• Shareholders

As of June 10th, 2021 the biggest shareholders were:

1. Private Companies = 40.9%

2. General Public = 37.3%

3. Individual insiders = 13.1%

4. Institutions = 8.6%

As of June 10th, 2021 the biggest shareholders were:

1. Private Companies = 40.9%

2. General Public = 37.3%

3. Individual insiders = 13.1%

4. Institutions = 8.6%

•Ownership

Breaking it down further, we can see what companies and individuals have the largest holdings in Purple Group.

Let me point out some individuals have direct + indirect ownership of Purple Group.

Like Mark Barnes, who is a shareholder in (BVI)

Breaking it down further, we can see what companies and individuals have the largest holdings in Purple Group.

Let me point out some individuals have direct + indirect ownership of Purple Group.

Like Mark Barnes, who is a shareholder in (BVI)

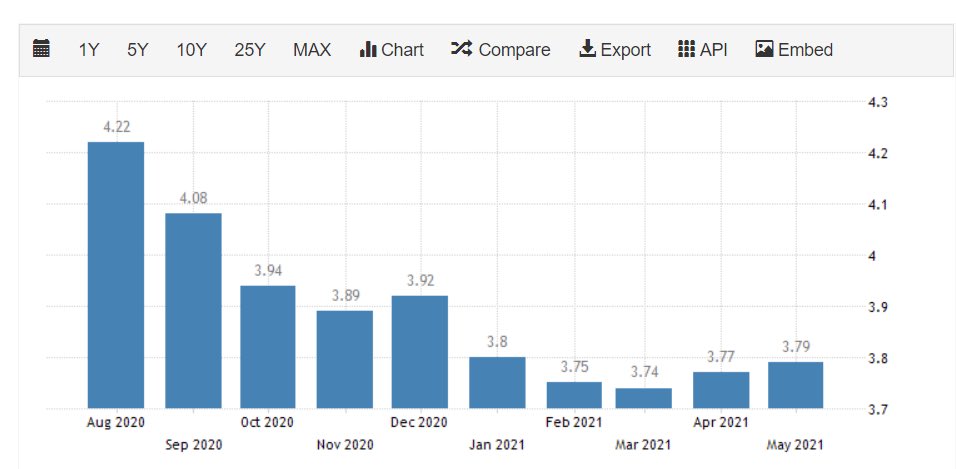

• 5 Year performance

$PPE has returned 111% to investors over the last 5 years with most of those returns coming in the last 14 months.

However,

Those holding between 2016-2020 experienced drawdowns in the share price because they bought at overvalued levels.

$PPE has returned 111% to investors over the last 5 years with most of those returns coming in the last 14 months.

However,

Those holding between 2016-2020 experienced drawdowns in the share price because they bought at overvalued levels.

• Entry Point

I use technical analysis to decipher entry points, because like shareholders between 2016-2020, you could be faced with drawdowns as the share grows into its current valuation.

You can watch the video at the end.

I use technical analysis to decipher entry points, because like shareholders between 2016-2020, you could be faced with drawdowns as the share grows into its current valuation.

You can watch the video at the end.

• Insider selling

Mark Barnes has been a net seller of $PPE The stall in the share price could come as early as Q1 2022. Consolidation will be healthy for the company.

As management enters the next chapter of growth it must convince new investors of the growth potential ahead

Mark Barnes has been a net seller of $PPE The stall in the share price could come as early as Q1 2022. Consolidation will be healthy for the company.

As management enters the next chapter of growth it must convince new investors of the growth potential ahead

• Growth

This is why Firefly has entered into the arena, to try expedite growth. Firefly has call options, that they have been executing, to acquire up to 13% in Purple Group from BVI’s holding, aka. Mark Barnes.

This is why Firefly has entered into the arena, to try expedite growth. Firefly has call options, that they have been executing, to acquire up to 13% in Purple Group from BVI’s holding, aka. Mark Barnes.

• Valuation

Stocks tend to revert to their mean overtime, maybe not now, but possibly in the future.

* Remember, stocks don’t only go up, be prepared to hold for the long term. Draw downs are natural.

Check out Purples Groups 2020 Financials below.

Stocks tend to revert to their mean overtime, maybe not now, but possibly in the future.

* Remember, stocks don’t only go up, be prepared to hold for the long term. Draw downs are natural.

Check out Purples Groups 2020 Financials below.

https://twitter.com/talkcentss/status/1407178073439563776

• Article

Read the full article below for a detailed report + to see my price prediction for Purple Group 2021.

davidketh.substack.com/p/purple-group…

Read the full article below for a detailed report + to see my price prediction for Purple Group 2021.

davidketh.substack.com/p/purple-group…

•Should I buy?

I’m not here to tell you what to do, but I can share with you my technical analysis.

After watching this you’ll have a better sense of the entry points on offer.

Watch now 👇🏽

I’m not here to tell you what to do, but I can share with you my technical analysis.

After watching this you’ll have a better sense of the entry points on offer.

Watch now 👇🏽

Follow me @talkcentss for more company analysis.

You can expect more:

- Technical analysis ideas

- Investment tips

- Property threads

- Personal Finance

You can expect more:

- Technical analysis ideas

- Investment tips

- Property threads

- Personal Finance

Or you can simply join the team who gets the information before anyone else.

Sign up below, it’s FREE, and only takes a few seconds. 👇🏽

davidketh.substack.com/p/talkcents

Sign up below, it’s FREE, and only takes a few seconds. 👇🏽

davidketh.substack.com/p/talkcents

• Recap

- Institutions don’t own much

- Partnership growth

- Insiders are selling

- Growing industry

- Institutions don’t own much

- Partnership growth

- Insiders are selling

- Growing industry

• • •

Missing some Tweet in this thread? You can try to

force a refresh