Alibaba $BABA 1Q21 Earnings 💪🏻

- Rev $32b +34% ↗️

- Rev (ex-Sun Art) $29b +22% ↗️

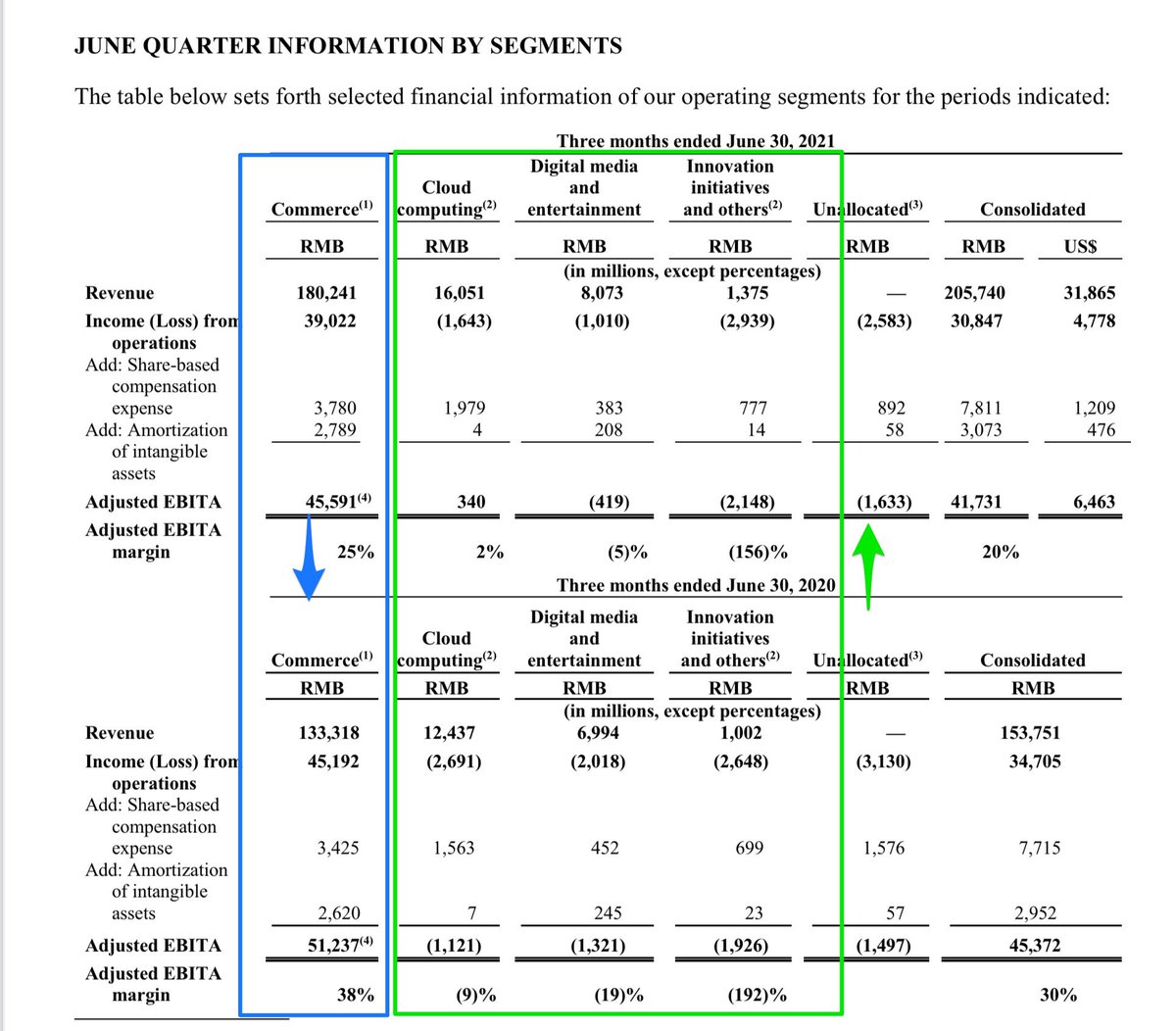

- EBIT $4.8b -11% ↘️ margin 15% -758bps ↘️

- Adj EBITA $6.5b -8% margin 20% -922bps ↘️

- Net Income $7b -5% ↘️ margin 22% -901bps ↘️

- OCF $5.2b -33% ↘️

- FCF $3.2b -43% ⬇️ (~ $1.4b fine)

