1/

We always hear people talking about inflation and interest rates.

But how does it affect me and the economy?

Let’s take a look

We always hear people talking about inflation and interest rates.

But how does it affect me and the economy?

Let’s take a look

2/

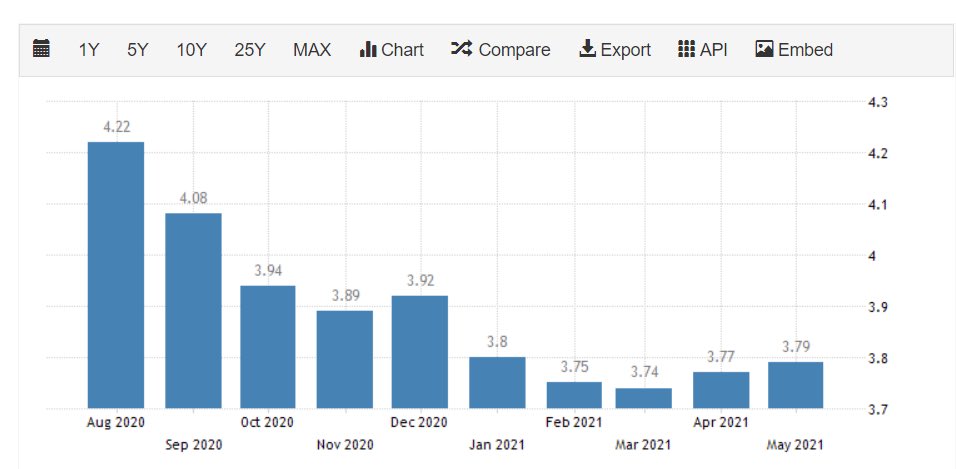

Bank Deposit rate

This is the rate banks give you for depositing your money with them.

It’s a liability to them, but a method for them to borrow

(cost of liability)

They are effectively paying you 3.79% to borrow your money and their cost is getting cheaper.

Bank Deposit rate

This is the rate banks give you for depositing your money with them.

It’s a liability to them, but a method for them to borrow

(cost of liability)

They are effectively paying you 3.79% to borrow your money and their cost is getting cheaper.

3/

Bank deposit rate (10 years)

Looks like it has fallen through the roof. Falling from 7% to 3.79% in 2 years.

It also hasn’t translated to any economic growth and is punishing those nearing retirement.

Bank deposit rate (10 years)

Looks like it has fallen through the roof. Falling from 7% to 3.79% in 2 years.

It also hasn’t translated to any economic growth and is punishing those nearing retirement.

4/

Prime lending rate

This is the rate banks lend to us.

(7%)

Most of the time they will only give their most credit worthy customers the prime rate (7%)

Many of us would probably pay much more, possibly prime +2. It all depends on our personal credit risk profile.

Prime lending rate

This is the rate banks lend to us.

(7%)

Most of the time they will only give their most credit worthy customers the prime rate (7%)

Many of us would probably pay much more, possibly prime +2. It all depends on our personal credit risk profile.

5/

Banking Profits

Net interest Income (NII) is the difference between the borrowing cost and the lending costs.

(Lending cost - borrowing costs)

7% - 3.79%

= 3.21%

Notice how banks don’t lose money, but you do - welcome to the working class.

Banking Profits

Net interest Income (NII) is the difference between the borrowing cost and the lending costs.

(Lending cost - borrowing costs)

7% - 3.79%

= 3.21%

Notice how banks don’t lose money, but you do - welcome to the working class.

