@BarnwalAashish @itsTarH Very^1000 different.

1. TAM: CS with its 30-60% market share has a far smaller TAM than TC. Tc Has single digit global market share. The picture is only getting started, here.

2.look at topline growth. 26% cagr for tatva pre covid, 22% including covid year. 14% for CS.

1. TAM: CS with its 30-60% market share has a far smaller TAM than TC. Tc Has single digit global market share. The picture is only getting started, here.

2.look at topline growth. 26% cagr for tatva pre covid, 22% including covid year. 14% for CS.

@BarnwalAashish @itsTarH 3. TC has quantified it's durable competitive advantage. Takes competitors 3-7 years to get into supply chain of clients. I don't know this quantification for CS

4. Much larger capex for TC (70% expansion) compared to 30% for CS

4. Much larger capex for TC (70% expansion) compared to 30% for CS

@BarnwalAashish @itsTarH 5. R&D spend is much higher for TC at around 1.7%. Guidance of 3-4% post commissioning of new R&D center.

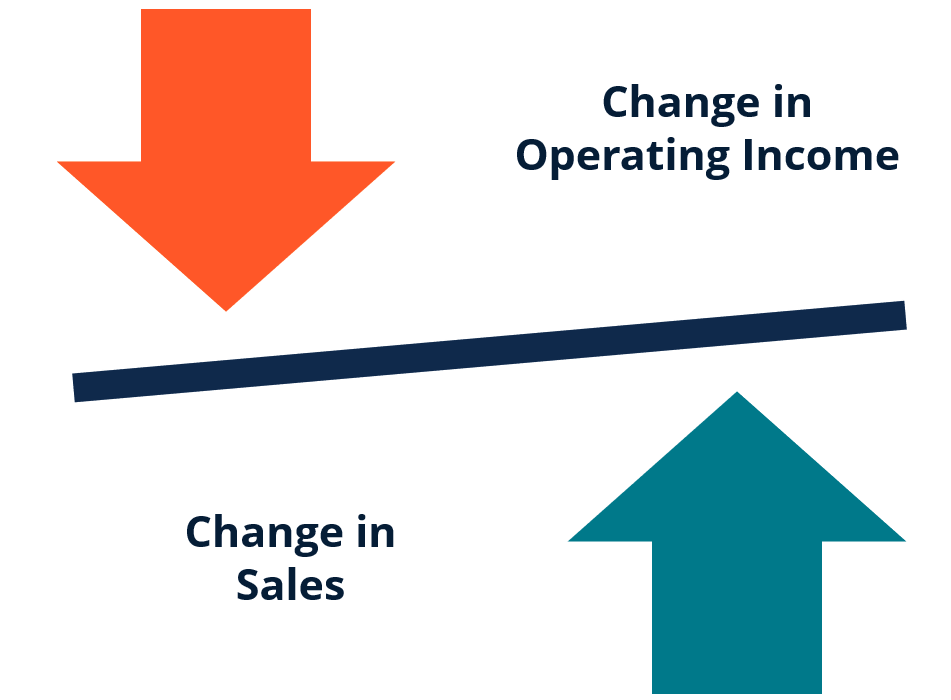

@BarnwalAashish @itsTarH 6. Given that current capacity utilization is lower for TC than cs expect higher operating leverage led margin improvement too for TC than CS.

@BarnwalAashish @itsTarH 7. While clean science name us clean. It is tatva chintan that is the true clean science specchem in this comparison. Just see the end user industry application for TC compared to cs. Cs products are intermediates for pharma (dermatology, cough cyrup), food packaging etc...

@BarnwalAashish @itsTarH Whereas tc products are used to reduce environment pollution from fossil fuel burning, cleaner and greener chemistry by reducing reactant usage, improving yields, reducing reaction time, and also used as electrolyte salts in batteries in EV and renewable energy storage.

@BarnwalAashish @itsTarH After reading that description tell me:

Which is the true clean science company :)

Which is the true clean science company :)

@BarnwalAashish @itsTarH But you won't find most twitter handles talk about this because of 2 reasons:

1. Herd mentality. I follow clean science because X is following clean science.

2. Name bias. I am so surprised but investors are into Company names 😅😅

3. Comparing priorities. Kahan tc kahan Zomato

1. Herd mentality. I follow clean science because X is following clean science.

2. Name bias. I am so surprised but investors are into Company names 😅😅

3. Comparing priorities. Kahan tc kahan Zomato

@BarnwalAashish @itsTarH Btw you might find that I said 2 then listed 3 reasons that is because I always seek to underpromise and overdeliver. 😀

@BarnwalAashish @itsTarH In short, pe ratio is not valuation:

Pe + industry structure + total addressable market + durable competitive advantages + growth rates + unit economics is valuation. :)

Tc is far far superior than cs as an investment right now. At least as per my framework. 🤷♀️

Pe + industry structure + total addressable market + durable competitive advantages + growth rates + unit economics is valuation. :)

Tc is far far superior than cs as an investment right now. At least as per my framework. 🤷♀️

• • •

Missing some Tweet in this thread? You can try to

force a refresh