MercadoLibre $MELI 2Q21 Earnings 🚀

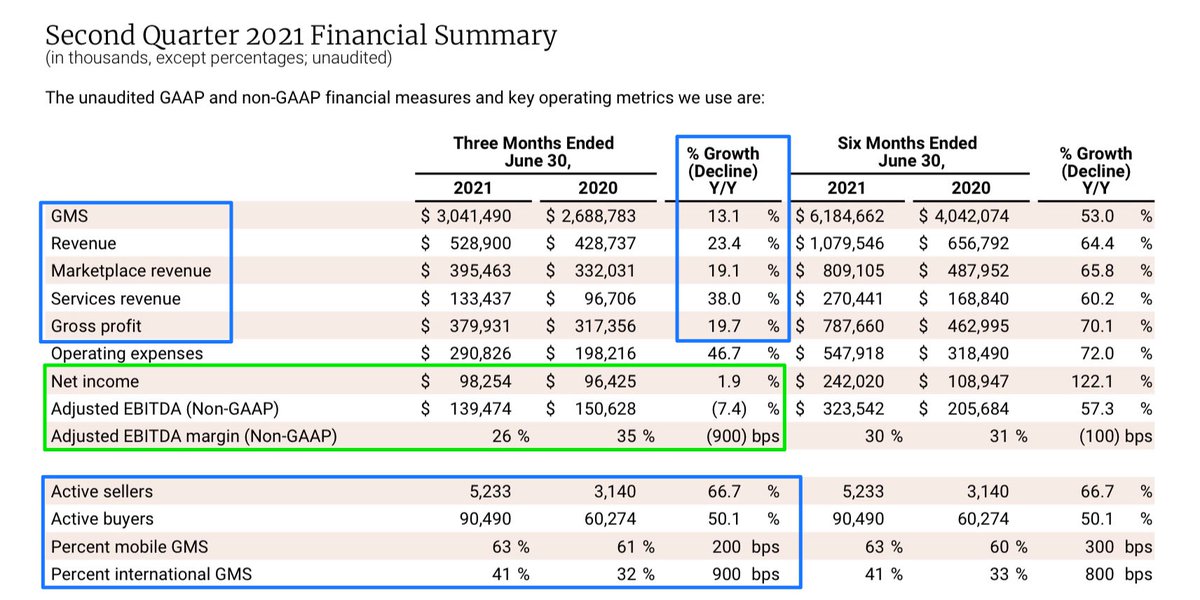

- Rev $1.7b +94% 🚀

- Gross Profit $754m +76% ↗️ margin 44% -439bps ↘️

- EBIT $166m +67% ↗️ margin 10% -158bps ↘️

- Net Income $68m +22% margin 4% -236bps ↘️

- OCF $262m -60% ↘️

- Com Rev $1.1b +96% 🚀

- Fintech Rev $560m +89% 🚀

- Rev $1.7b +94% 🚀

- Gross Profit $754m +76% ↗️ margin 44% -439bps ↘️

- EBIT $166m +67% ↗️ margin 10% -158bps ↘️

- Net Income $68m +22% margin 4% -236bps ↘️

- OCF $262m -60% ↘️

- Com Rev $1.1b +96% 🚀

- Fintech Rev $560m +89% 🚀

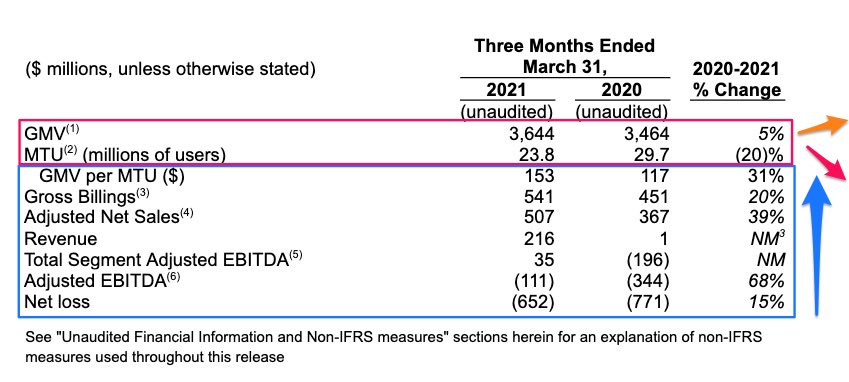

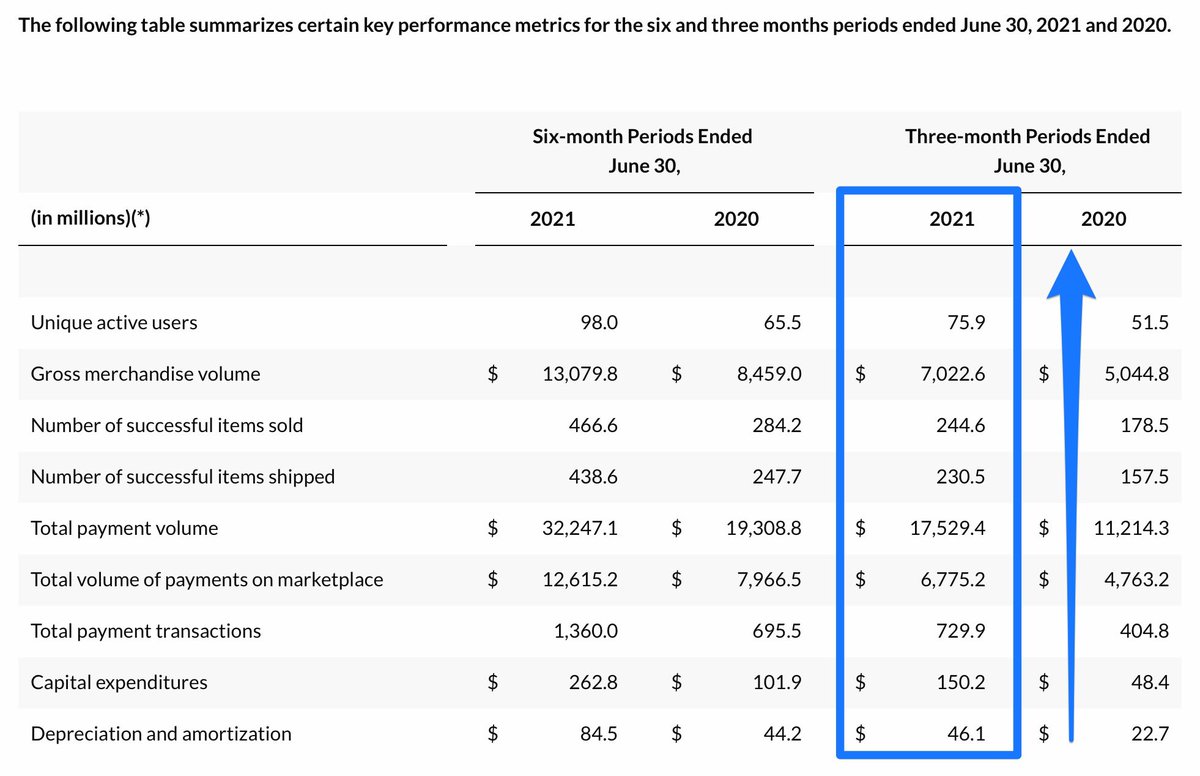

Strong Business Metrics 💪🏻🚀

- Users 76m +47% ↗️

- GMV $7b +39% ↗️

- Items sold 245m +37% ↗️

- Items shipped 231m +46% ↗️

- TPV $17.5b +56% ↗️

- Mkt TPV $6.7 (~96%) +42% ↗️

- Off-TPV $10.3b +70% ↗️

- MGMV $5.1b +218% 🚀

- MPOS +94% 🚀

- MWallet TPV +107% 🚀

