Time for a #jobsday charts thread! Starting off a bit differently this month: Wages.

Avg. earnings up 10 cents/hour in June, and 43 cents over the past three months.

On one hand: Growth slowing. OTOH: Earnings now well above pre-pandemic trajectory.

Avg. earnings up 10 cents/hour in June, and 43 cents over the past three months.

On one hand: Growth slowing. OTOH: Earnings now well above pre-pandemic trajectory.

We're seeing serious wage pressure in leisure and hospitality, consistent with anecdotal reports. Avg. earnings for nonsupervisors up 37 cents/hour in June, and more than $1.50 over past year.

Despite drop early in pandemic, their wages are now also above pre-crisis trend.

Despite drop early in pandemic, their wages are now also above pre-crisis trend.

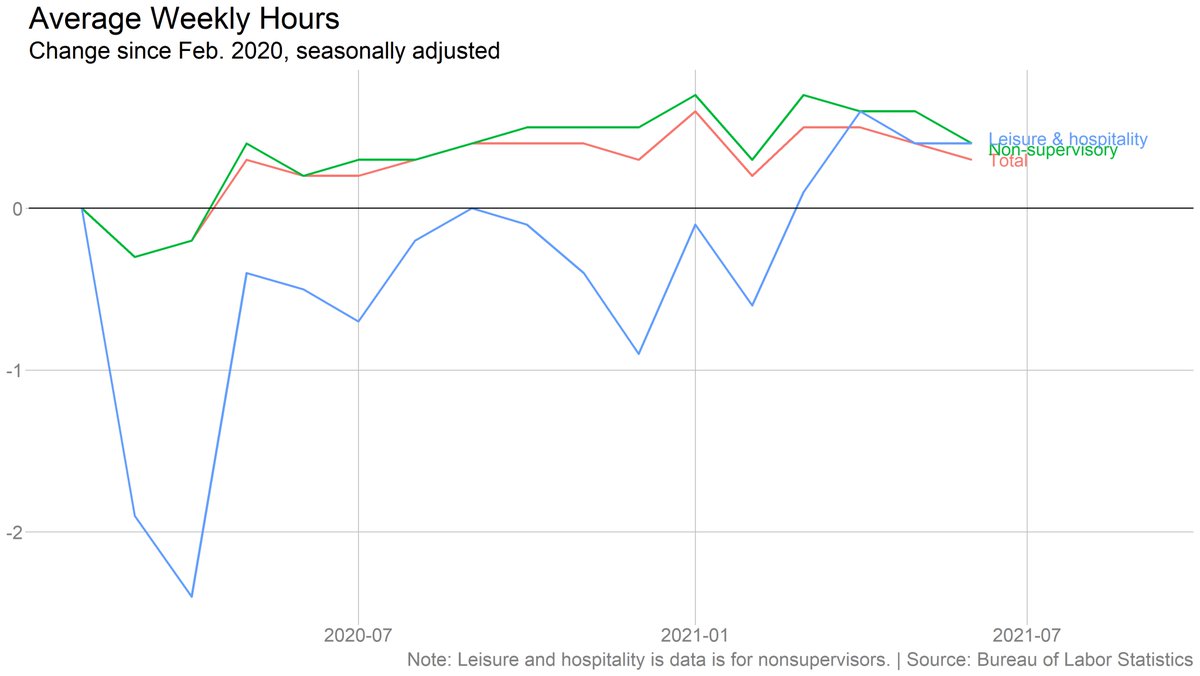

Notably, though, average weekly hours fell, both overall and for leisure and hospitality. That's surprising in an environment where employers can't find enough workers.

