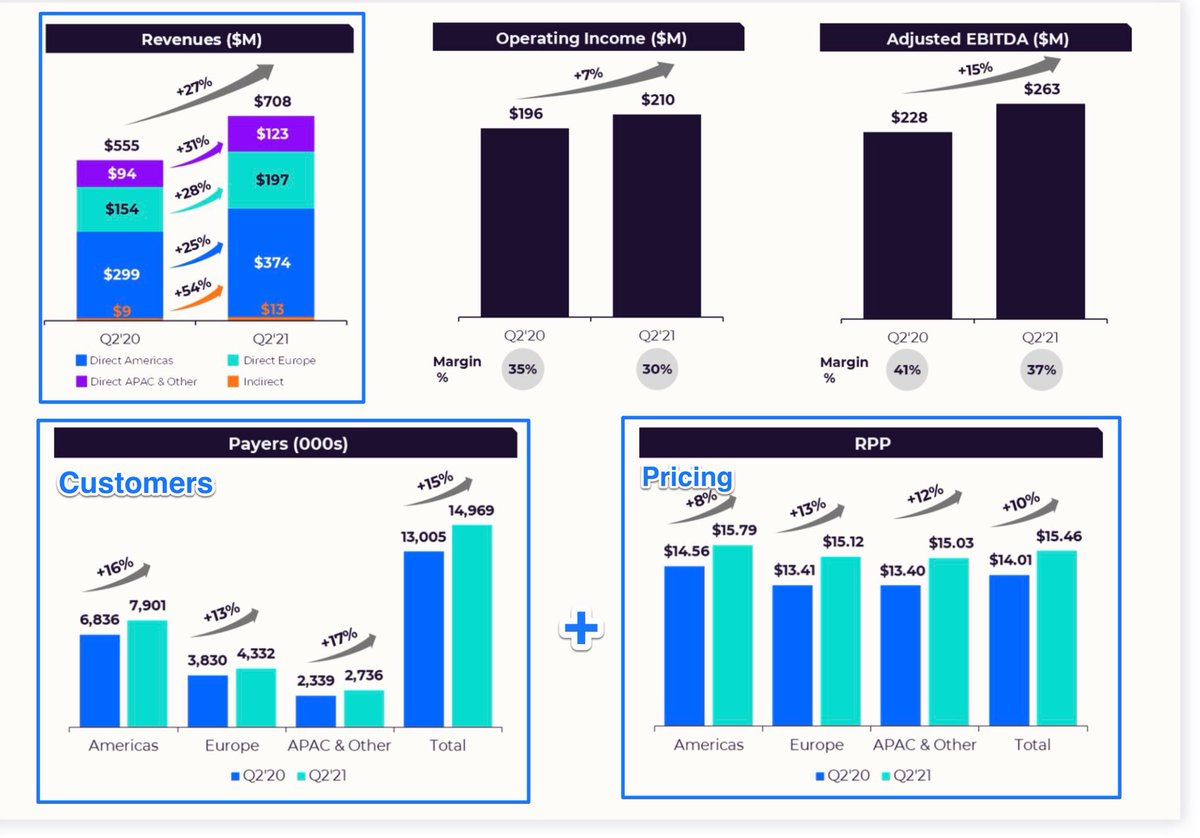

Roku $ROKU 2Q21 Earnings 🚀

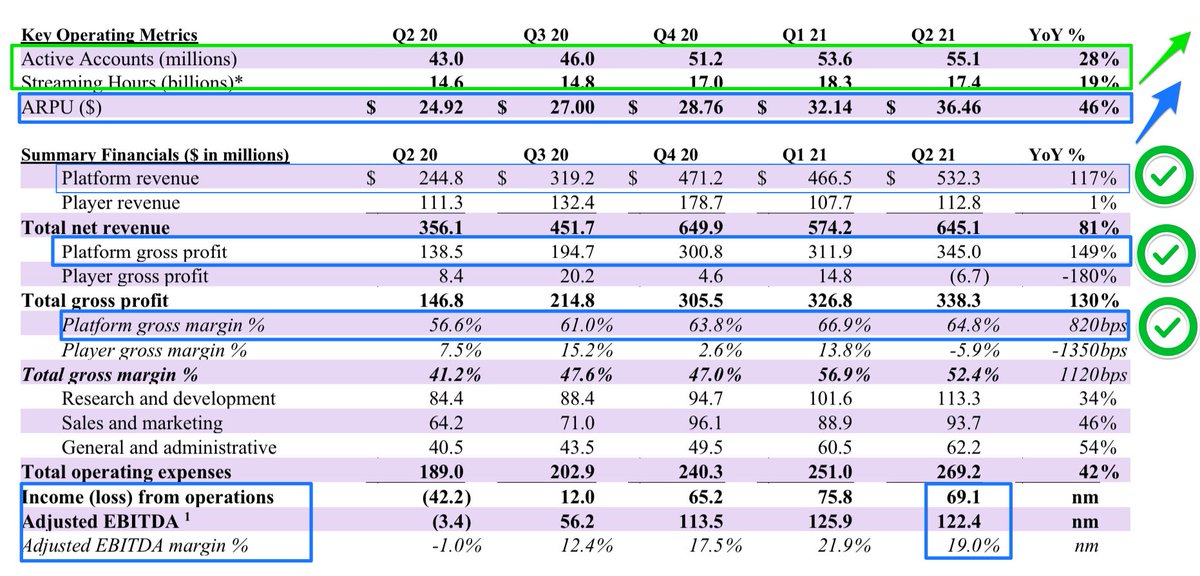

- Rev $645m +81% 🚀

- Gross Profit $338m +130% 🚀 margin 52% +1120bps ✅

- EBIT $69m +164% 🚀 margin 11% +2256bps ✅

- Adj EBITDA $122m +36X 🚀 margin 19% +1992bps ✅

- 6M OCF $144m +81% 🚀

- Rev $645m +81% 🚀

- Gross Profit $338m +130% 🚀 margin 52% +1120bps ✅

- EBIT $69m +164% 🚀 margin 11% +2256bps ✅

- Adj EBITDA $122m +36X 🚀 margin 19% +1992bps ✅

- 6M OCF $144m +81% 🚀

$ROKU Segment & Biz Metrics 💪🏻

➡️ Platform Driver of Growth & Profitability

- Plat Rev $532m +117% 🚀

- Player Rev $112m +1% ➡️

- Plat Gross Profit $345m +149% 🚀 margin 65% +820bps ✅

➡️ Strong ARPU Growth

- Accts 55m +28% ↗️

- Strming Hrs 17.4b +19% ↗️

- ARPU $36.46 +46% ⬆️💪🏻

➡️ Platform Driver of Growth & Profitability

- Plat Rev $532m +117% 🚀

- Player Rev $112m +1% ➡️

- Plat Gross Profit $345m +149% 🚀 margin 65% +820bps ✅

➡️ Strong ARPU Growth

- Accts 55m +28% ↗️

- Strming Hrs 17.4b +19% ↗️

- ARPU $36.46 +46% ⬆️💪🏻

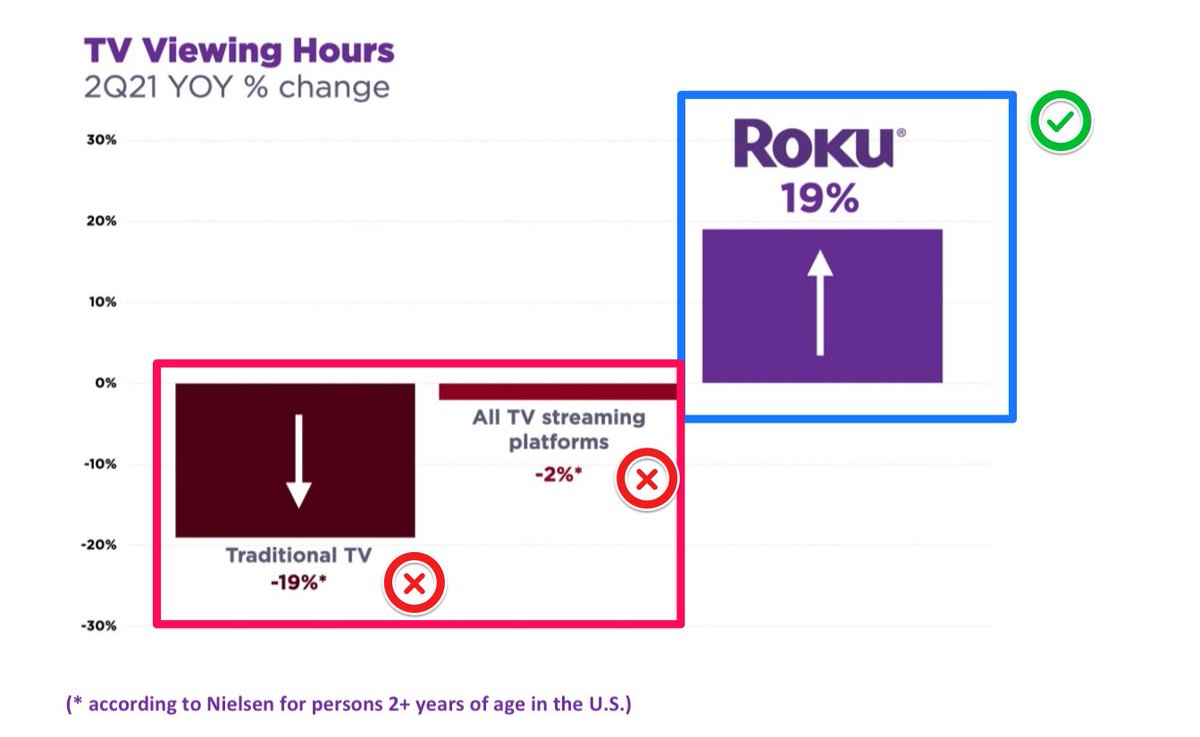

➡️ $ROKU Outperformance💪🏻

“On a YOY basis, Roku significantly outperformed the industry, with Roku’s streaming hours increasing nearly +19% globally, compared to a nearly -19% decline in traditional TV consumption and a nearly 2% decline in TV streaming... according to Nielsen.”

