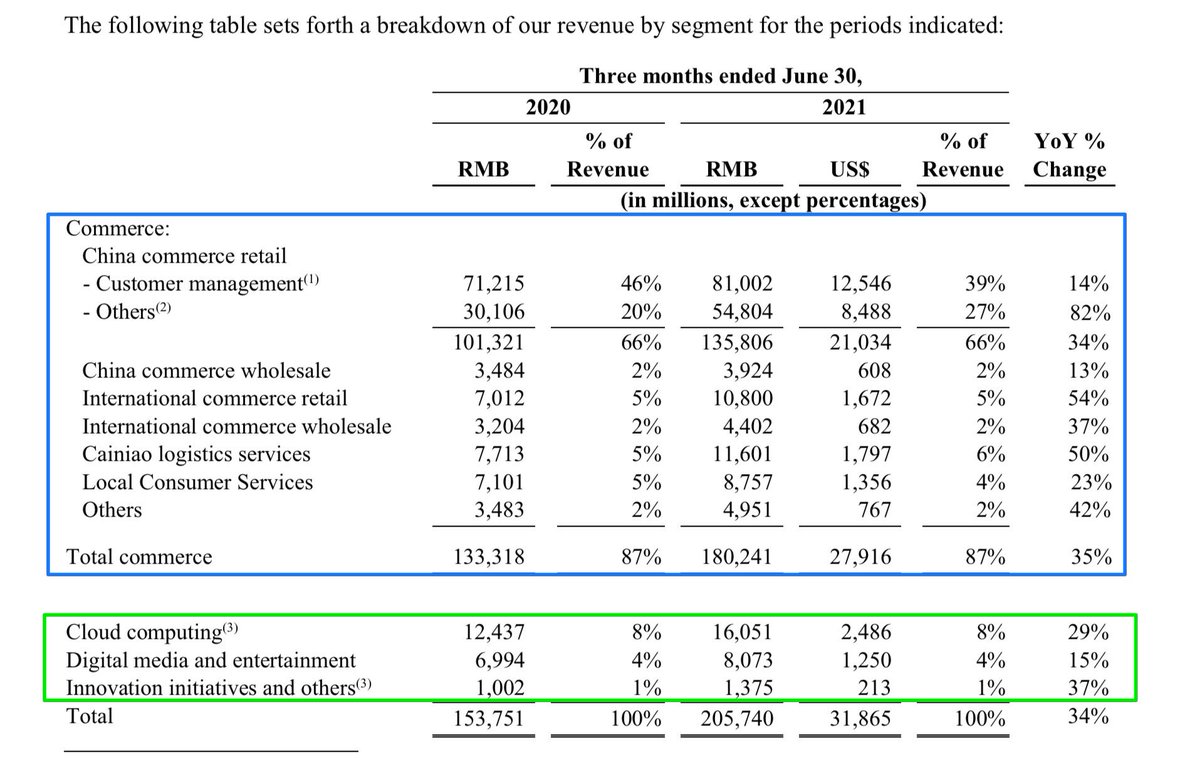

Grab $AGC 1Q21 Earnings 💪🏻

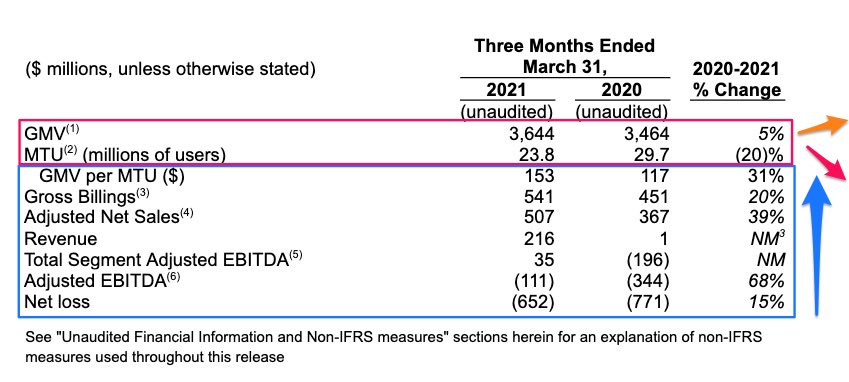

- GMV $3.6b +5% ➡️

- Net Sales $507m +39% ↗️

- Adj EBITDA -$111m ↗️ +$233m YoY

- GMV Deliveries $1.7b +49% ↗️

- Spend per user (MTU) +31% ↗️

- Gross Billings $541m +20% ↗️

- MTU 23.8m -20% ↘️ ❌🚩

- GMV $3.6b +5% ➡️

- Net Sales $507m +39% ↗️

- Adj EBITDA -$111m ↗️ +$233m YoY

- GMV Deliveries $1.7b +49% ↗️

- Spend per user (MTU) +31% ↗️

- Gross Billings $541m +20% ↗️

- MTU 23.8m -20% ↘️ ❌🚩

(1) Deliveries 🚛🚙🏍

- GMV $1.7b +49% ↗️

- Net Sales $293m +96% ⬆️

- Rev $53m ↗️ +$152m YoY ✅

- Adj EBITDA -$4m ↗️ +$147m YoY ✅

- Continues to scale GrabMart (everyday goods delivery offering). 1Q21 GMV +21% QoQ +36X vs 1Q20 🚀

- GMV $1.7b +49% ↗️

- Net Sales $293m +96% ⬆️

- Rev $53m ↗️ +$152m YoY ✅

- Adj EBITDA -$4m ↗️ +$147m YoY ✅

- Continues to scale GrabMart (everyday goods delivery offering). 1Q21 GMV +21% QoQ +36X vs 1Q20 🚀

(2) Mobility 🚙🚗

- GMV $1.9b -36% ⬇️

- Net Sales $167m -14% ↘️

- Rev $145m +18% ↗️✅

- Adj EBITDA $115m +42% ↗️

- Renewed mobility restrictions continues to hamper demand

- GMV $1.9b -36% ⬇️

- Net Sales $167m -14% ↘️

- Rev $145m +18% ↗️✅

- Adj EBITDA $115m +42% ↗️

- Renewed mobility restrictions continues to hamper demand

(3) Financial Services💲

- TPV +18% ↗️

- Net Sales $23m +31% ↗️

- Rev $8m ↗️ +$29m YoY ✅

- Adj EBITDA -$78m +$39m YoY ✅

- Loans +45% Insurance >+300% 🚀

- TPV +18% ↗️

- Net Sales $23m +31% ↗️

- Rev $8m ↗️ +$29m YoY ✅

- Adj EBITDA -$78m +$39m YoY ✅

- Loans +45% Insurance >+300% 🚀

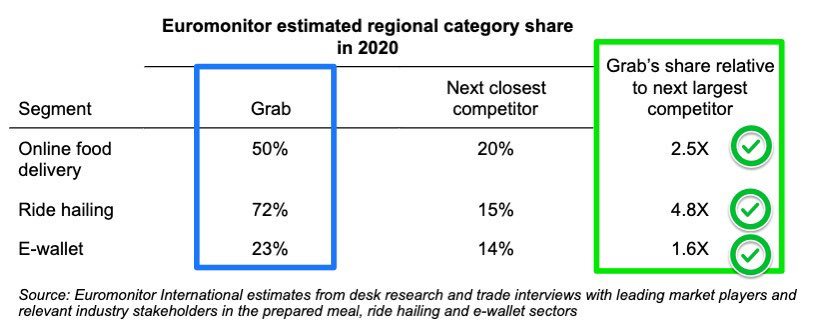