- Rev $32b +34% ↗️

- Rev (ex-Sun Art) $29b +22% ↗️

- EBIT $4.8b -11% ↘️ margin 15% -758bps ↘️

- Adj EBITA $6.5b -8% margin 20% -922bps ↘️

- Net Income $7b -5% ↘️ margin 22% -901bps ↘️

- OCF $5.2b -33% ↘️

- FCF $3.2b -43% ⬇️ (~ $1.4b fine)

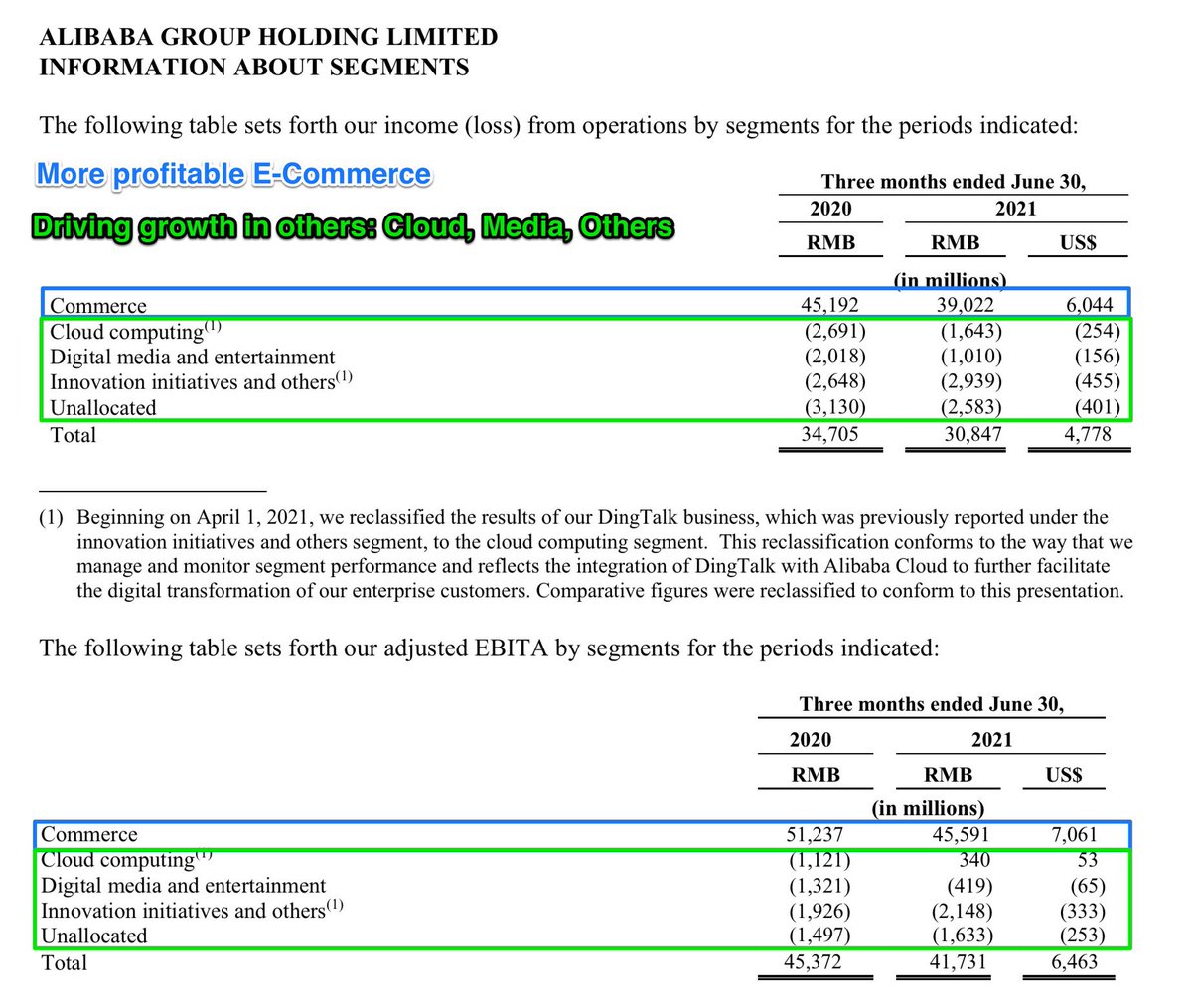

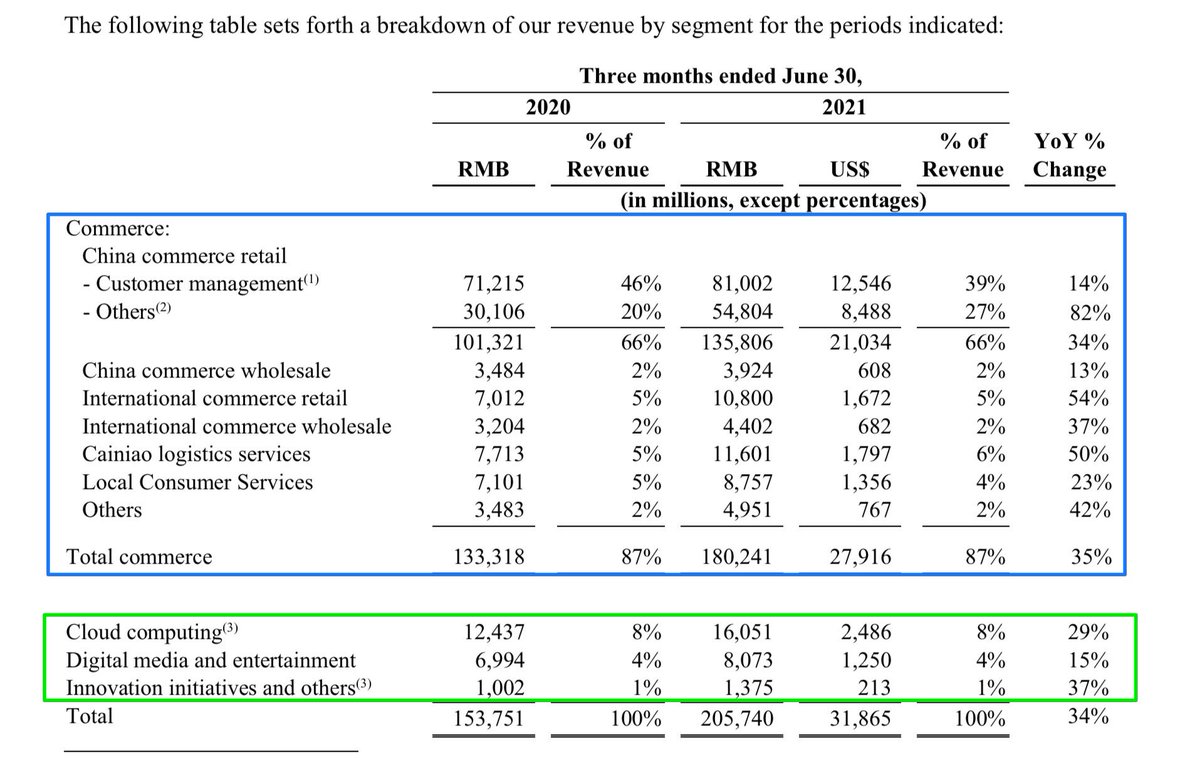

➡️ Faster growth & more profitable E-Commerce 🛒📦 (~87% of Rev, ~109% of Adj EBITDA Rev +35%YoY) continues to fund Cloud ☁️, Media 🎬, other initiatives.

➡️ All Segments grew revenue, Total +34%YoY:

1) E-Commerce (+35%YoY) ⬆️

2) Cloud (Rev +29%YoY) ⬆️

3) Media (Rev +15%YoY) ↗️ - slower, not new

4) Other Initiatives (Rev +37%YoY) ⬆️ - off small base

1) E-Commerce (+35%YoY) ⬆️

2) Cloud (Rev +29%YoY) ⬆️

3) Media (Rev +15%YoY) ↗️ - slower, not new

4) Other Initiatives (Rev +37%YoY) ⬆️ - off small base

➡️ Core commerce Adj EBITA margins lowered to 25% by -1300bps. due to anti-monopoly fine (non-recurring) and Capex investments.

➡️ Improving Adj EBITA margins (profitability) in Cloud (to 2% +1100bps) and in Media (-5% +1400bps) and Others.

➡️ Improving Adj EBITA margins (profitability) in Cloud (to 2% +1100bps) and in Media (-5% +1400bps) and Others.

➡️ Capex: “Investments in strategic areas…, such as Community Marketplaces, Taobao Deals, Local Consumer Services & Lazada, as well as our increased spending on growth initiatives within China retail marketplaces, such as Idle Fish and Taobao Live, and our support to merchants.

Final Thoughts on Alibaba $BABA:

(1) One-time anti-monopoly fine (paid ~50% of $2.8b) and (2) strategic LT capex investments resulting in lower profit & cash flow growth/margins near-term. Commerce continues to drive growth in Cloud and others. Thesis unchanged despite noise.

(1) One-time anti-monopoly fine (paid ~50% of $2.8b) and (2) strategic LT capex investments resulting in lower profit & cash flow growth/margins near-term. Commerce continues to drive growth in Cloud and others. Thesis unchanged despite noise.

• • •

Missing some Tweet in this thread? You can try to

force a refresh