Dropping what is probably the most alpha packed thing I've written so far: an in-depth writeup of my strategy for a highly competitive MEV opportunity, the Synthetix Ether Collateral Liquidations, along with code

Blog post:

bertcmiller.com/2021/09/05/mev…

Repo:

github.com/bertmiller/sMEV

Blog post:

bertcmiller.com/2021/09/05/mev…

Repo:

github.com/bertmiller/sMEV

Blog post contains:

- My process from start the finish

- Explanation of why I made the design decisions I did

- How I sped up data collection

- A few gas optimizations

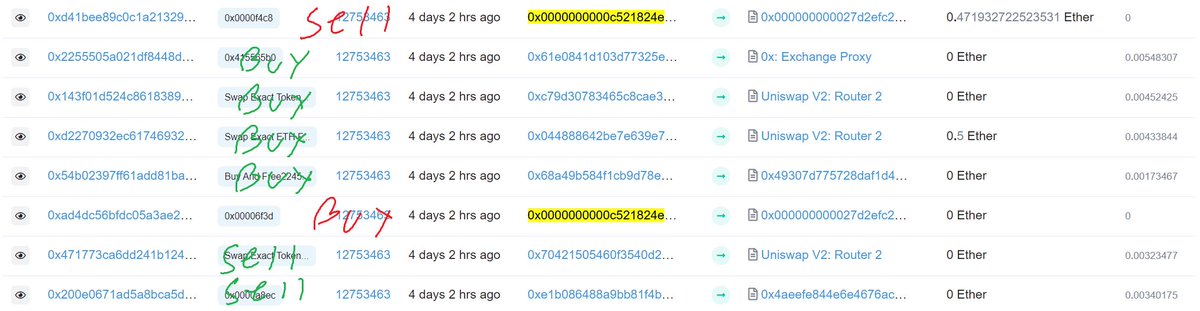

- Explanation of my economic strategy

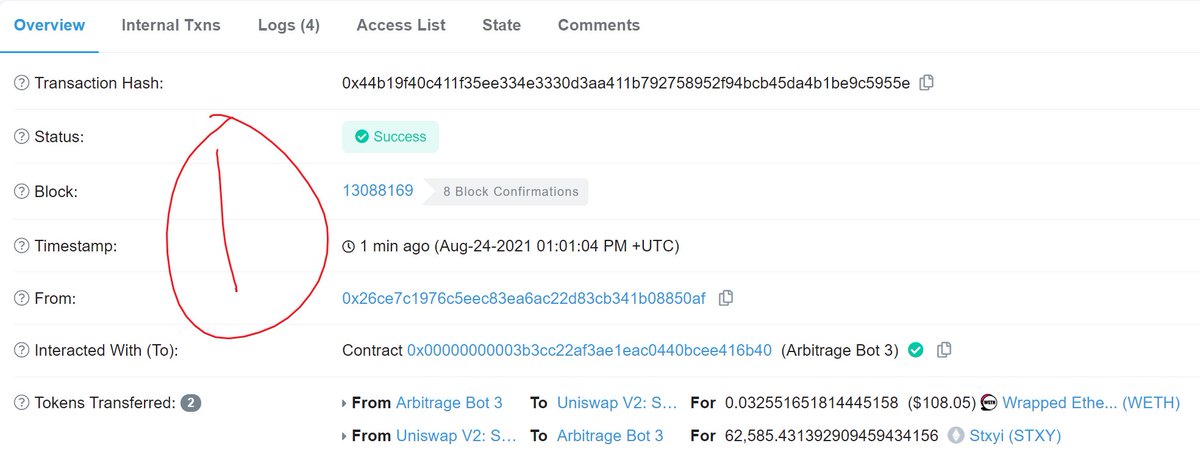

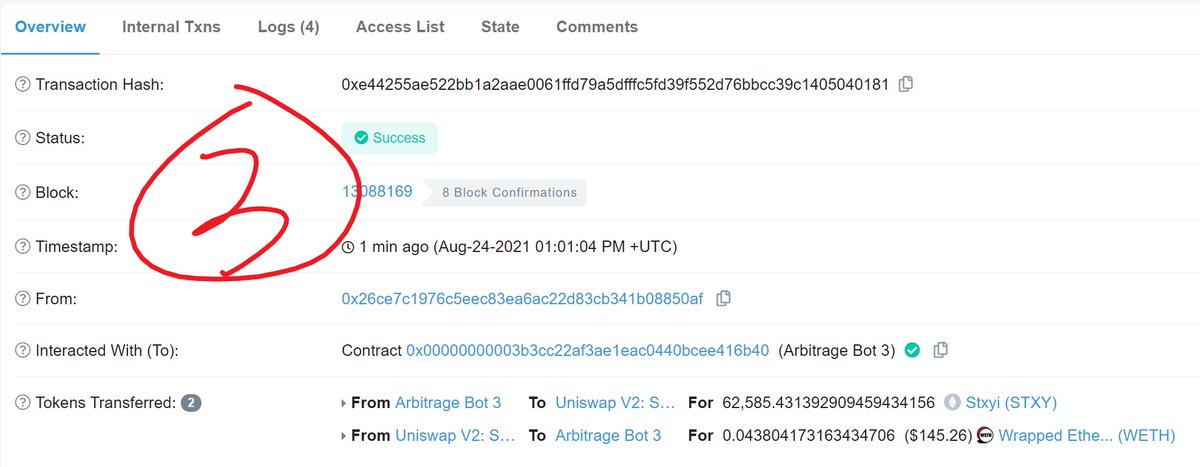

- My novel bundle submission strategy

- Code snippets

- Many links

- My process from start the finish

- Explanation of why I made the design decisions I did

- How I sped up data collection

- A few gas optimizations

- Explanation of my economic strategy

- My novel bundle submission strategy

- Code snippets

- Many links

Repo contains:

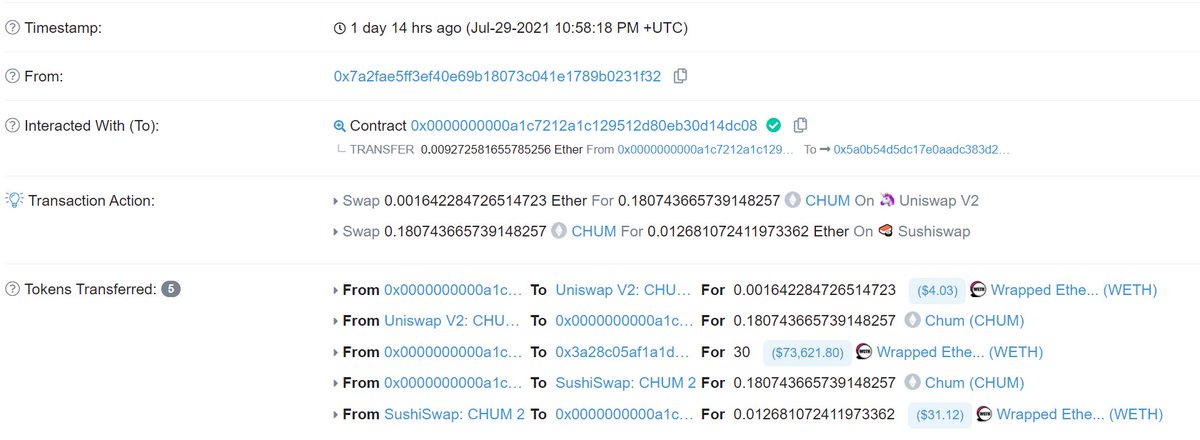

- The only (I think?) open source example of how to backrun transactions

- Monitoring tools I made

- Contracts used for execution, including dydx flashloan

- Contract for data collection

- my somewhat embarrassing messy Hardhat testing env

- The only (I think?) open source example of how to backrun transactions

- Monitoring tools I made

- Contracts used for execution, including dydx flashloan

- Contract for data collection

- my somewhat embarrassing messy Hardhat testing env

This was a fun challenge because it was extremely well known opportunity (h/t: @KalebKeny for that!) where everyone had ample time to prepare. So it was bound to be really competitive. I also got to use cool knowledge I had previously tweeted about around the Flashbots auction.

In the end there was a streak of unlucky blocks and a mempool bot got the MEV 🤷🏻♂️

Anyway, I hope this helps get more people into searching

gl, hf everyone

gl, hf everyone

Is the blog post enough or should I twitch stream this one too?

• • •

Missing some Tweet in this thread? You can try to

force a refresh