Now that results are out, lets understand what happened with #StridesPharma and where do we go from here 🧵👇🏼

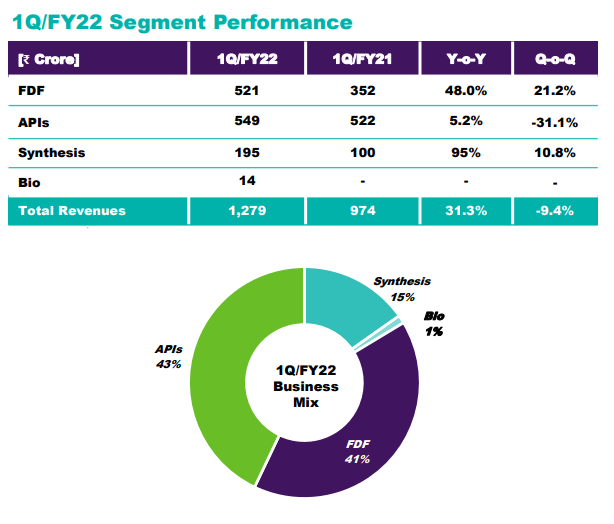

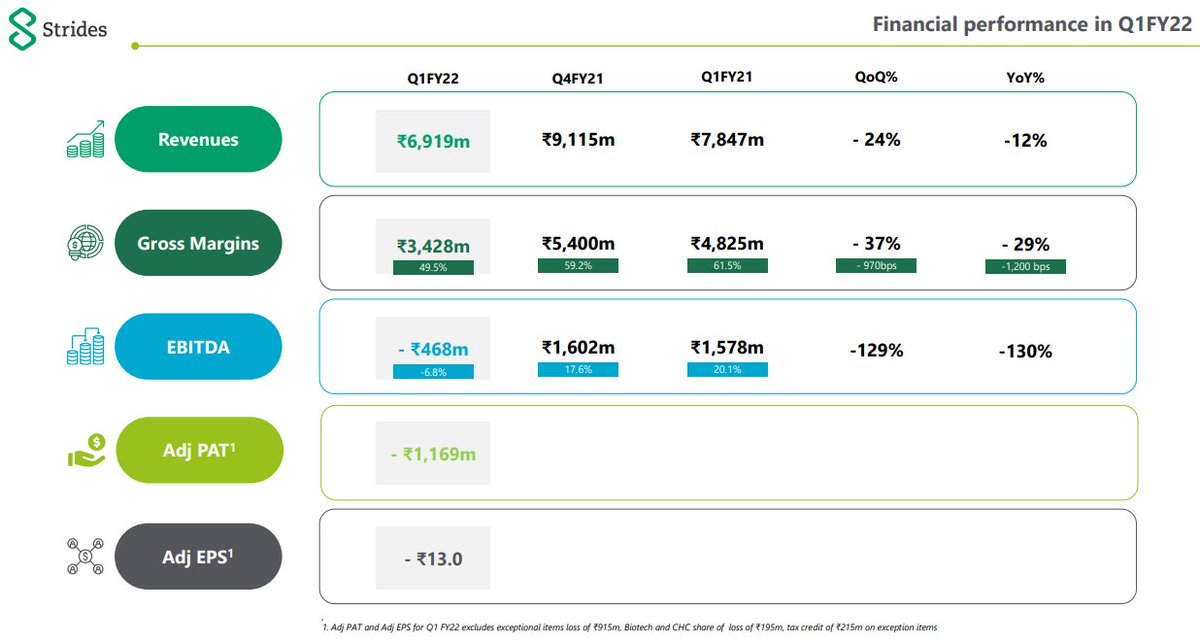

Strides today reported a 24% YoY / 12% QoQ decline in revenue and reduction in Gross Margins to 49.5% (first time ever in last 12 quarters)

The company also reported a first ever Op. Loss in its entire history.

The company also reported a first ever Op. Loss in its entire history.

The only market that did perform was Africa, which reported a 4% QoQ growth. Everything else was a washout.

