So this is an excellent reply, so time for a Friday morning cup of tea in the eucalyptus tree on how strategic certain coking coals are. There is a reason BHP tossing everything out of the pram except for BMA...1/n

https://twitter.com/mfwarder/status/1428581691002662915

First, the reserve/resource data the koala references was, let's just say a mosaic to put together and sometimes when it was obvious what we were trying to figure out, people stopped talking to us. But stand by the estimate 2/n

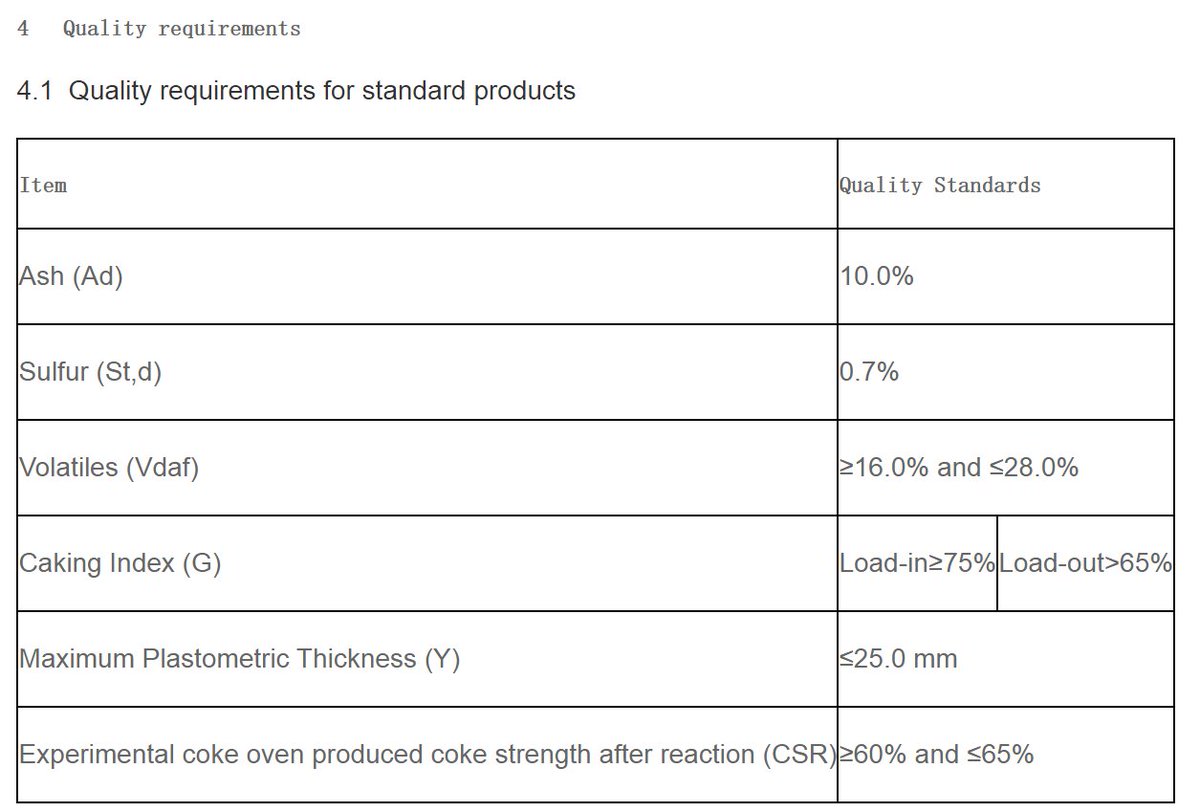

Why does the koala bring this up? Because outside of some seams in the Bowen basin (BMA/BHP & Anglo), the Elk Valley in BC, and Mine #7 in Alabama, just not that many coals that hit that 70+ CSR and <20 vol 6/n

One sidebar metric not considered here so far is fluidity, helps things flow smoothly in the steelmaking process, thats a prime characteristic in High Vol A product from the US and some Aussie mines along the Blackwater rail line and why they are valued so highly 7/n

