This relates to EG's wealth management product ("WMP") of which 99% of employees are invested in (they are protesting). Some top brass left and were paid out before payments halted. WMPs are a huge funding source for developers. Citizens (who buy apts) are creditors. Disaster.

https://twitter.com/ChannelNewsAsia/status/1436257426718670855

2. WMPs, which are funded by citizen's savings, totaled $1 TRILLION dollars according to BBG, and regulators are cracking down. bloomberg.com/news/articles/…

3. Reported: Staff of Shenzhen Financial Bureau: “We are not sure if Evergrande Wealth belongs to the Financial Bureau, the China Banking Regulatory Commission, or the People’s Bank of China. It is currently not on our P2P list.”

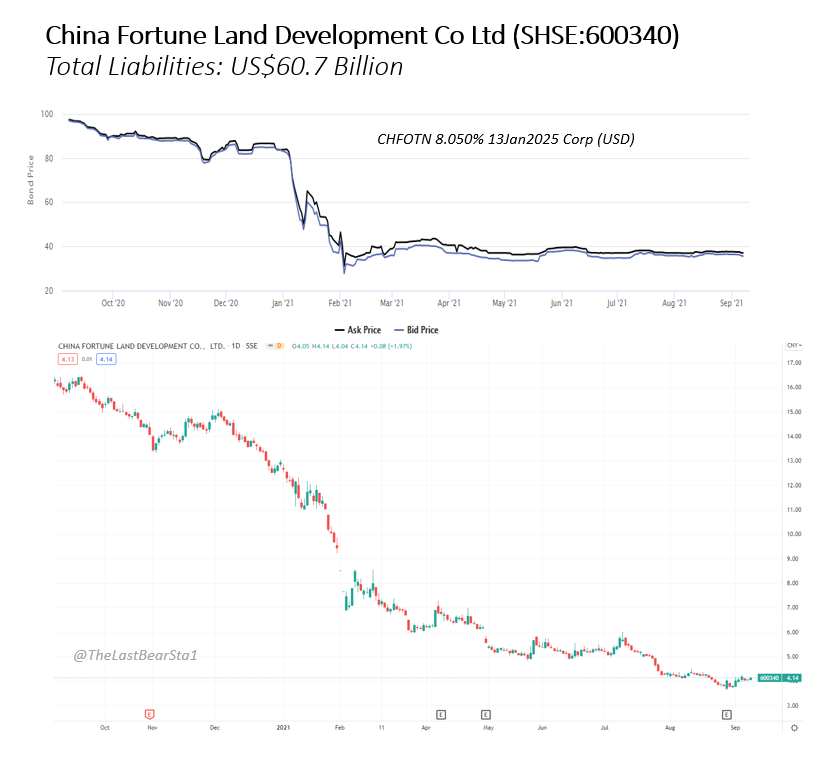

4. The true pile of liabilities are enormous:

- Employees

- Suppliers

- Remaining construction funding

- Pre-sold Depositors

- WMP/Trusts

- Banks

- Domestic bond holders

- Offshore bond holders.

Doesn't seem like there is any money for any of them.

Offshore recovery = 0

- Employees

- Suppliers

- Remaining construction funding

- Pre-sold Depositors

- WMP/Trusts

- Banks

- Domestic bond holders

- Offshore bond holders.

Doesn't seem like there is any money for any of them.

Offshore recovery = 0

• • •

Missing some Tweet in this thread? You can try to

force a refresh