It's the weekend!

Grab a cup of coffee, in this thread we will explore

1. What is risk management?

2. What is position sizing?

3. How to apply both these concepts to reduce volatility and drawdowns in your portfolio?

Lets dive right in.

Grab a cup of coffee, in this thread we will explore

1. What is risk management?

2. What is position sizing?

3. How to apply both these concepts to reduce volatility and drawdowns in your portfolio?

Lets dive right in.

What does losing $20 Billion in 24 hours and A Bank being sold for less than $1, have in common?

The answer is Risk Management.

The answer is Risk Management.

Through this thread we will explore 2 stories - Stories that will teach us the importance of risk management and position sizing in a portfolio.

These stories will show you that no matter

How Rich You Are

How Respected You Are

How Educated You Are

Improper risk management will blow up your portfolio and most likely bankrupt you.

How Rich You Are

How Respected You Are

How Educated You Are

Improper risk management will blow up your portfolio and most likely bankrupt you.

Bill Hwang was a somewhat a prodigy in finance and one of the wealthiest individual in US with a net worth of $20 Billion.

Bill Hwang had a modest upbringing, his family immigrated to the US from South Korea in 1980s. Soon after immigrating to US, his father passed away and Bill Hwang took up the night shift at a local McDonalds to help feed his family.

From these modest roots, Bill Hwang climbed up the ladder of finance and became one the most revered fund managers at Tiger Management started by the legendary hedge fund manager Julian Robertson.

Bill Hwang had to eventually shut down his hedge fund called Tiger Asia and from the proceeds of that fund he started his family office called Archegos Capital Management.

At Archegos, Bill Hwang turned $200 Million of his own money into $20 Billion in under 7 years.

Despite this wealth, Bill Hwang lived a modest living. He had a single house in suburban New Jersey and drive a Hyundai SUV.

No luxury houses and cars for him.

No luxury houses and cars for him.

