It's the weekend!

Grab a cup of coffee, in this thread I will explain

1. What are Special Situations?

2. Why are they so profitable?

3. How to look out for them?

Lets dive right in.

Grab a cup of coffee, in this thread I will explain

1. What are Special Situations?

2. Why are they so profitable?

3. How to look out for them?

Lets dive right in.

During my time at Goldman Sachs, I was fascinated to learn that the consistently most profitable desk for GS wasn't the Fixed Income or Derivatives or even Equity.

It was this tiny group that invested the company's own capital into various strategic assets and it remains one of the most profitable arms of Goldman's business to this date.

This group within Goldman is known as the Special Situations Group.

In 2019, years after consistent request from outsiders, the bank allowed the group to raise money from outside investors.

Until then it was only firms own money along with capital contributed by firms partners and employees that the group used to manage.

Until then it was only firms own money along with capital contributed by firms partners and employees that the group used to manage.

What made the group so profitable is its ability to take positions and invest into Special Situations - both in Private and Public Markets.

Special Situation is any unusual corporate event that can take a variety of forms.

These can be in the form of

A. Spin offs

B. Tender Offers

C. Mergers or Acquisitions

D. Bankruptcy

E. De listings

F. Stock Buy Backs

G. Rights Issue

and many more.

These can be in the form of

A. Spin offs

B. Tender Offers

C. Mergers or Acquisitions

D. Bankruptcy

E. De listings

F. Stock Buy Backs

G. Rights Issue

and many more.

The common underlying characteristic is that these events have little to do with fundamentals of the company when taking a decision to invest

Its more about the valuation at which the business is available to invest in - which sometimes maybe at a steep discount to its value.

Its more about the valuation at which the business is available to invest in - which sometimes maybe at a steep discount to its value.

Special Situations are usually a one time event and are far and few in between.

You do not get a spin off from a company every quarter nor does a company mergers with a new company every quarter.

You do not get a spin off from a company every quarter nor does a company mergers with a new company every quarter.

Maybe this isn't widely known but one of the most successful special situation investor is Warren Buffett himself.

In his early days, Buffett used to invest a big chunk of his portfolio into companies that were likely to experience special situations such as spinoffs or M&A transactions.

Years later in 2008, as Financial Crisis on Wall Street was brewing, Buffett invested into preferential shares of Goldman Sachs.

This was a special situation investment too as he was able to get share of the company for pennies while ensuring it pays a 10% Dividend!

This was a special situation investment too as he was able to get share of the company for pennies while ensuring it pays a 10% Dividend!

He ultimately made a sizeable profit from selling the shares of the company many years later while also ensuring he got paid preferential yearly dividends during the whole time.

There are many other legendary investors who purely have special situation investing to thank for the bulk for their returns.

My fav ones are

Howard Marks from Oaktree

Seth Klarman from Baupost Group

My fav ones are

Howard Marks from Oaktree

Seth Klarman from Baupost Group

Both of these are paraded around as value investors and while they are very good at finding value, their real strength is finding special situations that leads a company valuation into distress.

Oaktree even has a whole section dedicated to SS.

oaktreecapital.com/strategies/pri…

Oaktree even has a whole section dedicated to SS.

oaktreecapital.com/strategies/pri…

When it comes to special situations, the most legendary of them all though is the man who popularized the term 'Special Situation' - Joel Greenblatt

He first described Special Situations in this book, which I consider a bible on Special Situation investing

(highly recommended)

He first described Special Situations in this book, which I consider a bible on Special Situation investing

(highly recommended)

Here is a great lecture by him on special situations to the students of Columbia (circa 2005)

Why are Special Situations so profitable?

The main reason is Information Asymmetry and Distress.

Information Asymmetry = When few participants in market are aware of public knowledge, but not all

Distress = When no one wants to touch a company due to a temporary ailment (bankruptcy, debt issue, etc)

Information Asymmetry = When few participants in market are aware of public knowledge, but not all

Distress = When no one wants to touch a company due to a temporary ailment (bankruptcy, debt issue, etc)

Let's take a few examples of some special situations that have benefitted me personally.

I heard about Jubilant Ingrevia spin off from parent company in Feb this year.

By mid March, the spin off had completed and immediately the shares of the company started hitting lower circuits.

By mid March, the spin off had completed and immediately the shares of the company started hitting lower circuits.

This is very typical of a spin off.

