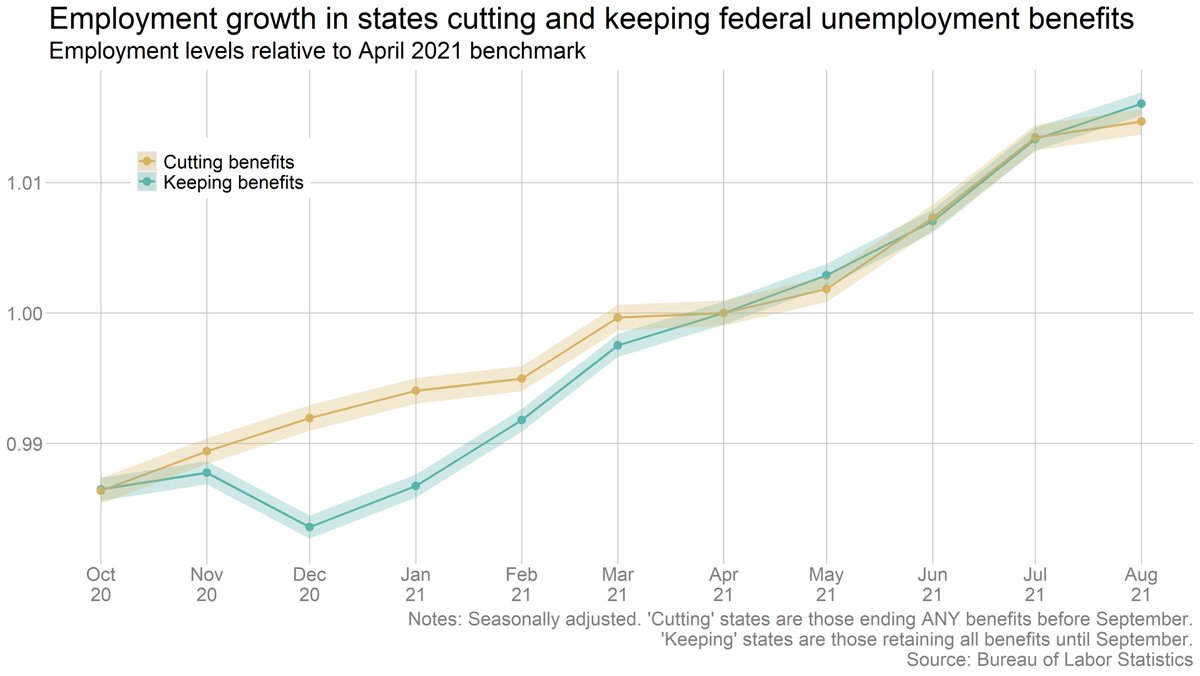

Did states that cut off expanded unemployment benefits early see a surge in job growth? We just got August data from @BLS_gov, and the answer still appears to be "no."

A thread updating this story: nytimes.com/2021/08/20/bus…

A thread updating this story: nytimes.com/2021/08/20/bus…

States that kept expanded unemployment benefits actually saw slightly *faster* job growth in August than states that ended all pandemic programs, though the difference was not statistically significant.

We see the same basic pattern if we instead compare states that kept benefits to those that cut off ANY benefits (i.e. including those that cut the $300 add-on but kept PUA/PEUC).

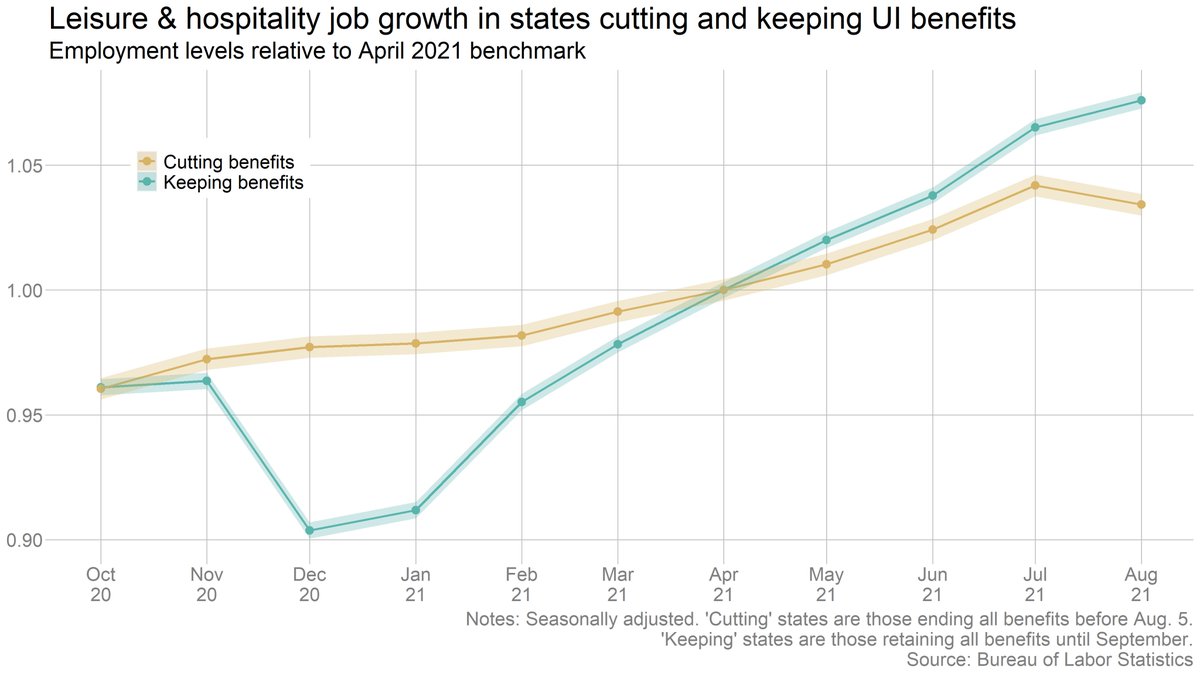

In states that kept UI benefits, employment in leisure and hospitality rose more slowly in August than in July. But in states that cut the benefits early, leisure and hospitality employment actually fell.

To be clear, we should not assume that UI explains that divergence. States that cut benefits have also seen bigger Delta surges (on average), which almost certainly had an effect on the hospitality sector. I'd love to see an analysis that attempted to control for that.

More generally, it's hard to draw firm conclusions about the impact of UI policy from state-level data. These states are very different, both before and during Covid.

States that cut benefits tended to have milder employment losses due to Covid in the first place, for example.

States that cut benefits tended to have milder employment losses due to Covid in the first place, for example.

We can try to compare pairs of states that had relatively similar employment experiences during Covid, to see what has happened since benefits were cut. This isn't a formal analysis, but it sure doesn't look like there has been a surge in employment in states that cut benefits.

This is consistent with research from @arindube and others who have found that cutting off UI had a fairly small impact on job-finding rates, and who have argued that the impact on aggregate employment would likely be even smaller.

nytimes.com/2021/08/20/bus…

nytimes.com/2021/08/20/bus…

I would emphasize that all of this evidence is preliminary. There will undoubtedly be more rigorous analyses as we get more detailed data. And we don't know what will happen as time goes on and people run through whatever savings they have left.

But the data so far seems pretty clear that there has not been the big flood of people back to work that some advocates for ending UI benefits were predicting. If there has been an impact on employment, in either direction, it has been small.

All data is availble from @BLS_gov here: bls.gov/news.release/l…

• • •

Missing some Tweet in this thread? You can try to

force a refresh