What I really don't get about Tether fears is this:

Let's say its right and Tether implodes to zero. What happens to Bitcoin or digital assets? Down 30% immediately? down 50%? down 60% down 80%?

Ok. Well, we just did that (many tokens were down 80%) and guess what? 1/

Let's say its right and Tether implodes to zero. What happens to Bitcoin or digital assets? Down 30% immediately? down 50%? down 60% down 80%?

Ok. Well, we just did that (many tokens were down 80%) and guess what? 1/

2/ Life went on. Nothing happened.

If fact, crypto markets do a -70% pretty often and guess what, nothing happens and adoption keeps rising.

When I first learned about Bitfinex's issues BTC was at 6,100. It could now fall 80% and still not hit that.

If fact, crypto markets do a -70% pretty often and guess what, nothing happens and adoption keeps rising.

When I first learned about Bitfinex's issues BTC was at 6,100. It could now fall 80% and still not hit that.

3/ We all get it but no one here has found a new source of risk the market didn't know.

It has been talked about for 4 years - the people involved! Deltec! the illicit use! the backing isn't 1:1 in cash in a vault guarded by Rottweilers! regulators! blah blah blah blah blah

It has been talked about for 4 years - the people involved! Deltec! the illicit use! the backing isn't 1:1 in cash in a vault guarded by Rottweilers! regulators! blah blah blah blah blah

One day, this too shall pass and the bogeyman will just be exposed as yet another speed bump on the road. Maybe it causes a sharp sell off, maybe not. Who cares...yawn.

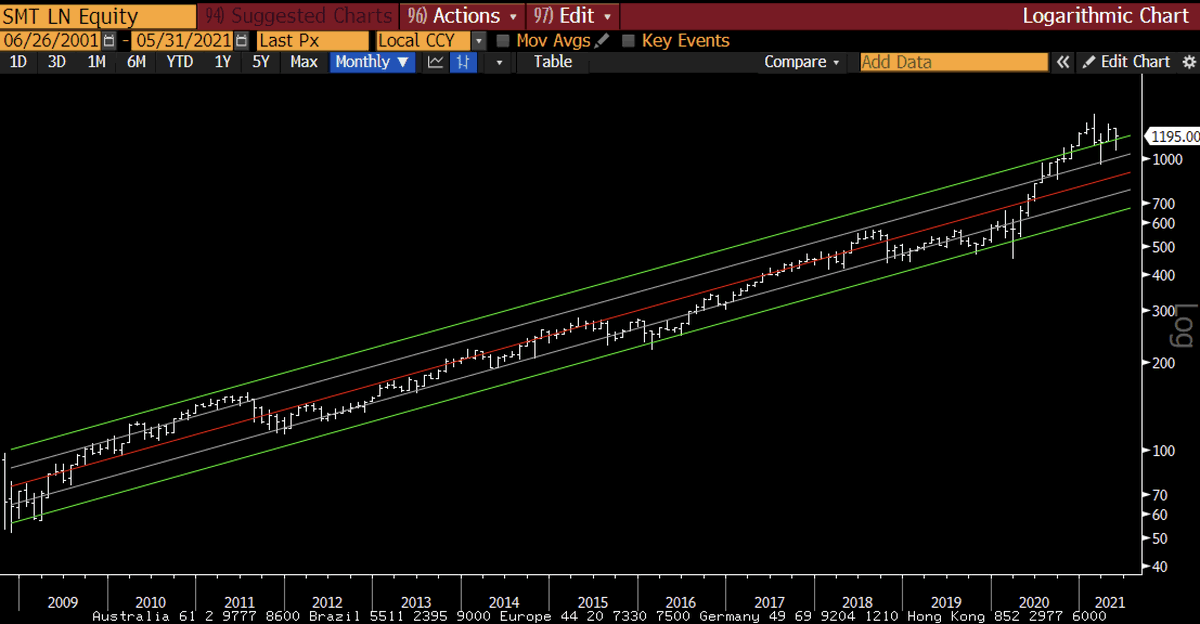

To stop an adoption curve like this, you need a whole lot more risk than Tether.

To stop an adoption curve like this, you need a whole lot more risk than Tether.

Really, you are just expressing your own risk aversion to BTC, not the actual risk to BTC.

Wildly different things.

It's ok to not be comfortable with this new technology, but looking for bogeymen everywhere is an expression of your own fears.

The mirror is a scary place.

Wildly different things.

It's ok to not be comfortable with this new technology, but looking for bogeymen everywhere is an expression of your own fears.

The mirror is a scary place.

• • •

Missing some Tweet in this thread? You can try to

force a refresh