Exxaro Tiles IPO

Let's understand everything about the business and its IPO!

Retweet for a wider reach!

#IPOwithJST #Tiles

Let's understand everything about the business and its IPO!

Retweet for a wider reach!

#IPOwithJST #Tiles

1/

About Exxaro Tiles

- Incorporated in 2008

- Manufactures vitrified tiles - Double Charge Vitrified Tiles and Glazed Vitrified Tiles made from ceramic materials

- Principal raw materials used in the manufacturing process are feldspar, clay, frit, bentonite, etc

About Exxaro Tiles

- Incorporated in 2008

- Manufactures vitrified tiles - Double Charge Vitrified Tiles and Glazed Vitrified Tiles made from ceramic materials

- Principal raw materials used in the manufacturing process are feldspar, clay, frit, bentonite, etc

2/

- Company has long term gas supply agreements with various suppliers for natural gas procurement

- Product portfolio consists of 1000+ different designs of tiles in 6 sizes

- Topaz Series, Galaxy Series, and High Gloss Series are some of the well-established products

- Company has long term gas supply agreements with various suppliers for natural gas procurement

- Product portfolio consists of 1000+ different designs of tiles in 6 sizes

- Topaz Series, Galaxy Series, and High Gloss Series are some of the well-established products

3/

Who does it supply to?

- Large Infra projects i.e. residential, educational, commercial, hotels, hospitals, government, builders or developers, religious institutions, etc

- Also exports tiles to different countries such as Poland, Bosnia, the USA, and others

Who does it supply to?

- Large Infra projects i.e. residential, educational, commercial, hotels, hospitals, government, builders or developers, religious institutions, etc

- Also exports tiles to different countries such as Poland, Bosnia, the USA, and others

4/

Distribution

- Selling products to retail customers through a distribution network of dealers and sub-dealers across India.

- 2000+ registered dealers

Distribution

- Selling products to retail customers through a distribution network of dealers and sub-dealers across India.

- 2000+ registered dealers

5/

Manufacturing -

For FY21 - capacity utilization of the Padra Facility was 64.43% while that of the Talod Facility was 71.95%

Manufacturing -

For FY21 - capacity utilization of the Padra Facility was 64.43% while that of the Talod Facility was 71.95%

7/

Issue Details

Price – ₹ 118 - 120

Date – 4 to 6 August

Issue Size – Rs 161 Cr

Split – 134 Cr Fresh issue + 27 Cr Offer for sale

Mcap Post issue – 536 Cr (Small company)

Issue Details

Price – ₹ 118 - 120

Date – 4 to 6 August

Issue Size – Rs 161 Cr

Split – 134 Cr Fresh issue + 27 Cr Offer for sale

Mcap Post issue – 536 Cr (Small company)

8/

Objectives of Issue –

- 50 cr towards repaying the existing debt

- 45 cr towards working capital

- Meet general corporate purposes.

Objectives of Issue –

- 50 cr towards repaying the existing debt

- 45 cr towards working capital

- Meet general corporate purposes.

9/

Credit Rating - (Brickwork ratings)

- For Fund-based long-term borrowing as BWR BBB+ with a stable outlook

- For Non-Fund based - short term borrowing as BWR A3+. Rating valid till Aug 5, 2021

Hat tip - what does the rating mean? Check here - brickworkratings.com/RatingsScale.a…

Credit Rating - (Brickwork ratings)

- For Fund-based long-term borrowing as BWR BBB+ with a stable outlook

- For Non-Fund based - short term borrowing as BWR A3+. Rating valid till Aug 5, 2021

Hat tip - what does the rating mean? Check here - brickworkratings.com/RatingsScale.a…

10/

Risks –

- Provided security in respect of loans by creating a charge over movable and immovable properties. The total amounts outstanding and payable are Rs 143 Cr as of FY21

Risks –

- Provided security in respect of loans by creating a charge over movable and immovable properties. The total amounts outstanding and payable are Rs 143 Cr as of FY21

11/

- As of FY21 - Trade receivables of Rs 90 Cr, 24% of the total balance sheet (has been constant at this % last 2 years also)

- Rs 3.3 Cr is due for 6 months+ and up to 1 year

- Rs 12 Cr due for 1 year+

- As of FY21 - Trade receivables of Rs 90 Cr, 24% of the total balance sheet (has been constant at this % last 2 years also)

- Rs 3.3 Cr is due for 6 months+ and up to 1 year

- Rs 12 Cr due for 1 year+

12/

- As of the date of RHP, they are yet to recover the amount of Rs. 3.7 Cr from 64 debtors on which they have filed complaints

- As of the date of RHP, they are yet to recover the amount of Rs. 3.7 Cr from 64 debtors on which they have filed complaints

13/

Financials -

B/S - Receivables high, debt to come down post IPO , debt to equity to get better

P&L - CAGR given, Net profit aided by lower cost of purchases

CF - Cash flows have been good

Financials -

B/S - Receivables high, debt to come down post IPO , debt to equity to get better

P&L - CAGR given, Net profit aided by lower cost of purchases

CF - Cash flows have been good

14/

In FY21 - EPS was Rs 4.54, RoE 11.88%, NAV Rs 38.2, and Sales of Rs 259 cr

Valuation -

P/E – 26.4x | P/S – 2.1x | P/BV – 3.1x

In FY21 - EPS was Rs 4.54, RoE 11.88%, NAV Rs 38.2, and Sales of Rs 259 cr

Valuation -

P/E – 26.4x | P/S – 2.1x | P/BV – 3.1x

15/

Peer comparison (Screener)

Of course Kajaria, Cera, Somany are very big when compared to Exxaro

Asian Granito - 2-year rev cagr has been 4%, 2-year profit cagr has been 65%, debt also low, still trades at 10x PE

Murudeshwar made a loss, trades at 2.1x P/S

Peer comparison (Screener)

Of course Kajaria, Cera, Somany are very big when compared to Exxaro

Asian Granito - 2-year rev cagr has been 4%, 2-year profit cagr has been 65%, debt also low, still trades at 10x PE

Murudeshwar made a loss, trades at 2.1x P/S

16/

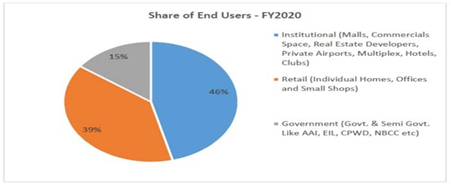

Ceramic Clusters in India (Morbi being the market leader)

End Users

End of thread! Thanks for reading!

We will post about Krsnaa IPO tomorrow and then Cartrade and Nuvoco Vistas also soon!

Ceramic Clusters in India (Morbi being the market leader)

End Users

End of thread! Thanks for reading!

We will post about Krsnaa IPO tomorrow and then Cartrade and Nuvoco Vistas also soon!

• • •

Missing some Tweet in this thread? You can try to

force a refresh