- Users 76m +47% ↗️

- GMV $7b +39% ↗️

- Items sold 245m +37% ↗️

- Items shipped 231m +46% ↗️

- TPV $17.5b +56% ↗️

- Mkt TPV $6.7 (~96%) +42% ↗️

- Off-TPV $10.3b +70% ↗️

- MGMV $5.1b +218% 🚀

- MPOS +94% 🚀

- MWallet TPV +107% 🚀

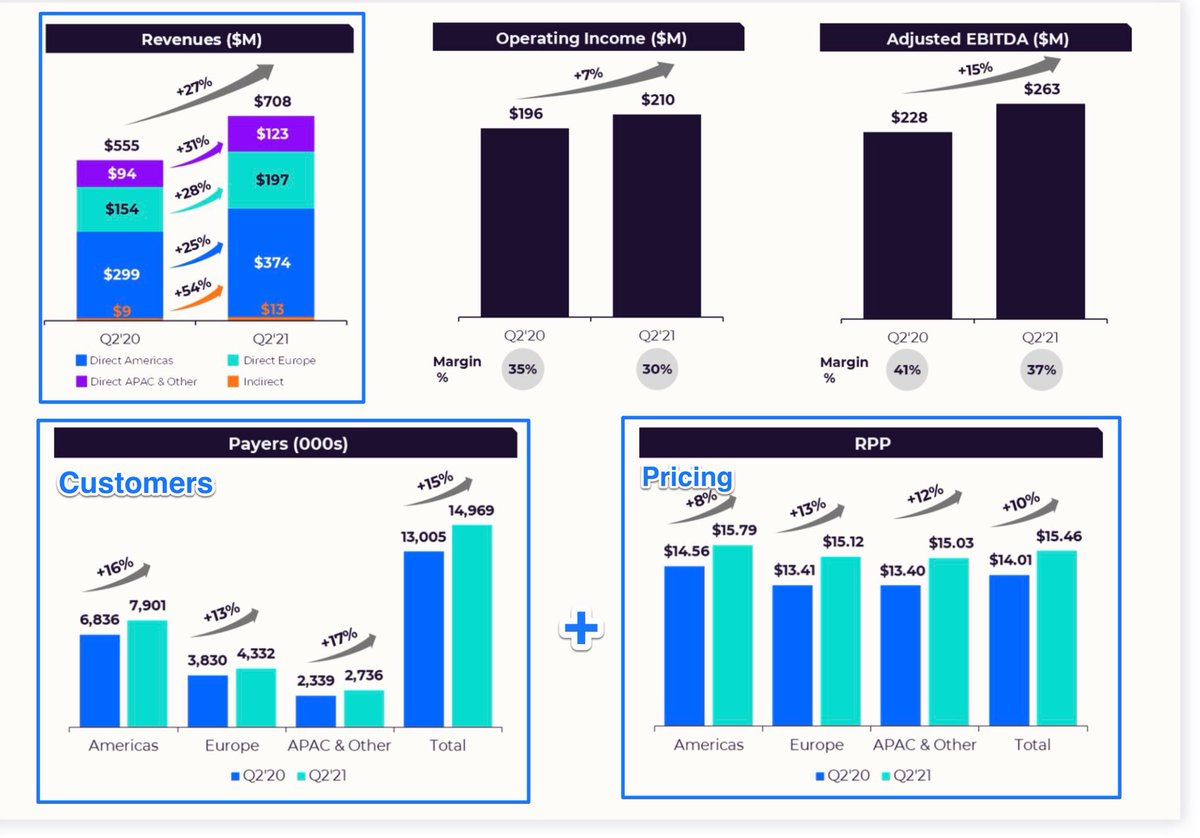

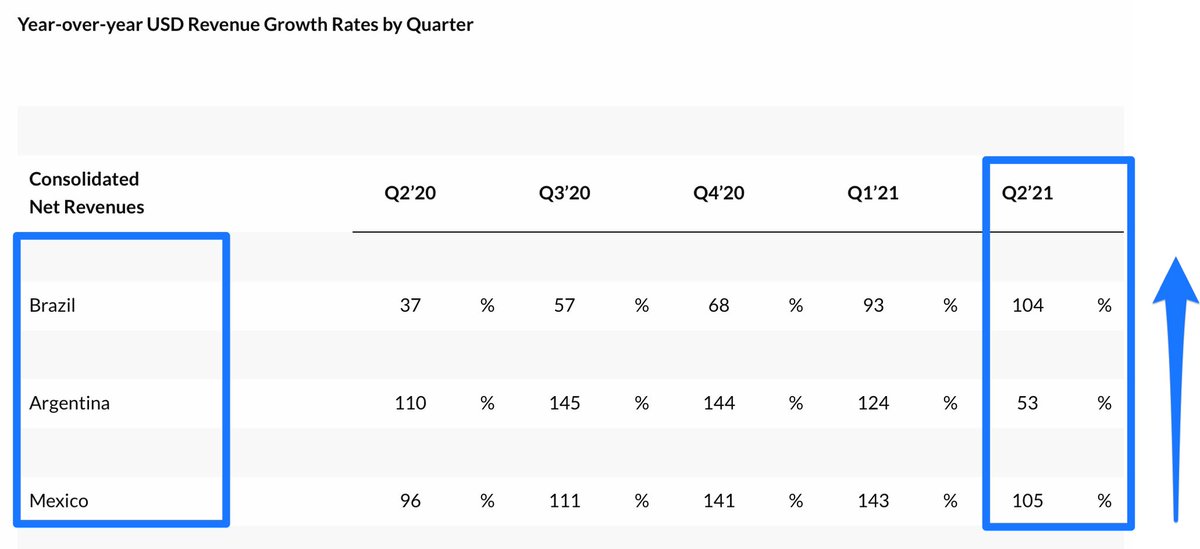

Rapid Growth in the top 3 Countries that matter for $MELI (~93%)

- 🇧🇷 Brazil Rev +104% (~56%)

- 🇦🇷 Argentina Rev +53% (~22%)

- 🇲🇽 Mexico Rev +105% (~15%)

✅ Brazil + Argentina Duo

~ 77% of Revenues

~91% of Contribution

- 🇧🇷 Brazil Rev +104% (~56%)

- 🇦🇷 Argentina Rev +53% (~22%)

- 🇲🇽 Mexico Rev +105% (~15%)

✅ Brazil + Argentina Duo

~ 77% of Revenues

~91% of Contribution

➡️ “…MercadoLibre delivered another quarter of strong growth in our commerce and fintech businesses in 2Q21, achieving record levels in both volume and revenues.

This strong performance builds on the solid Q1 we had this year….”

This strong performance builds on the solid Q1 we had this year….”

➡️ “We believe that our business is showing tremendous momentum despite immense volatility in our key markets due to the frequent closing of physical retail across Latin America.”

Final Thoughts on MercadoLibre $MELI:

➡️ The dominant LATAM E-commerce & increasingly FinTech powerhouse that keeps growing, delivering and compounding. Held since 2017, $MELI remains a strong core high conviction position of growth, profitability, optionality & large mkt oppty.

➡️ The dominant LATAM E-commerce & increasingly FinTech powerhouse that keeps growing, delivering and compounding. Held since 2017, $MELI remains a strong core high conviction position of growth, profitability, optionality & large mkt oppty.

• • •

Missing some Tweet in this thread? You can try to

force a refresh