It's the weekend!

Grab a cup of coffee, in this thread I will explain

1. How to do Industry Research?

2. How to research a Company from scratch?

3. How to determine Margin of Safety and build an Investment Case?

Lets dive right in.

Grab a cup of coffee, in this thread I will explain

1. How to do Industry Research?

2. How to research a Company from scratch?

3. How to determine Margin of Safety and build an Investment Case?

Lets dive right in.

The most frequent question I get asked is - How should I research an industry or a trend?

A good question indeed and my answer to this is simple.

Read, Read and then Read some more.

The more knowledge you consume, the better you will be able to identify and link trends across industries.

Read, Read and then Read some more.

The more knowledge you consume, the better you will be able to identify and link trends across industries.

But reading doesn't mean you need to pick a newspaper or start reading random articles over the internet.

Your reading and research needs to be structured.

This is where technology comes in to help and make our lives easier.

Your reading and research needs to be structured.

This is where technology comes in to help and make our lives easier.

Today, algorithms run our world and decide what data you consume.

Be it Instagram posts, TikTok reels or YouTube videos.

So learn to trick these algorithms and use them to your advantage.

Be it Instagram posts, TikTok reels or YouTube videos.

So learn to trick these algorithms and use them to your advantage.

Personally, I have a dedicated account on YouTube where I just subscribe to educational channels - handpicked by me over the years.

That account is not used to subscribe or watch to any other content - no music, no vlogs, no movie trailers, no fun stuff.

That account is not used to subscribe or watch to any other content - no music, no vlogs, no movie trailers, no fun stuff.

What this does is teaches the algorithm to feed and recommend new channels and videos to me that align with what I am looking for.

This way I discover new content without really doing any work to find it, the algorithm does all the hard work for me.

This way I discover new content without really doing any work to find it, the algorithm does all the hard work for me.

Another way to look for free industry research is to read and subscribe to publications of consulting and finance firms like

McKinsey

BCG

Deloitte

EY

Bain

Goldman Sachs

Most of these companies occasionally publish free to read detailed reports on a particular industry or sector

McKinsey

BCG

Deloitte

EY

Bain

Goldman Sachs

Most of these companies occasionally publish free to read detailed reports on a particular industry or sector

I didn't know much about Specialty Chemical Industry in Feb 2020 until I came across a report by McKinsey that presented the industry as one of the fastest growing chemical segments in the world.

That was my introduction to companies like Vinati, Navin, Aarti and Deepak.

That was my introduction to companies like Vinati, Navin, Aarti and Deepak.

Because I read that report in Feb 2020, I could take advantage of the fall in share price of these companies in March of 2020.

Here is a link to that report

mckinsey.com/industries/che…

Here is a link to that report

mckinsey.com/industries/che…

Similarly while researching for my write up on Policy Bazaar, I came across a report by BCG on Insurance Tech platforms around the world and with a special focus on India.

Here is a link to that report

bcg.com/en-in/india-in…

Here is a link to that report

bcg.com/en-in/india-in…

Similarly while researching on Zomato, I came across a report by BCG and Google on Food Tech and QSR industry in India.

Here is a link to that report

bcg.com/en-in/demystif…

Here is a link to that report

bcg.com/en-in/demystif…

Goldman Sachs too publishes some really good content on various trends on its insights page, which is free to subscribe

goldmansachs.com/insights/serie…

goldmansachs.com/insights/serie…

One my favorite places to look for free and detailed industry research is IPO filings of domestic and international companies.

When a company wants to go public, it needs to file a prospect document with the regulator.

This document in India is called RHP (Red Herring Prospectus) and in US is called S-1.

This document in India is called RHP (Red Herring Prospectus) and in US is called S-1.

You can find old and new RHPs and S-1 filings of various companies at below links

SEBI (India)

sebi.gov.in/sebiweb/home/H…

SEC - EDGAR (US)

sec.report/Form/S-1

sec.gov/edgar/searched…

SEBI (India)

sebi.gov.in/sebiweb/home/H…

SEC - EDGAR (US)

sec.report/Form/S-1

sec.gov/edgar/searched…

These pre IPO documents contains valuable research into industries that the respective company operates in.

Collect them and over time you will build a nice repository of industry specific content.

