Ok, you've all convinced me this is an experiment that needs to be done. So here's the deal.

I'm going to buy a real diamond--> create a NFT for it--> list it on @opensea--> destroy the original diamond. I'll ping this tweet on my profile so you can track progress.

Stay tuned.

I'm going to buy a real diamond--> create a NFT for it--> list it on @opensea--> destroy the original diamond. I'll ping this tweet on my profile so you can track progress.

Stay tuned.

https://twitter.com/RealNatashaChe/status/1429576700346748938

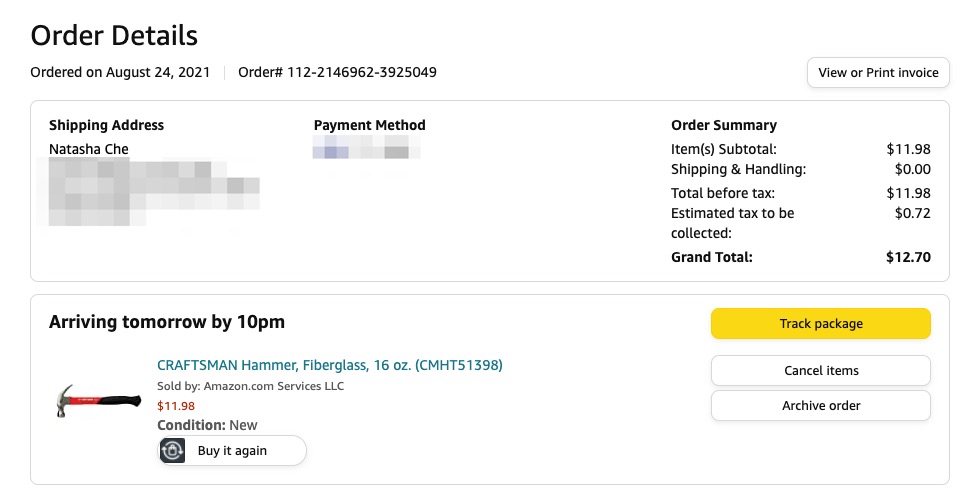

STEP 2: Buy a hammer for diamond smashing (Never smashed a diamond before. Hope this one'll do the job, or I'll need to find another way).

STATUS: Done.

STATUS: Done.

STEP 3: Buy a diamond.

STATUS: Done.

Went shopping online and got this 1.32 carat rock 💎 for $5k. It's supposed to ship next Monday. Meanwhile you're welcome to marvel at its beauty on a conceptual level: natashache.com/gia-1/

Oh and the receipt: natashache.com/blue-nile-rece…

STATUS: Done.

Went shopping online and got this 1.32 carat rock 💎 for $5k. It's supposed to ship next Monday. Meanwhile you're welcome to marvel at its beauty on a conceptual level: natashache.com/gia-1/

Oh and the receipt: natashache.com/blue-nile-rece…

Just got the hammer & the bench block in the mail. That was fast. Hope the diamond 💎 delivery guy does an equally good job as Amazon.

How can a NFT project be complete without some generational family feud? So I put up a fight with my mother 🤪

https://twitter.com/RealNatashaChe/status/1430968302231244803?s=20

Good news...💎Diamond LD15766346💎 ships today!

Says it'll come "in discrete packaging".

Hmm... didn't know diamond is actually a sex toy 🤔

But that's def not a feature included in the diamond NFT, in case you're wondering.

Says it'll come "in discrete packaging".

Hmm... didn't know diamond is actually a sex toy 🤔

But that's def not a feature included in the diamond NFT, in case you're wondering.

Those who shit on Bezos for throwing $ in space, not charities, don’t get it.

Without your ancestors throwing resources in seeming foolish experiments, you’d still be living in stone age.

You can be cynical & indignant abt the future. Or you can take the trouble to create it.

Without your ancestors throwing resources in seeming foolish experiments, you’d still be living in stone age.

You can be cynical & indignant abt the future. Or you can take the trouble to create it.

Guys, I need to upload 1 media asset to mint into the destroyed-diamond NFT. Which one do you like better?

1/ this 360' video of diamond LD15766346

2/ the GIA report image for said diamond (shown in comment)

3/ makes no fucking difference Tascha. both equally stupid

1/ this 360' video of diamond LD15766346

2/ the GIA report image for said diamond (shown in comment)

3/ makes no fucking difference Tascha. both equally stupid

STEP 4: Getting the diamond delivered in the mail

STATUS: Done

Fedex delivered the diamond I bought from Blue Nile at 10:12 AM US eastern time today.

Watch me receive the diamond and unbox it ✂️🎁💎

So excited for the next step 🤗

STATUS: Done

Fedex delivered the diamond I bought from Blue Nile at 10:12 AM US eastern time today.

Watch me receive the diamond and unbox it ✂️🎁💎

So excited for the next step 🤗

STEP 5: Figure out the floor price for the NFT.

STATUS: Done

Here's the reserve price breakdown:

STATUS: Done

Here's the reserve price breakdown:

https://twitter.com/RealNatashaChe/status/1432780251713601538

STEP 5: Destroy the diamond

STATUS: see below

So I tried to smash the diamond w/ a hammer. Turned out 💎 was much tougher than I thought (also I really suck as a handywoman). Here's how it went down in the end.

This historical event happened at 6:13 pm US EST, Aug 31 2021 🎉

STATUS: see below

So I tried to smash the diamond w/ a hammer. Turned out 💎 was much tougher than I thought (also I really suck as a handywoman). Here's how it went down in the end.

This historical event happened at 6:13 pm US EST, Aug 31 2021 🎉

This FAQ video answers

1. What's the Destroyed-Diamond NFT?

2. Why destroy the diamond?

3. Why does the NFT have value?

4. How is this NFT priced?

5. How to destroy the diamond?

Recorded this b/f the diamond-destroying saga today. Little did I know...

1. What's the Destroyed-Diamond NFT?

2. Why destroy the diamond?

3. Why does the NFT have value?

4. How is this NFT priced?

5. How to destroy the diamond?

Recorded this b/f the diamond-destroying saga today. Little did I know...

• • •

Missing some Tweet in this thread? You can try to

force a refresh