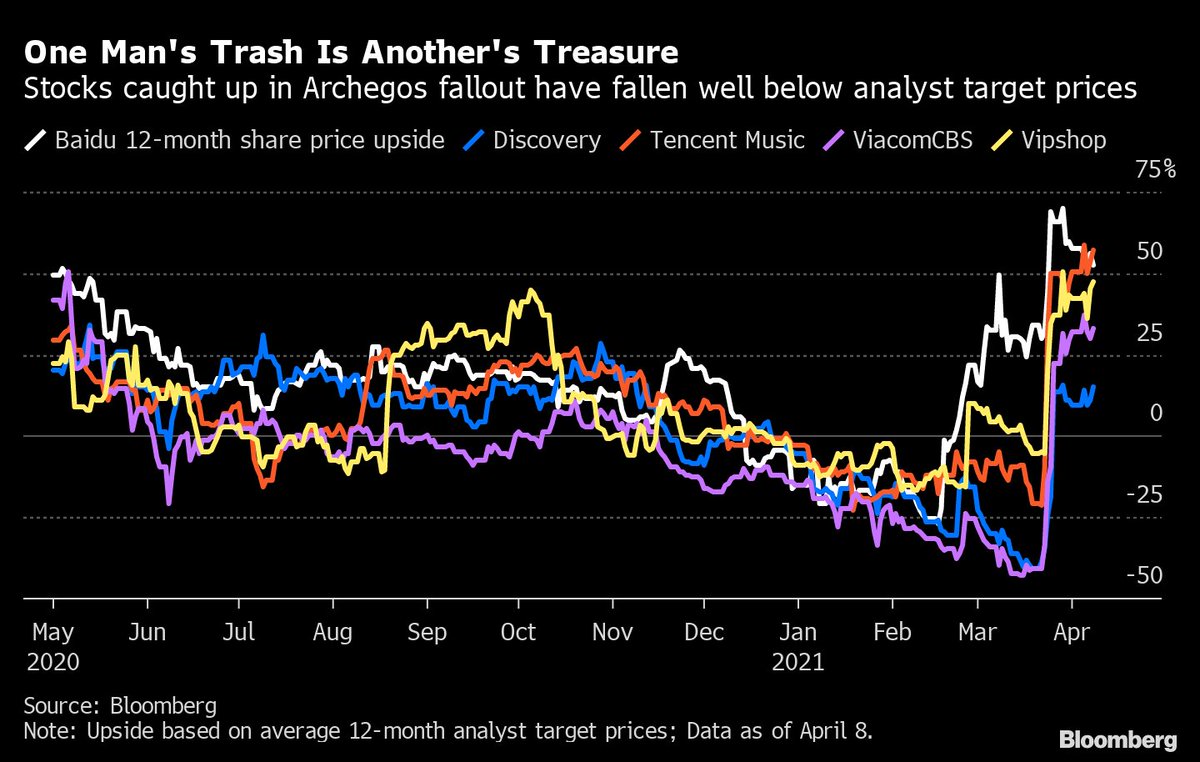

March 22, 2021

Viacom CBS announces a stock and convertible bond sale after market closes for that day.

Viacom wanted to raise money and for what so ever reason, market didn't like this new stock and bond sale from Viacom.

Viacom CBS announces a stock and convertible bond sale after market closes for that day.

Viacom wanted to raise money and for what so ever reason, market didn't like this new stock and bond sale from Viacom.

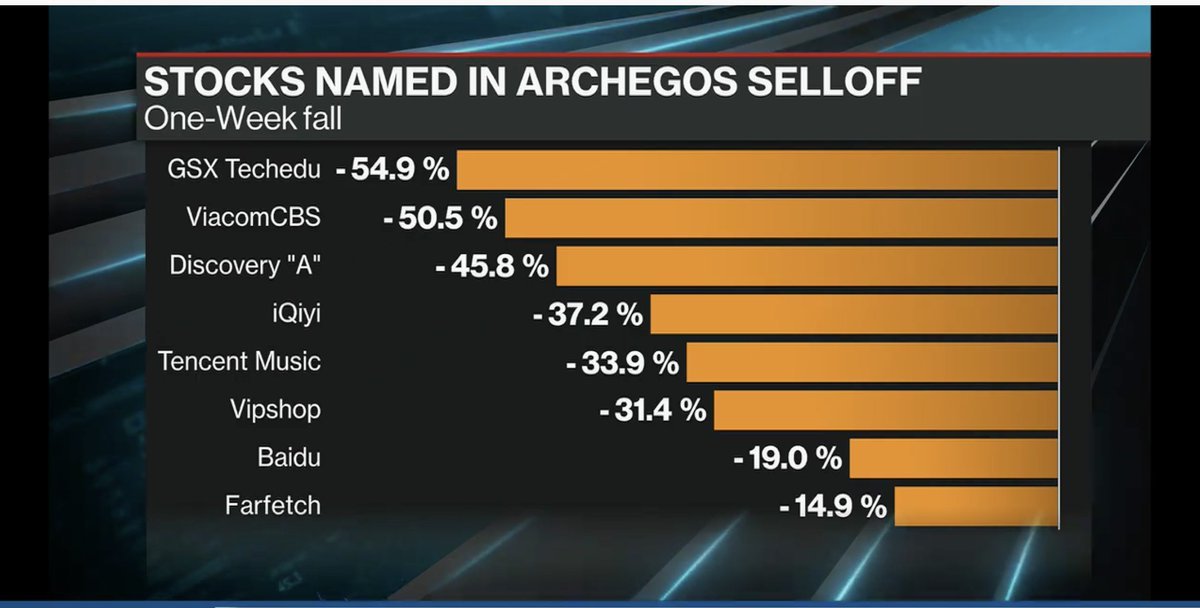

And Bill Hwang would lose $20 Billion.

Why did Bill Hwang lose all his wealth with the drop of a single stock?

Cause, Bill Hwang was levered massively. He used a financial instrument called a total return swap (which is a type of OTC derivative) to leverage all his positions.

Cause, Bill Hwang was levered massively. He used a financial instrument called a total return swap (which is a type of OTC derivative) to leverage all his positions.

A margin call on one or two of his positions would have been fine, Bill would simply sell some of his other holdings to pay for the margin.

But, see as soon as the street realized that Archegos wasn't immediately able to pay for the margin call on Viacom shares, his other positions started to tank as well.