Collect them and over time you will build a nice repository of industry specific content.

My point is you need to know

1. Where to Look

2. What to Look For and

3. How to Leverage Technology to your advantage

1. Where to Look

2. What to Look For and

3. How to Leverage Technology to your advantage

Reading 10 books on investing alone is not going to make you a better investor.

Practicing the above, finding, reading and learning from good and credible content will.

Practicing the above, finding, reading and learning from good and credible content will.

Whenever you start researching a company, you need to act like a sponge.

All you're trying to do is gather and consume as much information as you can.

All you're trying to do is gather and consume as much information as you can.

The best place to start is the website.

Look for mission statement of the company - what does it want to accomplish.

Understand what industry it operates in, what are its products, what it is selling and who runs it.

All you're looking for at this stage is basic information.

Look for mission statement of the company - what does it want to accomplish.

Understand what industry it operates in, what are its products, what it is selling and who runs it.

All you're looking for at this stage is basic information.

Once you have familiarized yourself with the company, its time to dig into more details.

Your next source of information should be Credit Reports.

These are free reports issued by credit agencies and contain valuable information into the state of the company and the industry.

Your next source of information should be Credit Reports.

These are free reports issued by credit agencies and contain valuable information into the state of the company and the industry.

At this stage, you are familiarized by the company and know its current state.

You are now looking for its past events and future prospects.

This is where quarterly conference calls helps.

You are now looking for its past events and future prospects.

This is where quarterly conference calls helps.

I personally like to read through and highlight anything important from the most recent 4 quarters of conference calls.

This gives me enough idea about

1. Current problems with the company

2. What's working for the company

3. Where is it planning to go in future

This gives me enough idea about

1. Current problems with the company

2. What's working for the company

3. Where is it planning to go in future

Once you're done with conference calls, its time to read through the annual report.

Pick up the latest available annual report and directly jump to the section called "Management Discussion and Analysis".

Pick up the latest available annual report and directly jump to the section called "Management Discussion and Analysis".

This is the section where promoters and directors of the company discuss at length about the industry, economy and prospects of the company.

Once you're done with this section, you can read Chairman's and CEO's comments and other sections of the annual report.

Once you're done with this section, you can read Chairman's and CEO's comments and other sections of the annual report.

You by now, have developed a detailed understanding and have some idea about the company.

Its now time to look at the numbers.

Its now time to look at the numbers.

