People angry about a jpeg 🖼 selling for $1 mn fail to see the big picture.

If you understand the nature of assets & long-term macro backdrop, it’s easy to see why NFTs will grow exponentially.

Here’s a simple framework to help wrap your head around this new asset class.

If you understand the nature of assets & long-term macro backdrop, it’s easy to see why NFTs will grow exponentially.

Here’s a simple framework to help wrap your head around this new asset class.

WHAT ARE ASSETS?

They are instruments to transfer ownership of value across time and space.

They are instruments to transfer ownership of value across time and space.

Your Amazon stock is ownership on Amazon future earnings. Your ounce of gold is ownership of $1830 (today’s gold price) worth of economic output— you can use it to claim a share of today’s GDP by, say, using your gold to buy some groceries.

Assets are priced based on how well they carry out this function of preserving & transferring value ownership. That’s what asset “risk premium” & “liquidity premium” are all about— ways to measure the quality of value-transfer service provided by asset X.

WHAT IS AN ASSET “BUBBLE”?

Think of the total output (GDP) of an economy as a pie 🥧. Say, the economy has only one asset, a token called PieSlice, w/ total supply of 10.

Think of the total output (GDP) of an economy as a pie 🥧. Say, the economy has only one asset, a token called PieSlice, w/ total supply of 10.

This asset serves as a database to keep track of who owns how much 🥧. Each PieSlice token is priced at 1 🍰— ownership claim on 1/10 of the total 🥧.

What happens if GDP doubles next year and becomes 2 🥧s?

What happens if GDP doubles next year and becomes 2 🥧s?

If the supply of PieSlice tokens also doubles, then 1 token will still be priced at 1 🍰. But in reality, expanding asset provision at the pace of GDP growth is not easy.

At bare minimum, something needs to meet three criteria to qualify as an asset:

At bare minimum, something needs to meet three criteria to qualify as an asset:

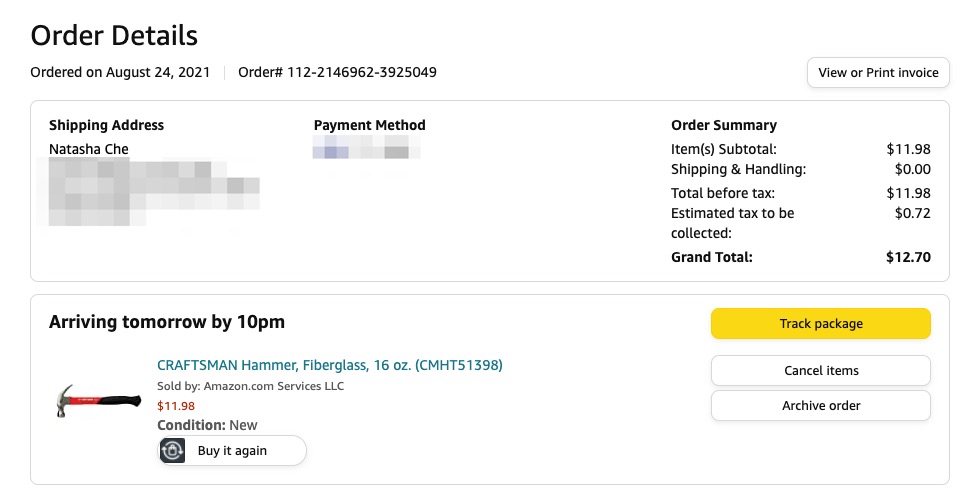

https://twitter.com/RealNatashaChe/status/1430968319130030080?s=20

In reality, forming social agreement needs many legal, psychological, institutional & tech factors to come together. It’s a challenge for any new asset-wanna-be. And existing assets can’t expand supply at will, or they’d violate their existing social agreement & lose value.

What happens when you have more 🥧s— whose ownership needs to be preserved and transferred— than asset instruments to do so? PieSlice token price goes up.

And people with spreadsheets stuck at past valuation models scream: Bubbles! Overvalued scams! 🙀

And people with spreadsheets stuck at past valuation models scream: Bubbles! Overvalued scams! 🙀

Mind you, I’m only describing one way for so-called bubbles to appear. This is a complex phenomenon w/ many possible causes. But what I’m describing is a major way in the past 2 decades, cuz the world is in fact going through a perennial asset shortage.

WHAT’S THE GLOBAL ASSET SHORTAGE?

An asset shortage on global level has been going on since early 2000s.

Asset supply has a hard time keeping up with global demand for value store, transfer, and collateral by households, firms, governments, insurance companies, and investors.

An asset shortage on global level has been going on since early 2000s.

Asset supply has a hard time keeping up with global demand for value store, transfer, and collateral by households, firms, governments, insurance companies, and investors.

This is because of 3 things.

1/ Emerging market GDP (e.g. China and commodity exporters) growing fast.

With growth comes new wealth and additional demand for assets to preserve and store that wealth.

1/ Emerging market GDP (e.g. China and commodity exporters) growing fast.

