Excited to share this new journal article, I co-authored with Beiling Yan, that’s now published in Canadian Public Policy (by @utpjournals): utpjournals.press/doi/full/10.31…

#CdnEcon #Econtwitter

#CdnEcon #Econtwitter

...Our goal in this paper was to analyze the potential to increase Canada’s exports and foreign direct investment abroad.

To do so, we constructed a unique administrative dataset @StatCan_eng with detailed information for millions of firms that operated in Canada from 2010-15.

To do so, we constructed a unique administrative dataset @StatCan_eng with detailed information for millions of firms that operated in Canada from 2010-15.

...Our big research challenge: how do you identify “potential” exporters?

In the past, people surveyed firms to ask if they could become future exporters.

But you might worry that approach may be unreliable, if some firms say “yes”, even if they aren’t serious exporters.

In the past, people surveyed firms to ask if they could become future exporters.

But you might worry that approach may be unreliable, if some firms say “yes”, even if they aren’t serious exporters.

...The novel idea in our paper: Don’t ask firms. Use big data to infer the number of potential exporters and potential export value.

We apply propensity score matching to assign all firms into groups of “currently active” & “potentially active”; ignore “limited int’l potential”.

We apply propensity score matching to assign all firms into groups of “currently active” & “potentially active”; ignore “limited int’l potential”.

...Remember the Where’s Waldo books?

In our dataset, we see current exporters (“Waldos”), and then apply an algorithm search for other firms that look just like exporters (“Wandas” in similar industries, capital, labour, etc.) but haven’t yet made the leap into global markets.

In our dataset, we see current exporters (“Waldos”), and then apply an algorithm search for other firms that look just like exporters (“Wandas” in similar industries, capital, labour, etc.) but haven’t yet made the leap into global markets.

...Along the way, by first studying the currently active populations of "Waldos", we found:

1) Canada’s exports are increasingly being complemented by Canadian companies working via affiliates operating in foreign markets.

1) Canada’s exports are increasingly being complemented by Canadian companies working via affiliates operating in foreign markets.

... 2) We showed that our outward FDI (or Canadian Direct Investment Abroad, CDIA), makes an outsized contribution to aggregate economic activity — and it’s growing really fast, particularly for debt-financed investments.

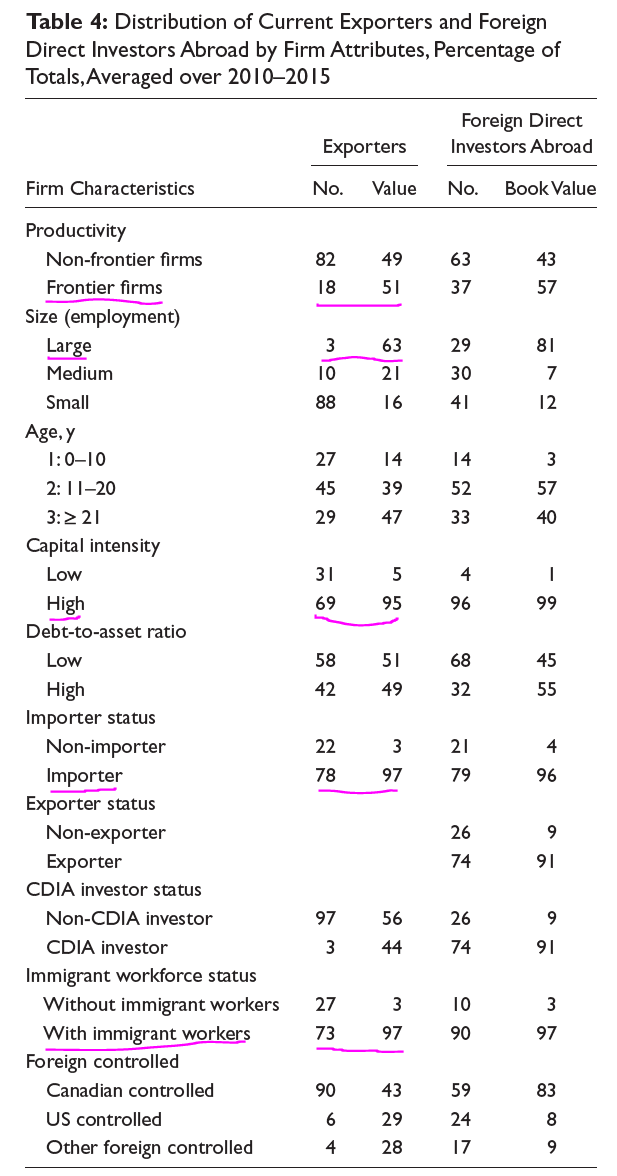

...3) We also confirmed a result that's increasingly common in datasets for other countries: namely, that export value is highly concentrated among “superstar global firms”.

These large, highly capital- intensive companies employ immigrants and simultaneously import and export.

These large, highly capital- intensive companies employ immigrants and simultaneously import and export.

...Interestingly, we found that few Canadian exporters engage in CDIA (only 3%), but most CDIA firms (74%) are exporters.

...Our core result was good news!

We found there is considerable potential to grow Canada’s exports (by 20-75%) & outward FDI (by 3-10%), coming from the many firms operating in Canada that we identified as potential exporters (18,000– 55,000) and investors abroad (750–3,000).

We found there is considerable potential to grow Canada’s exports (by 20-75%) & outward FDI (by 3-10%), coming from the many firms operating in Canada that we identified as potential exporters (18,000– 55,000) and investors abroad (750–3,000).

...However, because potential entrants tend to operate at smaller scale, their initial international activity, per-firm, is likely much lower than companies that are already internationally active — for exporters, less than half, and for outward investors, less than one-tenth.

Lots of important Qs remain:

Why are some high-potential firms not exporting or investing abroad?

What are the key obstacles to their int'l growth?

What interventions, if any, would best support their transition into world markets and help them become superstar global firms?

Why are some high-potential firms not exporting or investing abroad?

What are the key obstacles to their int'l growth?

What interventions, if any, would best support their transition into world markets and help them become superstar global firms?

...For those interested in the details, you can read the full paper here: utpjournals.press/doi/full/10.31…

Big thanks to the various seminar participants (like @trevortombe, @EugeneBeaulieu), CPP editors (@stephenfgordon) and anonymous referees who helped us improve the paper. #CdnEcon

Big thanks to the various seminar participants (like @trevortombe, @EugeneBeaulieu), CPP editors (@stephenfgordon) and anonymous referees who helped us improve the paper. #CdnEcon

• • •

Missing some Tweet in this thread? You can try to

force a refresh