U.S. employers added 850k jobs in June. Unemployment rate nudged up to 5.9%.

Full coverage:

nytimes.com/2021/07/02/bus…

Full coverage:

nytimes.com/2021/07/02/bus…

Household survey is less strong. Participation flat, employment actually ever so slightly negative.

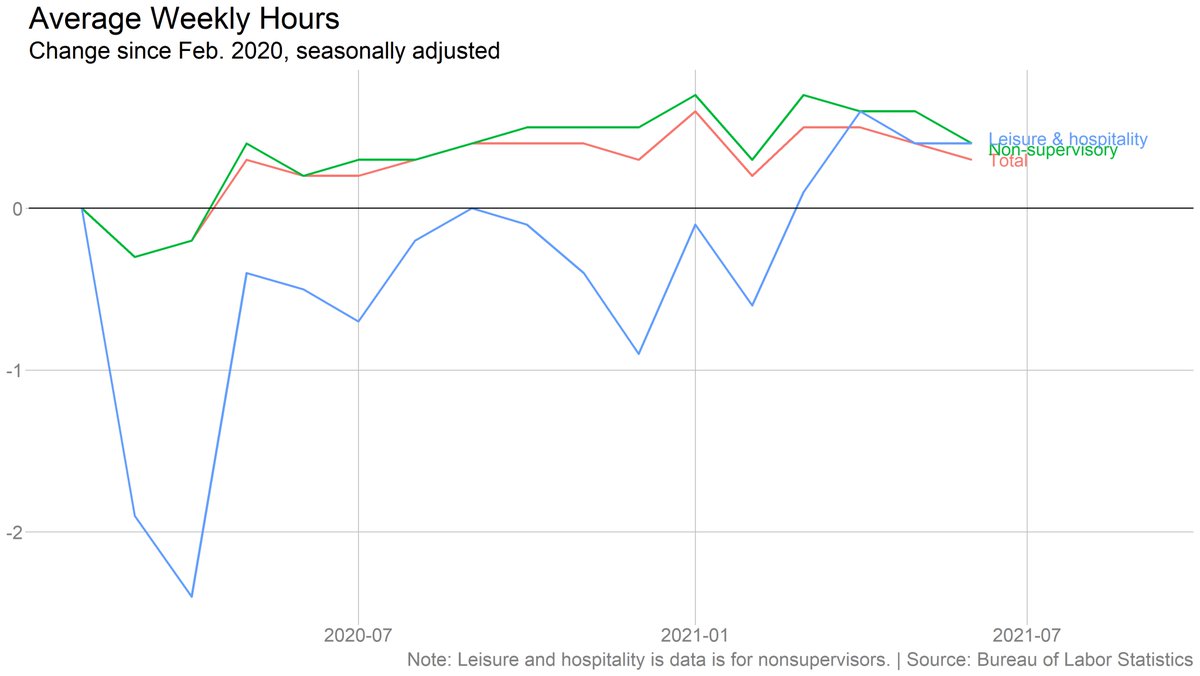

Another big gain in leisure and hospitality. Also in government (mostly local education -- have to look for possible seasonal adjustment issues there).

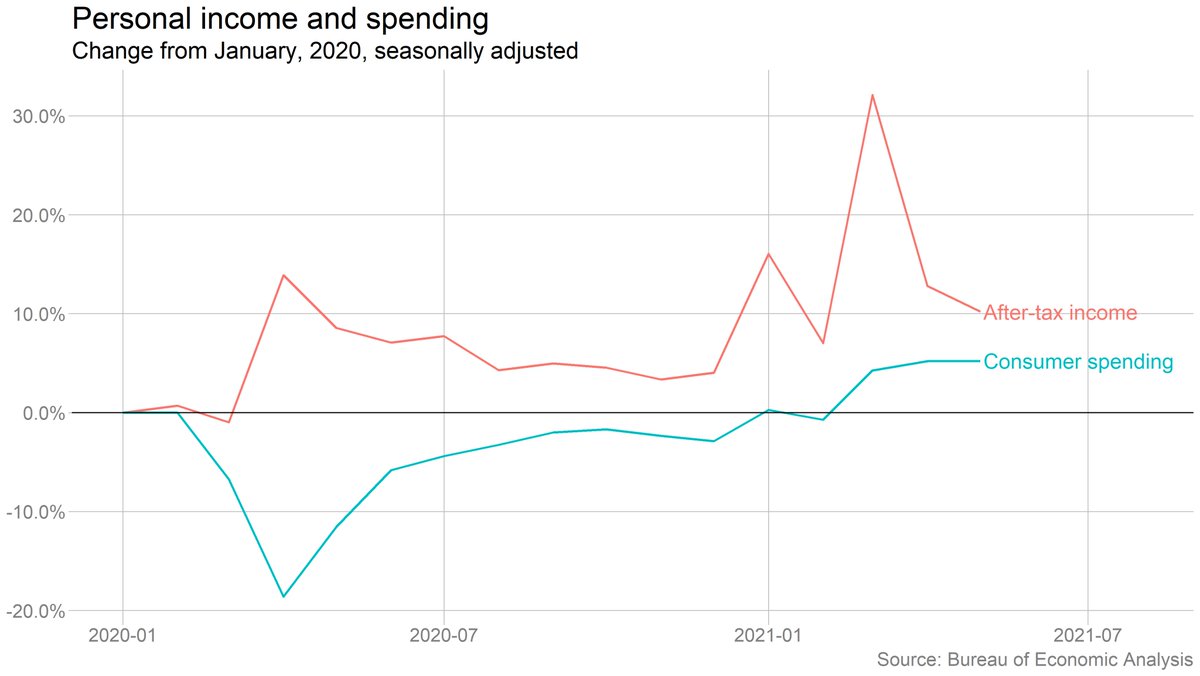

Average earnings up another 10 cents/hour. Notable line from the BLS release: "The data for recent months suggest that the rising demand for labor associated with the recovery from

the pandemic may have put upward pressure on wages."

the pandemic may have put upward pressure on wages."

• • •

Missing some Tweet in this thread? You can try to

force a refresh