Financial History: Sunday Reads

*The Panic Series (Part III) - 1825*

• Latin American Bond Fever

• BoE & Lender of Last Resort

• Bond Issues for Fictitious Countries

• Widespread Banking Failures

• (Discount on New Course!)

investoramnesia.com/2021/09/19/the…

*The Panic Series (Part III) - 1825*

• Latin American Bond Fever

• BoE & Lender of Last Resort

• Bond Issues for Fictitious Countries

• Widespread Banking Failures

• (Discount on New Course!)

investoramnesia.com/2021/09/19/the…

Find the first two installments below:

Panic of 1792: America's First Panic

investoramnesia.com/2021/09/05/the…

Panic of 1792: America's First Panic

investoramnesia.com/2021/09/05/the…

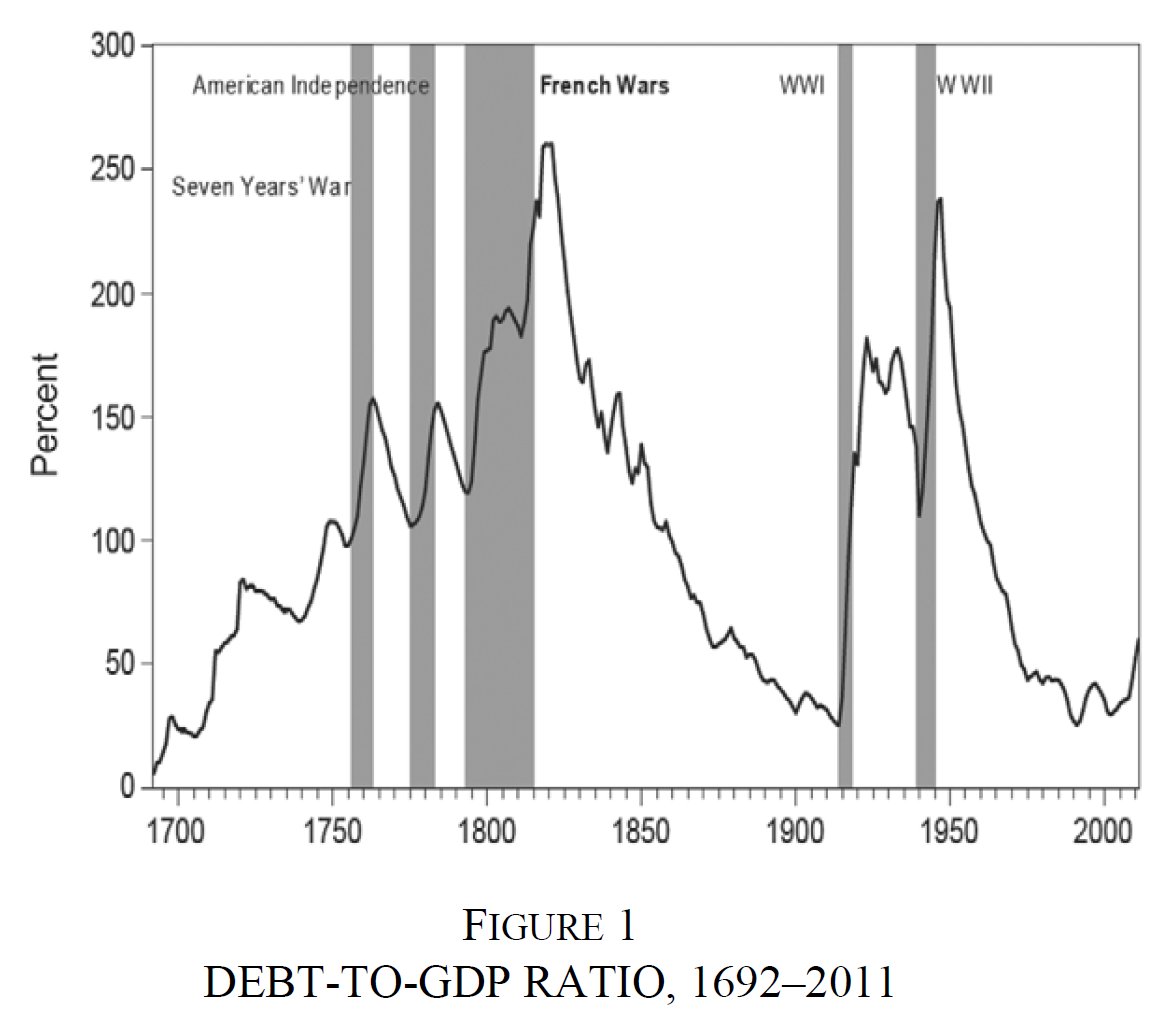

So far, each Panic Series post has made one thing clear: war is expensive.

