1/ Welcome back to the #DeFi Thursday.

Today we discuss the most massive algorithmic stablecoin crash known to humankind, $TITAN of @IronFinance

Or: How @mcuban was RUGGED BY THE PEOPLE and how to lose TWO BILLION DOLLARS.

Today we discuss the most massive algorithmic stablecoin crash known to humankind, $TITAN of @IronFinance

Or: How @mcuban was RUGGED BY THE PEOPLE and how to lose TWO BILLION DOLLARS.

2/ The "Rugged by the people" slogan was created by @freddieFarmer so do not let me take credit on that one.

But let's get started.

👇👇👇

But let's get started.

👇👇👇

3/ Iron Finance is (was) an algorithmic stablecoin on @0xPolygon blockchain.

4/ Algorithmic stable coin means that it is only partial or zero reserve - the price for $IRON token is pegged to US dollar partially through clever trading mechanisms with collateral token $TITAN and $USDC.

5/ The system broke down. The price of $TITAN collapsed and fractionally backed $IRON become truly fractionally backed with no hope to restore the peg.

$2B total value locked (TVL) crashed down fast, $TITAN price crashed down from $60 to ZERO.

$2B total value locked (TVL) crashed down fast, $TITAN price crashed down from $60 to ZERO.

6/ Someone could also say "fractional banking", or how your bank account works today. I am not sure if I agree with the definition. But happened effectively was a "bank run"

7/ So let's look at this in detail.

- The investment advice

- Was it a scam, rug pull, hack, etc

- What other algorithmic stablecoins share the similar risks

👇👇👇

- The investment advice

- Was it a scam, rug pull, hack, etc

- What other algorithmic stablecoins share the similar risks

👇👇👇

8/ I personally lost around $5000. It is an affordable learning experience for me.

Why I put money on a project that failed?

- Devs were building (some) stuff - instead of just cloning

- Getting traction

- The project was beyond the point there is no need to rug pull

Why I put money on a project that failed?

- Devs were building (some) stuff - instead of just cloning

- Getting traction

- The project was beyond the point there is no need to rug pull

9/ Treasury, income so high that a rational dev makes more money making it a real project instead of scamming people.

10/ What were the red flags?

- Anon team

- Too good to be true: Price goes up too fast, yields were way too high

- Anon team

- Too good to be true: Price goes up too fast, yields were way too high

11/ Like everything in startups, not just crypto: never put your money on early projects you are not comfortable losing.

Also some of your dog coins, the etc, project takes off always sell immediately at least as much you get your original investment back.

Also some of your dog coins, the etc, project takes off always sell immediately at least as much you get your original investment back.

12/ But was it a rug pull? Did Mr Cuban scam us with a marketing ploy? Were devs evil?

👇👇👇

👇👇👇

13/ While devs probably noticed earlier than others it is going to fail, there is nothing in the protocol itself that was changed. There were no external hacks. No parameters were changed maliciously.

14/ This is where "RUGGED BY THE PEOPLE" come in. It was not a Ponzi. It could have had some pyramid characteristics. But in the end, all algorithmic stablecoins have situations where they cannot recover from.

15/ In this case, it was too much sell pressure of $TITAN and it exceeded the protocol limitations and assumptions.

THE PEOPLE were selling too much.

RUGGED BY THE PEOPLE.

THE PEOPLE were selling too much.

RUGGED BY THE PEOPLE.

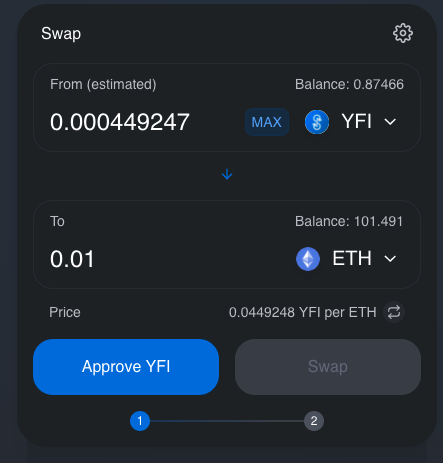

16/ Effectively 1 $IRON stablecoin was ~30% $TITAN and ~70% $USDC.

