1/ THE TALES OF BLOCKCHAIN FAILURES

A Twitter novel

Who? When? Why?

Keep reading 👇👇👇

A Twitter novel

Who? When? Why?

Keep reading 👇👇👇

2/ Solana was down yesterday, Arbitrum was "down" as well.

Salty maxis crawled out from the caves shouting "#Bitcoin is never down" "#Ethereum is never down" "#IOTA is never down"

Technically they are not correct.

Salty maxis crawled out from the caves shouting "#Bitcoin is never down" "#Ethereum is never down" "#IOTA is never down"

Technically they are not correct.

3/ So let's look at all the bad things that happened with the blockchain networks as a whole in history.

4/ Namely, we look blockchain *networks*. ERC-20 tokens and other smart contracts have bugs, rugs and fucks every day. These issues are not particularly interesting because the effect of the failure is well-contained.

5/ For example, we ignore e.g. episodes with two separate Parity multisig wallet hacks

coindesk.com/markets/2017/0…

coindesk.com/markets/2017/0…

6/ We also ignore the issue "network unavailable for practical purposes because the transactions are too expensive" as I do not want to engage in philosophical arguments with keen fans.

7/ My view is that if "It is impractical for you to use it as it was advertised for you, it is broken."

8/ How to define the failure then?

There are two primary failure modes for blockchains

- Invalid state transition (steal money from someone else's private key)

- Not able to make progress (no new blocks)

👇👇👇

There are two primary failure modes for blockchains

- Invalid state transition (steal money from someone else's private key)

- Not able to make progress (no new blocks)

👇👇👇

9/ The invalid state transition is the worst. You write a number to the block that is against the blockchain spec (even though not against the implementation, as the code is the law here).

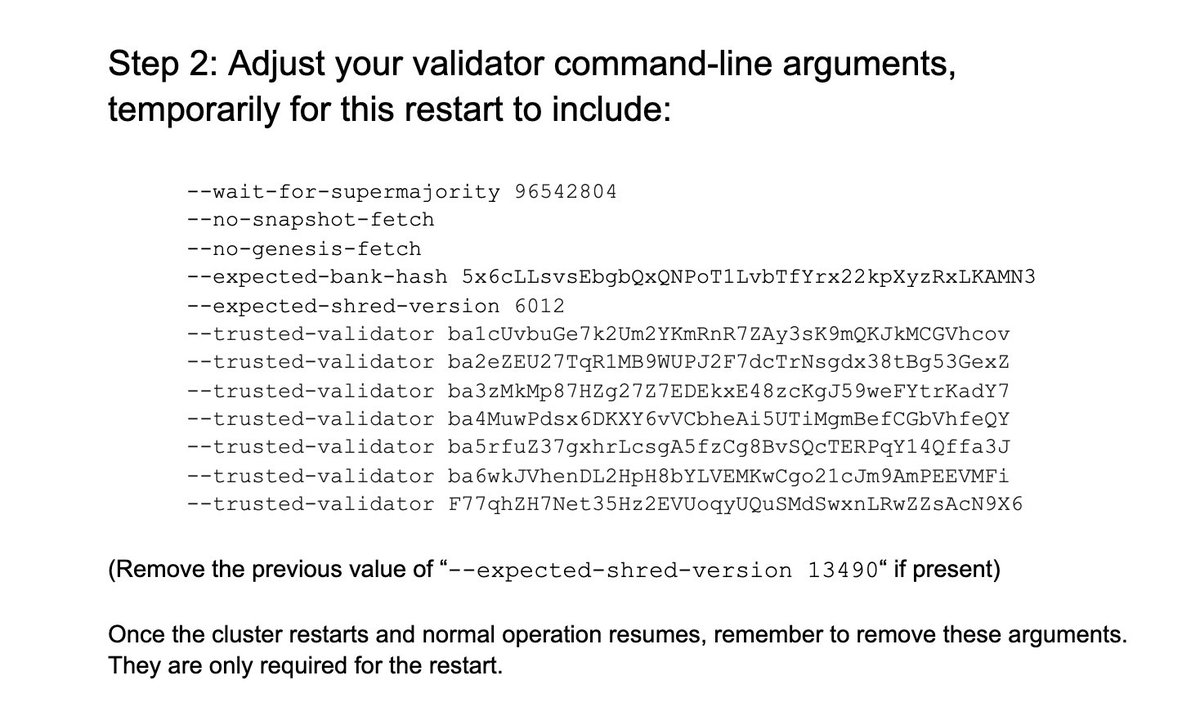

Basically, you took money out from someone else's private key or mint against rules.

Basically, you took money out from someone else's private key or mint against rules.

10/ The most famous invalid state transition is the #Bitcoin thin air mint attack in 2010.

