Let’s get a few things straight.

Eden's lead investor - @multicoincap - is lying about Flashbots and Eden.

🧵

Eden's lead investor - @multicoincap - is lying about Flashbots and Eden.

🧵

https://twitter.com/TusharJain_/status/1435616608202932224

Contrary to Multicoin's claims, minimizing MEV is core to Flashbots' mission & products.

That shows from our funding of fairness and ethics research, work on MEV aware dApps, & 100s of users that have used Flashbots to skip the mempool & protect themselves from frontrunning.

That shows from our funding of fairness and ethics research, work on MEV aware dApps, & 100s of users that have used Flashbots to skip the mempool & protect themselves from frontrunning.

More importantly, Multicoin is lying about Eden: it is not permissionless OR transparent.

Eden is a permissioned system with a multisig that has exclusive control over MEV payouts to miners. The Eden team alone decides whether miners are mining "Eden blocks" and should be paid.

Eden is a permissioned system with a multisig that has exclusive control over MEV payouts to miners. The Eden team alone decides whether miners are mining "Eden blocks" and should be paid.

What’s more, Eden refuses to disclose how they decide what is an Eden block and when they withhold MEV payments.

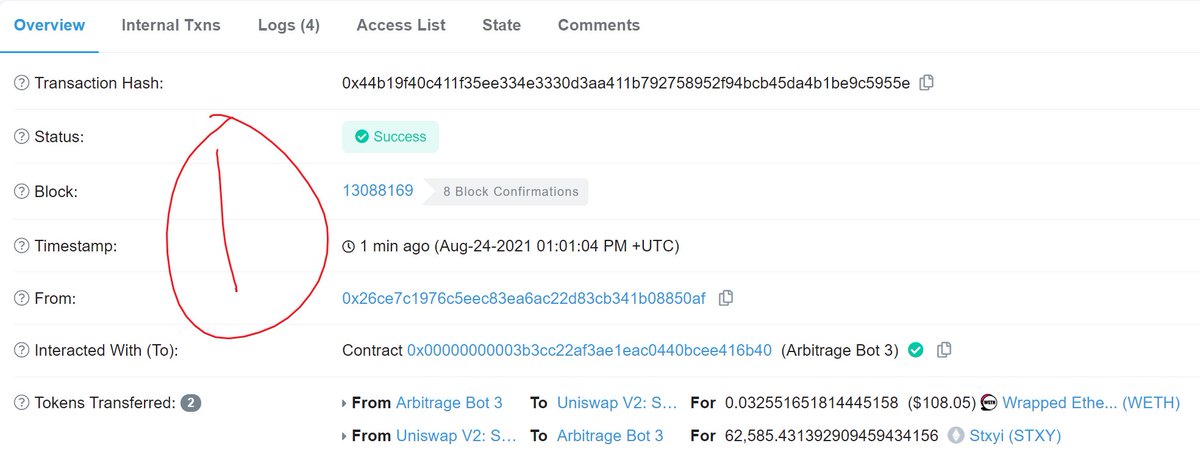

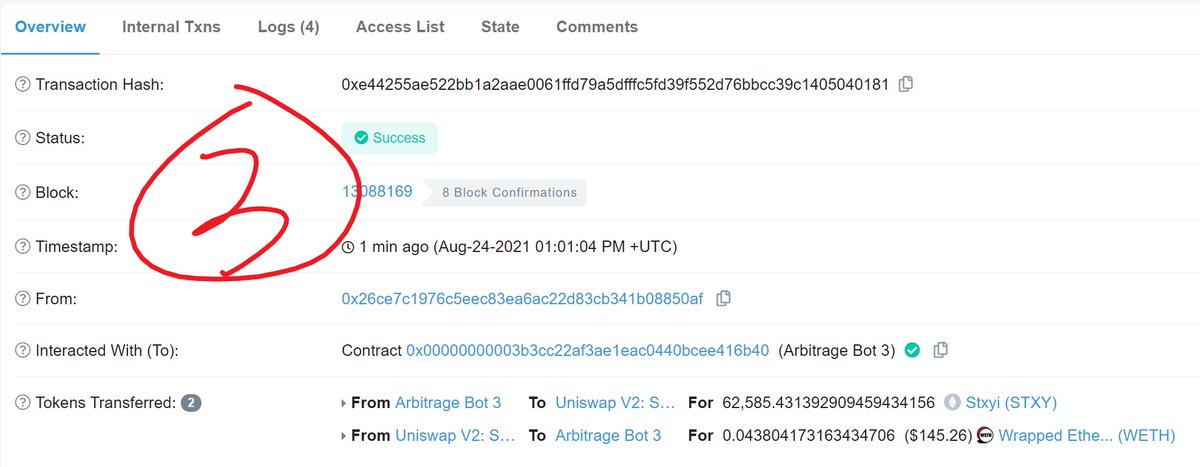

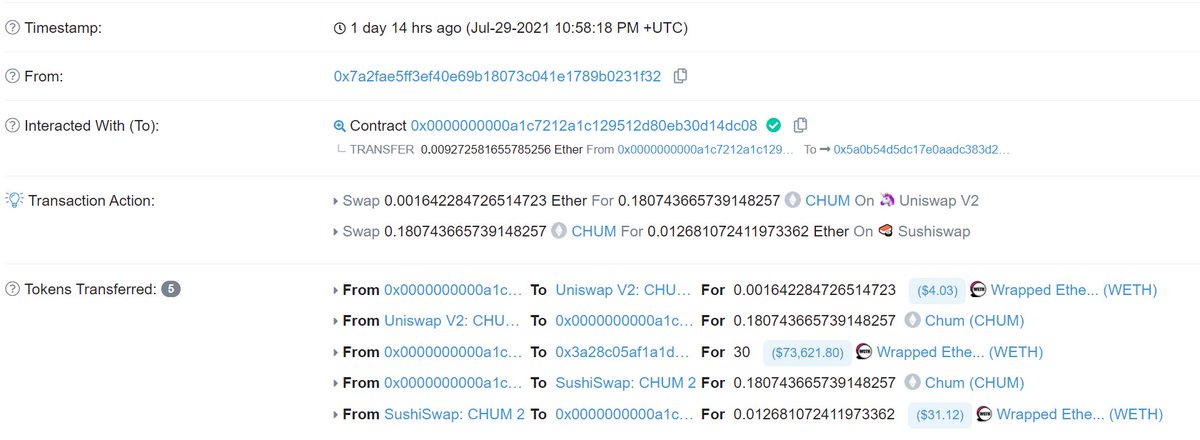

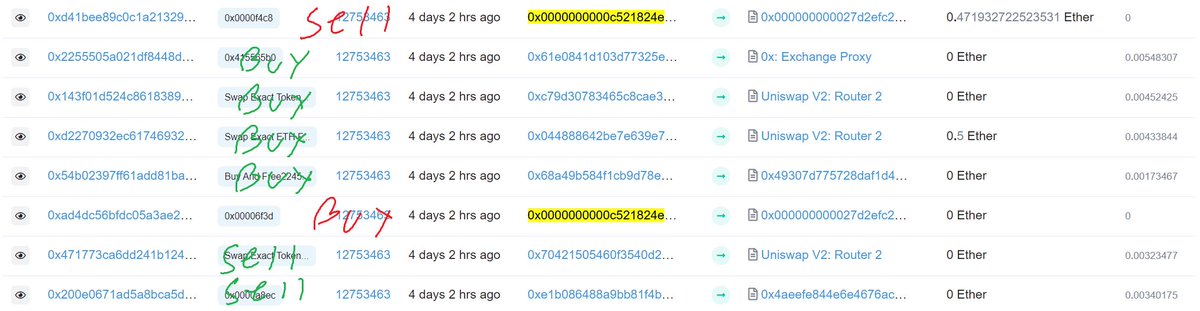

In contrast to the totally opaque and permissioned system of MEV payments pioneered by Eden, MEV through Flashbots is visible through our API and verifiable on-chain

In contrast to the totally opaque and permissioned system of MEV payments pioneered by Eden, MEV through Flashbots is visible through our API and verifiable on-chain

Eden’s lack of transparency goes deeper: the subjective nature of their rules means that no one can verify what an Eden block is.

