Brief thread on real yields.

One of the questions I am asked often is what these very low real TIPS yields mean. Many tend to take them as signs of bad news for US growth. But is that read accurate? 1/4

One of the questions I am asked often is what these very low real TIPS yields mean. Many tend to take them as signs of bad news for US growth. But is that read accurate? 1/4

The problem is that there are other things that "contaminate" TIPS yields and that muddle the waters. Specifically, these things are risk premiums and liquidity premiums.

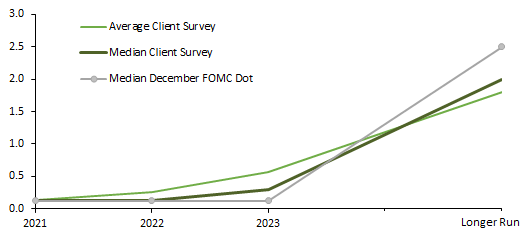

We can always express TIPS yields as follows (estimates from DKW). 2/4

We can always express TIPS yields as follows (estimates from DKW). 2/4

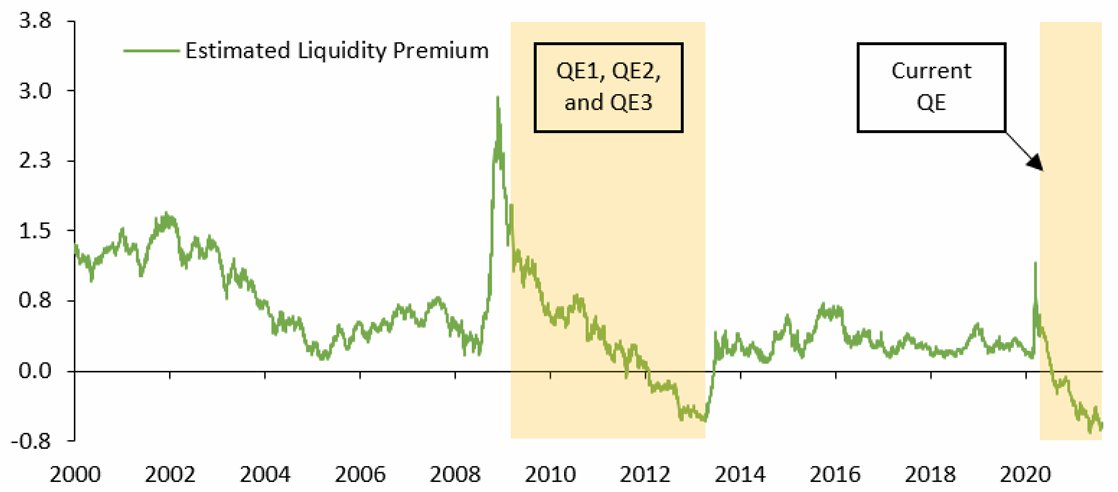

Liquidity premiums, in particular, are estimated to be very low (close to record lows, in fact); they appear to have been the main drivers of TIPS yields in this Covid era. Coincidence of not, the last time they were so low was at the tail end of QE3. 3/4

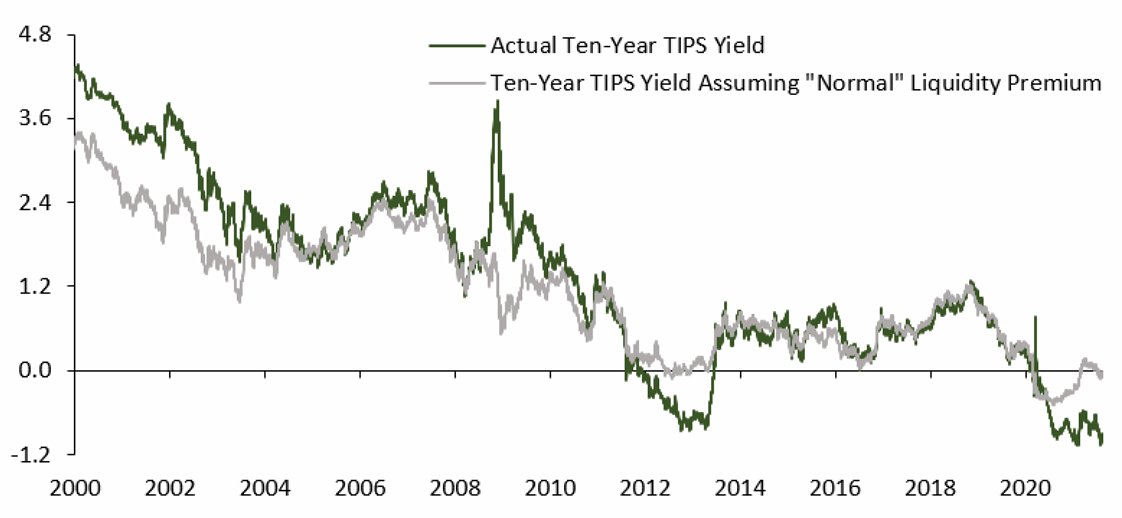

Assuming liq. premiums were "normal" (avg. of 2014-19), the resulting counterfactual 10 yr TIPS yield would be ~ 0, which is about where I would expect it to be at this stage of the cycle and with a low r*.

So, no bad news for growth; mostly just liquidity issues. 4/4

So, no bad news for growth; mostly just liquidity issues. 4/4

• • •

Missing some Tweet in this thread? You can try to

force a refresh