they do not google for it.

This helps amazon in 2 ways: dont need to pay google for the Amazon ad that might have redirected people to Amazon, can charge customer instead for the ad amazon shows to customer.

Amazon’s total dominance in products commerce has been the primary reason for Google’s Ads moat (and indeed search moat) being penetrated.

Similarly, why was Google able to penetrate AOL or Yahoo!‘s network effects? They simply had a better product based on Larry and Sergei’s PHD thesis : The page rank algorithm. Deep technical knowledge based moats are most difficult to disrupt.

You can cry at the top of Eiffel tower about user privacy, but as long as google is a __better__ search engine than DuckDuckGo, DDG and such like would always remain limited to the eccentrics

Because users (it appears) care more about quality of search than about their own privacy. As long as that remains true, Google’s search moat is supreme.

Even if it were to change, the lead they have over the next biggest in terms of just understanding the tail end of search queries based on data (which are the hardest to deal with) is so large, that they would still likely emerge winners even in a user privacy centric world.

This is the way in which we need to evaluate businesses’ durable competitive advantages.

Facebook

Facebook’s biggest competitor right now is Google Search and Google Maps. Both are very focussed on small and medium businesses and have created many specific products like GMB (Google My business) to counter the FB threat.

Facebook’s biggest competitor right now is Google Search and Google Maps. Both are very focussed on small and medium businesses and have created many specific products like GMB (Google My business) to counter the FB threat.

ALso, FB has tried to create a marketplace inside it but what they fail to understand is that someone already created eBay & it was disrupted by Amazon. FB’s valuations reflects (among other things) this market understanding of the durable competitive advantages of its products.

Another very interesting thing about FB and indeed most innovators is their ability to disrupt themselves They understand that they need to disrupt themselves or risk being disrupted by someone else. This explains why FB acquired insta and whats app and successfully scaled them.

Explains their attempted snapchat acquisition.

Explains why Google Acquired Maps (widens the local search [searching for things near you like doctors] moat),

Explains why Google built Discover feature (we will recommend you websites before you even know you want to read it.)

Explains why Google Acquired Maps (widens the local search [searching for things near you like doctors] moat),

Explains why Google built Discover feature (we will recommend you websites before you even know you want to read it.)

This ability and willingness to experiment and disrupt yourself can look stupid or foolish in the short term, but in long term, it pays off, specially as you learn from past mistakes and optimize your processes.

Amazon (Pay special attention to this because IMHO this matches zomato most closely).

What explains Amazon’s valuations (from a DCA perspective purely)? Amazon’s key insight into the business was that:

What explains Amazon’s valuations (from a DCA perspective purely)? Amazon’s key insight into the business was that:

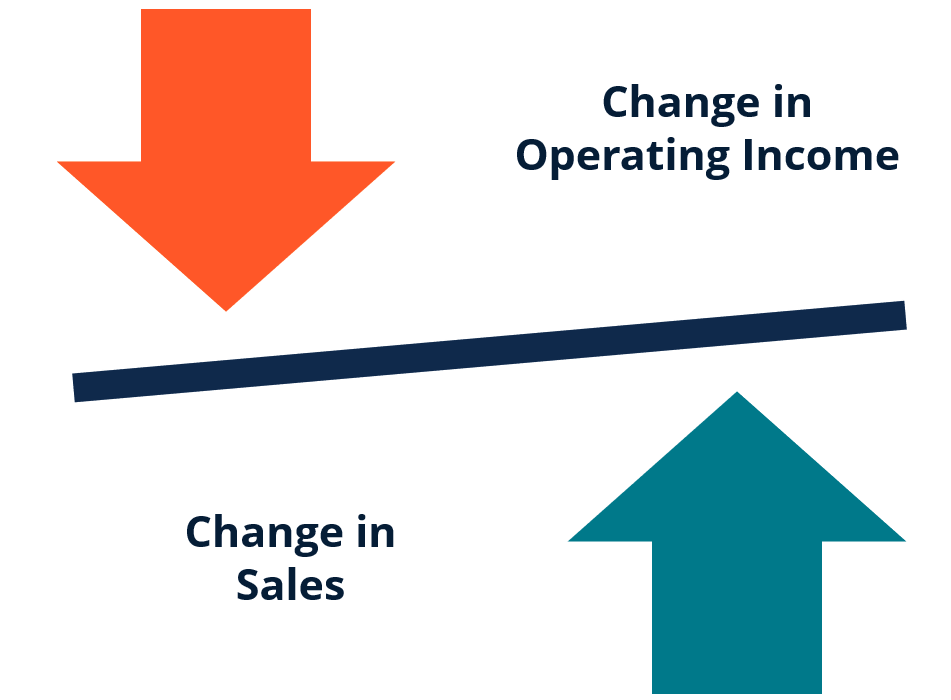

1. They need to share back scale advantage with their users. You’d be surprised but very few platform businesses are able to do this. Amazon keeps adding more and more services to their prime subscription and users are delighted.

