🚨🚨China Credit Update- Gradually then Suddenly (9/7/21)👇👇

2/ Evergrande is dead. Long live Evergrande. For those paying attention, this has been a forgone conclusion for a while. Now is the critical juncture - what will be done to contain it. The fate of Chinese credit markets and banking sector and hang in the balance.

3/ Contagion is the next step. Contagion is a disease that spreads - its a crowd panic of self preservation. Creditors were forced to take losses on EG and for some it could be fatal. If you're are a lender to property developers you're only concern is saving your own ass.

4/ Maybe EG was in worse position than others, but at this point do you want to take that risk? Developments are in fire sale, property sales and prices are down meaningfully, Beijing clampdown continues, and developers lost access to new debt which provides their liquidity

5/ New credit to developers dried up months ago. Existing bank debt may be able to be rolled simply because a bank accelerating on an insolvent co may spell its own demise. But if you own tradeable debt and you want out, you must move fast and accept deep discounts to move size

6/ This is how bond prices plummet. One person takes a 5% haircut to get out of their position, and by doing so forces a 5% haircut on the entire bond in the process. This is a reflexive self-reinforcing cycle. Rational actors know they must move fast or go down with the ship.

7/ Where this gets really messy is when the contagion spreads from property developers to banks. If the concern moves from direct exposure to concern of your counterparties exposure, you may stop lending to a banks. When interbank lending breaks down, shit hits the fan.

7/ In order to stop this cycle - a forceful message of support would need to come from Beijing. Words alone can be meaningful to calm markets in the short term particularly in this circumstance where the entire credit market has presumed central backstopping.

8/ Longer term though - words without actions will not succeed. Actions must be taken. Many other commentators continue to believe that the CCP will be able to fix "it'. But lets think about what "it" is:

9/ "It" is not Evergrande or Huarong. "It" is a decade of policy that has underpinned China's growth - debt expansion, largely focused in property, that achieve top-down growth targets, but do not create productive assets.

10/ The model is simple: local governments raise revenue by land sales to support SOEs and infrastructure projects. Developers take on debt to buy the land and build housing. Citizens take savings and debt to buy the houses. This can and has continued until debt runs dry.

11/ By imposing the Three Red Lines on developers, increasing mortgage rates, and cracking down on prices, Beijing has shut off the debt flow. Banks are now very weary to lend anyway even if they are have capacity to do so.

12/ Think about debt. A bank gives someone money, so they can create or buy something of value, which allows the loan to be repaid. If that money does not create value, the bank will lose money. Their recovery is simply how much value was created in the process.

13/ Massive unfinished, unsold, or uninhabited housing projects do not have value. So long as citizens have access to debt to continue to buy, projects may be able to be monetized, but this merely transfers losses from one party to another in the long-term.

14/ The only way Beijing can "fix" the situation is to reverse course and allow the continued expansion of debt. The problem is that this does not fix anything, it only makes the problem worse in the long term. So far I see no indication Beijing is considering this approach.

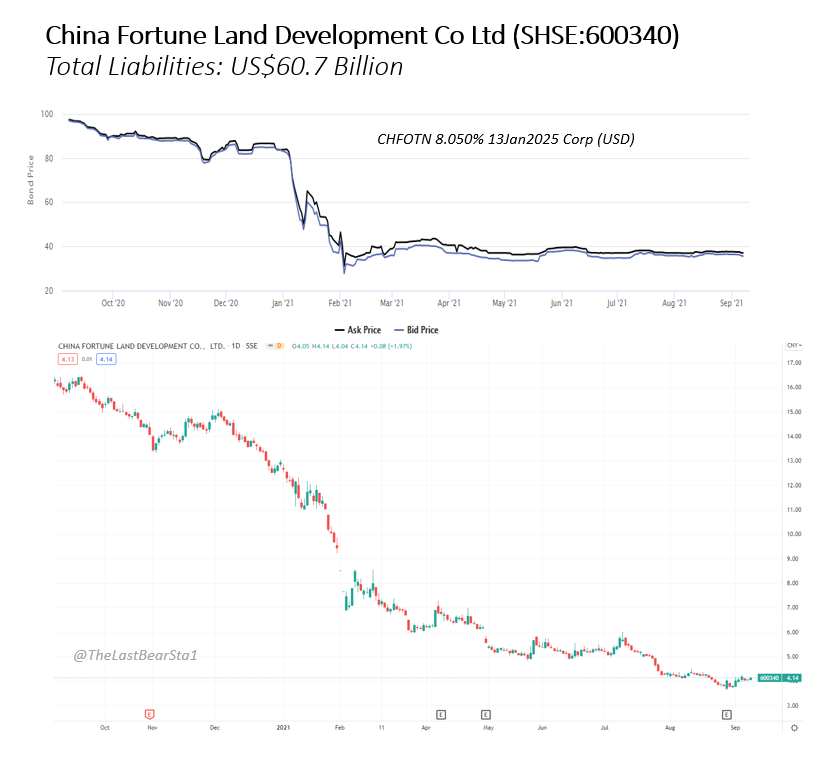

15/ A credit and banking crisis can occur when decade on true losses economic losses are finally revealed and recognized. The level of loan loss provisions and write-downs taken to date are likely peanuts - consider Bonds of stressed developers were trading at par just days ago.

16/ We *know* that the banking system has a non-performing loan problem, that has been concealed from central authorities. We *know* the property sector are banks biggest credit exposure. We *know* that land sales provide critical funding to local gvts and their massive debts

17/ Ok - theory session over. What practically can happen now? The PBOC can take instant, direct measures to provide banks more leeway buy cutting the RRR, and injecting liquidity into the system. Whether that will be sufficient is a question of how large bank losses really are.

18/ I'm skeptical such policy measures will be sufficient. Beyond these policies, there does not seem to be any indication that central regulators have *any* plan with how to deal with this situation - or even know how big of a problem they have. Huarong demonstrates this.

19/ Direct market intervention seems like the next most obvious move. If bank contagion emerges, you backstop some price levels on banks that are important or provide a direct lending to banks who can't get liquidity in the market (both routes socialize losses in the process)

20/ Time will tell if contagion spreads, what policy and market interventions are necessary and implemented, and what impact they may have.

21/ A final point where I disagree with others is on the necessity of Beijing supporting housing prices to avoid social unrest. First - this cannot be done without more debt, but more importantly, Xi himself has been warning against property speculation for years.

22/ The highest financial regulator also warned that those who think property prices will not fall will be badly hurt. To the extent speculating on third, fourth and fifth empty homes fueled this problem, does Beijing intervene to protect them or make them take their punishment?

23/ In the context of the broader Chinese regulations that have been coming at record pace, it seems the country is dead-set on removing what its views as cancers, however painful that may be. Property is the grey-rhino; cancer number one.

24/ China is putting itself on a distinctly different path from its debt-fueled past - a process it recognizes as painful but necessary. The Risk is that they (and the market) underestimate the pain.

• • •

Missing some Tweet in this thread? You can try to

force a refresh