Boss is always Boss @Mitesh_Engr

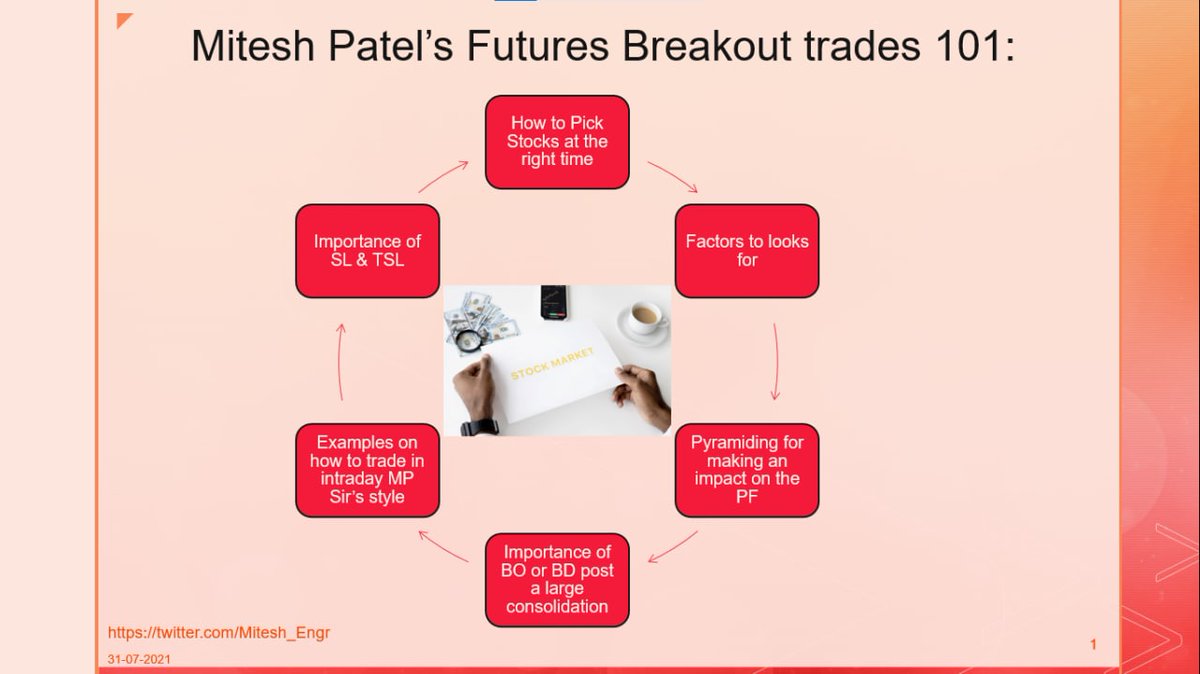

Mitesh Sir's FUTURES BREAKOUT TRADES 101:

• How to pick stocks at right time?

• What to look for?

• Importance of BO post consolidation

• How to manage SL

• How to get huge profits

• Multiple Examples

In collaboration with @niki_poojary

Mitesh Sir's FUTURES BREAKOUT TRADES 101:

• How to pick stocks at right time?

• What to look for?

