The biggest crypto story of the past few days has been the growth of Arbitrum.

Yield farms have skyrocketed the Ethereum L2's TVL beyond $1 billion.

Everyone's talking about it but what is Arbitrum anyway?

Let's get into it 🧵

Yield farms have skyrocketed the Ethereum L2's TVL beyond $1 billion.

Everyone's talking about it but what is Arbitrum anyway?

Let's get into it 🧵

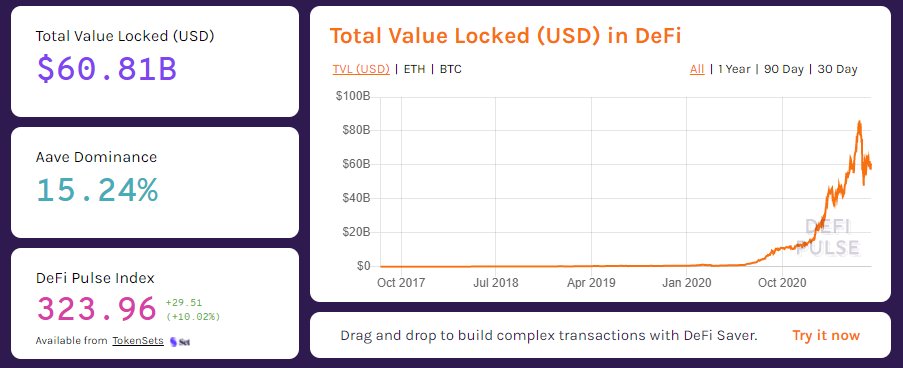

By far one of the largest narratives this year is Ethereum's transaction costs.

A combination of a rapidly rising ETH price and an increase in usage due to NFTs, yield farming, trading, and volatility has led to gas costs in excess of 100-200 gwei at many points this year.

A combination of a rapidly rising ETH price and an increase in usage due to NFTs, yield farming, trading, and volatility has led to gas costs in excess of 100-200 gwei at many points this year.

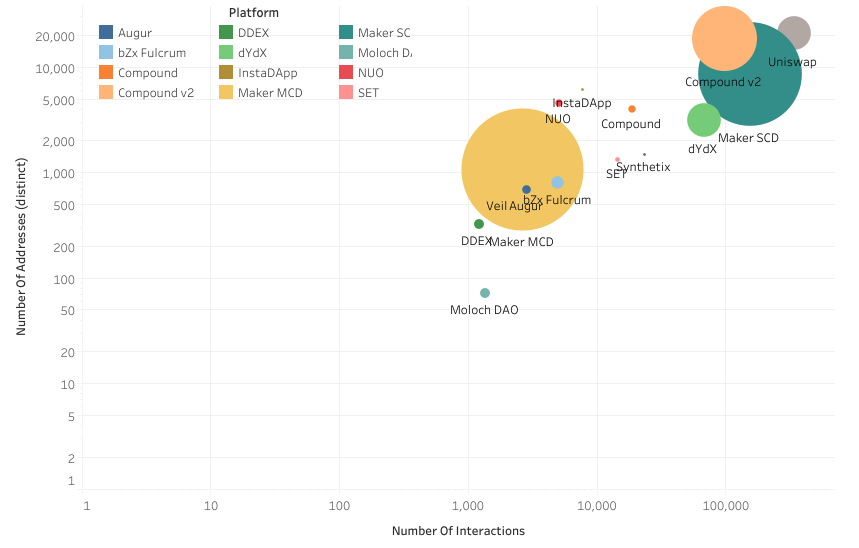

At the start of the year, users looked to other networks that run the Ethereum Virtual Machine (EVM).

Those networks, while providing low transaction fees and low latency, often compromise on security with smaller node sets and centralized bridging infrastructure.

Those networks, while providing low transaction fees and low latency, often compromise on security with smaller node sets and centralized bridging infrastructure.