The main reason behind this double digit price erosion are

1. Lower new product launches by competitor - which means they have to rely on selling older generic products leading to higher competition among existing competitors

1. Lower new product launches by competitor - which means they have to rely on selling older generic products leading to higher competition among existing competitors

2. Disruptions in manufacturing

Bulk of manufacturing for Strides (US) is driven out of their Bengaluru plant, which due to second wave of Covid wasn't operating at full capacity in May

Bulk of manufacturing for Strides (US) is driven out of their Bengaluru plant, which due to second wave of Covid wasn't operating at full capacity in May

This lower manufacturing impact them in two ways

a. Their Failure to Supply (FTS) which has always been less than 1% jumped to 4% for the first time in company's history

a. Their Failure to Supply (FTS) which has always been less than 1% jumped to 4% for the first time in company's history

b. I have been warning about logistics and shipment costs via this channel.

In order to reduce their FTS rate, Strides chose to opt for air freight which is more expensive than ship, leading to increase in costs by $4 Million YoY

In order to reduce their FTS rate, Strides chose to opt for air freight which is more expensive than ship, leading to increase in costs by $4 Million YoY

https://twitter.com/itsTarH/status/1410317136896028673?s=20

Generic Business is like a treadmill (Aditya Khemka sir's analogy)

You have to keep releasing new products to counter the price erosion in existing ones.

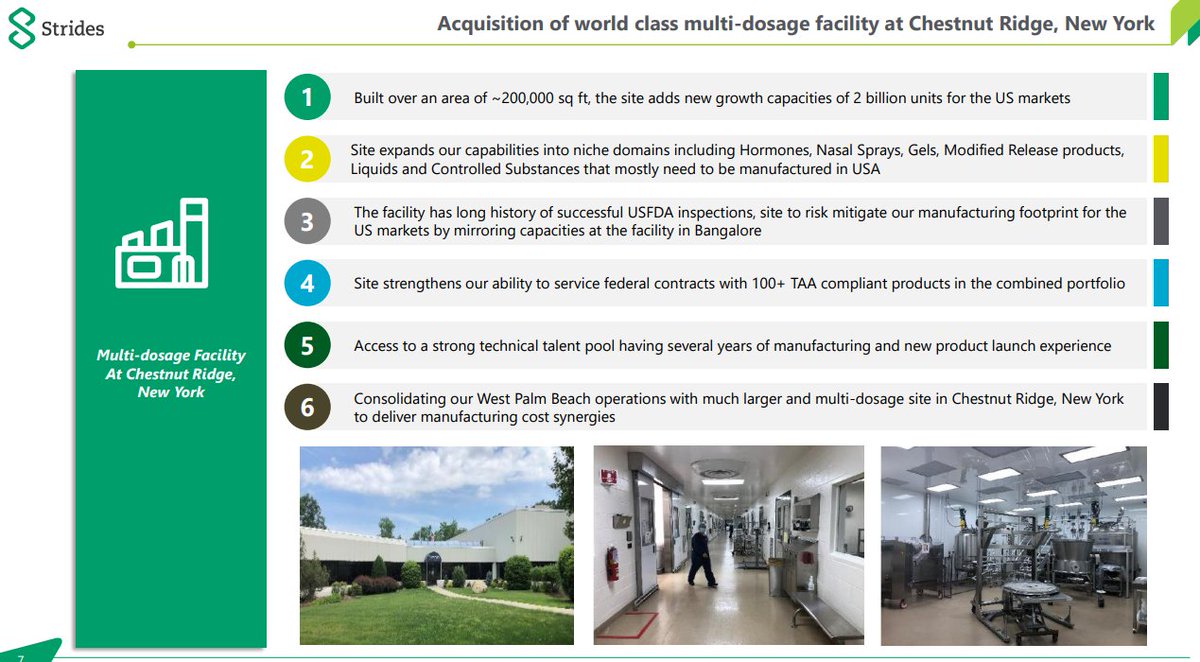

It is for this specific reason Strides went ahead and bought a manufacturing facility along with a portfolio of ANDAs

You have to keep releasing new products to counter the price erosion in existing ones.

It is for this specific reason Strides went ahead and bought a manufacturing facility along with a portfolio of ANDAs

This expense coupled with above mentioned challenges meant that what was a proving to be a bad quarter suddenly became worse.