"Within two hours of CVE 2010-5139 striking, Core developers Gavin and Satoshi were on the case, and the 184 billion BTC was purged from block 74638"

"Within two hours of CVE 2010-5139 striking, Core developers Gavin and Satoshi were on the case, and the 184 billion BTC was purged from block 74638"

11/ @zcash came close to have its own issue. Their implementation would have allowed users to mint his/her own ZEC out from the thin air.

fortune.com/2019/02/05/zca…

fortune.com/2019/02/05/zca…

12/ And because ZCash transactions are private, one could never tell if someone minted ZEC for themselves and keeps it hidden for the future to cash out.

The downside of privacy coins - you never know.

The downside of privacy coins - you never know.

13/ Invalid state transitions may be more interesting in the future, though. This is because sharding and inter blockchain communication (IBC).

All of @polkadot, @cosmos, @NEARProtocol and @ElrondNetwork could be affected by invalid state transitions.

All of @polkadot, @cosmos, @NEARProtocol and @ElrondNetwork could be affected by invalid state transitions.

14/ More about invalid state transition and invalid block issues in this excellent blog post by NEAR author, where they also explain the trade-offs of sharding solutions

medium.com/nearprotocol/t…

medium.com/nearprotocol/t…

15/ Then let's look downtime.

"My blockchain stopped working"

"Have you tried to turn it off and on again?"

👇👇👇

"My blockchain stopped working"

"Have you tried to turn it off and on again?"

👇👇👇

16/ #Bitcoin was practically down in 2013 and miners had to downgrade bitcoind to an earlier version.

The network was in such a bad state that transactions did not go through.

bitcoin.org/en/alert/2013-…

The network was in such a bad state that transactions did not go through.

bitcoin.org/en/alert/2013-…

17/ #Ethereum was unusable in Autumn 2016, as what started with denial-of-service attacks during Shangai Devcon kept plaguing the network for a long time.

18/ Block size was decreased by miners, the only control level Ethereum has, which led to the fact that you could not deploy some (most) of the smart contracts anymore.

reddit.com/r/ethereum/com…

reddit.com/r/ethereum/com…

19/ A CoinDesk article from the time.

DGC, Coinbase owner, was heavily in ETC, so anything related to Ethereum coming from them in 2016-2018 should be critically read.

coindesk.com/markets/2016/1…

DGC, Coinbase owner, was heavily in ETC, so anything related to Ethereum coming from them in 2016-2018 should be critically read.

coindesk.com/markets/2016/1…

20/ "Even if Geth nodes are no longer crashing completely, however, it has resulted in an overall slower network, making ethereum less available to anyone who want to spin up a smart contract or send a transaction."

21/ Eventually, in November 2016, an emergency hard work was issued to reprice the EVM opcodes to stop the denial-of-service attacks.

22/ What about #iota?

IOTA community intentionally shut down the network in the past due to a wallet hack.

zdnet.com/article/iota-c…

IOTA community intentionally shut down the network in the past due to a wallet hack.

zdnet.com/article/iota-c…

23/ Yesterday, @Solana was down. Because Solana's growing popularity this makes this interesting.

Solana had to be "restarted".

Solana had to be "restarted".

https://twitter.com/moo9000/status/1437864799724097540

24/ A good metric to measure blockchain uptime would be

Value on chain (native token + other tokens) * time the network is unusable.

With this equation, I believe Solana incident yesterday takes top #1 spot in the "blockchain is broken" events category.

Value on chain (native token + other tokens) * time the network is unusable.

With this equation, I believe Solana incident yesterday takes top #1 spot in the "blockchain is broken" events category.

25/ What have we learnt?

👇👇👇

👇👇👇

26/ A lot of blockchain scalability issues are about resource pricing.

See this video from @jadler0 about resource pricing and block size growth, it goes all the way back to discuss Bitcoin/Bitcoin Cash fork motives.

See this video from @jadler0 about resource pricing and block size growth, it goes all the way back to discuss Bitcoin/Bitcoin Cash fork motives.

27/ John hints that EVM based sidechainsn like @0xPolygon and Binance Smart Chain should take more conservative block size and gas price approach, not less, as they are otherwise deemed to repeat the past mistakes of Ethereum.

28/ Also, from all the incidents where the network went down we see it all comes down to the community.

The community is the law.

The community is the law.

29/ The community decides what is the ultimate truth on-chain. In the case of Solana, it was a new patched source code and 7 trusted nodes and a last good known block number the developers asked everyone to follow.

30/ What about the transactions after this block? Well, they never happened according to the community.

31/ This is the pragmatic way to solve problems. In fact, it is the only way. A blockchain is a byproduct of the community, not another way around.

If you disagree you are free to run your own node and your own chain with your friends, with different truth anchors.

If you disagree you are free to run your own node and your own chain with your friends, with different truth anchors.

32/ That's all this time. Now heading off the lunch.

If you are interested in the blockchain history read my mega history thread as well:

If you are interested in the blockchain history read my mega history thread as well:

https://twitter.com/moo9000/status/1389571466002325510

• • •

Missing some Tweet in this thread? You can try to

force a refresh