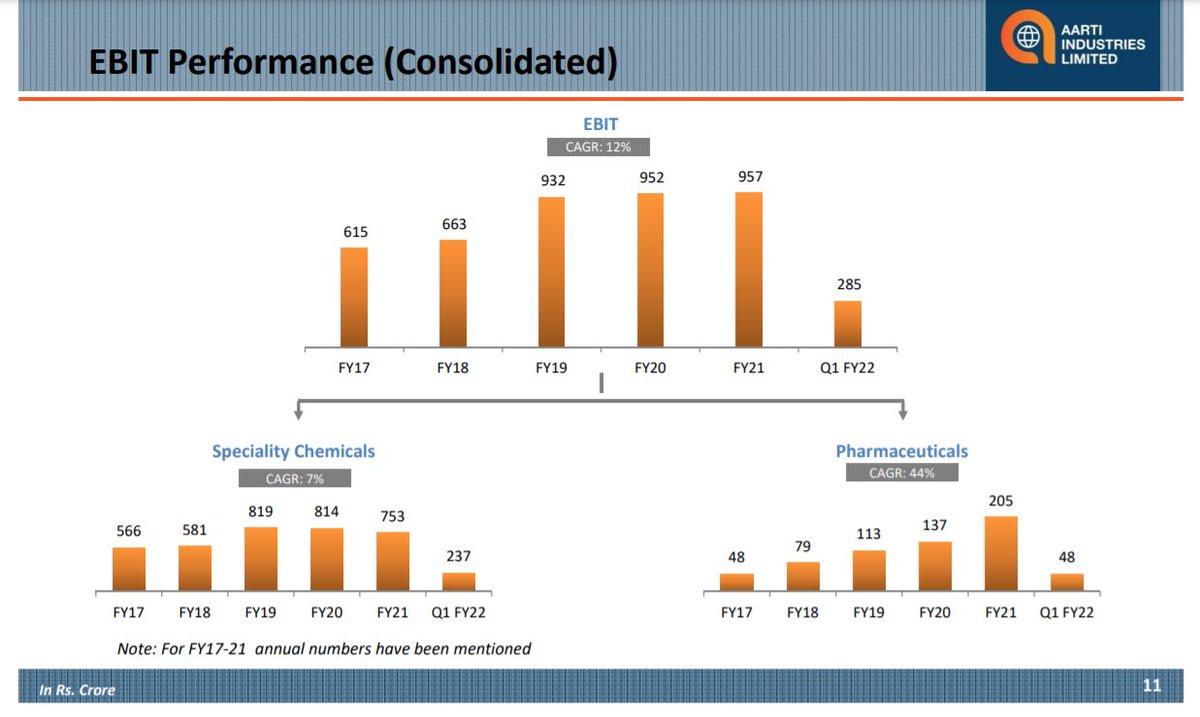

This is when you can dwell into investor presentations published by the company under the 'investors resources' section on its website.

These presentations contain information regarding company's financials, its future plans, any current challenges etc.

Learn to take this data with a pinch of salt as no company will criticize itself in its own investor presentation.

Learn to take this data with a pinch of salt as no company will criticize itself in its own investor presentation.

Keep a note of all of this information you consume.

Make notes.

The more notes you make, the better you will be able to connect the dots and find patterns.

Make notes.

The more notes you make, the better you will be able to connect the dots and find patterns.

Maybe the management of a company keeps giving bullish guidelines and in subsequent quarters give excuses for not achieving the targets.

Pattern like these will begin to emerge as you research more.

Pattern like these will begin to emerge as you research more.

Try identify peers of the company and look at them to build comparisons.

Understand what they are doing, follow the entire process from above with these companies.

Doing this alone will put you ahead than 99% of investors in the market today.

Understand what they are doing, follow the entire process from above with these companies.

Doing this alone will put you ahead than 99% of investors in the market today.

So now

1. You know about the industry

2. You know about the company

3. You know about the peers of the company

Its time to build an investment case.

1. You know about the industry

2. You know about the company

3. You know about the peers of the company

Its time to build an investment case.

Before building an investment case, remember why you are investing in a company.

Is it cause investing in this opportunity suits your risk and return profile or just cause you have done so much research.

Invest cause of the former and not for the latter.

Is it cause investing in this opportunity suits your risk and return profile or just cause you have done so much research.

Invest cause of the former and not for the latter.

All investments should be aligned to your portfolio objectives and required return.

If you require a return of 20% a year with low volatility then at this stage you will have to determine and understand if the opportunity to invest in this company fits into these goals.

If you require a return of 20% a year with low volatility then at this stage you will have to determine and understand if the opportunity to invest in this company fits into these goals.

First step in building an investment case is to start with the market cap of the company.

Lets assume the market cap today = 10,000cr

Your required return is 20% per year for next 5 years which means the market cap of the company 5 years later needs to be 25,000cr.

Lets assume the market cap today = 10,000cr

Your required return is 20% per year for next 5 years which means the market cap of the company 5 years later needs to be 25,000cr.

We now need to determine if the company can reach this market cap.

There are only two ways a company can increase its market cap

1. Earnings and EPS of the company increases

2. The multiple commanded by the company in the market increases

1. Earnings and EPS of the company increases

2. The multiple commanded by the company in the market increases

For the #1

We need to look at Sales, Operating Profit, EPS and determine if these will grow at 20% or more in next 5 years.

The triggers for growth can be capacity expansion, new higher margin product launches or increasing market share.

We need to look at Sales, Operating Profit, EPS and determine if these will grow at 20% or more in next 5 years.

The triggers for growth can be capacity expansion, new higher margin product launches or increasing market share.

For the #2

We need to look at Operating Profit Margin commanded by the company today

If the margin earned by the company expands from a single digit (5%) to double digits (25%) and if these margins are sustainable then market will start giving a higher multiple to this company.

We need to look at Operating Profit Margin commanded by the company today

If the margin earned by the company expands from a single digit (5%) to double digits (25%) and if these margins are sustainable then market will start giving a higher multiple to this company.