• Importance of BO post consolidation

• How to manage SL

• How to get huge profits

• Multiple Examples

In collaboration with @niki_poojary

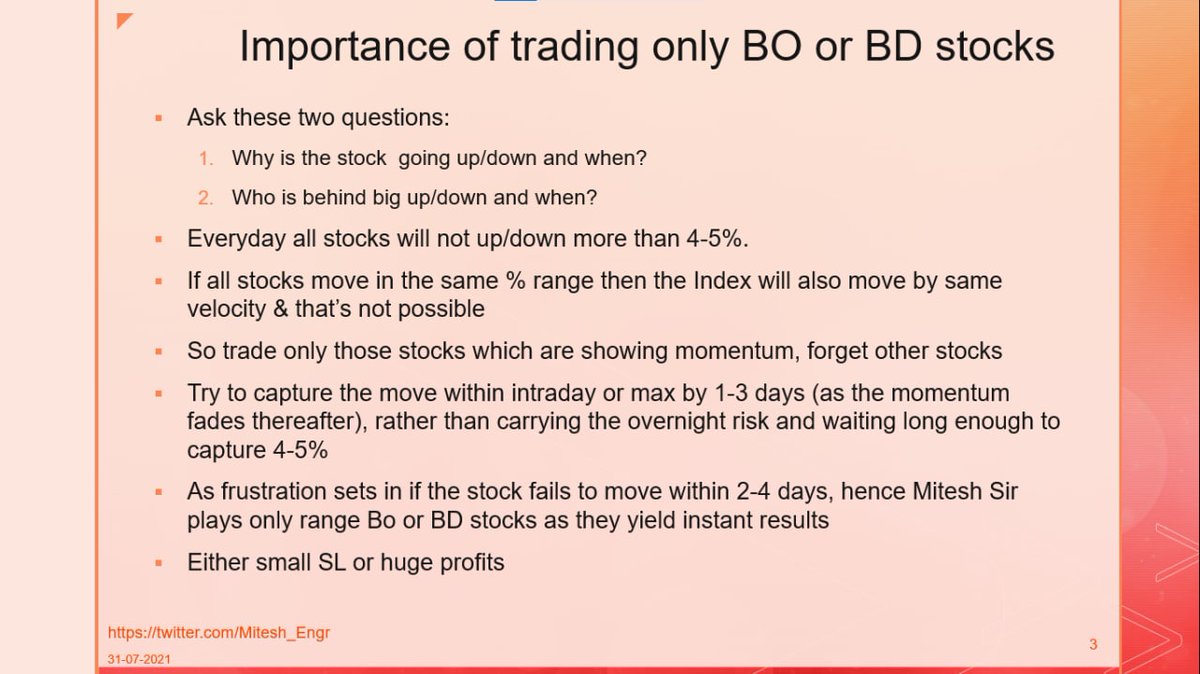

Importance of Trading only BO or BD stocks by @Mitesh_Engr Sir: 👇

•Two questions to always ask:

~Why stock is going up/down and when?

~ Who is behind big up/down and when?

• Trade only stocks with Momentum

• Instant results

• Small SL or huge profits

•Two questions to always ask:

~Why stock is going up/down and when?

~ Who is behind big up/down and when?

• Trade only stocks with Momentum

• Instant results

• Small SL or huge profits

@Mitesh_Engr Sir's take on how to Trade: 👇

• Observe fight between buyer & seller

• Position will be created within first 3 hours

• Operators will win

• Just find BO or BD

• Look for huge volume support

• Give company to operators

• ATP importance explained

• Observe fight between buyer & seller

• Position will be created within first 3 hours

• Operators will win

• Just find BO or BD

• Look for huge volume support

• Give company to operators

• ATP importance explained

How to take trade in Breakout/Breakdown stocks by @Mitesh_Engr Sir: 👇

• Check Support & Resistance

• Wait for 2-3 months consolidation

• Surge in volumes

• Trade on 3 min charts

• Small SL

• Keep trailing

• Always pyramid in profit

• Check Support & Resistance

• Wait for 2-3 months consolidation

• Surge in volumes

• Trade on 3 min charts

• Small SL

• Keep trailing

• Always pyramid in profit

When and Why to Pyramid? By @Mitesh_Engr Sir

• Adding to winning positions

• Signals of continued strength

• Potentially large profits

• An Example of pyramiding in one of his trades

• Adding to winning positions

• Signals of continued strength

• Potentially large profits

• An Example of pyramiding in one of his trades

Deep pocket traders can create the momentum

One needs only 10 crore to create 3% of total Future Trading volume within the first hour in morning.

One needs only 10 crore to create 3% of total Future Trading volume within the first hour in morning.

Consolidation in uptrend followed by a BO - by @Mitesh_Engr Sir

• This is one of Mitesh Sir's favourite pattern.

• IGL example is a textbook example

• Bharti example look for volumes in downmove

• Less volumes during downmove

• Gives conviction for further uptrend

• This is one of Mitesh Sir's favourite pattern.