In this case, the 1825 Panic begins with the end of The Napoleonic Wars.

To finance the conflict, Britain suspended convertibility of BoE notes into gold from 1797-1821.

In this case, the 1825 Panic begins with the end of The Napoleonic Wars.

To finance the conflict, Britain suspended convertibility of BoE notes into gold from 1797-1821.

The result? Soaring inflation and ballooning public debt.

When the Napoleonic Wars ended in 1815, prices were 22% higher than their 1797 levels.

Britain's Debt-to-GDP Ratio hit 226%

When the Napoleonic Wars ended in 1815, prices were 22% higher than their 1797 levels.

Britain's Debt-to-GDP Ratio hit 226%

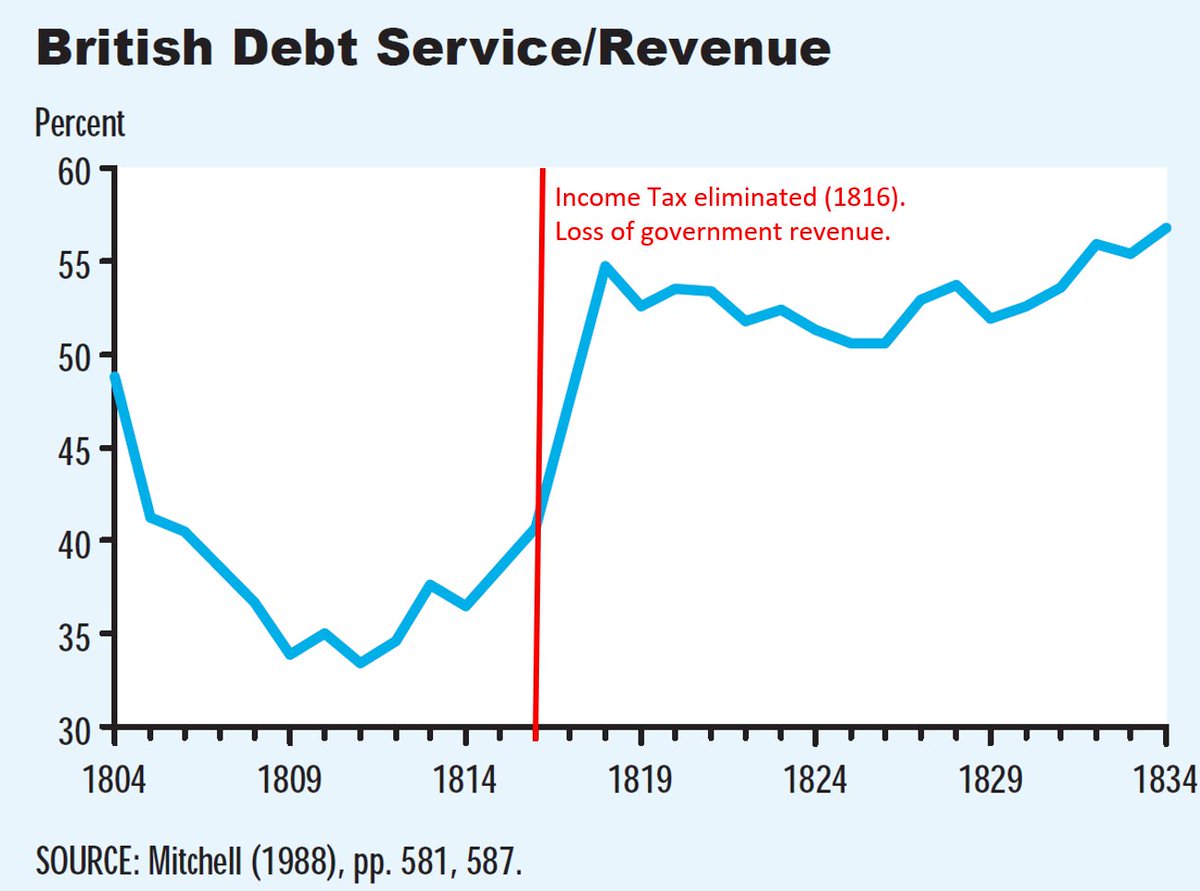

When the war ended, Britain's finances were not ideal.

Even worse, a key source of revenue had vanished when the national income tax was eliminated in 1816.

The income tax had represented 20% of the Treasury’s revenues. The gap in revenues / debt servicing costs is shown below

Even worse, a key source of revenue had vanished when the national income tax was eliminated in 1816.

