Belize is in the process of negotiating a so-called green debt restructuring of an outstanding US$ bond. While the deal is being heralded as "groundbreaking" and a "good solution" there are plenty of reasons to be skeptical about the benefits of the deal.

https://twitter.com/marcjonesrtrs/status/1436345134044663809

The deal involves the provision of financing by @nature_org to buyback a bond worth US$ 526 million (which has already been restructured 3 times) on 55 cents on the dollar. As part of the agreement, Belize commits to fund a marine conservation trust (US$ 23 million).

The proposed restructuring is unlikely to restore debt sustainability. As a result, current bond holders might end up getting a better deal than under a comprehensive debt restructuring under an IMF program. This might explain why key bondholders are keen on this deal.

As things stand, the IMF classifies Belize's debt as unsustainable with substantial risks. The pandemic pushed the public debt to GDP ratio to 132% in 2021. The projected decline assumes an adjustment of 6.3 points of GDP + low financing costs (optimistic assumptions).

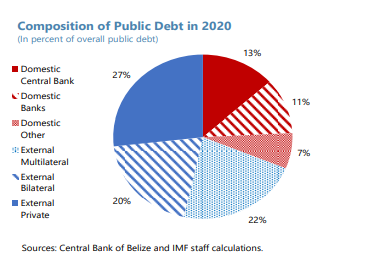

The proposed restructuring involves a fraction of Belize's debt (around a quarter of the total). Thus, while the deal might give some breathing space, it is far from solving the solvency problems faced by the country (as reflected by the size of the required adjustment).

Against this background, the green component of the deal seems more like a "greenwashing" smoke screen to distract from the fact that this agreement fails to ensure Belize's debt sustainability while providing an easy exit to bondholders @DanielaGabor @kmac

• • •

Missing some Tweet in this thread? You can try to

force a refresh