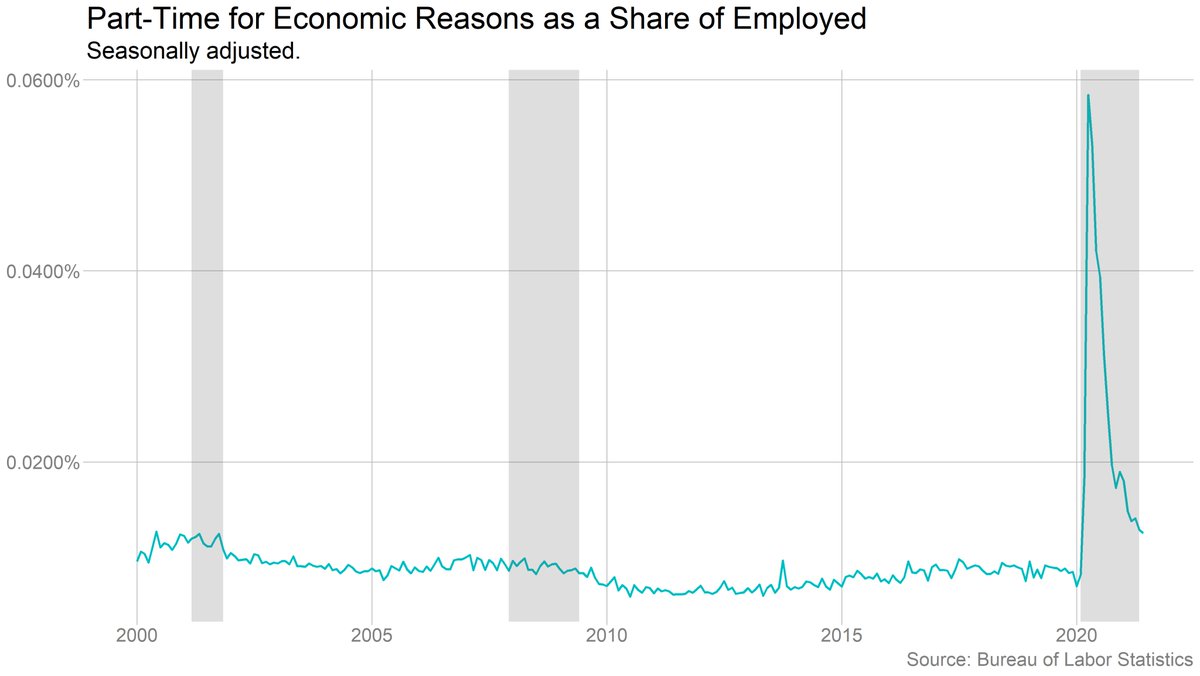

On the other hand, big drop in involuntary part-time work. That suggests people who want to work full-time are having an easier time finding hours.

People are returning to the office! (I can vouch: Much of our jobs day team is in-person today.) Less than 15% of all workers were remote due to the pandemic in June, down from 35% last May.

The unemployment rate ticked up in June, to 5.9%. But if you factor in people who have left the labor force in the pandemic, it actually ticked down slightly to 8.6%. (This approach roughly replicates what the Fed has been discussing.)

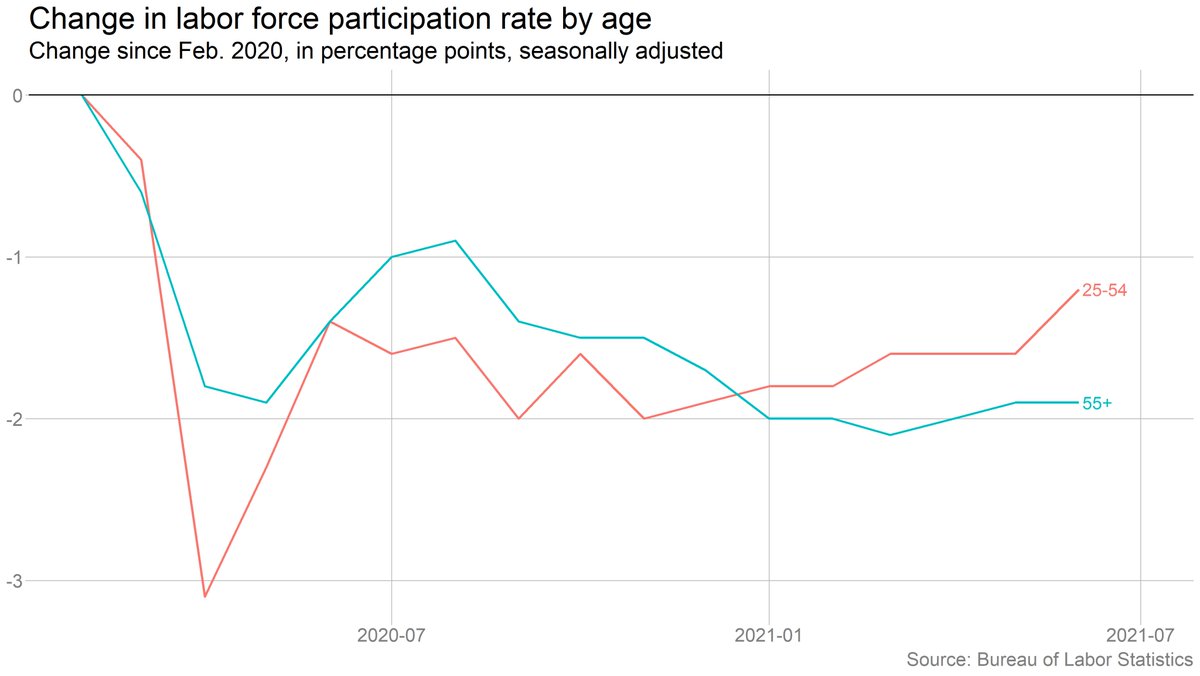

Speaking of the labor force! It grew slightly last month, though participation was flat. Participation rate is still WELL below its prepandemic level.