The income tax had represented 20% of the Treasury’s revenues. The gap in revenues / debt servicing costs is shown below

To reduce costs, the British government pursued a strategy similar to Hamilton's in 1792: retiring and repurchasing high yielding bonds on the open market to issue new debt at lower yields.

However, this meant that investors were now forced to "reach for yield" in riskier assets as yields on consols were unattractively low.

Can you guess what happens next?

Can you guess what happens next?

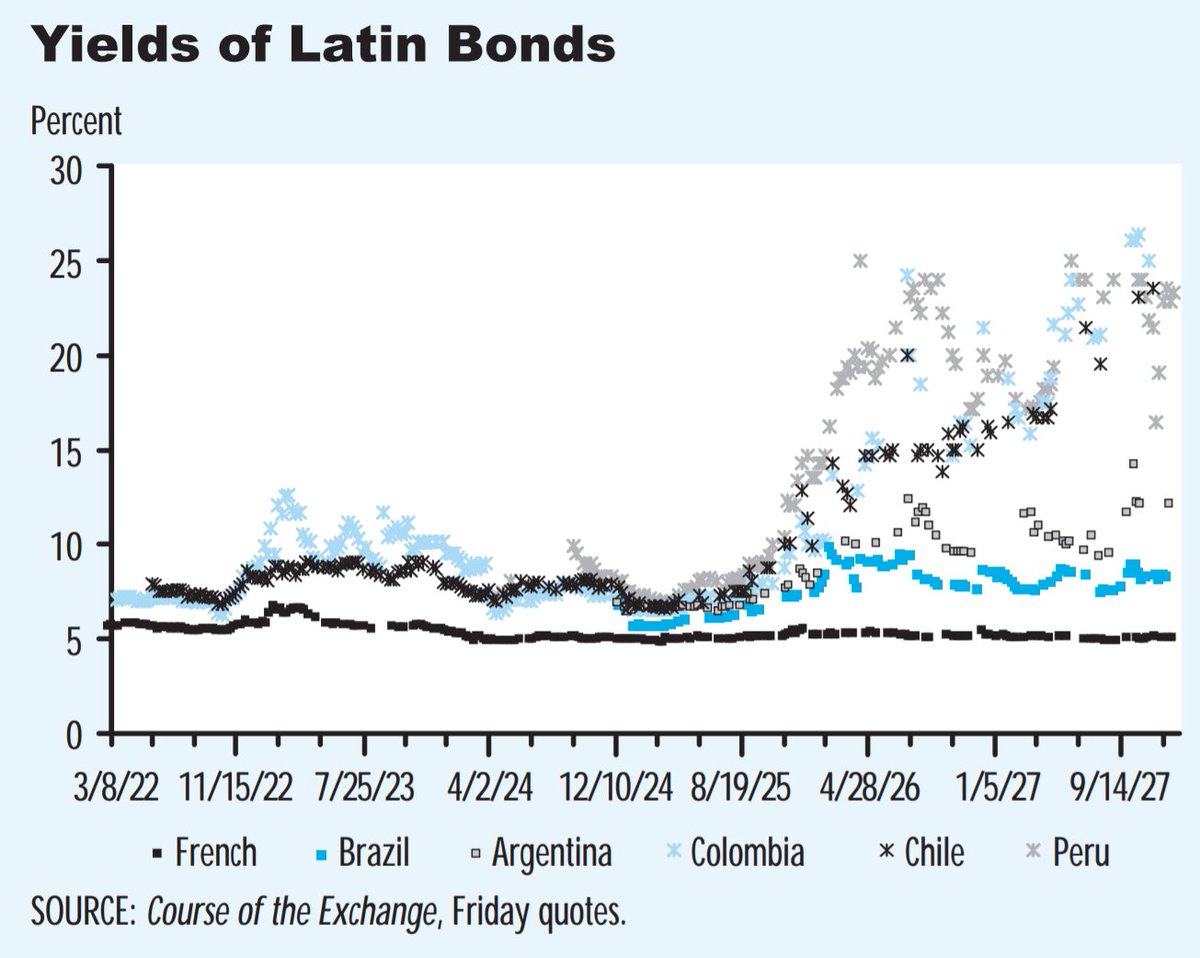

In 1825 the popular high-yielding assets were Latin American bonds.

Their sudden popularity stemmed from the fact that many countries had recently gained independence from Spain, and were issuing sovereign debt.

Their sudden popularity stemmed from the fact that many countries had recently gained independence from Spain, and were issuing sovereign debt.

These foreign bonds were being issued in London at a time when even tickers were not yet invented. This meant that British investors interested in buying Latin American bonds would have little-to-no information on the country... the perfect environment for a scam like Poyais..

• • •

Missing some Tweet in this thread? You can try to

force a refresh