Me: I bought a diamond yesterday.

Mom: Nice. They’re good investments.

Me: I’m going to smash it & sell it as a NFT.

Mom: Say again?

So I tried to convince my mother (accountant w/ 30 yr experience) that NFT is a better asset than diamond.

Did I succeed? Let’s find out 👇

Mom: Nice. They’re good investments.

Me: I’m going to smash it & sell it as a NFT.

Mom: Say again?

So I tried to convince my mother (accountant w/ 30 yr experience) that NFT is a better asset than diamond.

Did I succeed? Let’s find out 👇

First off, if you’re out of loop, this all started b/c I’m doing an experiment inspired by all the brilliant comments people made on this tweet of mine:

https://twitter.com/RealNatashaChe/status/1429576700346748938?s=20

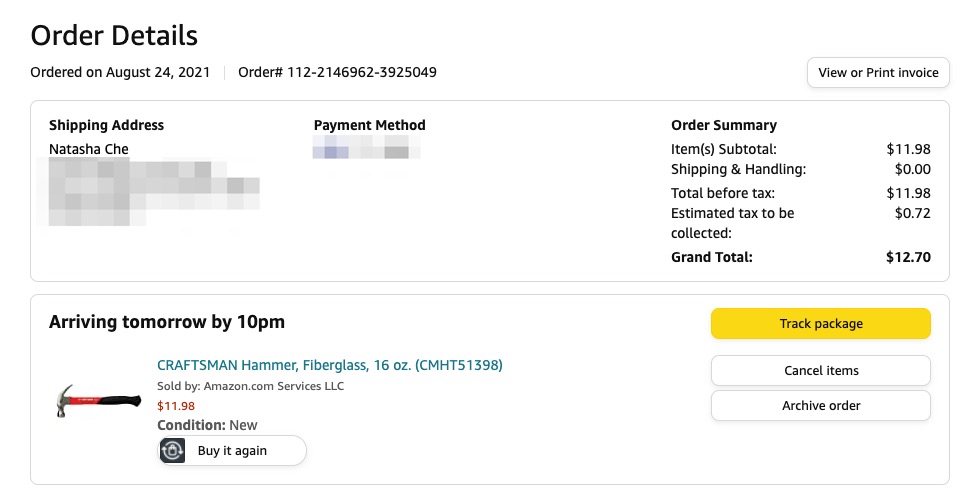

I decided to buy a real diamond, create an associated NFT, destroy the diamond, and see if the NFT retains value. I told my mother about this on the phone. Like everyone else, she immediately went— this is crazy.

Mom: So if I buy this NFT, are you shipping me the diamond?

Me: No. Diamond’ll be destroyed.

Mom: Then what am I buying??

Me: You’re buying the “asset” function of this diamond. This fuction is transferred to the NFT from the diamond.

Mom: Explain.

Me: No. Diamond’ll be destroyed.

Mom: Then what am I buying??

Me: You’re buying the “asset” function of this diamond. This fuction is transferred to the NFT from the diamond.

Mom: Explain.

Me: A diamond has two functions:

1/ real-world utility as jewelry & industrial tool

2/ store-of-value asset

When I create a NFT for the diamond, which is a token in a computer network that denotes an amount of value & ownership, I transfer function 2 to the NFT.

1/ real-world utility as jewelry & industrial tool

2/ store-of-value asset

When I create a NFT for the diamond, which is a token in a computer network that denotes an amount of value & ownership, I transfer function 2 to the NFT.

Once this NFT is created, the contract specifies that the physical diamond no longer holds function 2. It’ll only has function 1.

So I can still wear it as jewelry or use it as a cutting tool. But I can no longer sell it, list it on my balance sheet, or use it as collateral for borrowing. Cuz those belong to function 2, which has been transferred to you, the NFT owner.

Mom: What stops you from selling me the NFT and then sell the physical diamond too?

Me: Glad you asked. That’s why I’ll destroy the diamond, so you have 100% guarantee such double-selling won’t happen.

Me: Glad you asked. That’s why I’ll destroy the diamond, so you have 100% guarantee such double-selling won’t happen.

Mom: But you can’t separate functions 1 and 2. Say you have a house. It got burned down but you still have the deed. Will that piece of paper be worth anything? No. How is it any different just because your deed goes digital?

Me: It’s different b/c the agreement about the asset is different. The agreement in real estate is that the house is the asset, NOT the deed, which is but a paper record about the asset. On your balance sheet, it’s the house being counted, not the deed.

But with NFT, the token IS the asset, not just bookkeeping of some other asset. When I mint the diamond NFT, the asset part of the diamond’s value is transferred to the NFT.

Mom: Houses have asset value because they cost much to build. Digging diamonds is also costly work. But it costs nothing to make up digits on a computer. How can they be worth anything?

Me: If value comes from work or utility or cost, schools should pay students to take classes, since it’s hard work. Air is useful, but nobody pays for it. The paper that $100 bills are printed on costs little. Yet you can use dollar bills to buy groceries.

