So first 3 venture investments (and 4 out of first 5) are now all decacorns or unicorns

Talkdesk $10B (first VC, $25 pre)

Algolia $2B (first U.S. VC, $12m pre)

Pipedrive $1B (first U.S. VC, $16m pre)

A few reflections and learnings:

Talkdesk $10B (first VC, $25 pre)

Algolia $2B (first U.S. VC, $12m pre)

Pipedrive $1B (first U.S. VC, $16m pre)

A few reflections and learnings:

1/ Partnership consensus -- who knows about that

Talkdesk: 100% partners: Yes

Algolia: 100% partners: No

Pipedrive: 100% partners Meh

They won't always see what you see, no matter how deeply you see it

Talkdesk: 100% partners: Yes

Algolia: 100% partners: No

Pipedrive: 100% partners Meh

They won't always see what you see, no matter how deeply you see it

2/ Just close the deal

The only times here I tried to negotiate any price or terms, the deal just got worse

Just shake hands on what the founders want if it's fair

The only times here I tried to negotiate any price or terms, the deal just got worse

Just shake hands on what the founders want if it's fair

3/ Everyone had a tough, unfundable year

This isn't true of all startups, but even $10B Talkdesk had a rough year transitioning from SMB to Enterprise

So did all the others

More in here:

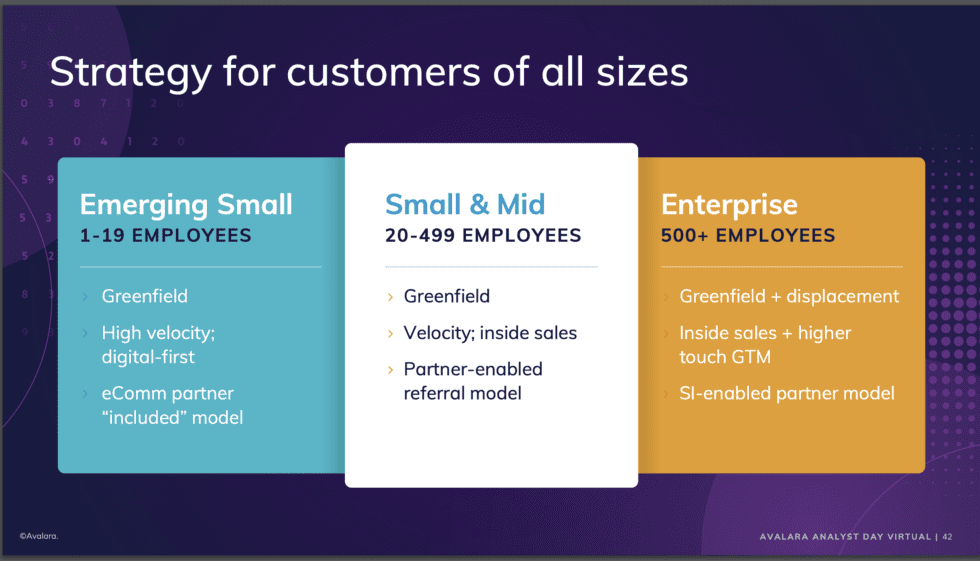

This isn't true of all startups, but even $10B Talkdesk had a rough year transitioning from SMB to Enterprise

So did all the others

More in here:

4/ Buy all the shares -- or buy none at all

The only regret I have is not buying every single share offered

Even with these 3, there were multiple chances to buy more

The only regret I have is not buying every single share offered

Even with these 3, there were multiple chances to buy more

5/ New managers have a superpower

I had never invested before, and the first three were all decacorns / unicorns+

As a CEO though I knew which founders were better than me, and what problems I was passionate about (call center, seach, CRM, etc)

I just did those ones

I had never invested before, and the first three were all decacorns / unicorns+

As a CEO though I knew which founders were better than me, and what problems I was passionate about (call center, seach, CRM, etc)

I just did those ones

6/ Your partners are there to help you make even more money. Not minimize risk per se

Your other GPs should help you take more risk, right way. Lean in to next round. Do that SPV or Oppo investment

That's where they actually help most

A >great< partnership thus makes big $$

Your other GPs should help you take more risk, right way. Lean in to next round. Do that SPV or Oppo investment

That's where they actually help most

A >great< partnership thus makes big $$

7/ Ownership matters. But.

Being one largest investors in $10B Talkdesk will make the $98m fund I worked at an insane amount of money

But don't pass due to ownership. Just buy every share you can.

That's the hack. Buy every share you can if you know it's a winner.

Being one largest investors in $10B Talkdesk will make the $98m fund I worked at an insane amount of money

But don't pass due to ownership. Just buy every share you can.

That's the hack. Buy every share you can if you know it's a winner.

8/ Play to your strengths

In the end, as VC my strengths were the same as a CEO -- inbound

I got an F chasing deals / outbound. Never closed one.

But 100% inbound, you only see a subset

Still, it's worked >enough<.

You don't have to see every deal.

In the end, as VC my strengths were the same as a CEO -- inbound

I got an F chasing deals / outbound. Never closed one.

But 100% inbound, you only see a subset

Still, it's worked >enough<.

You don't have to see every deal.

9/ Write a check when no one else will (in your winners)

This isn't appreciated as much by founders as it should be, but still, it's appreciated for a long time

It's fun to step up and write a check when no one else would at first, because you >know<

Had to do this 3x so far

This isn't appreciated as much by founders as it should be, but still, it's appreciated for a long time

It's fun to step up and write a check when no one else would at first, because you >know<

Had to do this 3x so far

10/ Finally, the winners get cheaper

I didn't get this until 2021. The recent rounds at Talkdesk ($10B) and Algolia ($2B) are the cheapest in their history

By ARR multiples, risk, + growth combined

So find a way to just do them, even as a seed investor

But only true for best

I didn't get this until 2021. The recent rounds at Talkdesk ($10B) and Algolia ($2B) are the cheapest in their history

By ARR multiples, risk, + growth combined

So find a way to just do them, even as a seed investor

But only true for best

Bonus: You Know Early

You don't know at seed stage how big a success story will be. But you know it >will< be a success

In 2014, here are CEOs of Talkdesk, Algolia & $800m Greenhouse sharing learnings, back when seed CEOs:

All become big wins:

You don't know at seed stage how big a success story will be. But you know it >will< be a success

In 2014, here are CEOs of Talkdesk, Algolia & $800m Greenhouse sharing learnings, back when seed CEOs:

All become big wins:

• • •

Missing some Tweet in this thread? You can try to

force a refresh