Bill had bought these Total Return Swaps with almost all the banks on Wall Street, if Bill wasn't able to fund his margin calls, these banks would be forced to liquidate his holdings and incur losses.

As these holdings were very large, the first bank to liquidate would be hurt the least.

Goldman Sachs was the first one to dump these holdings, Credit Suisse was the last.

Goldman escaped unscathed by this entire mess while Credit Suisse took one the biggest losses in their entire history.

Goldman escaped unscathed by this entire mess while Credit Suisse took one the biggest losses in their entire history.

As for Bill Hwang he lost it all, in matter of 24 hours.

$20 Billion, his life's earnings, all gone, poof, zero, zlich, nada!

$20 Billion, his life's earnings, all gone, poof, zero, zlich, nada!

The sad part is, all of Bill's stock holdings recovered most of their losses the next week, but because Bill was levered his portfolio didn't survive to see that day.

Lesson #1

Never take on leverage and never invest with borrowed money

Borrowed money is like the grim reaper that is waiting to kill your portfolio at the first instance

If a prodigy like Bill Hwang wasn't able to survive with leverage, why would you?

Never take on leverage and never invest with borrowed money

Borrowed money is like the grim reaper that is waiting to kill your portfolio at the first instance

If a prodigy like Bill Hwang wasn't able to survive with leverage, why would you?

Had Bill hadn't leveraged himself, he would have survived and recovered most of his losses.

Bill was actually given the option by his banks to liquidate half his holdings and pay for the margin call. ~$10 Billion

After paying for the call, he would still be left with ~$10 Billion and live to survive another day.

After paying for the call, he would still be left with ~$10 Billion and live to survive another day.

Bill Hwang didn't agree to that.

Lesson #2

Be willing to take a loss.

No investment is without risk and knowing the risks in an investment will help you minimize losses if things go south.

Be willing to take a loss.

No investment is without risk and knowing the risks in an investment will help you minimize losses if things go south.

Our second story highlights this lesson.

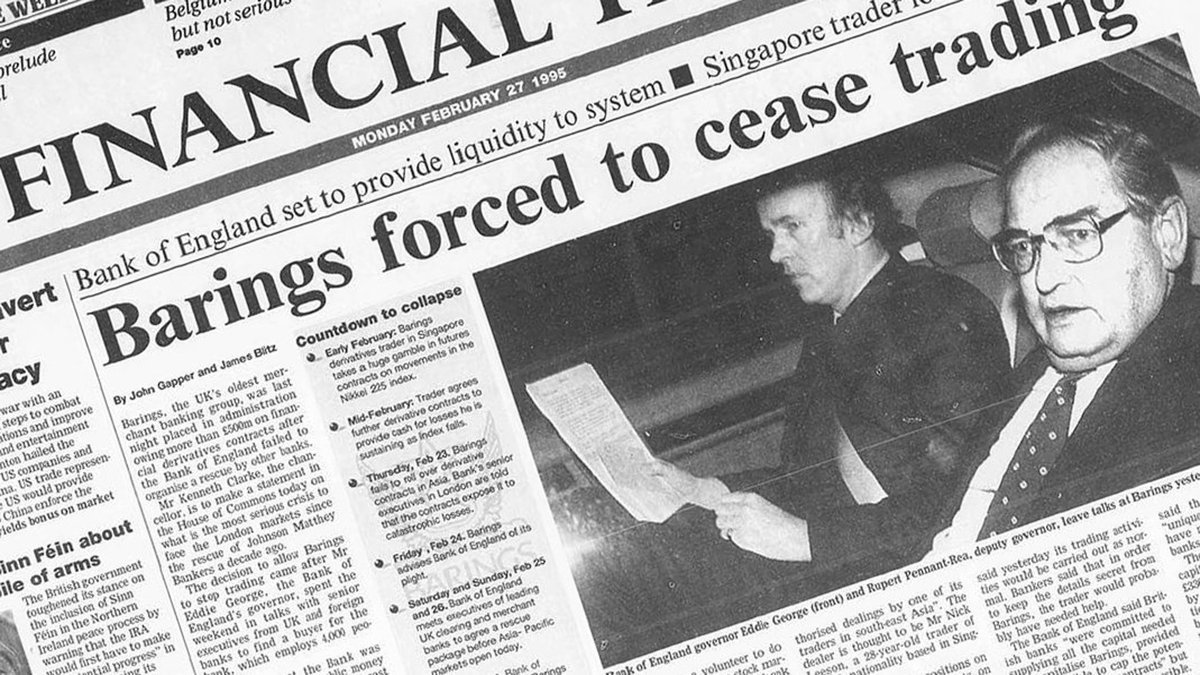

Barings Bank was one of the oldest bank in UK. At its prime, the Queen of England had an account there.

