1/Thanks to @steve_sedgwick and @cnbcKaren for having me on @CNBC #SquawkBox this morning.

We talked about - what else? - #inflation and #centralbanks and whether the #Fed & peers are 'making an historic mistake', in Steve's words.

A few charts & comments for background:-

We talked about - what else? - #inflation and #centralbanks and whether the #Fed & peers are 'making an historic mistake', in Steve's words.

A few charts & comments for background:-

2/It's trite to say the jump in price indices is *all* attributable to a 'basis effect' when they've accelerated so much THIS year.

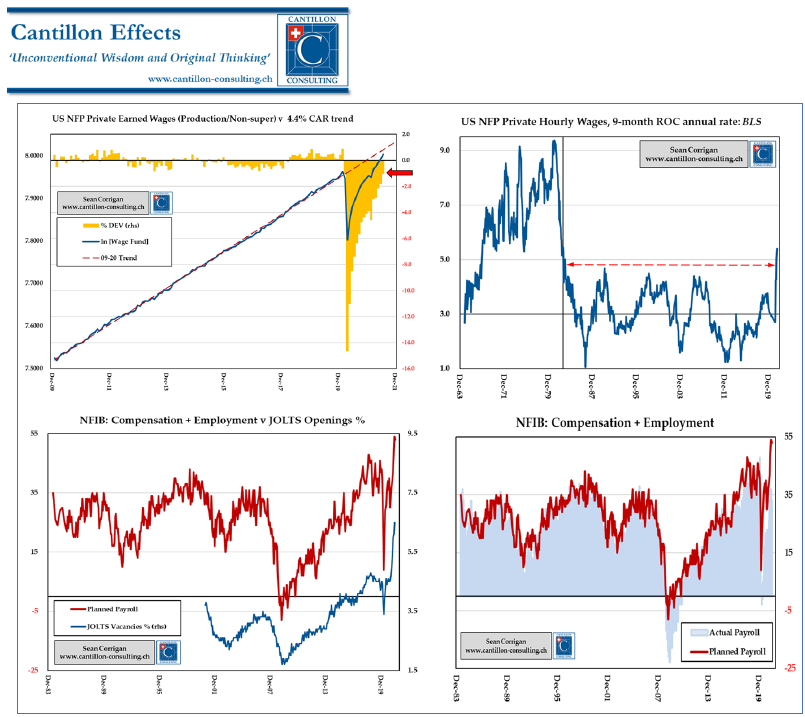

3/ #JeromePowell and his merry band may wish to believe that the rise is a mere blip, but all too many businessmen & women (i.e., the people who *really* matter) seem to believe the converse is the case.

4/ The labour market, too, has made great strides and -given that the gov't is still providing both too many incentives to idleness and too many barriers to employment- wages seem to be responding, pace JayPo.

5/ Spending has been on a tear these past several months and industry is doing its best to respond. Compare where we are today to pre-#COVID 2019 and it's hard to see the necessity for a continuation of present policies.

6/ A sure sign of the imbalance between spendable means and available goods is the growing #trade deficit - and with it the associated logistics jam.

7/ Step outside the factory for a moment to take a peek at financial markets and the craziness becomes apparent - as well as the unshakeable sense of building peril.

#SPX #MandA #PE #junk #yields

#SPX #MandA #PE #junk #yields

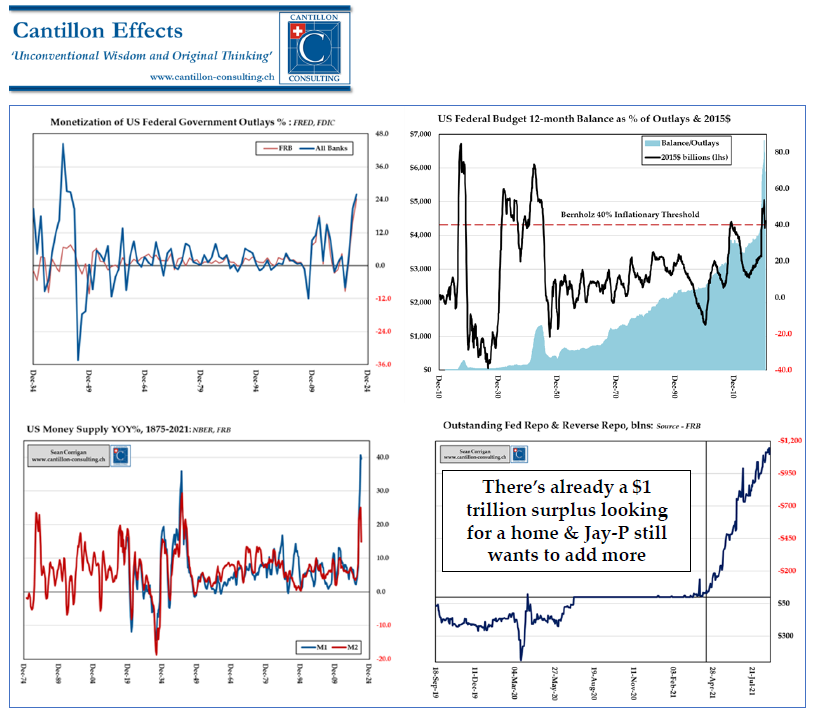

8/ While you *could* argue last year's monetized deficit *replaced* frozen private incomes, there's no such excuse for what's coming down the (soon to be refurbished) turnpike.

From the 80s' "Military Keynesianism" to the 20s' "Ecomilitant Keynesianism"™️ - we're in trouble!

From the 80s' "Military Keynesianism" to the 20s' "Ecomilitant Keynesianism"™️ - we're in trouble!

10/ @threadreaderapp please unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh