There are a few things to look at when analyzing a rights issue as a special situations play. Capital allocation skills of the management rank right at the top. Fundamental question - is it growth capital or a cover-up for fiscal misprudence in the past? (1/13)

Let's see how to spot the ones that may be covering up past fiscal misprudence. In this example, I take NxtDigital Limited, with 1100 crore market cap. Previously called Hinduja Ventures, it provides TV broadcast and broadband services. (2/13)

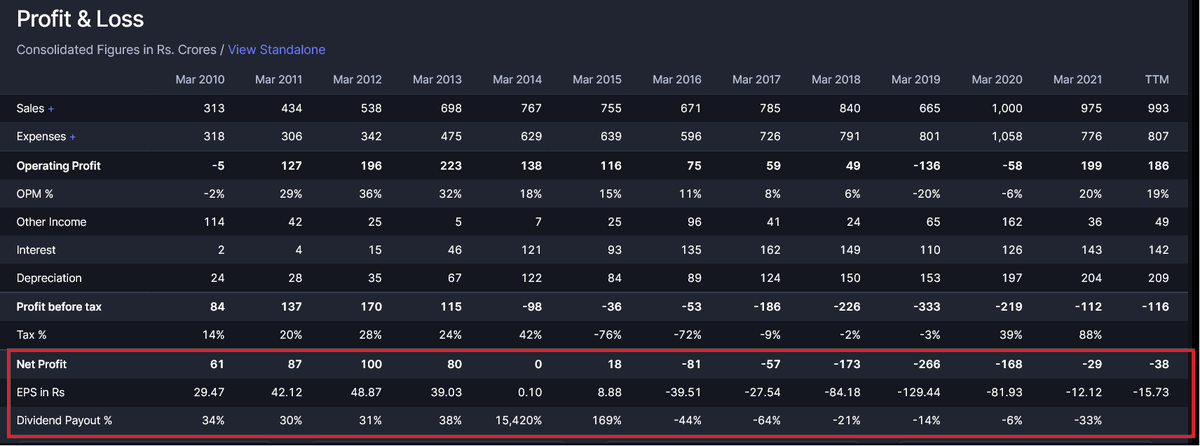

NxtDigital announced a rights issue of Rs 300 crore in May 2021, in 2:5 ratio at a price of Rs 300/share. Further, it also paid Rs 5.50 annual dividend for FY21. At the same time, company has incurred negative PAT at consolidated level for 7 consecutive years. (3/13)

From the first ever concall held in May 2021, it was revealed that the funds from rights issue will be used to pare debt and improve EBIDTA margins significantly. Further, company is seeking to sell non-core assets to pare more debt. Sounds like a turnaround, eh? (4/13)

Investors never question dividend by companies. Some cash is better than no cash, right? However, the logic of giving out dividend also needs to be scrutinized. If a company isn't making free cash flows, there is little objective logic to paying dividend. (5/13)

Some may ask, what's the problem if minority shareholders are getting the payout too? Well, the answer doesn't lie in who is paying money to who, but whether any money should be paid out to anyone in the first place. (6/13)

In the last 7 years, NxtDigital has been paying out dividend robustly. NxtDigital incurred loss of Rs (575) Cr b/w FY13-21, which amounts to Rs (277) per share, while paying out cumulative dividends of Rs 136 in that period, while incurring Rs 1100 Cr in interest. (7/13)

With such huge interest outflow, why was Nxtdigital paying out such substantial dividends? Rs 287 Cr paid over 7 years is identical to the current fund raise. So instead of using cash to pare debt, Nxtdigital paid it out, is now asking the amount back via a rights issue! (8/13)

Presented this way, it becomes apparent that cash is basically flowing out of the company regardless of how the business is operationally faring. Yes, the promoters don't get 100% of it, but they do get 65-70% of it. (9/13)

Interesting to see that NxtDigital absorbed a subsidiary in FY19 and wrote off Rs 1300 Cr invested into the subsidiary. This scheme of arrangement led to the equity falling from 2000 Cr to just over 200 Cr. 1800 crore of equity wiped out with an accounting adjustment. (10/13)

From the above, and the management speak in the concall relating to improving the DE ratio (refer 4/13), it is apparent that the need for fund-raise is inexplicably poor capital allocation in the past. (11/13)

In this context, the primary conclusion for this rights issue will be a big NAY, because none of the funds will contribute to growth and future cash flows may be misallocated to the purpose the management deems fit, including more subsidiaries or paid out as dividend. (12/13)

NxtDigital's balance sheet and accounts have a lot more to point out, but this is a limited perspective on analyzing capital allocation history in rights issue. For educational purpose only and not as a recommendation to play the rights issue, or otherwise. (13/13)

Epilogue: Do read the May 21 transcript to get an idea of how the management portrays or sees the business, as a contrast to the analysis above.

bseindia.com/xml-data/corpf…

bseindia.com/xml-data/corpf…

• • •

Missing some Tweet in this thread? You can try to

force a refresh