It was founded in 1762 and almost 233 years later in 1995, the Bank would be bought by ING for less than $1.

It was founded in 1762 and almost 233 years later in 1995, the Bank would be bought by ING for less than $1.

Barings hired a trader called Nick Leeson and Lesson single handedly bought the entire institution down.

Nick Leeson took on speculative trades in Japan's Nikkei's index during the Japanese market boom.

Leeson used to bet if the index would go up or down and if it moved in the direction he was betting he would make money.

Leeson used to bet if the index would go up or down and if it moved in the direction he was betting he would make money.

Initially this worked and Leeson made a lot of money for the bank. The bank in return gave him a free leash and he was allowed to take as many trades irrespective of how speculative they were.

Just like with any bet that has 50:50 odds, these bets soon turned sour and Nick had to book losses.

Instead of stopping there Nick tried to recover these losses by hiding them from the Banks books and taking even larger bets in hopes that they would recover all the losses.

Instead of stopping there Nick tried to recover these losses by hiding them from the Banks books and taking even larger bets in hopes that they would recover all the losses.

Nick would have maybe succeed too, had it not been for an earthquake in Japan that cause Nikkei to report one of the biggest single day falls.

Kobe Earthquake of 1995 was one of the most intense in Japan. While building his positions Leeson would have never imagined that an earthquake could occur and wipe his entire position and bring down his employer.

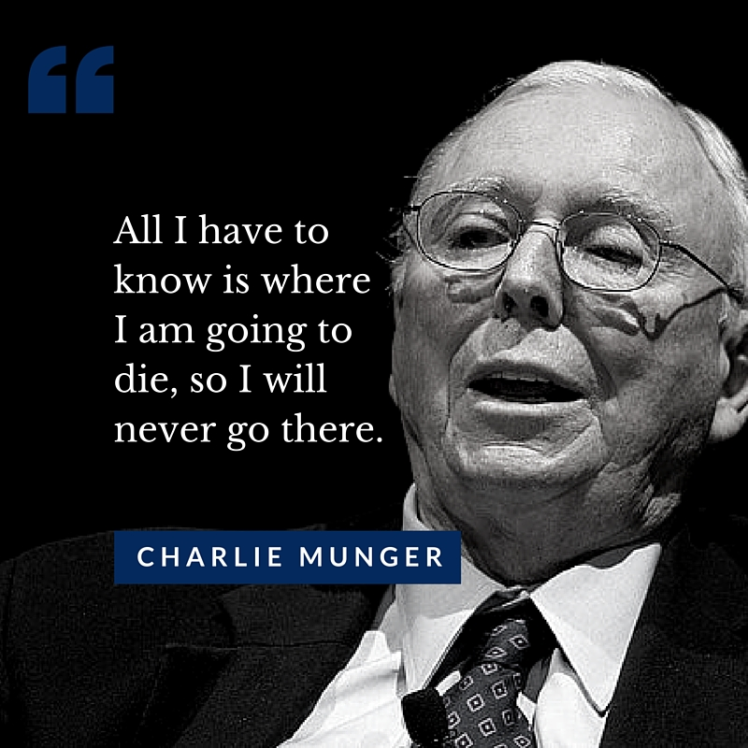

Lesson #3

You don't know, what you don't know.

You don't know, what you don't know.

If you're working with leverage and borrowed ideas then anything can wipe you out.

Your task as an investor is to be fully aware of every risk that the investment has.

The probability of some risks maybe higher than others but there is no investment with zero risk.

Your task as an investor is to be fully aware of every risk that the investment has.

The probability of some risks maybe higher than others but there is no investment with zero risk.

