There is a common misconception that due to concentrated liquidity on Uni v3 liquidity providers (LPs) earn substantially more trading fees. This is what the original v3 announcement suggests but it's not exactly how it works. Let's find out why! 🧵👇

$UNI

$UNI

https://twitter.com/Uniswap/status/1374407493741256711

TL;DR:

- Concentrated liquidity on Uni v3 increases capital efficiency but not necessarily Fees APR for LPs.

- Fees APR is dependent on the competition between LPs.

- LPs are incentivized to provide liquidity on narrow price ranges which amplifies their risk of impermanent loss.

- Concentrated liquidity on Uni v3 increases capital efficiency but not necessarily Fees APR for LPs.

- Fees APR is dependent on the competition between LPs.

- LPs are incentivized to provide liquidity on narrow price ranges which amplifies their risk of impermanent loss.

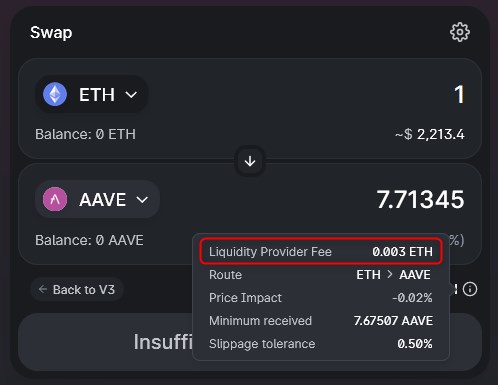

1) To begin with, a short reminder where the fees for LPs come from.

When traders swap on AMMs they pay a trading fee which is dependent on AMM/pool:

- Uniswap v2: 0.3%

- Sushiswap: 0.3%

- Uniswap v3: 0.05%, 0.3% or 1%

- Bancor: from 0.1% to 1%

When traders swap on AMMs they pay a trading fee which is dependent on AMM/pool:

- Uniswap v2: 0.3%

- Sushiswap: 0.3%

- Uniswap v3: 0.05%, 0.3% or 1%

- Bancor: from 0.1% to 1%

2) Collected fees are shared between LPs and the protocol (token holders):

- Uniswap: 100% to LPs, 0% to $UNI holders

- Sushiswap: 83.3% to LPs, 16.7% to $SUSHI stakers

- Bancor: 45% to LPs, 45% to $BNT LPs and 10% to all BNT holders by BNT supply reduction (55% to the protocol)

- Uniswap: 100% to LPs, 0% to $UNI holders

- Sushiswap: 83.3% to LPs, 16.7% to $SUSHI stakers

- Bancor: 45% to LPs, 45% to $BNT LPs and 10% to all BNT holders by BNT supply reduction (55% to the protocol)

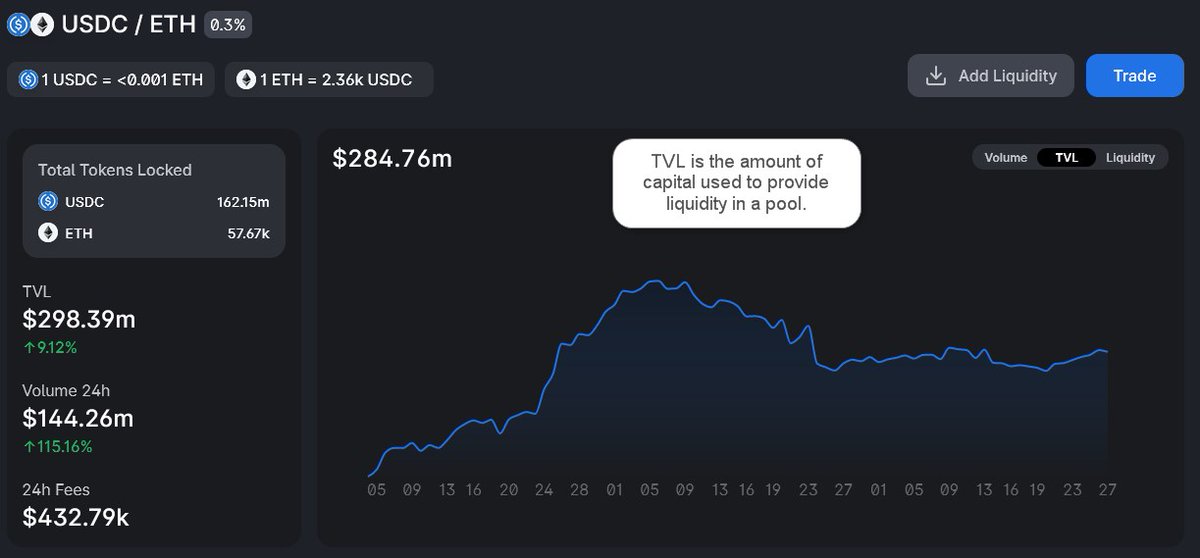

3) The amount of fees LPs collect clearly depends on the trading volume. The more volume, the more fees. But it's not the full picture. LPs have to share the fees with other LPs. The higher total liquidity of the pool, the higher competition for the collected fees.