Shares upon listing soon start hitting lower circuits as existing large holders of parent company (Mutual Funds etc.) start selling cause they cannot hold the shares for a variety of reasons(lower market cap than allowed as per fund rules,etc)

Shares upon listing soon start hitting lower circuits as existing large holders of parent company (Mutual Funds etc.) start selling cause they cannot hold the shares for a variety of reasons(lower market cap than allowed as per fund rules,etc)

This creates a temporary window for a special situation investor to scoop in and take advantage of the opportunity.

I started buying Jubilant Ingrevia soon after listing with an avg price of 275.

I started buying Jubilant Ingrevia soon after listing with an avg price of 275.

Since then shares have increase by about ~200% as more market participants realize the discount in value relative to its peers (Laxmi Organics).

Borosil Renewables demerged from its parent company Borosil in Mar'20.

Again, soon after listing, it hit multiple lower circuits as larger investors in Borosil were forced to sell their shares in Borosil Renewables.

Again, this is where I was buying (although not as much as I would have wanted given clarity on Covid wasnt clear atm)

My average price on Borosil even after multiple times averaging up remains in double digits (thanks to buying early during the spin off).

My average price on Borosil even after multiple times averaging up remains in double digits (thanks to buying early during the spin off).

Here is one more.

Inox Wind and Inox Wind Energy

(I missed out on this one)

Since spin off, Inox Wind Energy has risen by about 400% in just 2 months.

Inox Wind and Inox Wind Energy

(I missed out on this one)

Since spin off, Inox Wind Energy has risen by about 400% in just 2 months.

There are many more examples of such special situations.

