Took me a sec to understand this one. Inverted yields calling for a top in ISM manufacturing numbers. When those yields are shifted forward 18 months.

Decent correlation.

1/

Decent correlation.

1/

https://twitter.com/AndreasSteno/status/1422198705894137864

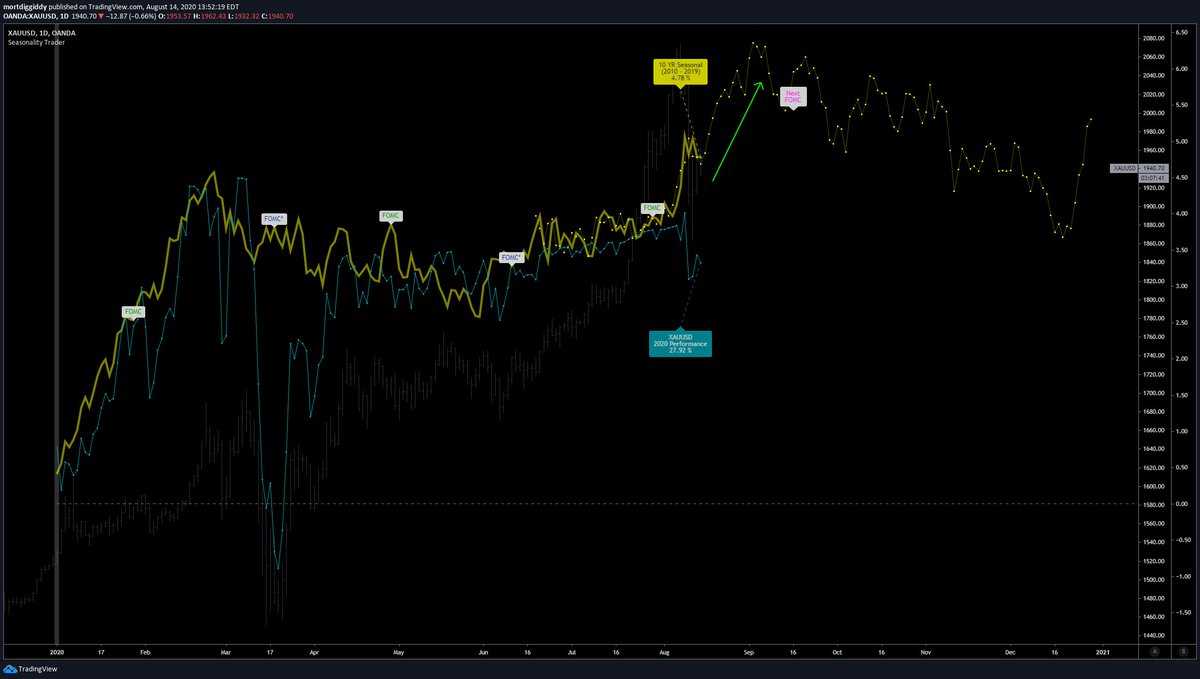

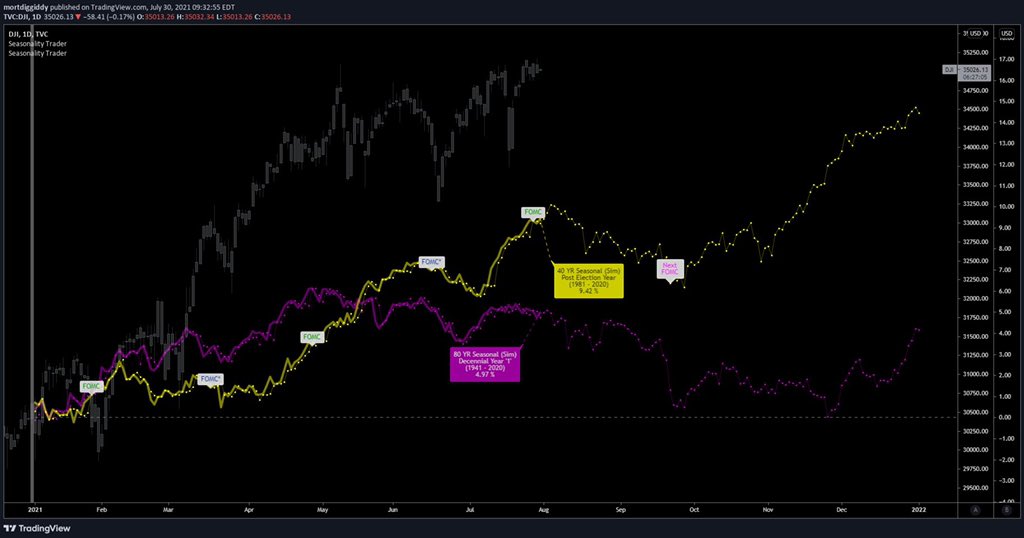

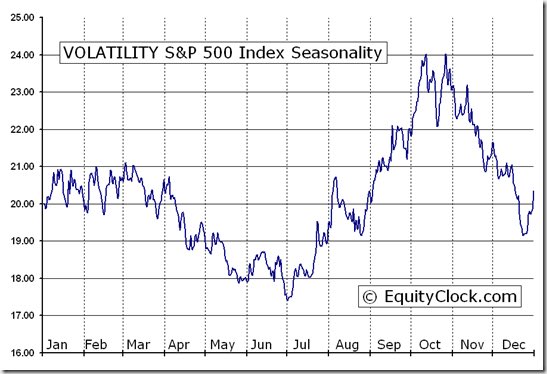

6/ There are a lot of correlations with manufacturing pointing to a slowdown in August - September.

This is in line with seasonal tops in decennial and election cycles for this time of year.

$SPY $QQQ $SPX $IWM $VIX $VXX $AMZN $GOOG $AAPL $DJI

This is in line with seasonal tops in decennial and election cycles for this time of year.

$SPY $QQQ $SPX $IWM $VIX $VXX $AMZN $GOOG $AAPL $DJI

• • •

Missing some Tweet in this thread? You can try to

force a refresh