These other networks, while offering a similar user experience to Ethereum, do not directly adopt the security of the mainnet.

They are distinct layer-one networks with their own consensus mechanisms.

Enter Rollups.

They are distinct layer-one networks with their own consensus mechanisms.

Enter Rollups.

A rollup is a scaling solution that inherits the security of the underlying network while simultaneously improving transaction throughput and fees.

Rollups attempt to solve the admittedly contentious debate between the trade-off between fees, security, and usability.

Rollups attempt to solve the admittedly contentious debate between the trade-off between fees, security, and usability.

A rollup like Arbitrum (an "optimistic" rollup) migrates computation and data storage off chain onto a new network.

These new networks run EVM, or slight variations of EVM, allowing for the relatively simple porting of Ethereum-based applications to these networks.

These new networks run EVM, or slight variations of EVM, allowing for the relatively simple porting of Ethereum-based applications to these networks.

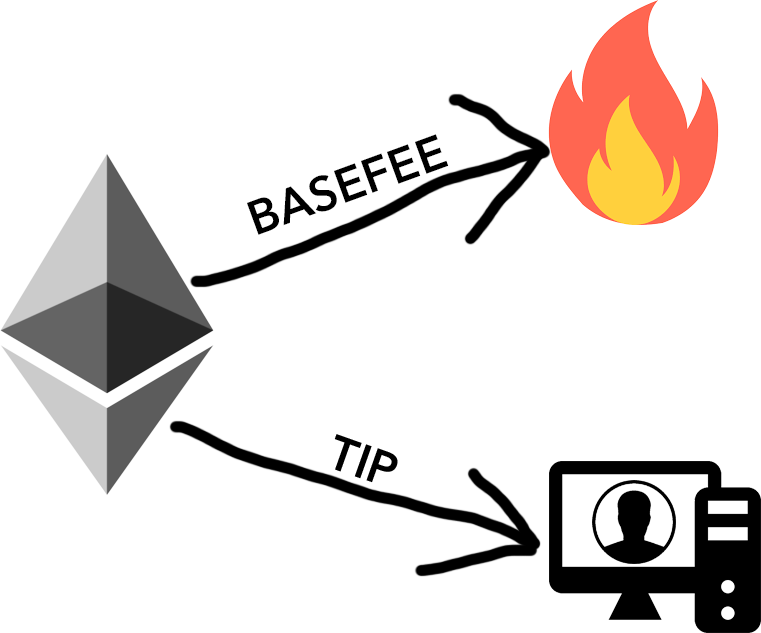

Where the transaction fees savings come in is in the fact that only fragments of each rollup transaction are recorded on the Ethereum mainnet in batches.

The rollup fragments have a much smaller footprint on the L1 than if those same transactions were executed on mainnet.

The rollup fragments have a much smaller footprint on the L1 than if those same transactions were executed on mainnet.

Optimistic rollups generally allow anyone to run a node for the network and it assumes that all rollup batches are valid.

Hence "optimistic."

Hence "optimistic."

The optimistic approach raises the obvious question of what if someone submits a fraudulent batch for some economic advantage.

Optimistic rollups allow anyone to challenge batches or txes they perceive as wrong.

A dispute protocol then rewards the winner and taxes the loser.

Optimistic rollups allow anyone to challenge batches or txes they perceive as wrong.

A dispute protocol then rewards the winner and taxes the loser.

Anybody can dispute on a rollup because the network will publish small amounts yet adequate data on the Ethereum mainnet to retrace and rebuild the state of the rollup.

That can then be used to identify fraudulent behavior.

That can then be used to identify fraudulent behavior.

The challenge period also applies to withdrawals from the network to the mainnet.

There is currently a seven-day challenge period.

Excited to see the design space around instant-liquidity-as-a-service develop. (E.g. pay 20 bps and get your Ethereum or coins instantly on L1.)

There is currently a seven-day challenge period.

Excited to see the design space around instant-liquidity-as-a-service develop. (E.g. pay 20 bps and get your Ethereum or coins instantly on L1.)