Suven Pharma and Suven Life

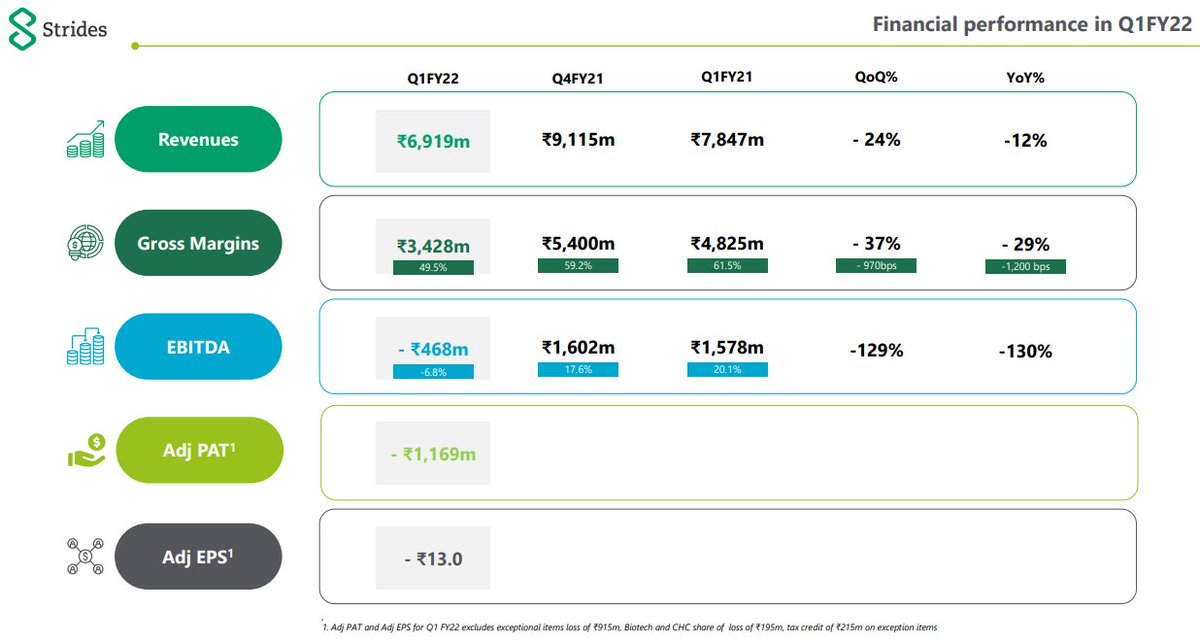

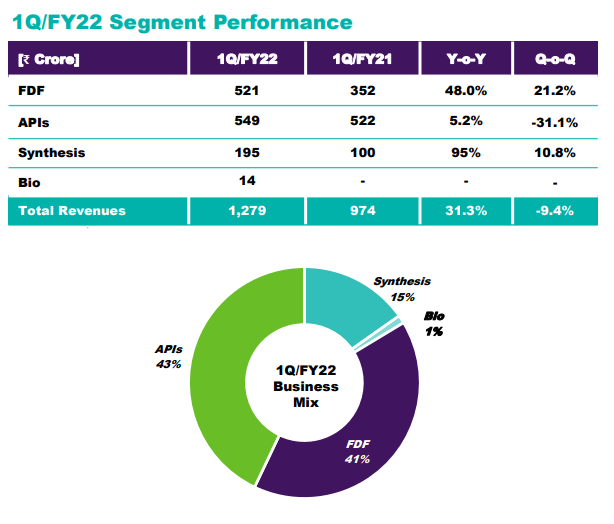

Strides and Solara

Strides, Solara and Sequent

Reliance Rights Issue

Apollo Tricoat and Apollo Pipe Merger

I am sure there are many many more that I am not aware of.

Suven Pharma and Suven Life

Strides and Solara

Strides, Solara and Sequent

Reliance Rights Issue

Apollo Tricoat and Apollo Pipe Merger

I am sure there are many many more that I am not aware of.

So how can you profit from Special Situations?

Here are a few ways

1. Keep a look out for companies that may spin off

2. Study the peers of the spin off entity

3. Try to find if spun off entity is/will be available at discount

4. Look for other types of special situations (rights issue, merger etc.)

1. Keep a look out for companies that may spin off

2. Study the peers of the spin off entity

3. Try to find if spun off entity is/will be available at discount

4. Look for other types of special situations (rights issue, merger etc.)

By following special situations and researching on them you can give yourself an edge and advantage that institutions do not have.

Leverage that advantage it to its fullest potential.

Leverage that advantage it to its fullest potential.

With this, we come to an end of this thread.

I hope this helped you understand what special situations are and how you can benefit from them.

If you know about any recent spin offs or special situation events, please do comment.

I would love to read and research more into them.

I hope this helped you understand what special situations are and how you can benefit from them.

If you know about any recent spin offs or special situation events, please do comment.

I would love to read and research more into them.

If you find this thread useful then follow me

@itsTarH

I write a new thread every weekend.

All my previous work, can be found here.

@itsTarH

I write a new thread every weekend.

All my previous work, can be found here.

