If you mint a NFT based on a physical asset, e.g. a 💎 , how much should it be worth?

It seems a complex question, but is actually easy to answer w/ classical asset pricing principles.

Let’s see how to set a floor price for my diamond NFT & learn some asset pricing methods 👇

It seems a complex question, but is actually easy to answer w/ classical asset pricing principles.

Let’s see how to set a floor price for my diamond NFT & learn some asset pricing methods 👇

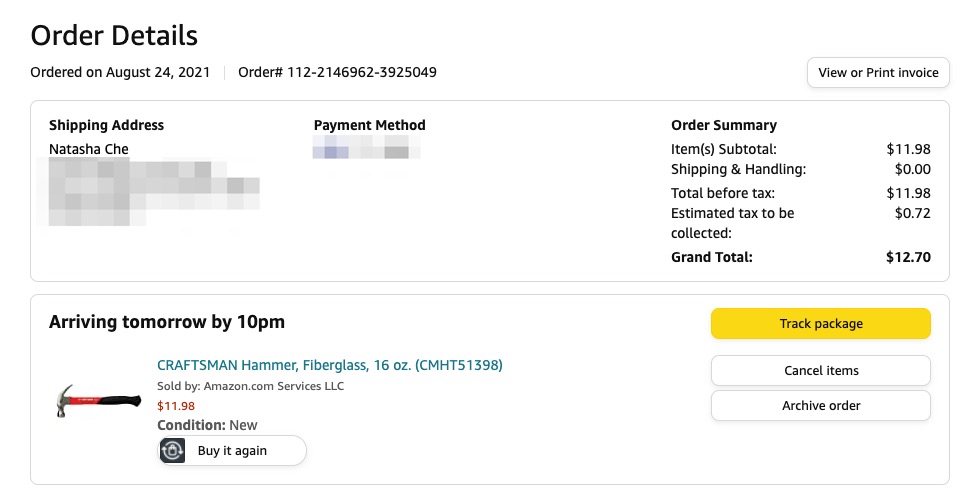

For background, I’m doing a destroyed-diamond NFT experiment, where I buy a real diamond—> create an associated NFT—> destroy the diamond—> sell the NFT.

You can follow the progress of the project here:

You can follow the progress of the project here:

https://twitter.com/RealNatashaChe/status/1430248952818028544?s=20

To price a new asset, we can think of its value as the sum of values of all its features.

Example: a house has features like number of rooms, location, quality of appliances. If you can find reference prices for the main features, you can put them together to reach a price for the house.

We can use the same principle to tackle pricing for NFTs linked to physical assets, by following these steps:

1/ Find the price of the corresponding physical asset

2/ Subtract the values of its physical features

3/ Add the values of digital-asset features of the NFT

1/ Find the price of the corresponding physical asset

2/ Subtract the values of its physical features

3/ Add the values of digital-asset features of the NFT

What does this look like in practice?

The diamond I bought from Blue Nile is priced at $4999.

bluenile.com/diamond-detail…

The diamond I bought from Blue Nile is priced at $4999.

bluenile.com/diamond-detail…

This value is the total value of two main features of the said diamond:

1/ physical utilities as jewelry & industrial tool

2/ store-of-value asset

When I destroy the diamond & mint the NFT, the latter only inherits the value of feature 2.

1/ physical utilities as jewelry & industrial tool

2/ store-of-value asset

When I destroy the diamond & mint the NFT, the latter only inherits the value of feature 2.

https://twitter.com/RealNatashaChe/status/1430968307918663682?s=20

But how do we know the respective value of each feature?

In this case, we’re in luck. There’s already something in real world that only has feature 1 of the natural diamond, but not feature 2:

The lab-grown diamond.

In this case, we’re in luck. There’s already something in real world that only has feature 1 of the natural diamond, but not feature 2:

The lab-grown diamond.

Lab-grown diamonds have identical physical utility as natural diamonds, but they do not serve as store-of-value.

I found this one on Clean Origin that have almost identical characteristics as the natural diamond I bought from Blue Nile, but is priced 75% cheaper:

cleanorigin.com/round-lab-crea…

cleanorigin.com/round-lab-crea…

How do we know the lab-grown diamonds don’t have feature 2 (as store-of-value asset)? By looking at their re-sell values— they sell for pennies.

An example from eBay.

An example from eBay.

Why do lab-growns not have feature 2?

