1/ Crypto native interest rates 👇

In my opinion the “Fed Funds Rate” of crypto will be derived from the Ethereum / top L1 staking rates.

It's a futuristic take but an interesting thought experiment, lets build a better financial system with crypto native interest rates.

In my opinion the “Fed Funds Rate” of crypto will be derived from the Ethereum / top L1 staking rates.

It's a futuristic take but an interesting thought experiment, lets build a better financial system with crypto native interest rates.

2/ The ETH staking rate will derive yield from two sources:

1) Block Rewards

2) Network Fees

Let’s dive into these and how we can relate them back to our current economic system.

1) Block Rewards

2) Network Fees

Let’s dive into these and how we can relate them back to our current economic system.

3/ Source 1: Block Rewards

Block rewards are inflation needed to secure the underlying network and can be thought of as a base rate.

This is very interesting because inflation of Ethereum (money supply) and the staking rate (interest rate) will be tied together at the hip.

Block rewards are inflation needed to secure the underlying network and can be thought of as a base rate.

This is very interesting because inflation of Ethereum (money supply) and the staking rate (interest rate) will be tied together at the hip.

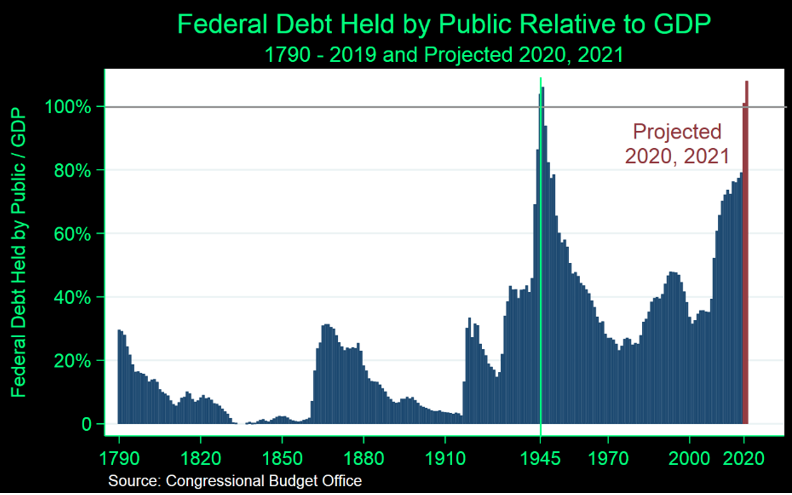

4/ When we look at these two metrics in the US, we have M2 money supply growing at ~8% since 2008 and interest rates (FFR) at .25% for most of that time.

This causes massive distortions within the economy incentivizing huge amounts of unproductive debt.

This causes massive distortions within the economy incentivizing huge amounts of unproductive debt.

5/ Within a crypto native model these distortions no longer become possible as the block rewards portion of the interest rate is directly derived from the “money supply / ETH expansion”.

*Post merge we may even see deflationary ETH due to fee burns*

*Post merge we may even see deflationary ETH due to fee burns*

6/ Source 2: Network Fees

After the merge, with fee revenue going to validators, we will have the second albeit variable source of our yield.

The amount of fees (economic activity) generated on Ethereum will directly impact the staking rate.

After the merge, with fee revenue going to validators, we will have the second albeit variable source of our yield.

The amount of fees (economic activity) generated on Ethereum will directly impact the staking rate.

7/ During times of economic expansion the staking rate will increase due to soaring fees thus making it more expensive for borrowers, and vice versa during economic contraction. Thus naturally balancing out the economic cycle.

^Above is how interest rates are "supposed" to work.

^Above is how interest rates are "supposed" to work.

8/ The raising interest rate portion of this theory has been getting harder and harder since the 1970's due to increasing levels of unproductive debt.

Yet in the new system this unproductive debt is not nearly as incentivized. Building a stronger base and anti-fragile economy.

Yet in the new system this unproductive debt is not nearly as incentivized. Building a stronger base and anti-fragile economy.

9/ This code executes automatically keeping monetary policy in check and building an anti-fragile economy just like the anti-fragile DeFi we see today.

Although this may be many years away it makes me an optimist for our future.

Although this may be many years away it makes me an optimist for our future.

10/ In the short-medium term, the implications of this could be quite fascinating:

Currently the US 10-year is yielding ~1.3% and US M2 money supply was growing at 8% a year pre-covid and 10-15% a year post covid.

Currently the US 10-year is yielding ~1.3% and US M2 money supply was growing at 8% a year pre-covid and 10-15% a year post covid.

11/ Alternatively you invest in Ethereum that is deflationary due to EIP-1559 and provides an interest rate of at a minimum 1.71% (see table) + fees generated on the network.

Your ETH based interest rate on a real basis is significantly better than that of US treasury bonds.

Your ETH based interest rate on a real basis is significantly better than that of US treasury bonds.

12/ This sort of system could act as a blackhole for capital as Ethereum would provide a significantly better real yield.

Although this may not seem realistic today it is where we are heading in my opinion and may not seem so crazy in 10-15 years time.

Although this may not seem realistic today it is where we are heading in my opinion and may not seem so crazy in 10-15 years time.

13/ Thanks for reading!

This is not financial advice; all opinions are my own and please do your own research.

This is not financial advice; all opinions are my own and please do your own research.

• • •

Missing some Tweet in this thread? You can try to

force a refresh