Going to do a quick thread with a first look at what new state-level July data tells us about the impact of cutting UI benefits.

Context:

Context:

https://twitter.com/bencasselman/status/1428689232130891778

Key caveat here: The state-level data is noisy, and there are a LOT of differences between these states, both in general and in how they've responded to the pandemic in particular. So it's not easy to design a clean experiment here.

That said: It sure doesn't look like there's been a big jump in employment in the states that cut benefits so far. A few charts:

CORRECTION: Deleting charts because I reversed my code in a very stupid and embarrassing way. Will replace shortly. The basic takeaway in the tweet above does not change, however.

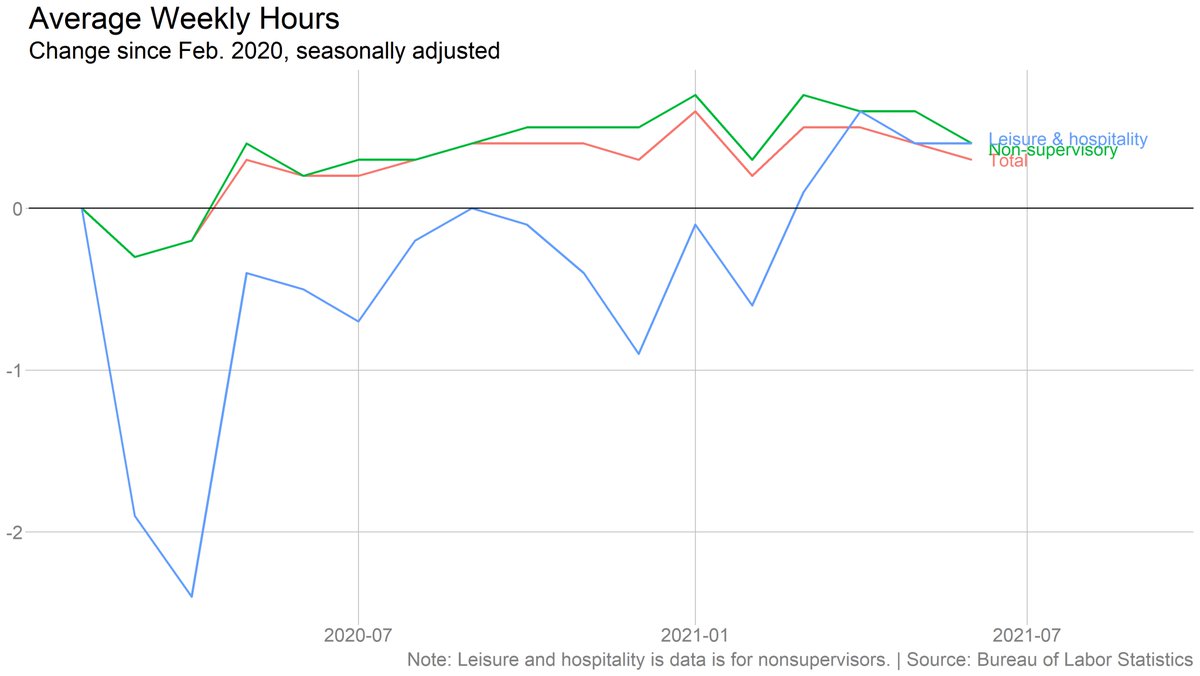

First off, here's change in employment since April, before states began announcing they were cutting UI. The states keeping benefits have actually seen slightly *faster* growth, although the difference is statistically insignificant.

(Note: corrected chart)

(Note: corrected chart)

Note: I'm breaking states here into two groups, those that cut all federal benefits by early July and those keeping them all until next month. I'm dropping states that are only cutting some benefits, or where cutoffs are tied up in court.

The confusion around school reopening has messed with seasonal adjustment, and may have affected states differently. So it makes sense also to look at private-sector data (not affected by public education).

Here we see essentially zero difference between the states.

Here we see essentially zero difference between the states.

Now, benchmarking to April may not be entirely fair. The cutoff states may already have been further ahead in their recoveries, or not have had as much ground to make up.

This chart shows the states benchmarked to their prepandemic employment -- you can see that the cutoff states never fell as far initially, and so don't have as far to climb. But not much evidence the relationship has changed since they started cutting benefits.

By the way, not much difference if we look at states cutting ANY benefits -- i.e. adding back the states I dropped from my earlier charts.

I thought we might see more impact in leisure and hospitality, specifically, since those workers are likely to be most affected by the benefits cutoff (and those sectors are dealing with so many hiring challenges). But it's the benefits-keeping states that are pulling ahead.

Thanks to @p_ganong for helping me think all this through, and for helping with the standard error calculations. All mistakes, including boneheaded label-switching in (since deleted) charts, are my own.

More analysis/discussion from @p_ganong here:

https://twitter.com/p_ganong/status/1428741098848067591

Also check out this thread from @JedKolko:

https://twitter.com/JedKolko/status/1428723650383863813

• • •

Missing some Tweet in this thread? You can try to

force a refresh