https://twitter.com/itsTarH/status/1401095938945425410?s=20

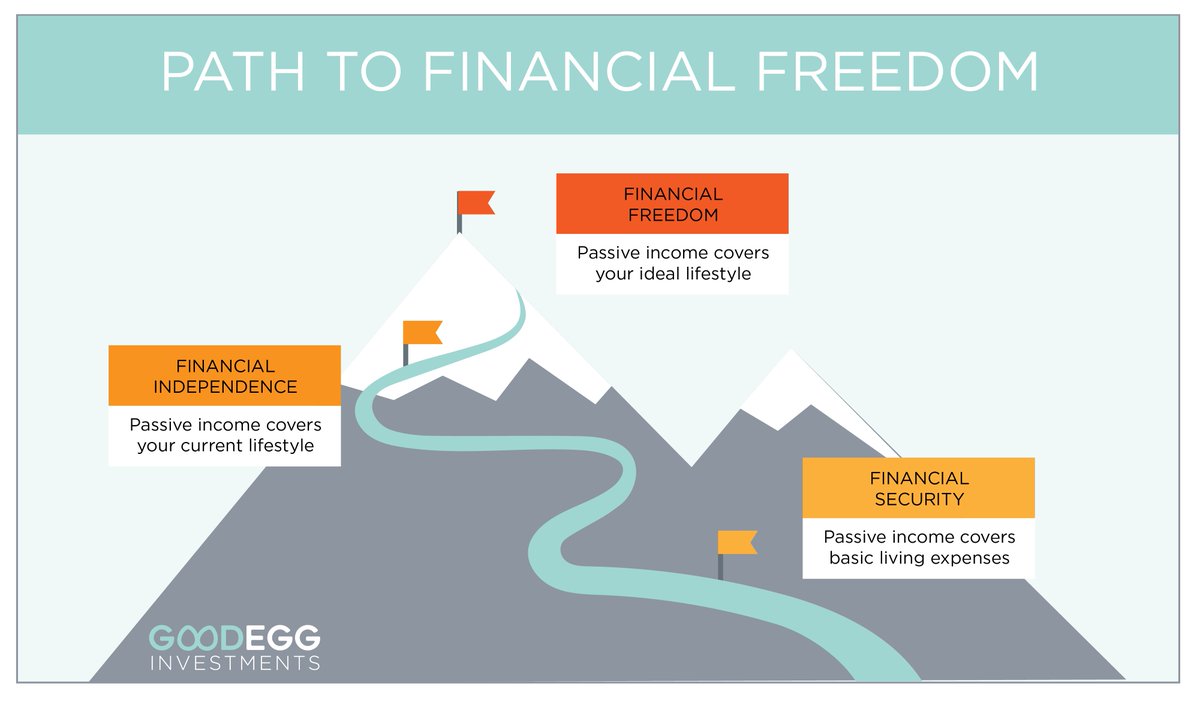

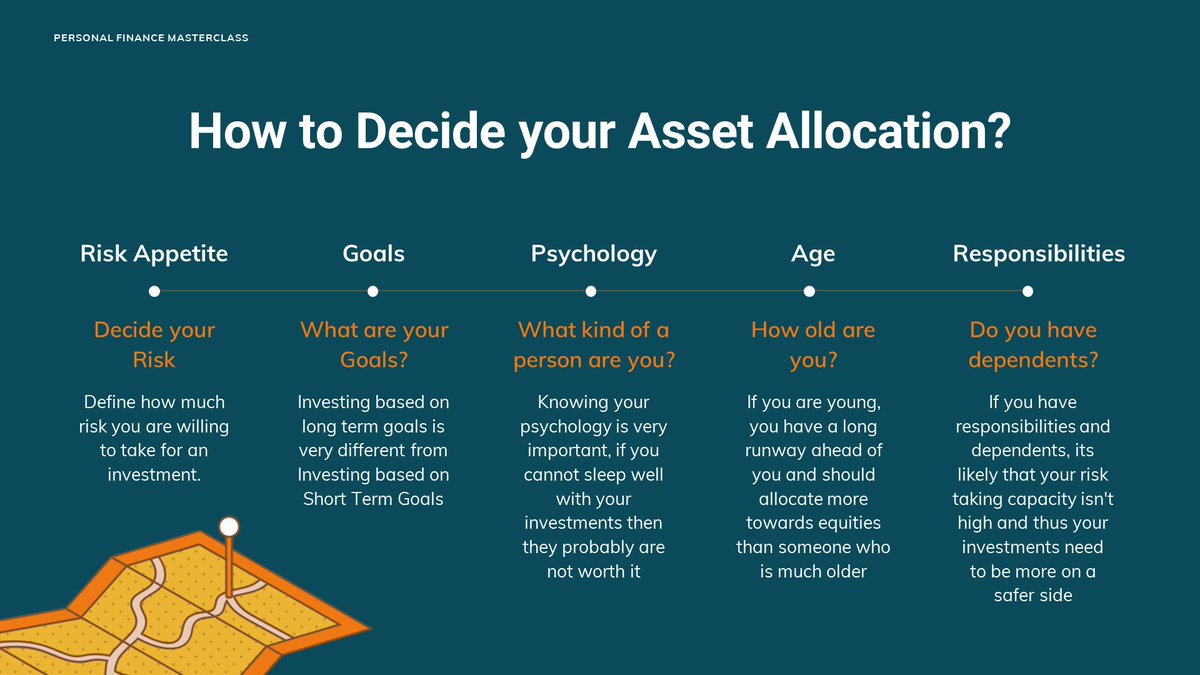

I also teach a class on Personal Finance, if you're interested.

Sign up using the link below to get free 30 days access to it.

skl.sh/2Wjk7A7

Sign up using the link below to get free 30 days access to it.

skl.sh/2Wjk7A7

https://twitter.com/itsTarH/status/1419694448892514311?s=20

Also, write and publish long from articles on my substack (investkaroindia.substack.com)

Subscribe for free, if you're interested.

Thank you to the 2000+ of you who already have!

PS: Deep Dive into Policy Bazaar will publish tomorrow on this website

Subscribe for free, if you're interested.

Thank you to the 2000+ of you who already have!

PS: Deep Dive into Policy Bazaar will publish tomorrow on this website

Thank you for reading, please retweet the first tweet in this thread for a broader reach.

See you all next weekend!

See you all next weekend!

• • •

Missing some Tweet in this thread? You can try to

force a refresh