You need 3 conditions to qualify as a store of value (SoV):

1/ Limited supply

2/ Durability

3/ Social agreement

You need 3 conditions to qualify as a store of value (SoV):

1/ Limited supply

2/ Durability

3/ Social agreement

Lab-grown diamonds only have #2. There’s no #1 to speak of, cuz it takes only 1 week to grow a diamond in lab (vs 3 billion yrs for natural diamond). And they have the stigma as “fake” diamonds, so no #3, either.

Since feature 1 (physical utility) only accounts for 25% of natural diamond’s value, the NFT that inherits feature 2 should be priced at least 75% of the natural diamond.

But we’re only getting started.

But we’re only getting started.

NFTs have better utilities as an asset than physical diamond. Transactions are tracked, ownerships verifiable, interactions with other assets programmable, and all done with low cost & high security. These features should be priced in.

One such feature is that NFTs are more liquid than physical diamonds. Especially if fractionalized ownership is allowed (Heads up, I may enable fractional shares of my destroyed-diamond NFT. Still deciding).

An asset with better liquidity feature should be priced higher. But by how much?

BTW, like this so far? I write about ideas on investment, macro and human potential. Subscribe to my newsletter for updates 👉 taschalabs.com/newsletter/

This is a topic studied a lot in tradFi. e.g. Amilhud & Mendelson (1986) estimate a liquidity price premium for US stocks.

S_j in the equation below is stock j’s bid-ask spread, a common measure for asset liquidity. Higher the bid-ask spread, more illiquid the asset.

S_j in the equation below is stock j’s bid-ask spread, a common measure for asset liquidity. Higher the bid-ask spread, more illiquid the asset.

What’s the bid-ask spread of physical diamond?

According to the Diamond Pro, if you buy a real diamond & resell it, the price drops sharply, to about 50% of original price. That’s a bid-ask spread of 50%.

According to the Diamond Pro, if you buy a real diamond & resell it, the price drops sharply, to about 50% of original price. That’s a bid-ask spread of 50%.

But NFT doesn’t suffer physical depreciation. Online marketplaces allow for low-cost & frequent trading. If it’s fractionalized, you can also trade it on DEXs. All of that leads to a much smaller bid-ask spread. Let’s say it’s 5%.

Using the coefficients above from Amilhud & Mendelson (1986), and assuming an average holding period of 24 months, you get the liquidity price premium of diamond NFT over physical diamond:

[1 + 0.00412 x (log(50%) - log(5%))]^24 - 1 = 10.4%

[1 + 0.00412 x (log(50%) - log(5%))]^24 - 1 = 10.4%

So the destroyed-diamond NFT’s base price should be:

$5000 x 75% + $5000 x 10.4% = $4270

$5000 x 75% + $5000 x 10.4% = $4270

Keep in mind we still haven’t priced in other digital-asset features (programmability, low maintenance, security, etc) that makes NFT a superior asset class to physical diamond.

On top of that, since it's the world’s first destroyed-diamond NFT, some see it as performance art. And as the creator I'm incentivized to maintain the value of the NFT, cuz I get a percent of future resells. So holders of the NFT tokens may get other perks from me.

Hence this NFT doubles as a digital collectible and a community token.

But these add-on values are harder to price. So they shouldn’t be counted in the floor price.

You can use the same framework to price any NFT that’s linked to physical assets.

But these add-on values are harder to price. So they shouldn’t be counted in the floor price.

You can use the same framework to price any NFT that’s linked to physical assets.

Say, you own a mansion on 5th Avenue in NYC that costs $10 million. You mint a NFT and fractionalize the ownership to 10,000 shares.

The folks who buy the fractionalized tokens would not live in the mansion (no feature 1). But they get the SoV asset benefit (feature 2).

The folks who buy the fractionalized tokens would not live in the mansion (no feature 1). But they get the SoV asset benefit (feature 2).

So to price the mansion NFT, you can:

1/ Start with the going price of the mansion

2/ Subtract the value of its physical features

3/ Add the value of digital-asset features, e.g. higher liquidity

The harder part is to find reference prices for 2 and 3. That’s case by case.

1/ Start with the going price of the mansion

2/ Subtract the value of its physical features

3/ Add the value of digital-asset features, e.g. higher liquidity

The harder part is to find reference prices for 2 and 3. That’s case by case.

So here you have it. My diamond NFT will be listed with a floor price of $4270 (or around 1.3 ETH using the ETH/USD price of August 30, 2021).

You can track the progress of the destroyed-diamond NFT journey here 👇

https://twitter.com/RealNatashaChe/status/1430248952818028544?s=20

Like this? I write about ideas to help you become smarter, richer, freer. Follow me on Twitter for updates 👉 @realnatashache .

• • •

Missing some Tweet in this thread? You can try to

force a refresh