Ethereum will be the new government bond.

Staked ETH, or PoS asset of a dominant blockchain, will replace US Treasuries as the risk-free asset in any portfolio.

This shall be the biggest revolution in the history of financial markets.

Here’s how I think it’ll go down 👇

Staked ETH, or PoS asset of a dominant blockchain, will replace US Treasuries as the risk-free asset in any portfolio.

This shall be the biggest revolution in the history of financial markets.

Here’s how I think it’ll go down 👇

First, how does a “risk-free asset” come to be?

There’s no guarantee in life. Everything has risk. An asteroid can hit earth tomorrow and we all die.

But in practice, people take the debt issued by the US government as a benchmark, risk-free asset, because—

There’s no guarantee in life. Everything has risk. An asteroid can hit earth tomorrow and we all die.

But in practice, people take the debt issued by the US government as a benchmark, risk-free asset, because—

Governments collect taxes. The US has the largest, most robust economy in the world. The US government has the largest, most robust incomes. It literally just takes a cut of the US GDP every year.

When you buy US Treasuries, you’re indirectly taking a share of the US GDP. You can fuss about whether US is issuing too much debt, if yield is artificially low, if monetary policy is over indulgent, yada yada yada...

But at the end of day, investment risk in US Treasuries is still lower than anything else out there. That’s why people take it as the risk-free asset. Every other bond, stock, and property look to US Treasury yield as a basis of their pricing.

At least that’s the regime before crypto came along.

But that changes when a public blockchain starts to power the real economy.

When you do stuff with ETH & other ERC tokens, ethereum collects a fee (i.e. gas).

But that changes when a public blockchain starts to power the real economy.

When you do stuff with ETH & other ERC tokens, ethereum collects a fee (i.e. gas).

The more complicated the activity (read: higher value-added), the higher the fee. A simple transfer of funds takes 21000 gas. A token swap on Uniswap requires running a contract and many steps behind the scene, so costs 10x more.

This is like a VAT (value added tax) on the economic value creations happening on ethereum. More activities, more taxes collected.

Right now crypto is playing in the sandbox with itself. The activities are deFi and NFT. But it’s a matter of time before “real economy” stuff starts happening on chain. Settling imports and exports, buying houses and cars, paying employees and contractors…

And let’s not forget a public blockchain is global. Unlike taxes by a nation state government, fees on ethereum are collected world wide with no geo boundary.

Implication: As ethereum integrates with real economy, fee revenue will start tracking the level of real economic activities around the world. Gas fees will become a guaranteed cut taken out of global value creation, i.e. world GDP growth.

Remember why US treasuries are considered risk-free assets? Cuz they are backed by tax incomes from the biggest economy in the world.

But since gas fees are “tax incomes” from the entire world economy, ethereum can single-handedly beat US treasuries at the risk-free asset game.

But since gas fees are “tax incomes” from the entire world economy, ethereum can single-handedly beat US treasuries at the risk-free asset game.

If you want anything safer and more diversified than a fixed income off of the entire earth GDP, you’d have to start buying assets on Mars and Venus.

Where do the ethereum “taxes” go?

You’re smart. By now you see what I’m going to say next.

Where do the ethereum “taxes” go?

You’re smart. By now you see what I’m going to say next.

Once ethereum switches to proof of stake, the gas incomes that don’t get burned will go to the validators (stakers).

Unlike bitcoin proof-of-work where miners rack up million $$ bills in hardware costs to compete for new blocks, anybody can stake ETH. It’ll be as easy as buying Treasury bonds.

While BTC mining turns into a capital-intensive utility industry, ETH staking will become the fixed-income staple in the portfolio of every average Joe.

What will be the ETH staking yield in the long term?

In the short term things are hard to predict because of too many moving pieces— number of stakers, activity volumes, ETH price, burn rate, etc. @drakefjustin has done great analyses on these.

In the short term things are hard to predict because of too many moving pieces— number of stakers, activity volumes, ETH price, burn rate, etc. @drakefjustin has done great analyses on these.

In the long term, if ethereum keeps its status as the dominant smart contract chain, and grows to power more and more real activities on the world scale, over time the yield should track global growth + global inflation.

The US 10-year treasury yield averages 4.8% in the long run. There’re big swings across time, depending on inflation, monetary and fiscal policies at any given moment. But the long run average yield is close to average US real GDP growth + average US inflation.

In other words, if a global risk-free asset had existed over the past decade, the average yield should be around 2.4% + 2.8% = 5.2%.

So a 5% nominal yield appears a rule of thumb for a risk-free base asset in the long term.