In each of these stories, the protagonist had made some common errors.

- They used excessive leverage

- They didn't know how to take a loss

- They threw risk management out the door

- Their positions didn't reflect the proper risk return ratio

- They used excessive leverage

- They didn't know how to take a loss

- They threw risk management out the door

- Their positions didn't reflect the proper risk return ratio

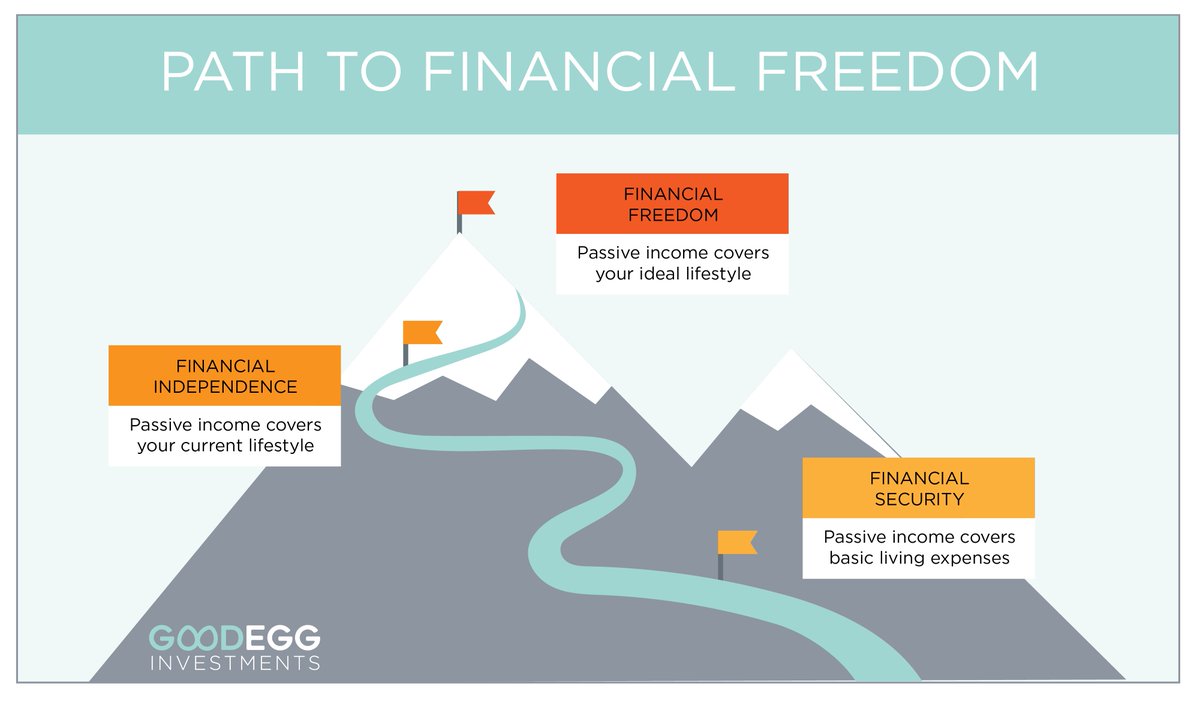

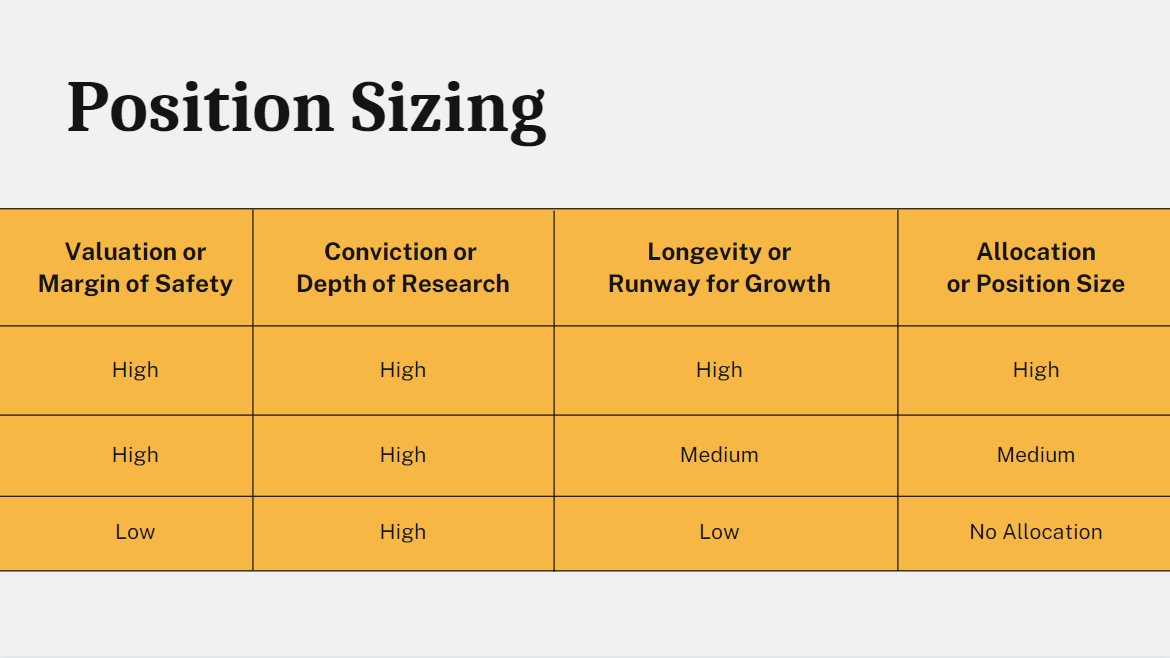

Other than not taking any leverage, position sizing is extremely important in managing risk within a portfolio.

Here is an example of how I size my positions.

The three factors that I consider are

1. Margin of Safety

2. Depth of Research

3. Longevity of Earnings

The three factors that I consider are

1. Margin of Safety

2. Depth of Research

3. Longevity of Earnings

Only when an opportunity checks of all three boxes is when I try to take a position in.

If my depth of research and longevity of earnings in a position is high then I will start with a small allocation and allocate big if margin of safety increases.

If my depth of research and longevity of earnings in a position is high then I will start with a small allocation and allocate big if margin of safety increases.

Risk comes from not knowing what you own and not from concentrating into positions you own.

Diversifying into 50 stocks will not eliminate the risk from your portfolio.

Knowing majority of risks of all 10 stocks you own will certainly help you manage it.

Diversifying into 50 stocks will not eliminate the risk from your portfolio.

Knowing majority of risks of all 10 stocks you own will certainly help you manage it.