17/ The risk parameters were laid out. 1 $IRON can be redeemed to $0.71 $USD, as stated out on the fractional reserving documentation.

Turkish people have seen haircuts larger than 30% so not that bad.

Turkish people have seen haircuts larger than 30% so not that bad.

18/ On the other hand, you could lose quite a lot of money if you aped into $TITAN

Never buy assets that go up too fast and have pump characteristics. But this is not a scam either. This happens in all markets.

See: $GMC, $AMC, $DOGE, $SHIBA or LUMBER

Never buy assets that go up too fast and have pump characteristics. But this is not a scam either. This happens in all markets.

See: $GMC, $AMC, $DOGE, $SHIBA or LUMBER

19/ A better explain what happened with $TITAN in this capture by @dmccCT

https://twitter.com/dmccCT/status/1405359831792373760

20/ Was two billion dollars really lost? No.

Most of the investors had only paper profits on $TITAN. Somehow if you bought too late probably lost all of it. But there was never a two billion dollar inflow to $TITAN token, so by definition, you cannot lose two billion dollars.

Most of the investors had only paper profits on $TITAN. Somehow if you bought too late probably lost all of it. But there was never a two billion dollar inflow to $TITAN token, so by definition, you cannot lose two billion dollars.

21/ Also on $IRON, there is a bottom 70% reserve guaranteed.

22/ Then let's talk about algorithmic stablecoins!

Who is next in the line to go down with this fate.

ATTACK ON THE TITAN.

#AttackOnTitan #ShingekiNoKyojin #Shingeki #進撃の巨人

👇👇👇

Who is next in the line to go down with this fate.

ATTACK ON THE TITAN.

#AttackOnTitan #ShingekiNoKyojin #Shingeki #進撃の巨人

👇👇👇

23/ Historically, there has never been an algorithmic stablecoin that would have been successful long term.

But same can be said for all currencies.

We all die one day.

But algo stables tend to die quicker.

"Fail fast" as VCs, say.

But same can be said for all currencies.

We all die one day.

But algo stables tend to die quicker.

"Fail fast" as VCs, say.

24/ The first algorithmic stablecoin was @officialnubits from 2014.

So we have 7 years of history with algo stables.

So we have 7 years of history with algo stables.

25/ With algorithmic stablecoins, the issue is that they work, until they don't.

They all assume someone is buying the other side within certain risk parameters.

They all assume someone is buying the other side within certain risk parameters.

26/ When there is no one to catch the falling knife... well the knife falls.

27/ Thus the amount of collateral/reserves that can effective backstop the peg in the awful market situation, to cushion to crash, defines the quality of a synthetic or algorithmic stablecoin.

28/ Some other coins that could be at a similar risk of a bank run: $FRAX of @fraxfinance

($IRON was kind of a clone of $FRAX, but not sure if they used the same codebase or fork)

($IRON was kind of a clone of $FRAX, but not sure if they used the same codebase or fork)

29/ Here are some good remarks regarding $FRAX

https://twitter.com/traders_insight/status/1405292745393115136

30/ Hopefully, this is a good lesson learnt for all crypto people and algo stable developers.

But this was no rug.

But this was no rug.

31/ Other notes

👇👇👇

👇👇👇

32/ People at the gas station bar keep whispering the @ironfinance developers are actually the @value_defi team.

But like all things you hear at the gas station, do not take this as truth until the dev team confirms themselves.

But like all things you hear at the gas station, do not take this as truth until the dev team confirms themselves.

33/ Thank you for reading.

Now I will get back to the pussy.

Don't forget to subscribe to my newsletter at newsletter.capitalgram.com

Now I will get back to the pussy.

Don't forget to subscribe to my newsletter at newsletter.capitalgram.com

34/ CC and thanks for original research and pointing facts out to @JozoJesko

@traders_insight @senamakel @dmccCT @MrCoinnoisseur @brewhaus_crypto @zjdolan

@traders_insight @senamakel @dmccCT @MrCoinnoisseur @brewhaus_crypto @zjdolan

Ps. Update from the @IronFinance team

• • •

Missing some Tweet in this thread? You can try to

force a refresh