Participation did rise for prime-age (25-54) workers, especially women. Could be a sign people are returning to work as child care options return, although we'll need more detailed data to draw any real conclusions.

This is interesting: In the spring, teen employment was running way above its recent normal. Much less true in June -- teen employment rate (not seasonally adjusted) was pretty close to its pre-pandemic level. Suggests teens aren't doing much to boost labor supply this summer.

Black workers saw some employment gains last month, but they (along with Hispanics) are still lagging in the recovery. And Black unemployment ticked up to 9.2% (vs. 5.2% for white workers).

The unemployment rate rose last month, but mostly because more people quit their jobs or reentered the labor force to look -- both signs of confidence among workers.

(Did I make this chart just because I wanted to use the headline? Perhaps.)

(Did I make this chart just because I wanted to use the headline? Perhaps.)

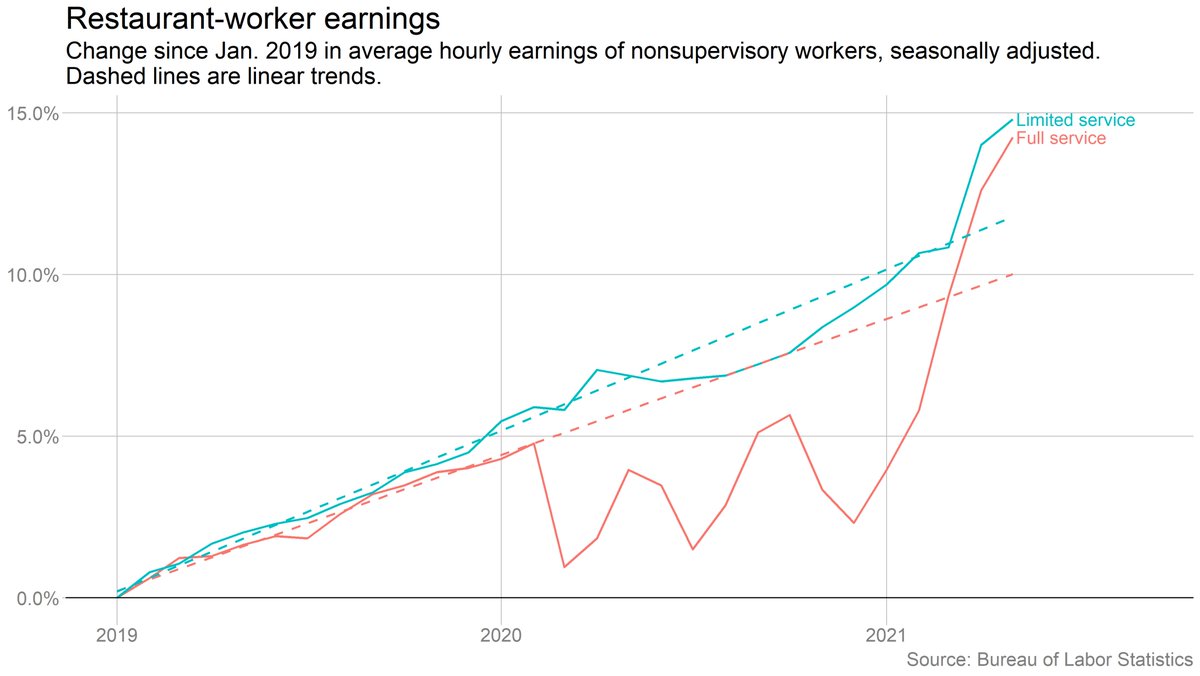

One more note re: wages: The recent spike in earnings has been significantly more pronounced in full-service restaurants than limited service. That's consistent with @joshbivens_DC's argument that much of this is about tips.

BUT limited-service still way above prepandemic trend.

BUT limited-service still way above prepandemic trend.

Note: The divergence between the household and payroll surveys appears to be due in part to differences in the concepts being measured (people vs jobs, W-2 vs 1099, etc). But probably also just reflects normal variation -- over 6 mos., the two surveys are closely aligned.

• • •

Missing some Tweet in this thread? You can try to

force a refresh