Work or production cost is NOT the essence of what makes an asset, a.k.a. store-of-value. At the end of day, you only need 3 conditions to qualify as a store of value (SoV):

1/ Limited supply

2/ Durability

3/ Social agreement

1/ Limited supply

2/ Durability

3/ Social agreement

Take diamonds. They’re hard to dig, which meets condition 1. They’re chemically stable, which meets condition 2. Those factors, plus the fact they’re pretty & make useful tools, help to form a social agreement overtime that diamonds denotes X amount of value (condition 3).

NFT can meet the same 3 conditions, but through different ways.

1/ Limited supply: programmed & enforced by code

2/ Durability: decentralized blockchain ledger hard to destroy

3/ Social agreement: bootstrapped by forming strong communities, or transferred from other established asset classes

2/ Durability: decentralized blockchain ledger hard to destroy

3/ Social agreement: bootstrapped by forming strong communities, or transferred from other established asset classes

My diamond NFT essentially transfers the social agreement about value that’s already established on the physical diamond. By destroying the diamond itself, I make the transfer complete. So my diamond NFT meets all 3 conditions as store-of-value.

Mom: But why bother? The world has diamonds and houses as assets already. It doesn’t need your NFTs.

Me: B/c NFTs work better as assets than diamonds. Rocks are high maintenance. You have to clean them, store them in a safe and worry about people stealing them.

Me: B/c NFTs work better as assets than diamonds. Rocks are high maintenance. You have to clean them, store them in a safe and worry about people stealing them.

And there’s no liquid markets for diamonds. You have to find an “expert” to check they are real, tell you how much they are worth, find a buyer and handle shipping.

Wealth is supposed to make you free. Diamond is more a shackle than freedom if you think carefully. Same with houses, paintings, gold bullions.

NFT is better. Transactions are tracked, ownerships verifiable, interactions with other assets programmable, and all done with low cost and high security. You don’t need a warehouse for it or suffer physical depreciation.

It’s a store-of-value on steroid.

It’s a store-of-value on steroid.

Saying the world doesn’t need NFT is like saying the world doesn’t need cars cuz it already has horses.

As NFTs grow, people’ll realize things like diamonds & houses are inferior SoV than digital assets. The former’s popularity as assets will decrease. That means the markets for those physical assets will become even more illiquid, making them harder to sell still.

People will always buy diamonds & houses, but to wear and to live in mostly. Their SoV role will be replaced by digital assets. That also means prices for diamonds & houses will drop in long run, as prices’ll reflect only their real-world utility, not their role as SoV.

BTW, like this so far? I write about ideas on investment, macro and human potential. Subscribe to my newsletter for updates 👉 natashache.com/newsletter/

Mom: Still it costs nothing to make up digits on a computer. What enforces limited supply? You can’t expect people to smash a diamond or burn a house every time they “transfer value” to NFT. That’s craziness.

Me: Destroying the diamond is a radical way to enforce the asset value transfer. In most cases you don’t have to.

There’re ways to establish 1-to-1 mapping btw a NFT and a real-world asset like a house. What you need is to make sure the physical house is no longer permitted to keep the role as an asset, e.g. used as collateral, after you mint the NFT.

And most NFTs are digital native assets anyway. Supply limit is code enforced. e.g. Crypto Punks issue 10,000 NFTs, each identified by a unique punk image.

Mom: But what stops others from issuing more NFTs like those? Punks, dogs, cats, unicorns...you can have as many as you want. It all costs nothing.

Me: Sure. In any growing industry you’ll have bubbles. If many NFTs of similar concepts flood the market, prices for those me-too tokens will collapse just like what happened to the tulips.

But the original projects like Crypto Punks already have cult-like following w/ strong community culture. Culture is a hard thing to build even though it’s invisible.

Ultimately, psychology is what supports the prices of gold and bitcoin. The same will apply to the NFTs that manage to survive the bubble.

Store-of-value is going digital. NFT is a general-purpose technology that makes it happen. Many innovations will be built on top, which collectively overhaul the concept of “assets” as we know it.

Mom: It’s all a speculation, honey.

Me: It’s not. If I tell you which NFT will moon next month, that’d be a speculation. But the long-term trend of digital replacing physical stuff as assets is clear. No investor can afford not to see this.

Me: It’s not. If I tell you which NFT will moon next month, that’d be a speculation. But the long-term trend of digital replacing physical stuff as assets is clear. No investor can afford not to see this.

Mom: Alright alright, I know you’d fight tooth and nail to have the last word. Can we talk about my choir rehearsal instead?

Post mortem: Ok so I didn’t totally convince mom. But she’s warming up to the NFT idea. I hope this helps you think through the implications of digital assets as well :)

BTW, you can track the progress of my destroyed-diamond NFT journey here 👇

https://twitter.com/RealNatashaChe/status/1430248952818028544?s=20

Like this? I write about ideas to help you become smarter, richer, freer. Follow me on Twitter for updates 👉 @realnatashache .

• • •

Missing some Tweet in this thread? You can try to

force a refresh