Will Chinese government bail out Evergrande?

They shouldn't.

Here's why.

They shouldn't.

Here's why.

Housing price needs to come down.

China's been wanting to switch to domestic consumption led growth for many yrs. So far it hasn't happened (much).

How come?

The average Joe doesn't have enough money.

China's been wanting to switch to domestic consumption led growth for many yrs. So far it hasn't happened (much).

How come?

The average Joe doesn't have enough money.

Housing, the biggest spending item, is less & less affordable as price ballooned, esp the last 5 yrs.

If you can't even afford shelter, there's def no extra purchasing power to buy other stuff.

If you can't even afford shelter, there's def no extra purchasing power to buy other stuff.

Real estate price is fueling inequality and a popular discontent the CCP is looking to resolve.

There's many reasons why property prices went up so much. a) Loose monetary condition.

There's many reasons why property prices went up so much. a) Loose monetary condition.

b) Asset shortage in a growing economy that's not good at creating assets except real estate and stocks.

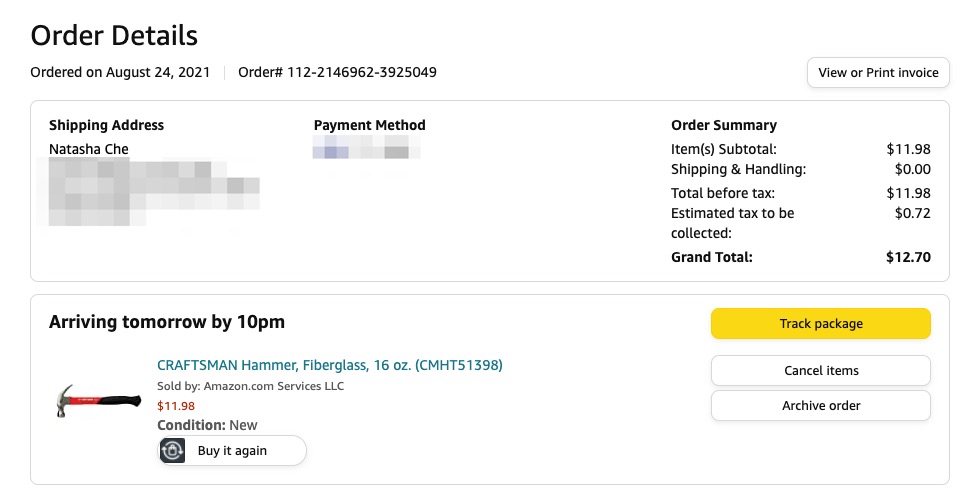

https://twitter.com/RealNatashaChe/status/1435316969998192643?s=20

c) Real estate developers like Evergrande use uncontrolled leverages and bid up land prices.

Why the leverages are so high is a long story. But nuf to say it's a main driver exacerbating the housing price problem.

Why the leverages are so high is a long story. But nuf to say it's a main driver exacerbating the housing price problem.

To sustain growth for the next decade China needs to resolve many structural problems in the economy.

Even though short term it will be painful, normalizing real estate prices so that domestic consumption power can be unleashed needs to be done. No question about it.

Even though short term it will be painful, normalizing real estate prices so that domestic consumption power can be unleashed needs to be done. No question about it.

Given the macro priority, it's only reasonable to let developers like Evergrande fail on its own.

Bailing this one out would only show companies that if they're "too big to fail", they will be saved, thus encourage more reckless risk taking.

(And if you don't think China is taking notes on the moral hazard consequence of US gov bailing out banks in 2008, you're mistaken.)

(And if you don't think China is taking notes on the moral hazard consequence of US gov bailing out banks in 2008, you're mistaken.)

Plus Evergrande is not the only one having problems. All the real estate companies in China operate on the same model-- build empires on borrowed money with little capital of their own.

If you save this one, a dozen more to come. When's the end?

But if you let this one fail, you show the others how they should behave.

But if you let this one fail, you show the others how they should behave.

A lot of people say Chinese gov has to save Evergrande cuz otherwise large market contagion will destabilize economy & cause uproar from population.

Luckily China is not a democracy and government is not beholden to voters.

Of course it needs to care about public sentiment, but the state actually has a lot more leeway than politicians in a democratic gov to make short-term tradeoff for long term gain.

Of course it needs to care about public sentiment, but the state actually has a lot more leeway than politicians in a democratic gov to make short-term tradeoff for long term gain.

Plus they have a great propoganda machine that is very effective at directing public sentiment.

Still, it would take real leadership from the top to not succumb to bailout pressure.

There'll be pain either way. It's not an easy choice at all.

That's why I said 'no bailout' is what the government *should* do, not necessarily what they *would* do.

There'll be pain either way. It's not an easy choice at all.

That's why I said 'no bailout' is what the government *should* do, not necessarily what they *would* do.

So the real question is: is Xi Jinping a courageous leader willing to take some calculated political risk for long term gain, or is he a pussy?

I'm inclined to bet on the former. But I can also be totally wrong. We'll see.

I'm inclined to bet on the former. But I can also be totally wrong. We'll see.

Like this? Don’t forget to

• retweet

• follow me for more ideas to help you become smarter, richer, freer 👉 @RealNatashaChe

• retweet

• follow me for more ideas to help you become smarter, richer, freer 👉 @RealNatashaChe

• • •

Missing some Tweet in this thread? You can try to

force a refresh