Example of this is Intellect Design Arena.

In case of Intellect, look how the sales haven't really increased a lot but margin went from 6% to sudden 24%.

Result was Intellect being a 15 bagger since March'20. .

In case of Intellect, look how the sales haven't really increased a lot but margin went from 6% to sudden 24%.

Result was Intellect being a 15 bagger since March'20. .

You can only know about these cases if and when you do deep industry and company research.

Intellect in its concalls was guiding for a margin increase, its just that no one was paying attention to Intellect and reading those concalls.

Whoever was, made 15x in one year.

Intellect in its concalls was guiding for a margin increase, its just that no one was paying attention to Intellect and reading those concalls.

Whoever was, made 15x in one year.

Another good tool, I use while building an investment case is to apply Porter's Five Force Model.

It helps me determine the industry structure and how a company stands within it.

You can learn more about it in this thread below.

It helps me determine the industry structure and how a company stands within it.

You can learn more about it in this thread below.

https://twitter.com/itsTarH/status/1403618903243120641?s=20

Margin of Safety comes from buying a company well below its intrinsic value.

Based on all the research you did earlier you can determine a fair multiple to give to the company.

Look at peers of the company and examine the multiple they are getting and why.

Based on all the research you did earlier you can determine a fair multiple to give to the company.

Look at peers of the company and examine the multiple they are getting and why.

If there is a mismatch between the valuation of peers vs the company you're researching - then you have a margin of safety for yourself.

An example of this Margin of Safety is Jubilant Ingrevia.

An example of this Margin of Safety is Jubilant Ingrevia.

I bought Jubilant Ingrevia right after demerger at an average price of Rs 250 per share.

My buying reason was the massive discount to the company compared to its peer Laxmi Organics.

My buying reason was the massive discount to the company compared to its peer Laxmi Organics.

Since Mar of this year, Jubilant has rerated and the valuation gap between Jubilant and Laxmi Organics has minimized.

Again you will get to know about these opportunities only if you research dedicatedly.

Investing for me is a second full time job and one that rewards quite handsomely for the efforts.

Investing for me is a second full time job and one that rewards quite handsomely for the efforts.

All of the above is a summarized version of my investment process.

You need to build one for yourself and unless you put a method to this madness, your returns will never be extraordinary.

You need to build one for yourself and unless you put a method to this madness, your returns will never be extraordinary.

So that's how you do Industry Research, Company Research and Determine Margin of Safety before building an Investment Case for yourself.

I hope this thread helps you to build an investment framework for yourself.

I hope this thread helps you to build an investment framework for yourself.

Another important aspect of investment case, is incorporating risk management and determining appropriate position size for your portfolio.

You can learn all about it in this thread below.

You can learn all about it in this thread below.

https://twitter.com/itsTarH/status/1426496694691065861?s=20

I am an advocate of visual learning and visualizing numbers beyond the excel sheets

I teach a small class of Data Visualizing using a Free tool called Tableau over @skillshare

Get access to the class by using the below link

skl.sh/2XNug6A

I teach a small class of Data Visualizing using a Free tool called Tableau over @skillshare

Get access to the class by using the below link

skl.sh/2XNug6A

https://twitter.com/itsTarH/status/1427993843127906304?s=20

I also teach a class on Personal Finance - concepts and frameworks that helped me achieve Financial Independence Early.

Here is a link to that class.

skl.sh/2Wjk7A7

Here is a link to that class.

skl.sh/2Wjk7A7

https://twitter.com/itsTarH/status/1419694448892514311?s=20

Also, write and publish long from articles on my substack (investkaroindia.substack.com)

Subscribe for free, if you're interested.

Thank you to the 2500+ of you who already have!

Subscribe for free, if you're interested.

Thank you to the 2500+ of you who already have!

If you find this thread useful then follow me

@itsTarH

I write a new thread every weekend.

All my previous work, can be found here.

@itsTarH

I write a new thread every weekend.

All my previous work, can be found here.

https://twitter.com/itsTarH/status/1401095938945425410?s=20

Thank you for reading, please retweet the first tweet in this thread for a broader reach.

See you all next weekend!

See you all next weekend!

• • •

Missing some Tweet in this thread? You can try to

force a refresh