What company should i make my next company thread on?

1. Strides

2. Vaibhav Global

3. Tatva Chintan

1. Strides

2. Vaibhav Global

3. Tatva Chintan

Strides

A very misunderstood company with discernible change. Thanks to @itsTarH for bringing it on my radar. Lots of value unlocking opportunities like Stelis, injectables. Trading at a discount coz its getting valuation of the worst/most gruesome biz. Next 5 years will be very

A very misunderstood company with discernible change. Thanks to @itsTarH for bringing it on my radar. Lots of value unlocking opportunities like Stelis, injectables. Trading at a discount coz its getting valuation of the worst/most gruesome biz. Next 5 years will be very

@itsTarH Different than last 5 IMO. Even base biz (regulated markets) likely to do better, & as the promoter exits the valuations might improve. Branded biz in unregulated markets can provide stability to cashflow going forward.

Stelis has book value of 2500cr. Strides owns 33%

Stelis has book value of 2500cr. Strides owns 33%

@itsTarH Vaibhav Global 💎💍

Vertically integrated platform for e-retailing of jewellery & lifestyle products sourced or manufactured thoughtfully. Growing earnings at 25% in base case and 40% in the blue sky scenario.

Huge runway, & BHAG of growing volume 20x in next 10 years.

Vertically integrated platform for e-retailing of jewellery & lifestyle products sourced or manufactured thoughtfully. Growing earnings at 25% in base case and 40% in the blue sky scenario.

Huge runway, & BHAG of growing volume 20x in next 10 years.

@itsTarH Tatva Chintan

A SpecChem investor's wet dreams are made of this stuff. Makes chemicals which :

1. makes Chem & Pharma production cleaner, greener. Direct proxy play on Pharma & Chemical sectors + them becoming cleaner.

A SpecChem investor's wet dreams are made of this stuff. Makes chemicals which :

1. makes Chem & Pharma production cleaner, greener. Direct proxy play on Pharma & Chemical sectors + them becoming cleaner.

@itsTarH 2. Produces electrolyte salts which Enables batteries to store high density energy (Super Capacitor batteries). Direct play on EV + Renewable energy storage.

3. Produces chemicals (SDA) which enable fossil fuel consumption to be cleaner (eg: BS VI compliant cars)

3. Produces chemicals (SDA) which enable fossil fuel consumption to be cleaner (eg: BS VI compliant cars)

@itsTarH Takes 3-7 years for any competitor to get through stringent client checks. Largest producer in india, yet, global opportunity 20x larger in each segment. Capacity utilization at 40% of post-IPO capacity expansion.

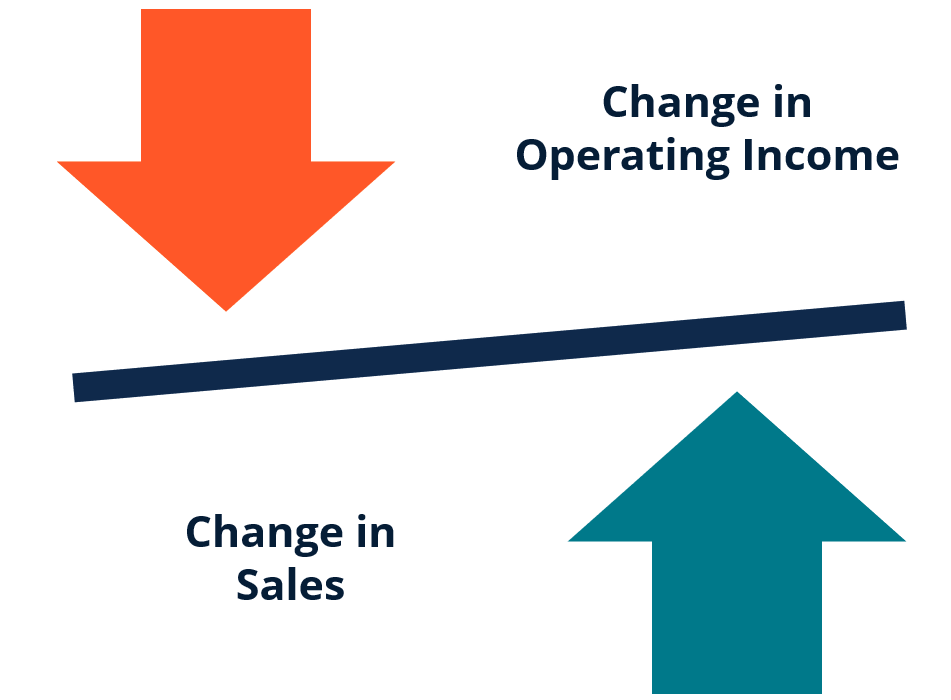

Margin expansion due to better product mix, operating leverage

Margin expansion due to better product mix, operating leverage

Which of these 3 should I make next thread on?

do follow if you'd like to read the actual thread. 😂🤣

PS: i cannot guarantee that a thread on TC (if it wins) will come before tuesday (IPO application closing), coz i am busy this weekend.

But i will share my unstructured google docs notes before tuesday if most people are interested in TC.

🙏🙏

But i will share my unstructured google docs notes before tuesday if most people are interested in TC.

🙏🙏

• • •

Missing some Tweet in this thread? You can try to

force a refresh