Look at the positions you own, determine their margin of safety, be honest with yourself about your depth of research and determine the longevity of earnings for these businesses.

You will get your answer on how much to allocate.

You will get your answer on how much to allocate.

With this, we come to an end of this thread.

I hope this helped you understand what not to do and how to size positions in your portfolio.

I hope this helped you understand what not to do and how to size positions in your portfolio.

If you find this thread useful then follow me

@itsTarH

I write a new thread every weekend.

All my previous work, can be found here.

@itsTarH

I write a new thread every weekend.

All my previous work, can be found here.

https://twitter.com/itsTarH/status/1401095938945425410?s=20

I also teach a class on Personal Finance, if you're interested.

Sign up using the link below to get free 30 days access to it.

skl.sh/2Wjk7A7

Sign up using the link below to get free 30 days access to it.

skl.sh/2Wjk7A7

https://twitter.com/itsTarH/status/1419694448892514311?s=20

Also, write and publish long from articles on my substack (investkaroindia.substack.com)

Subscribe for free, if you're interested.

Thank you to the 2000+ of you who already have!

Here is a recent deep dive I wrote on PolicyBazaar.

Subscribe for free, if you're interested.

Thank you to the 2000+ of you who already have!

Here is a recent deep dive I wrote on PolicyBazaar.

https://twitter.com/itsTarH/status/1425516219378012160?s=20

If you want to know more about Archegos and Barnings Bank, here are two great videos that will help you learn.

Archegos Capital Management

Barings Bank

Thank you for reading, please retweet the first tweet in this thread for a broader reach.

See you all next weekend!

See you all next weekend!

• • •

Missing some Tweet in this thread? You can try to

force a refresh