There is also a special form of node called a sequencer.

A sequencer in an optimistic setup has the ability to control the ordering of transactions. This allows the rapid execution of transactions vs. a 13-second block time on the Ethereum mainnet.

A sequencer in an optimistic setup has the ability to control the ordering of transactions. This allows the rapid execution of transactions vs. a 13-second block time on the Ethereum mainnet.

Offchain Labs currently operates Arbitrum's sequencer, though research is being done into a decentralized sequencer.

It may look something like a group of servers that operate on a consensus basis to determine transaction ordering.

It may look something like a group of servers that operate on a consensus basis to determine transaction ordering.

Optimistic rollups, at full scale, are expected to improve Ethereum transaction fees by upward of 50x.

That's to say, an AMM transaction on mainnet that cost $50 may cost $1 or even less, dramatically improving the user experience.

That's to say, an AMM transaction on mainnet that cost $50 may cost $1 or even less, dramatically improving the user experience.

Transaction fees on rollups are always a constant multiple improvement over the mainnet.

That's to say if the cost of gas on Ethereum grows by 2x, so should the cost of Arbitrum transactions.

That's to say if the cost of gas on Ethereum grows by 2x, so should the cost of Arbitrum transactions.

Really excited to see the Arbitrum ecosystem develop.

Also keeping a close eye on projects launching on Arbitrum first, then branching out to other networks.

This may increasingly become a commonly seen playbook for applications w/ users that have sensitivity around tx fees.

Also keeping a close eye on projects launching on Arbitrum first, then branching out to other networks.

This may increasingly become a commonly seen playbook for applications w/ users that have sensitivity around tx fees.

Another interesting phenomenon we may see is larger smart contracts.

Not many know that Ethereum has a natural constraint on smart contract size. SCs are optimized before they are pushed on chain.

Arbitrum's unlimited contract size may enable the creation of new dApps.

Not many know that Ethereum has a natural constraint on smart contract size. SCs are optimized before they are pushed on chain.

Arbitrum's unlimited contract size may enable the creation of new dApps.

Something else I'm keeping an eye on is protocols that allow for the bridging of not just capital but also arbitrary data between L1s (even those non-EVM compat) and L2s.

Imagine someone on L2 being able to instantly interact with a contract on an L1 w/o having to bridge funds.

Imagine someone on L2 being able to instantly interact with a contract on an L1 w/o having to bridge funds.

Finally, it's worth pointing out that Arbitrum's virtual machine is not 1:1 identical to the EVM we are all familiar with.

Differences largely relate to the need for rollups to prove execution to the L1 and to enable dispute processes.

Differences largely relate to the need for rollups to prove execution to the L1 and to enable dispute processes.

This is by no means advice to use Arbitrum or any applications currently on the network.

PSA: There is no Arbitrum token as well.

Full disclosure: ParaFi Capital is a supporter of Offchain Labs—the great group of developers building Arbitrum.

PSA: There is no Arbitrum token as well.

Full disclosure: ParaFi Capital is a supporter of Offchain Labs—the great group of developers building Arbitrum.

Some resources I've found helpful:

L2 TVL tracker: l2beat.com

Vitalik's take on a rollup-focused Ethereum: ethereum-magicians.org/t/a-rollup-cen…

Projects Arbitrum onboarded: portal.arbitrum.one

L2 TVL tracker: l2beat.com

Vitalik's take on a rollup-focused Ethereum: ethereum-magicians.org/t/a-rollup-cen…

Projects Arbitrum onboarded: portal.arbitrum.one

With the launch of Arbitrum and Optimism coupled w/ the rise of other L1s due to large liquidity mining schemes + innovative dApps, this autumn is going to be exciting.

But that's it from me.

Best of luck my fellow apes.

But that's it from me.

Best of luck my fellow apes.

• • •

Missing some Tweet in this thread? You can try to

force a refresh