4) What really matters is volume to liquidity ratio (V/L). The higher the V/L, the higher APR from fees for LPs. On most AMMs (Uniswap v2, Sushiswap, Bancor), V/L for a pool determines Fees APR for all the LPs in this pool. Uniswap v3 is different though.

https://twitter.com/korpi87/status/1372634343793958920

5) All the LPs on traditional AMMs participate in the same market making strategy (e.g. x*y=k), therefore, the fees they get are proportional to their share of the Total Value Locked (TVL) in the pool.

https://twitter.com/korpi87/status/1393282810522259458

6) Uni v3 allows LPs to customize their market making strategy by defining a price range to which they wish to provide liquidity. This way LPs express their opinions on market movements and also compete with other LPs for fees.

https://twitter.com/Uniswap/status/1374407418205990921

7) Let's assume there are only two LPs who provide liquidity in the same pool with the same capital but different strategies:

- Risk-avoiding LP chooses a wide price range (WPR)

- Risk-tolerant LP chooses a narrow price range (NPR) within the WPR

How do they share trading fees?

- Risk-avoiding LP chooses a wide price range (WPR)

- Risk-tolerant LP chooses a narrow price range (NPR) within the WPR

How do they share trading fees?

8) LPs on Uni v3 earn trading fees only if the current price (P) is in the range they provide liquidity to. If P is in WPR but not in NPR, all the fees go to Risk-avoiding LP. If P is in NPR (hence in WPR too), LPs share the total fees. But not evenly. Risk-tolerant LP gets more.

9) Although both LPs provide the same capital to the AMM, their shares of total liquidity in NPR are not equal. TVL and liquidity on Uni v3 are not the same. LPs, by choosing a price range, allocate their capital in that range only - this is a concept of concentrated liquidity.

10) Concentrated liquidity clearly means a higher capital efficiency in comparison to allocating capital across the entire price curve in x*y=k AMM (e.g. Uni v2). It is often represented by an efficiency multiplier which can reach 4000x improvement vs v2.

https://twitter.com/Uniswap/status/1374407493741256711

11) What does the efficiency multiplier tell us?

For example: LPing on 0.995-1.005 range in v3 DAI/USDC pool has an efficiency multiplier of 400x. It means that $5M concentrated into this range on v3 provides the same depth for traders as $2B on v2.

For example: LPing on 0.995-1.005 range in v3 DAI/USDC pool has an efficiency multiplier of 400x. It means that $5M concentrated into this range on v3 provides the same depth for traders as $2B on v2.

https://twitter.com/Uniswap/status/1374407495712600076

12) Does the efficiency multiplier of 400x mean that LPs earn 400x more fees? I wish but it doesn't work this way :) It would be true if the pool on v3 had the same volume as the pool on v2 with 400x lower TVL and the market traded in that price range 100% of the time.

13) The free market is (quite) efficient. If there is an opportunity for outsized returns with similar risk profile, capital is reallocated until returns are evened out. That's why LPs on Uni v3 don't necessarily earn substantially more than on v2 as it's often propagated.

14) Let's compare Fees APR between Uni v2 and v3 for LP strategies with a similar risk profile. Because concentrated liquidity substantially increases a risk of IL, v3 LPing may earn more fees than v2 but it may also lose more due to higher IL.

https://twitter.com/korpi87/status/1400963737578782724

15) Therefore, the best candidates for a fair comparison are pools with very low IL risk, e.g. pools with stablecoins: DAI-USDC, DAI-USDT, USDC-USDT. If we ignore the possibility that a stablecoin can permanently diverge from 1$ peg, IL risk is fairly minimal on both v2 and v3.