The Eden team claims high hashrate, but on-chain only 6% of blocks contain any slot txs and only 5% follow the whitepaper's ordering rules.

The Eden team claims high hashrate, but on-chain only 6% of blocks contain any slot txs and only 5% follow the whitepaper's ordering rules.

Moreover, miners are switching away from producing Eden blocks because of the opportunity costs of including low-fee transactions from Eden stakers when gas prices are high.

The economics of Eden are fundamentally broken.

The economics of Eden are fundamentally broken.

Of course, it’s not in Eden’s interests to provide more transparency.

Eden's success relies on their token pumping. That's the only way miners might stomach the 40% tax (only 60% of inflation goes to miners) that Eden and their investors want to levy on MEV.

Eden's success relies on their token pumping. That's the only way miners might stomach the 40% tax (only 60% of inflation goes to miners) that Eden and their investors want to levy on MEV.

Flashbots is designed to be long term incentive aligned with the Ethereum ecosystem.

We have built strong ties to the community to achieve our goals of minimizing MEV to the extent possible and fairly extracting what we can’t.

We invite everyone in the ecosystem to join us.

We have built strong ties to the community to achieve our goals of minimizing MEV to the extent possible and fairly extracting what we can’t.

We invite everyone in the ecosystem to join us.

If you are interested in learning more about MEV or Flashbots, we'll have a Twitter spaces tomorrow you can tune into

https://twitter.com/bertcmiller/status/1435566900340215808

Lastly, Flashbots is growing fast. Check out our job postings below if you want to work at a long-term oriented organization that cares deeply about Ethereum.

https://twitter.com/hudsonjameson/status/1434980550066978819

• • •

Missing some Tweet in this thread? You can try to

force a refresh