So a 5% nominal yield appears a rule of thumb for a risk-free base asset in the long term.

Note this is measured using inflation rate of fiat currency, which averages 2-3% a year. If ETH supply growth is lower than that, it will mess up all the assumptions, but not for the reason you may think.

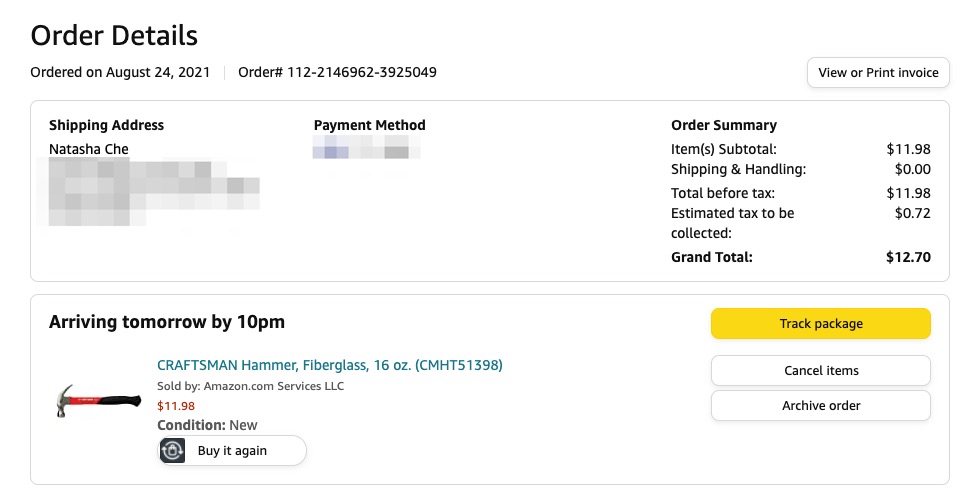

BTW, like this so far? I write about ideas on investment, macro and human potential. Subscribe to my newsletter for updates 👉 natashache.com/newsletter/

Why low inflation is bad for a global base asset?

ETH supply growth is around 4.5% a year right now. Once moving to proof of stake, issuance is set to drop to below 1%. Crypto investors cheer because they think lower supply growth is going to hike ETH price.

ETH supply growth is around 4.5% a year right now. Once moving to proof of stake, issuance is set to drop to below 1%. Crypto investors cheer because they think lower supply growth is going to hike ETH price.

While in the short term that’s true, it’s very short-sighted thinking.

Money supply growth + money velocity growth = inflation rate + real GDP growth

Money supply growth + money velocity growth = inflation rate + real GDP growth

As a global base currency, you do not want your money supply to be too high or too low. If money supply grows less than volume of economic activities (real GDP growth), you’ll have systemic deflation.

The opposite way, you’ll have inflation. Both are bad user experience.

https://twitter.com/RealNatashaChe/status/1425986035197087746?s=20

Your goal should be to keep prices of things denominated in your currency stable. That requires money supply growth to keep pace with real GDP growth.

If you’re a global base currency and global real GDP grows 2-3% a year, money supply growth needs to be that much as well.

If you’re a global base currency and global real GDP grows 2-3% a year, money supply growth needs to be that much as well.

But since you’re only on your way to become that and not there yet, the volume of economic activities covered by you will grow faster than global GDP, until you reach global dominance. That means your money supply needs to grow faster than 2-3%.

The future global base asset will be…?

At the beginning of the post, I said ETH would be a new global risk-free base asset. The truth is any dominant blockchain of sufficient scale can be that. I’m not married to ethereum.

At the beginning of the post, I said ETH would be a new global risk-free base asset. The truth is any dominant blockchain of sufficient scale can be that. I’m not married to ethereum.

ETH token economics needs to change, on top of scaling and transaction cost issues.

I didn’t even mention bitcoin because that’s already a lost case.

I didn’t even mention bitcoin because that’s already a lost case.

https://twitter.com/RealNatashaChe/status/1416050003684954113?s=20

But quite a few ETH killers are gaining traction and more will come. All of them need to be mindful of short-term thinking on token economics.

Anyway, who needs Netflix when you have so much excitement to watch in crypto for free 🍿 🍿 🍿

Anyway, who needs Netflix when you have so much excitement to watch in crypto for free 🍿 🍿 🍿

Like this? I write about ideas to help you become smarter, richer, freer. Follow me on Twitter for updates 👉 @realnatashache .

• • •

Missing some Tweet in this thread? You can try to

force a refresh