If I remove the logistics costs and FTS related expenses, the drop in revenue weren't so bad and the company may even have reported an Operating Profit (even though it would have been much lower than previous Quarter)

The con call too today seemed very rushed and even though they acknowledged the issues in this quarter, they didn't seem disappointed enough (at least to me) in their results.

This is when the CEO kept on repeatedly assured in last quarter con call that price erosion was temporary and they should scale well in next Quarter.

So where do we go from here?

The management claims that their acquired portfolio (deal still underway and will take 60 days) will immediately help them with price erosion as their product portfolio now has niche products and facility in NY means that they do not have to rely on BLR plant as much as before.

This also means that Quarter 2 will also be a wash out in all likelihood and if Covid new variant spreads further, it may turn out to be even worse as their NY facility and new portfolio can only start contributing by Q3 and Q4.

They keep their guidance of achieving $215 Million in sales from US markets for FY22.

Q1 : $41 Million

This means in next 3 quarters they have to do an avg. of $58 Million in sales.

Tall claim and challenging task, in my opinion.

Q1 : $41 Million

This means in next 3 quarters they have to do an avg. of $58 Million in sales.

Tall claim and challenging task, in my opinion.

Longer term (~3 years out) I do still believe that they can achieve their goal, although they path to getting their will not be a straight smooth line.

I expected a weak quarter from them considering the shipping challenges and other generic players reporting price erosion in their portfolios.

Had hedged myself by buying 760 PE and it helped me offset any losses from the correction today (glad Strides is now part of F&O)

Had hedged myself by buying 760 PE and it helped me offset any losses from the correction today (glad Strides is now part of F&O)

I will now reduce my weightage in Strides from current double digits to low single digits as I do expect the correction to continue (if not in price then in time wise).

I also am reducing my position as I do not trust the management enough now and see more headwinds for them.

I also am reducing my position as I do not trust the management enough now and see more headwinds for them.

We also got an update on Stelis as a separate presentation for the first time ever

In the concall, they alluded that they are still exploring options for Stelis listing

In Feb they had clearly laid out plans to demerge this business though

(Another example of mgmt dillydalling)

In the concall, they alluded that they are still exploring options for Stelis listing

In Feb they had clearly laid out plans to demerge this business though

(Another example of mgmt dillydalling)

I still think Stelis is a gem hidden inside Strides but the generic business keeps it from its value being realized.

Here a few highlights from Stelis presentation that caught my attention

Here a few highlights from Stelis presentation that caught my attention

The first one is their facility now is eligible for USFDA and other regulatory approvals.

This only happens when a product is in either late Phase 2 or Phase 3 stage and due for commercialization soon.

A USFDA approved biologics facility in Asia is highly highly valuable asset.

This only happens when a product is in either late Phase 2 or Phase 3 stage and due for commercialization soon.

A USFDA approved biologics facility in Asia is highly highly valuable asset.

They have a very healthy order book, as expected, almost all Biologics CDMO facilities world over are running on full capacity with 2+ years of order book.

They are developing mRNA and DNA based vaccine facilities and have significant interest from other parties with a CDMO contract by Q4FY22.

(mRNA, CDMO = Pfizer?)

(mRNA, CDMO = Pfizer?)

Another key update that is easy to miss, is that Stelis is no longer a Pvt Limited company but is now just Stelis Biopharma Limited.

This usually happens when a company is getting ready to be listed.

So next year, I have high hopes for this business being available to invest in

This usually happens when a company is getting ready to be listed.

So next year, I have high hopes for this business being available to invest in

That's it from me, please do read the Stelis Presentation, its quite in depth.

Strides ppt: bseindia.com/xml-data/corpf…

Stelis ppt: bseindia.com/xml-data/corpf…

Strides ppt: bseindia.com/xml-data/corpf…

Stelis ppt: bseindia.com/xml-data/corpf…

Lastly, please do not follow me or my positions blindly. I know when and how to hedge and protect my downside while concentrating on the upside

I tweet only to help others learn

Nothing is investment advice and only meant to educate

Your capital, your profits and your losses.

I tweet only to help others learn

Nothing is investment advice and only meant to educate

Your capital, your profits and your losses.

• • •

Missing some Tweet in this thread? You can try to

force a refresh