They front load the costs (value/benefits to users) and backload the profits. This creates 2 illusions

(i) in the user’s mind there is the illusion of always getting good and increasing value for money.

(ii) for the uninformed investor it creates the illusion of high P/E ratios.

(i) in the user’s mind there is the illusion of always getting good and increasing value for money.

(ii) for the uninformed investor it creates the illusion of high P/E ratios.

2. They understood that theirs is a highly commoditized industry. By focussing on user experience from the 1st year of operations (many videos available show how obsessed bezos has been with user experience).

By this single stroke of genius alone they have been able to create a differentiated offering. Their competitors simply do not understand. It is herculean task to speak to customer support. Nobody wants to do that.

By optimizing those workflows #amazon creates that goodwill in the minds of customers and in fact they are even happy to pay a small premium for the better customer experience. (several anecdotal examples available here just ask your friends or family).

what they are doing is very basic. And yet, competitors are unable to replicate. Even intelligent ones. #AWS is one of the most developer friendly development ecosystem compared to say #Google #Cloud. Why? It doesn’t make sense.

And yet, such are the facts. Google keeps saying “our cloud is better on specs”. Guess what? Customers care more about their experience and are ready to pay up for it.

Vaibhav Global

What explains VGL’s ability to grow topline at 2x the industry and industry leader? There are 2 reasons for this:

What explains VGL’s ability to grow topline at 2x the industry and industry leader? There are 2 reasons for this:

1. They consciously operate at half the price point of their competitors. They are able to do this while being more profitable by having labor, manufacturing, power cost arbitrage (india is cheaper) & through vertical integration.

You’d be surprised by how many people, even in developed countries like USA, want inexpensive products. Anyway the whole game is discount jewellery, you’re not buying the brand (#tiffany’s), then it is better to be at half the price point of your largest competitor.

2. By being a closed platform (controlling for products and not selling 3P products) they are able to ensure a more uniform quality customer experience & optimize for the full life cycle: think of it as an optimization algorithm.

Create a product X, sell it, gather feedback (both qualitative & quantitative); then improve the product based on the deltas.

Open Platforms ability to do this is limited to what the 3P seller is willing to do.

Vertically integrated players are able to do this much better.

Open Platforms ability to do this is limited to what the 3P seller is willing to do.

Vertically integrated players are able to do this much better.

Saregama 🎵🎶

Being customer facing enables you to understand end user very well and optimize for their needs directly. And intermediaries (like YT & #spotify) would not always be willing to share that granular data with you.

Being customer facing enables you to understand end user very well and optimize for their needs directly. And intermediaries (like YT & #spotify) would not always be willing to share that granular data with you.

This and what i said above about willingness to experiment are key reasons i love saregama’s music IP platform. They experimented with Carvaan. Only Music IP company who can actually understand user behavior patterns at a granular level.

Amazon is happy to sell echo at a loss just to get the same data. I can see same pattern pay out in Saregama, all this user behavior data would enable them to outbid their competitors who have to rely on intermediary (streaming app’s) analytics, whatever they choose to share.

#EaseMyTrip (Your average aggregator)

IMO, aggregators typically are the lowest of all platforms for 2 reasons (amazon is an exception to the rule):

IMO, aggregators typically are the lowest of all platforms for 2 reasons (amazon is an exception to the rule):

1. Network effects do not play out as users tend to compare their purchases unless there is a huge user experience advantage for 1 co over the other. That is not the case with flight booking aggregators.

2. Users life is made even easier by meta aggregators like skyscanner. It’s a race to the bottom. Your user is not on your network, the relationship is transactional in nature. Meta aggregators make this even easier.

3. Since your suppliers are consolidated & huge(airlines) it makes for them to integrate with ALL aggregators. Where are the network effects? An airline wont think: let me integrate with easemytrip & not MMT since EMT has more followers.

Same for restaurants. They are not going to integrate with only zomato or swiggy or amazon food. It simply doesnt make sense.

I would say lowest quality of DCA lies with pure digital aggregators like PayTM, EaseMyTrip, Zomato etc.

I would say lowest quality of DCA lies with pure digital aggregators like PayTM, EaseMyTrip, Zomato etc.

e-pharmacy and #sastasundar

1. Most e-pharmacies are unable to get high customer retention & relationship is transactional. There is clear ways in which they can create a differentiated product: higher product availability, better customer service.

1. Most e-pharmacies are unable to get high customer retention & relationship is transactional. There is clear ways in which they can create a differentiated product: higher product availability, better customer service.

I evaluated 50 google playstore reviews for Pharmeasy, Sastasundar and 1mg.

One of the biggest pain points for both 1MG and PE was getting what you ordered: Customers often got replacements for their ordered medicine without their consent

One of the biggest pain points for both 1MG and PE was getting what you ordered: Customers often got replacements for their ordered medicine without their consent

Often had their items cancelled which were shown as in stock when the order was placed. SS has substantially low instances of this problem.

Customer Care Experience: Far Far worse experiences for PE (PharmEasy) and 1mg. PE customers were scratching their heads on why the PE customer support were so nonchalant, & lacked basic understanding of what they were going through.