16) Let's use the aforementioned range of 0.995-1.005 for DAI/USDC (400x efficiency multiplier). I found some LPs who have been LPing in that range and compared their APRs with APRs for the same periods on Uni v2. Results on the graph below:

17) V3 DAI/USDC position with 400x efficiency multiplier didn't earn substantially more fees for LPs. Surprisingly, it's the opposite. V3 LPs largely underperformed v2 pool in June and July and earned marginally more if they started LPing in early May. Why did it happen?

18) In May Uni v3 had higher volume and lower TVL than in June and July (higher V/L), therefore, LPing was more profitable than it is now. Moreover, competition between LPs wasn't as fierce as today, hence, wide price ranges still offered competitive returns for LPs. Not anymore.

19) The desire to outsmart other LPs incentivized LPs to narrow down their price ranges to earn more fees. As a result the great majority of the total liquidity is concentrated in a single tick (the narrowest possible range) and fees for everyone went down to low single digits.

20) We have come to the gist of the aforementioned misconception about Uni v3:

Concentrated liquidity = Capital efficiency

But:

Concentrated liquidity <> More fees for LPs

And remember we have ignored the impact of IL which completely changes the perspective on volatile pairs!

Concentrated liquidity = Capital efficiency

But:

Concentrated liquidity <> More fees for LPs

And remember we have ignored the impact of IL which completely changes the perspective on volatile pairs!

21) Concentrated liquidity substantially increases the risk of IL. It might be irrelevant on stablecoin pools but it's a serious issue on other pairs. Because of IL, LPs on Uni v3 often underperform buy-and-hold strategy, especially in narrow price ranges.

https://twitter.com/korpi87/status/1400963737578782724

22) Uni V3 allows LPs to express their market making strategy which is a trade-off between earning opportunity and IL risk. This is a playground mostly for professionals as LPing requires active management of liquidity pools taking time & skill & money.

https://twitter.com/korpi87/status/1398069586252206081

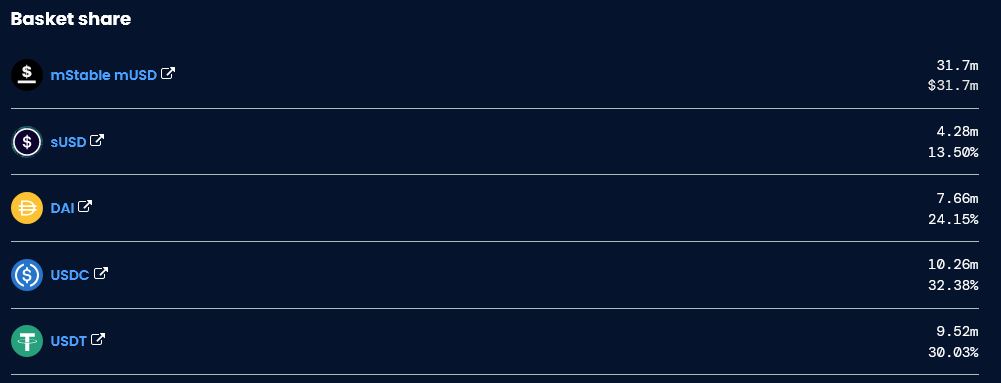

23) The majority of token holders don't have time & skill & money to become successful LPs on Uni v3. But these requirements are not needed on @Bancor. With single-sided staking and IL-protection, Bancor is an interest-bearing account for token holders.

https://twitter.com/korpi87/status/1409449906876604417

24) To start saving on Bancor, token holders just need to deposit their favorite tokens and wait while earning trading fees and liquidity mining rewards. They are guaranteed to outperform holding because Bancor protects them from any IL (full protection after 100 days).

25) While other AMMs can often lure LPs with higher Fees APR, the ROI can often become negative when IL is taken into account. Bancor, with its killer IL protection, can be a DeFi bank for all crypto users. Just wait until they discover this opportunity...

https://twitter.com/korpi87/status/1409449809283530753

Resources I used:

- revert.finance - track Uni v3, Uni v2 and Sushiswap positions

- amm.vav.me - compare LPing profitability on Uni v2, Sushiswap and Bancor

- defi-lab.xyz/uniswapv3simul… - play with Uni v3 ranges to see your efficiency multiplier and IL risk

- revert.finance - track Uni v3, Uni v2 and Sushiswap positions

- amm.vav.me - compare LPing profitability on Uni v2, Sushiswap and Bancor

- defi-lab.xyz/uniswapv3simul… - play with Uni v3 ranges to see your efficiency multiplier and IL risk

• • •

Missing some Tweet in this thread? You can try to

force a refresh