“On a YOY basis, Roku significantly outperformed the industry, with Roku’s streaming hours increasing nearly +19% globally, compared to a nearly -19% decline in traditional TV consumption and a nearly 2% decline in TV streaming... according to Nielsen.”

➡️ LT Secular Trend -TV Streaming

“We are pleased with our strong performance in Q2, and are excited about the road ahead. Roku remains very well positioned to benefit from the long-term secular trend of audiences, content & advertisers shifting to TV streaming around the globe.

“We are pleased with our strong performance in Q2, and are excited about the road ahead. Roku remains very well positioned to benefit from the long-term secular trend of audiences, content & advertisers shifting to TV streaming around the globe.

➡️ The DTC Streaming Platform

“Our success during the Upfronts this year, the clear value we offer partners seeking to build their own DTC streaming businesses, and the continued acceleration of The Roku Channel flywheel are evidence of the competitive advantages we have built.”

“Our success during the Upfronts this year, the clear value we offer partners seeking to build their own DTC streaming businesses, and the continued acceleration of The Roku Channel flywheel are evidence of the competitive advantages we have built.”

➡️ Player margins under pressure near-term 📉

- Tight component supply conditions and shipping constraints continued to increase costs faster than expected.

- Insulated increased costs in 2Q, causing player margins to ↘️.

- Expect to worsen into 2H21 and continue into 2022.

- Tight component supply conditions and shipping constraints continued to increase costs faster than expected.

- Insulated increased costs in 2Q, causing player margins to ↘️.

- Expect to worsen into 2H21 and continue into 2022.

➡️ Platform monetisation remains strong & to dominate

“Within Platform segment, monetization remains strong, and while there will be a slowdown in YoY growth relative to last year’s pandemic-driven acceleration,…expect continued significant growth in the 2nd half of the year.”

“Within Platform segment, monetization remains strong, and while there will be a slowdown in YoY growth relative to last year’s pandemic-driven acceleration,…expect continued significant growth in the 2nd half of the year.”

Final Thoughts on $ROKU:

➡️ Continues to benefit from long-term secular shift to TV streaming. Players had always been a subsidy to grow the Platform biz, not too bothered by lower margins. Combination of strong growth, increasing market share and improving profitability.

➡️ Continues to benefit from long-term secular shift to TV streaming. Players had always been a subsidy to grow the Platform biz, not too bothered by lower margins. Combination of strong growth, increasing market share and improving profitability.

• • •

Missing some Tweet in this thread? You can try to

force a refresh