Similar, although less vocal concerns for 1mg. In stark contrast, most customers enjoyed their SS customer care experience with many describing as courteous, polite. Even when they complained, this was more around them not liking the resolution.

Reason I like SastaSundar is due to their hybrid phigital model: customer establishes a relationship with HealthBuddy as a RelationShip manager at a Bank. The storefront also enables higher higher word of mouth marketing.

Their consistency in delivering high quality medicines reliably is far superior to PE and 1mg. They are clearly able to capture some part of market which doesnt obsess over delivery speeds.

Here: Read all my findings in this spreadsheet:

docs.google.com/spreadsheets/d…

Here: Read all my findings in this spreadsheet:

docs.google.com/spreadsheets/d…

In general i think differentiated experience offering OR scale are the only way to succeed in aggregator space. SS is going more for former right now IMO although they do have plans for aggressive expansion when they are able to raise funds.

WHat is zomato going for?

WHat is zomato going for?

Value addition

Platform businesses are businesses which are highly scalable. But the most key ingredient which needs to be highly scalable is the value addition of the platform/business. This is where algorithms shine, and physical world becomes cumbersome and slow.

Platform businesses are businesses which are highly scalable. But the most key ingredient which needs to be highly scalable is the value addition of the platform/business. This is where algorithms shine, and physical world becomes cumbersome and slow.

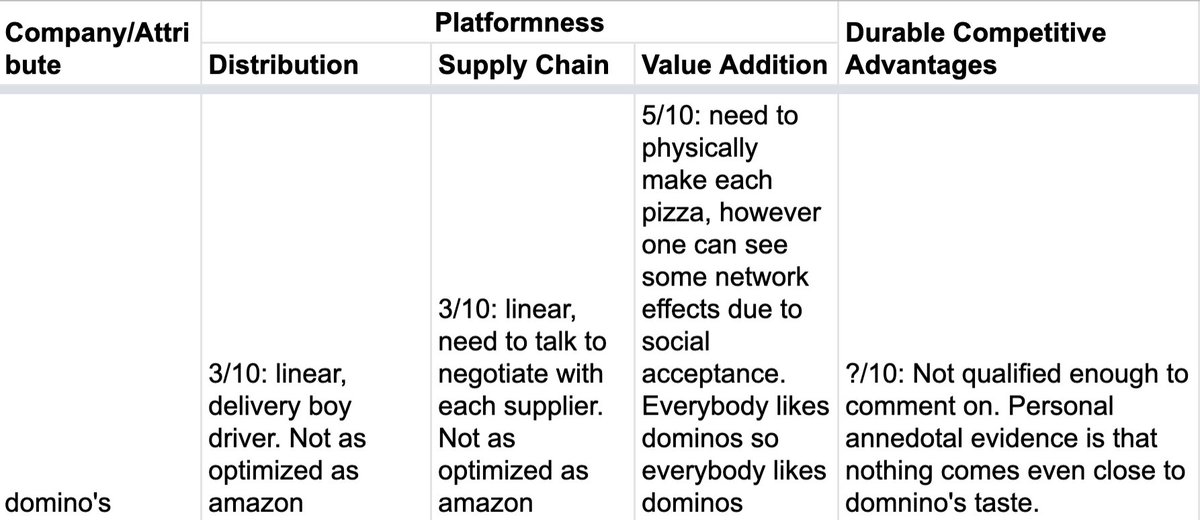

Once Google creates a search algorithm, it will only spend time on perfecting it, improving the metrics. Google spends very little incremental time and money on servicing every request. The processing part of the business is highly scalable. Can the same be said for Domino’s? No

You cannot scale pizza making arbitrarily fast enough. With cloud services like AWS, If i have an awesome search algorithm today, i could create a search engine to rival Google’s today

If it truly was better (this is of course the hard part), then the scaling would be handled by AWS, no capex required, capex converted to opex & if it truly was better (this is of course the hard part), then the scaling would be handled by AWS, no capex required, only opex

One can also appreciate why #Tesla, with their most advanced robotics driven manufacturing is as closest to being a platform company as a physical hardware manufacturing company can be. Another example here is #Apple’s hardware business.

This definitely has the characteristics of being a highly platform business, because they handle R&D and design in-house (which are more scalable) then outsource the linear part (manufacturing) to Chinese companies.

A discerning reader will appreciate that although apple does not do the linear part, it still exists. All that outsourcing does is converts capex into opex.

A truly platform business like Google has very tiny opex per user interaction (imagine how much computing power + electrical power it takes to facilitate 1 search). This is negligible compared to ad revenue they generate on the search query.

I conclude this thread with my understanding of each business, in terms of its platformness and durable competitive advantages. note that these are my subjective views. I could be wrong.

If you like this thread, please retweet the 1st tweet so maximum investors can benefit.

This is the longest thread i have ever created. Brownie points and my deepest gratitude to anyone who can tell me how many tweets this thread has. (I dont know so myself).

• • •

Missing some Tweet in this thread? You can try to

force a refresh