1/x A new paper from @ckaiwu uses natural language processing to score corporate cultures. There are a bunch of interesting takeaways. sparklinecapital.com/post/measuring…

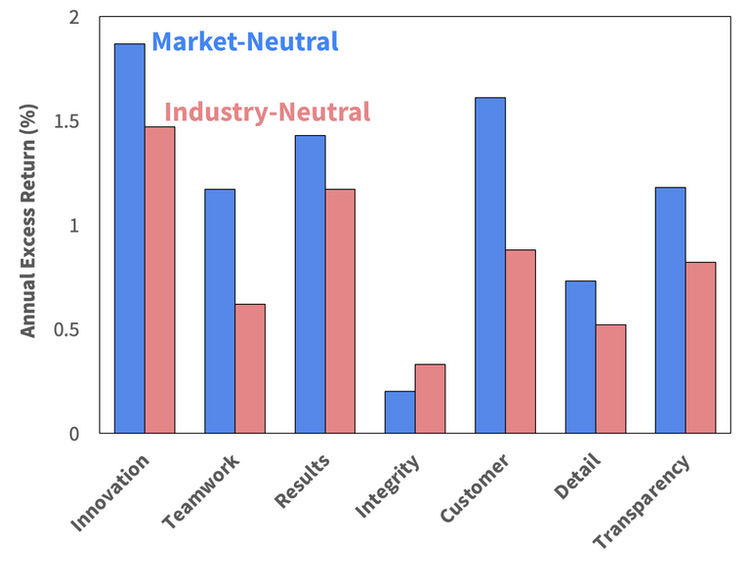

3/x So far, this just supports what a lot of investors believe about culture being a competitive advantage.

4/x But digging into the details reveals interesting anomalies. For instance, scoring high on innovation is negatively correlated with having a customer focus.

5/x And a corporate culture that instills a sense of stability is actually value destroying at "creative firms" even while the same trait is very value creative at "procedural firms".

6/x Also fascinating is how companies whose scores vary significantly from their industry peers outperformed strongly. So a unique culture, regardless of the way in which it is unique, appears to be a strong positive signal.

7/x The paper smartly notes that the causality may run in the other direction, with only very high performing firms given "permission" to operate such an atypical culture. But our own work has shown us how valuable "uniqueness" can be as well. intrinsicinvesting.com/2018/02/16/idi…

8/x "Measuring" culture may well be one of the great underexploited pools of alpha in equity markets today. The value of positive cultures is well understood, but tools like natural language processing offer an opportunity to dig much deeper into the complex dynamics.

• • •

Missing some Tweet in this thread? You can try to

force a refresh