6/

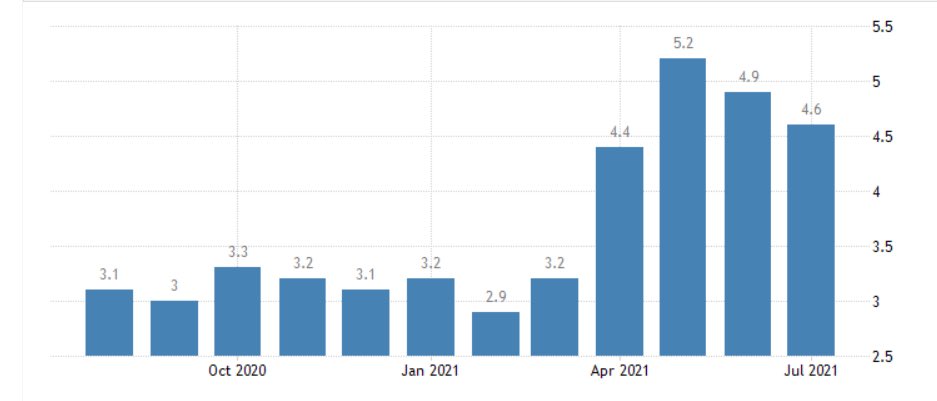

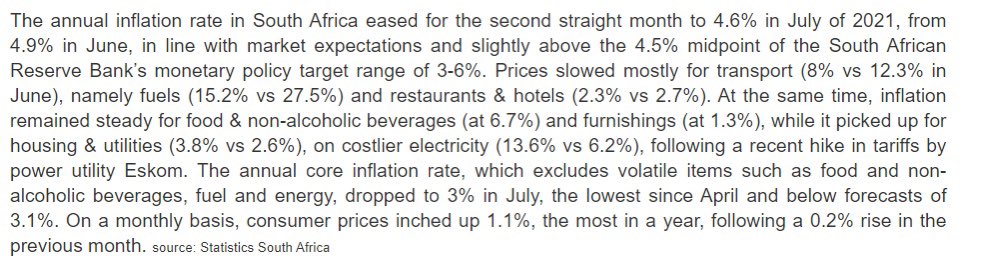

Inflation rate

Over the last year the inflation rate has been rising, which makes sense because in 2020 the velocity of money slowed down.

Latest CPI data put inflation at 4.6%.

Inflation = 4.6%

Deposit Rate = 3.79%

(You lose)

Forcing you to take risks, to stimulate.

Inflation rate

Over the last year the inflation rate has been rising, which makes sense because in 2020 the velocity of money slowed down.

Latest CPI data put inflation at 4.6%.

Inflation = 4.6%

Deposit Rate = 3.79%

(You lose)

Forcing you to take risks, to stimulate.

7/

Velocity of Money

Is a measure of the number of times that the average unit of currency is used to purchase goods/services within a given period

Simply put, its how many times money changes hands

The speed of money exchange is one of the variables that determine inflation

Velocity of Money

Is a measure of the number of times that the average unit of currency is used to purchase goods/services within a given period

Simply put, its how many times money changes hands

The speed of money exchange is one of the variables that determine inflation

8/

Velocity (2)

Velocity of money =

GDP ÷ money supply

If velocity is slowing down, inflationary pressures will slow down, too. One way to do this is to cut the money supply.

•Taxes

•Increase interest rates

Austerity 🥴

Here is a simple example of understanding it👇🏽

Velocity (2)

Velocity of money =

GDP ÷ money supply

If velocity is slowing down, inflationary pressures will slow down, too. One way to do this is to cut the money supply.

•Taxes

•Increase interest rates

Austerity 🥴

Here is a simple example of understanding it👇🏽

9/

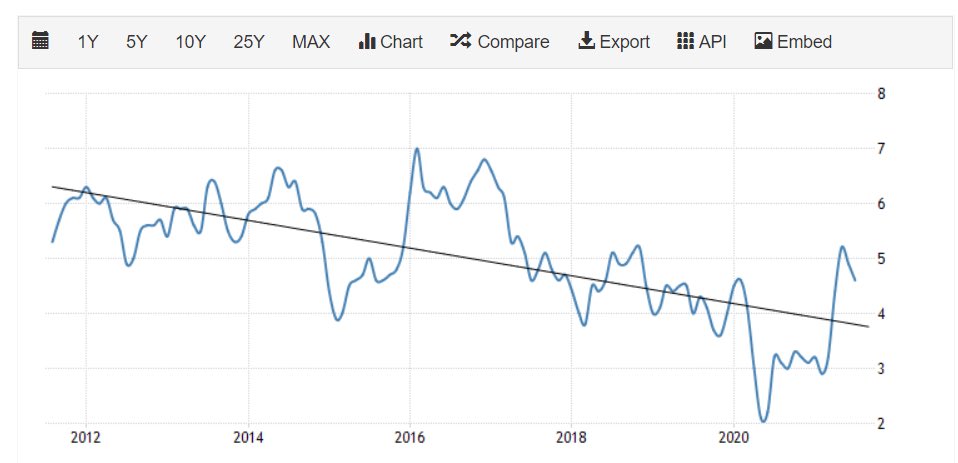

Back to Inflation (10 years)

South Africa’s inflation rate has been drifting downwards. And currently we are over shooting the average inflation rate.

Consistent inflation will lead the SARB to act and hike rates, because their mandate is to protect the currency.

Back to Inflation (10 years)

South Africa’s inflation rate has been drifting downwards. And currently we are over shooting the average inflation rate.

Consistent inflation will lead the SARB to act and hike rates, because their mandate is to protect the currency.

10/

Inflationary pressures

The SARB and the governor @KganyagoLesetja look for second-round effects of inflation before responding

These are indirect effects of higher energy prices, it’s when businesses pass on the higher cost of production to their consumers.

👇🏽

Inflationary pressures

The SARB and the governor @KganyagoLesetja look for second-round effects of inflation before responding

These are indirect effects of higher energy prices, it’s when businesses pass on the higher cost of production to their consumers.

👇🏽

11/

What does this mean?

Well, to me it means government and SARB is going to be doing more of what they have done - Austerity

There will be no meaningful growth because they are scared of inflation. Any signs of it they will protect the currency

The economy is Flat Lining👇🏽

What does this mean?

Well, to me it means government and SARB is going to be doing more of what they have done - Austerity

There will be no meaningful growth because they are scared of inflation. Any signs of it they will protect the currency

The economy is Flat Lining👇🏽

12/

Notice how government and SARB’s policies have delivered NO growth over the last 13 years,

Our GDP is still below that of 2008, and they still want to do what’s not working.

“Insanity is doing the same thing over and over and expecting a different result” - Einstein on SA

Notice how government and SARB’s policies have delivered NO growth over the last 13 years,

Our GDP is still below that of 2008, and they still want to do what’s not working.

“Insanity is doing the same thing over and over and expecting a different result” - Einstein on SA

13/

Why am I losing money?

Inflation=4.6%

Deposit rate= 3.79%

That’s a loss of 0.81% in purchasing power if you keep money in the bank

Retirees/savers are being punished the hardest

They are being forced to search for yield and take on more risk at an older age. #Bitcoin

Why am I losing money?

Inflation=4.6%

Deposit rate= 3.79%

That’s a loss of 0.81% in purchasing power if you keep money in the bank

Retirees/savers are being punished the hardest

They are being forced to search for yield and take on more risk at an older age. #Bitcoin

14/

The actions of SARB and government have been futile

It’s made servicing our debt cheaper, but increasing costs elsewhere have sucked that excess disposable income up.

Also, as debt is serviced that’s money that leaves the system which in effect brings down inflation.

The actions of SARB and government have been futile

It’s made servicing our debt cheaper, but increasing costs elsewhere have sucked that excess disposable income up.

Also, as debt is serviced that’s money that leaves the system which in effect brings down inflation.

15/

Interest rate cuts have done nothing, because as government gives with the right hand they take away with the left hand.

Their economic policies have stunned economic growth and their policies are absorbing capital out of the system. #stupidity

Interest rate cuts have done nothing, because as government gives with the right hand they take away with the left hand.

Their economic policies have stunned economic growth and their policies are absorbing capital out of the system. #stupidity

16/

Without inflation we cannot have meaningful growth. There is something wrong at the moment.

A dichotomy - monetary and fiscal policy aren’t aligned. The real gate keepers aren’t here to give us our freedom. We are the working class, remember that.

Learn to play the game.

Without inflation we cannot have meaningful growth. There is something wrong at the moment.

A dichotomy - monetary and fiscal policy aren’t aligned. The real gate keepers aren’t here to give us our freedom. We are the working class, remember that.

Learn to play the game.

If you enjoyed this thread follow me @talkcentss for more economic analysis.

You can expect:

• Investment ideas

• Trading tips

• 10x investment ideas

• Property threads

You can expect:

• Investment ideas

• Trading tips

• 10x investment ideas

• Property threads

Or you can be like 1000 other people who get the best premium content absolutely free every Monday.

Sign up now, it only takes a few seconds👇🏽

davidketh.substack.com/p/talkcents

Sign up now, it only takes a few seconds👇🏽

davidketh.substack.com/p/talkcents

• Thread Summary

- Slowing economy

- SA loves austerity

- Forced to take risks

- No economic growth

- SARB protects currency

- Losing money in the banks

- Gatekeepers are keeping us poor

- Slowing economy

- SA loves austerity

- Forced to take risks

- No economic growth

- SARB protects currency

- Losing money in the banks

- Gatekeepers are keeping us poor

• • •

Missing some Tweet in this thread? You can try to

force a refresh