• IGL example is a textbook example

• Bharti example look for volumes in downmove

• Less volumes during downmove

• Gives conviction for further uptrend

Tech Mahindra trade of @Mitesh_Engr Sir explained:

• Tech M was consolidating near higher levels

• Gapped up with huge volumes

• Operators in total control

• Tech M was consolidating near higher levels

• Gapped up with huge volumes

• Operators in total control

BEL Breakout Trade by @Mitesh_Engr Sir

• Resisted a level two times

• Third attempt with volumes

• Smart Money is interested

• Give company to smart money to make money

• Picked the trade at the right time

• Rejected a big red candle with upmove

• Resisted a level two times

• Third attempt with volumes

• Smart Money is interested

• Give company to smart money to make money

• Picked the trade at the right time

• Rejected a big red candle with upmove

Wipro Trade Explained by @Mitesh_Engr Sir:

• Up with volumes

• Not correcting much

• Not going up for retailers to sell

• Learn to put a SL the way shown

• Up with volumes

• Not correcting much

• Not going up for retailers to sell

• Learn to put a SL the way shown

Muthoot Finance Trade - Fresh ATH Trade by @Mitesh_Engr Sir explained:

• Strong Volume in Daily

• Detailed explanation on how he traded is explained by himself

• Went long & SL hit

• Bought again while reversing

• Pyramiding done

• Exited with huge profit

• Strong Volume in Daily

• Detailed explanation on how he traded is explained by himself

• Went long & SL hit

• Bought again while reversing

• Pyramiding done

• Exited with huge profit

INFY ADR: Live Trade explained on twitter on @Mitesh_Engr Sir's handle

Mitesh Sir was explaining how he would trade looking at INFY ADR.

• Buy above high, Sell below low

• Buy triggered

• SL at cost when it went up further

• Sl hit

• Again re-entry

Mitesh Sir was explaining how he would trade looking at INFY ADR.

• Buy above high, Sell below low

• Buy triggered

• SL at cost when it went up further

• Sl hit

• Again re-entry

Hindalco Trade of @Mitesh_Engr Sir explained:

• Sellers entered at 420 levels

• Buyers managed to defeat sellers

• Huge surge in volumes

• Smart Money footprints evident

Both Daily and Intraday charts are posted with detailed explanations 👇

• Sellers entered at 420 levels

• Buyers managed to defeat sellers

• Huge surge in volumes

• Smart Money footprints evident

Both Daily and Intraday charts are posted with detailed explanations 👇

What to do after trade is successful?

An example of what he did in Hindalco.

• Booked long & sold Otm puts

• Risked profit further

• If stock reverses sell calls

• Ready to short futures too if reverses

• Follow the market

Made around 3.7 lakh profit on a 26 lakh account.

An example of what he did in Hindalco.

• Booked long & sold Otm puts

• Risked profit further

• If stock reverses sell calls

• Ready to short futures too if reverses

• Follow the market

Made around 3.7 lakh profit on a 26 lakh account.

According to @Mitesh_Engr Sir what to focus on and what to avoid:

• Focus on Stop losses and Trailing Stop losses

• Profits will take care of themselves

• Mistake is predicting targets

• View prevents you to change position

• He never ever knows target

• Only SL and TSL

• Focus on Stop losses and Trailing Stop losses

• Profits will take care of themselves

• Mistake is predicting targets

• View prevents you to change position

• He never ever knows target

• Only SL and TSL

Warning: Futures Trading is highly risky

Venture into it only after you've made decent percentage gain on your capital.

Try to avoid before that.

Money leaves your account faster than it comes when you don't know what you're doing in futures.

Venture into it only after you've made decent percentage gain on your capital.

Try to avoid before that.

Money leaves your account faster than it comes when you don't know what you're doing in futures.

This was a Breakouts thread on how @Mitesh_Engr Sir trades them in FUTURES.

@niki_poojary and @AdityaTodmal will be making more threads on how Mitesh Sir trades.

Next thread is on his Breakdown Trades

Keep an eye out for these threads.

Happy learning to everyone!

__________

@niki_poojary and @AdityaTodmal will be making more threads on how Mitesh Sir trades.

Next thread is on his Breakdown Trades

Keep an eye out for these threads.

Happy learning to everyone!

__________

• • •

Missing some Tweet in this thread? You can try to

force a refresh