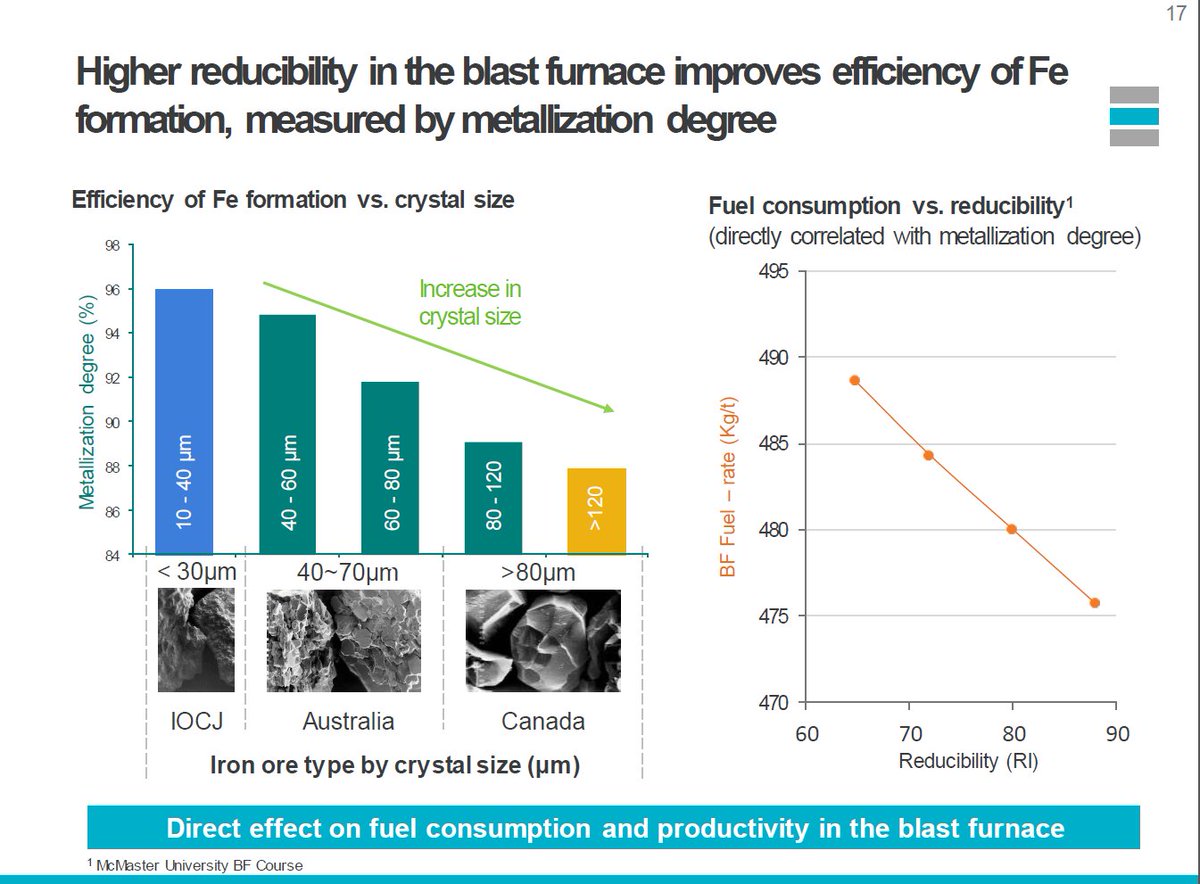

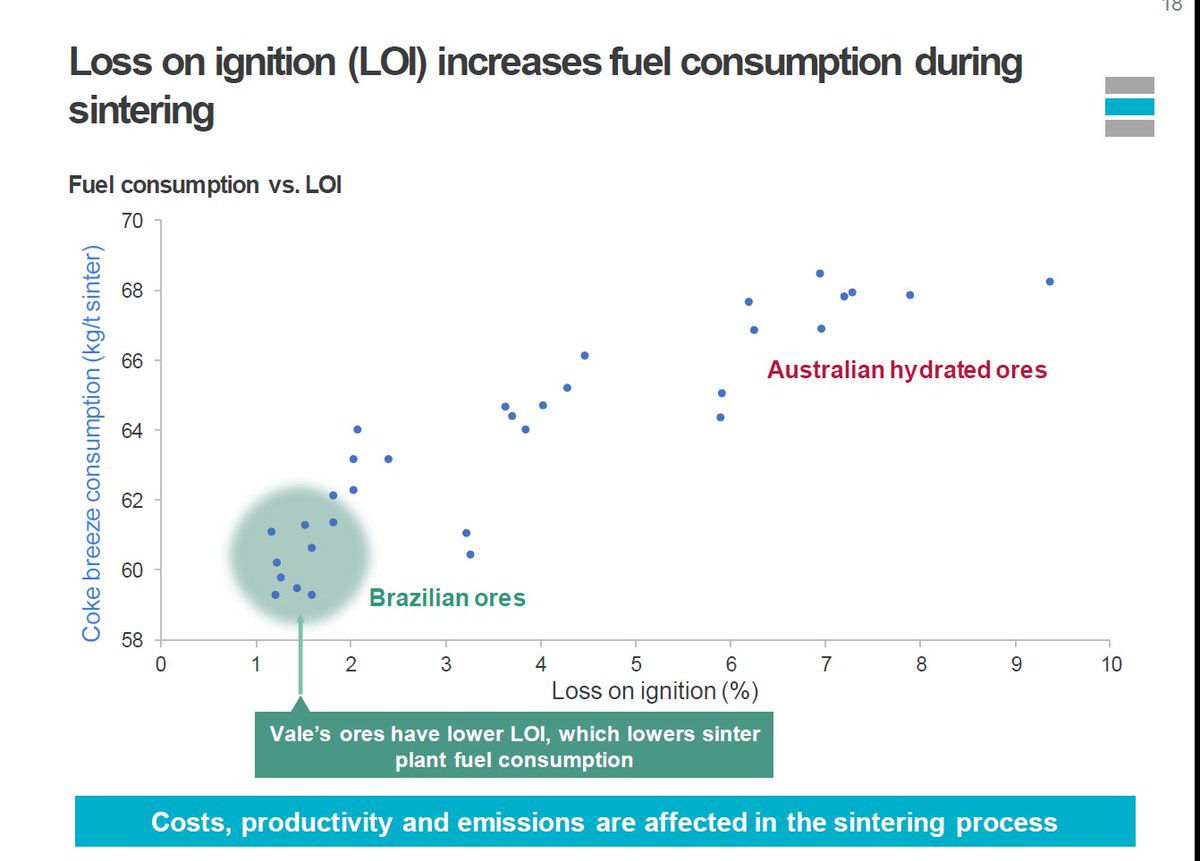

So why does the koala bring this up? Because historically Matt is correct, this stuff didn't really matter, but in an ESG focused world where the productivity of furnaces to make high quality steel & minimized emissions/t steel produced, raw material input quality matters 8/n

And China is trying to crack iron ore px at the point in the year shipments inflect higher, but still need the steel, and has serious supply issues domestically and seaborne (esp if Aussie coals still no good politically), so things are "weird" right now for coking in China 9/n

But bigger picture, makes you appreciate how valuable long life reserves are going to be for high quality coking coal since the alternative is, you know, billions of capex on HBI/DRI to enable natural gas to replace coking coal globally, or longer term hydrogen 10/n