With growth comes new wealth and additional demand for assets to preserve and store that wealth.

But emerging economies to this day have trouble creating quality assets. (You need many legal, tech, institutional & social factors to come together, remember?) This turns into growing demand for existing assets produced by advanced economies (e.g. US treasuries).

This chart from FT shows traditional safe assets from advanced countries as percent of world GDP. It’s projected to drop fast. Asset issuance has gone up since COVID. But basic trend stays the same.

2/ Derivative asset classes like mortgage-backed securities got destroyed in global financial crisis.

Say what you want about these securities, but for a time they were serving the crucial asset function of value store and transfer. The world had an asset supply crunch after they got wiped out and has not recovered.

Hint: the fact that MBS got so popular so fast tells you how much demand there is for quality assets. That means any new asset classes that can do what MBS only claimed to do will grow, a lot. More on this in a sec.

3/ Traditional asset classes like US treasuries & fiat cash slowly losing their social agreement.

Advanced economies are highly indebted. And their perpetual monetary loosening damages fiat valuation. All this boils down to a slow erosion of these assets’ social agreement— the most crucial feature for any asset to have value.

The erosion in trust in tradFi assets only aggravates the pre-existing supply shortage in assets.

It’s in this context that the success of crypto asset classes becomes inevitable. Specifically—

It’s in this context that the success of crypto asset classes becomes inevitable. Specifically—

(BTW, like this so far? I write about ideas on investment, macro and human potential. Subscribe to my newsletter for updates 👉 taschalabs.com/newsletter)

NFT WILL GROW BECAUSE IT DEMOCRATIZES ASSET CREATION

Let me say it again: NFT will grow because it democratizes asset creation.

Think about that for a sec.

Let me say it again: NFT will grow because it democratizes asset creation.

Think about that for a sec.

Remember we talked about how complex it is to create a new asset? Traditionally, you need various social, legal, institutional ingredients to come together. Many tradFi assets in emerging markets failed to become quality assets b/c they didn’t have all the right ingredients.

Then blockchain came along.

You now have an easy way to create durability, program supply limit, verify & transfer ownership, build interaction w/ other assets. And it’s one global database— asset ownership no longer has geographical limit 🤯

You now have an easy way to create durability, program supply limit, verify & transfer ownership, build interaction w/ other assets. And it’s one global database— asset ownership no longer has geographical limit 🤯

A while ago I wrote about how ethereum staking may be poised to become the new global bonds.

https://twitter.com/RealNatashaChe/status/1427344424074301473

Though not as big as bonds, non-fungible assets are a sizable asset class. The global real estate market alone is around $11 trillion.

#Bitcoin drew a roadmap of how you can bootstrap social agreement about an asset, by building a strong community backed by a decentralized immutable database.

NFT communities take the same playbook and run with it to create new non-fungible assets on various scales.

NFT communities take the same playbook and run with it to create new non-fungible assets on various scales.

The blockchains provide the infrastructure needed for NFT to be a well functioning asset class w/ rich features. The jpegs and people behind them provide the stories & communities for NFT projects’ social agreement to form.

You can create social agreement, i.e. the story of an asset, in many ways. E.g. NFTs as avatars, NFTs as collectibles, NFTs as in-game items, NFTs as 1-to-1 mapping to physical assets & inherit the latter’s value, like for my destroyed diamond NFT.

https://twitter.com/RealNatashaChe/status/1434184387420213249?s=20

The sky’s the limit. Anybody can do this. And most of them will fail.

But when you unleash global creativity with strong incentives, you get powerful results.

But when you unleash global creativity with strong incentives, you get powerful results.

Just like how Youtube democratized film creation & produced a generation of star artists and commercial engines, NFT is democratizing asset creation & producing a new generation of stores-of-value that help to meet the demand for assets in a new global financial paradigm.

IMPLICATIONS ON INEQUALITY

The global asset shortage increased inequality, b/c the prices of physical assets like real estate, which also have physical utilities, got bid up. People who actually need houses to live in can’t afford one. The poor got poorer.

The global asset shortage increased inequality, b/c the prices of physical assets like real estate, which also have physical utilities, got bid up. People who actually need houses to live in can’t afford one. The poor got poorer.

Digital assets like NFTs reduce inequality— as SoV function gets shifted to digital, physical properties no longer need to carry dual functions. You’ll be able to buy a house just to live in, buy a diamond just to look pretty, while using the digital to preserve values.

And unlike houses, digital assets can be easily fractionalized to reduce entry barrier. The result is more widespread asset ownership and a more equitable world 🎉

You can track the progress of Tascha’s Destroyed Diamond NFT here 👇

https://twitter.com/RealNatashaChe/status/1430248952818028544?s=20

Like this? Don’t forget to

• retweet

• follow me for more ideas to help you become smarter, richer, freer 👉 @realnatashache

• retweet

• follow me for more ideas to help you become smarter, richer, freer 👉 @realnatashache

• • •

Missing some Tweet in this thread? You can try to

force a refresh