Top Dog.

➡️ Grab is Southeast Asia’s leading super-app based on GMV in 2020, and the category leader by GMV in: (1) online food delivery and (2) ride-hailing, and by TPV in the (3) e-wallet segment of financial services in Southeast Asia. 💪🏻

➡️ Grab is Southeast Asia’s leading super-app based on GMV in 2020, and the category leader by GMV in: (1) online food delivery and (2) ride-hailing, and by TPV in the (3) e-wallet segment of financial services in Southeast Asia. 💪🏻

“We exceeded our internal targets for Adj Net Sales and Adj EBITDA for 1Q21, & continued the strong growth momentum of our deliveries business. We saw robust topline growth, even compared to the 1Q20 that saw limited impact from COVID-19, and took strides towards profitability.”

“In 2Q21, we saw the continuing resilience & strong performance of our business, combined with disciplined operational execution. We are confident that our diversified geographical & vertical footprint puts us in a strong position to capture the massive opportunity in SEA.”

Final Thoughts on Grab $AGC:

➡️ Mobility yet to fully recover due to restrictions. Deliveries & Financial Services driving growth, improving profitability and new opportunities. Multiple levers of long-term growth for SEA’s leading Super-App. Continue to monitor mobility.

➡️ Mobility yet to fully recover due to restrictions. Deliveries & Financial Services driving growth, improving profitability and new opportunities. Multiple levers of long-term growth for SEA’s leading Super-App. Continue to monitor mobility.

• • •

Missing some Tweet in this thread? You can try to

force a refresh