🚨New Project!🚨

Thrilled to announce a new financial history project with @chapter_HQ . An exciting new way to learn market history as a community.

• 4 Weeks of Curated Content

• Insights linking past & present

• Q&A

• Community interactions

getchapter.app/@jamie/hindsig…

Thrilled to announce a new financial history project with @chapter_HQ . An exciting new way to learn market history as a community.

• 4 Weeks of Curated Content

• Insights linking past & present

• Q&A

• Community interactions

getchapter.app/@jamie/hindsig…

Week 1 covers: "The Market as a Game".

Looking back at how markets have been perceived as a game by investors and speculators since the very first exchange in 1688.

Meme stocks and the "gamification" of markets is nothing new!

Looking back at how markets have been perceived as a game by investors and speculators since the very first exchange in 1688.

Meme stocks and the "gamification" of markets is nothing new!

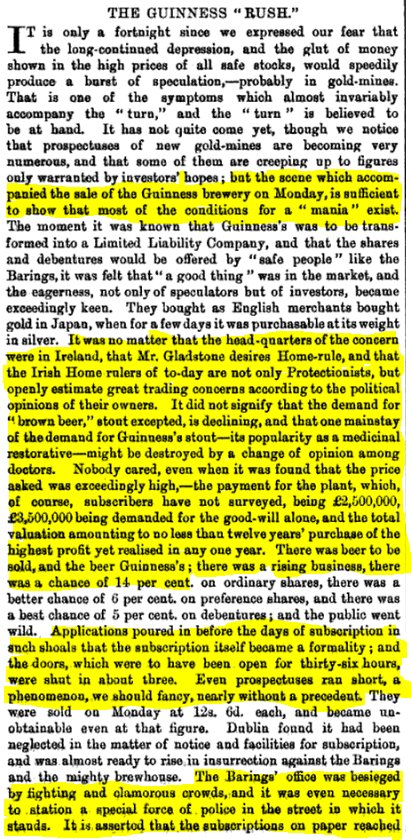

Week 2 dives into different "Bubble Frameworks".

You will learn how to identify the environments that produce bubbles and how to invest when they occur.

You will learn how to identify the environments that produce bubbles and how to invest when they occur.

Week 3 goes in-depth on "Familiar Patterns in Market History".

While much has changed over the centuries in markets, there are clear and identifiable patterns that tend to repeat themselves.

While much has changed over the centuries in markets, there are clear and identifiable patterns that tend to repeat themselves.

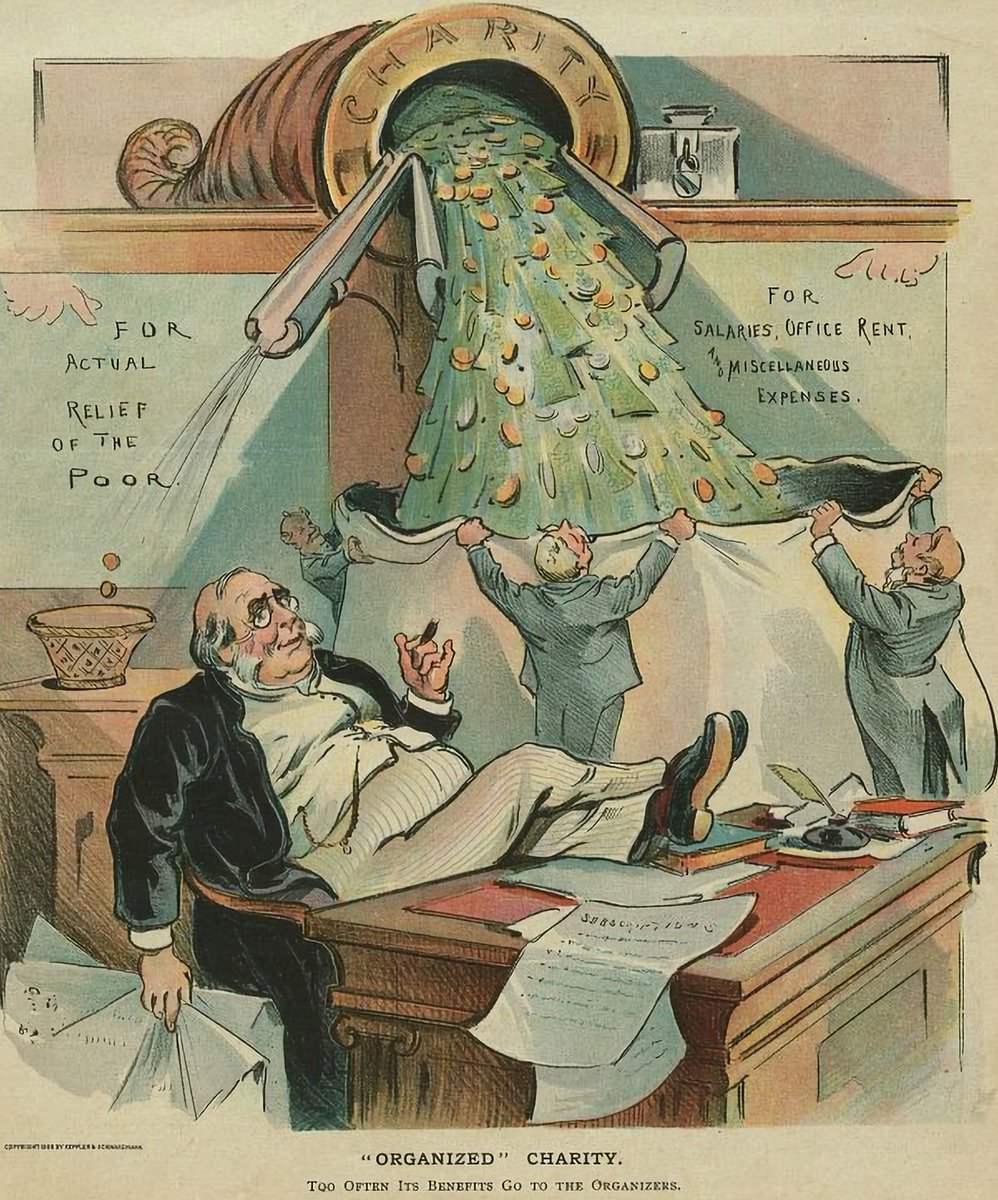

Finally, week 4 analyzes "Old Solutions with New Spins".

Think concepts like ESG, activist investing and short-selling are new? Think again.

We look at what problems and benefits previous iterations of "modern" concepts had throughout history.

Think concepts like ESG, activist investing and short-selling are new? Think again.

We look at what problems and benefits previous iterations of "modern" concepts had throughout history.

Find more details in here, and look forward to seeing you all on launch date (August 30th) !

getchapter.app/@jamie/hindsig…

getchapter.app/@jamie/hindsig…

• • •

Missing some Tweet in this thread? You can try to

force a refresh