Bottom line, yea China (and Mongolia) has an ocean of coal, but it's not of the high quality you desire if you're trying to optimize for furnace productivity AND minimize emissions. The coking coal prices we look at are the high quality prices, & when steel demand is good...11/n

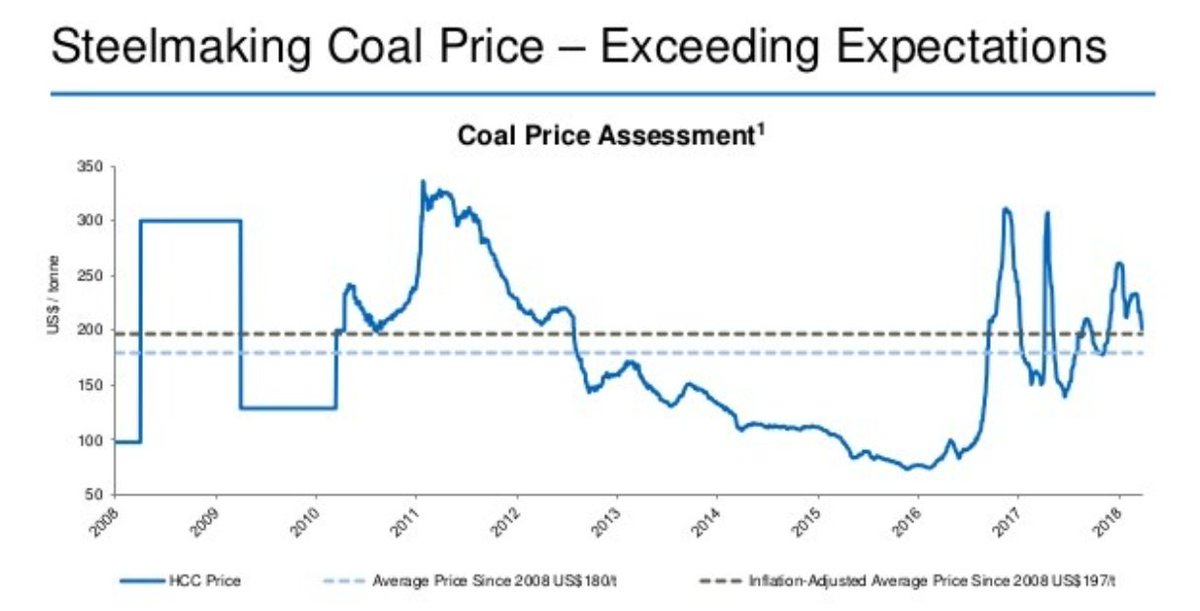

You can see where the koala is going with this. There's a reason even during a decade long bear mkt, the AVG PRICE for "benchmark" coking coal ~$180/t. When the Goonyella mines can't deliver, things get super interesting because those reserves are so rare around the world. 12/12

• • •

Missing some Tweet in this thread? You can try to

force a refresh