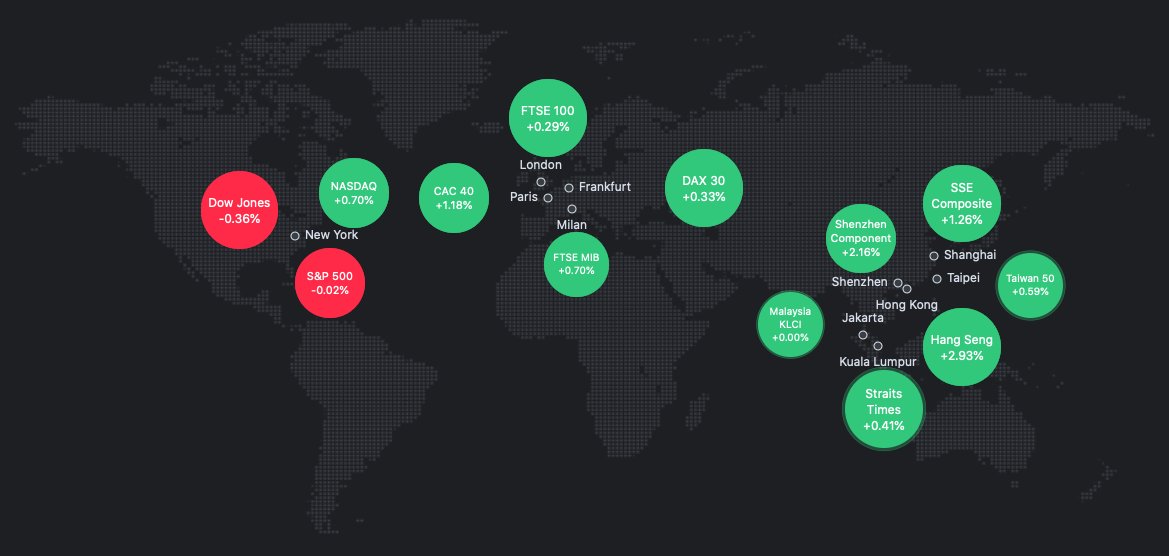

FTSE China A50 Index futures open 2.6% higher on Thursday morning following the 3% gain overnight.

Sources said China's authority had a hastily call with major intl banks in a bid to restore the market calm after the recent rout.

#China #StockMarket

Sources said China's authority had a hastily call with major intl banks in a bid to restore the market calm after the recent rout.

https://twitter.com/Sino_Market/status/1420369242067668995?s=20

#China #StockMarket

Hang Seng Tech Index up 6%, #Meituan jumps 10%, #Tencent rises 7% and #Alibaba gains 5%.

$BABA #Hang #China #HongKong #StockMarket

$BABA #Hang #China #HongKong #StockMarket

SSE Composite Index +1.26%

Shenzhen Component Index +2.16%

SZSE ChiNext Price Index +2.75%

#China #StockMarket $ASHR

Shenzhen Component Index +2.16%

SZSE ChiNext Price Index +2.75%

#China #StockMarket $ASHR

#K12 Education stocks in Hong Kong get recovered on Thursday, the gauge tracking this sector jumps 8% at the opening.

New Oriental Education gains about 10%, Scholar Education up 6%.

$EDU #stockamarket

New Oriental Education gains about 10%, Scholar Education up 6%.

$EDU #stockamarket

The digital health sector in #HongKong gains 7%.

JD Health +10.9%

Alibaba Health +8.95%

#JD #Alibaba $JD $BABA #China #StockMarket

JD Health +10.9%

Alibaba Health +8.95%

#JD #Alibaba $JD $BABA #China #StockMarket

#JD.com +9%, most since Nov. 5.

#Tencent +7.3%, most since April 1.

#Bilibili +13%, most on record.

#Alibaba +5.2%, most since May 12.

$JD $BABA $BILI $TCEHY #China #HongKong #StockMarket

#Tencent +7.3%, most since April 1.

#Bilibili +13%, most on record.

#Alibaba +5.2%, most since May 12.

$JD $BABA $BILI $TCEHY #China #HongKong #StockMarket

Hang Seng Tech Index extends gains to 7.3%, the biggest increase intraday on record.

#Tencent +9.0%

#Alibaba +6.5%

#JD.com +11.0%

#China #Hang #HongKong #StockMarket

#Tencent +9.0%

#Alibaba +6.5%

#JD.com +11.0%

#China #Hang #HongKong #StockMarket

SZSE ChiNext Price Index extends gains to 4%, mainly led by the rare metals sector and the lithography machine sector.

#China #StockMarket

#China #StockMarket

Hang Seng Index increases by 3.1%, with #Alibaba Health up 19.3%, #Tencent up 9.6%, #Meituan up 9.2%, #BYD up 9.4% and #Xiaomi up 3.0%.

#China #StockMarket

#China #StockMarket

The automobiles sector surges about 9% in #HongKong.

XPeng Inc +12.4%,

Geely Automobile +8.0%.

#XPEV #GEELY #Vehicle #Auto $XPEV $GEELY #China

#StockMarket

XPeng Inc +12.4%,

Geely Automobile +8.0%.

#XPEV #GEELY #Vehicle #Auto $XPEV $GEELY #China

#StockMarket

SZSE ChiNext Price Indexextends gains to 5%, mainly led by the #semiconductors sector and the new material sector.

The semiconductors sector increases by 5.8%.

Shanghai Fudan Microelectronics Group+14.1%,

SMIC +6.1%.

#China #StockMarket #SMIC

The semiconductors sector increases by 5.8%.

Shanghai Fudan Microelectronics Group+14.1%,

SMIC +6.1%.

#China #StockMarket #SMIC

The online Education sector in #HongKong continues to extend gains, up 14%.

Scholar Education Group +39%,

Koolearn Technology +16.3%,

New Oriental Education +12.2%.

#EDU $EDU #education #China #StockMarket

Scholar Education Group +39%,

Koolearn Technology +16.3%,

New Oriental Education +12.2%.

#EDU $EDU #education #China #StockMarket

• • •

Missing some Tweet in this thread? You can try to

force a refresh