About Management and Risk, follow the Thread👇

1. Due to the Macro environment in the chain and the cyclical moment that #Bitcoin is in, I am leaving the more aggressive Risk Management in the Private Fund (BANCA2) that I manage.

1. Due to the Macro environment in the chain and the cyclical moment that #Bitcoin is in, I am leaving the more aggressive Risk Management in the Private Fund (BANCA2) that I manage.

2. Today we have positions in over 10 different crypto-actives, including the largest position in #Bitcoin .

The targets set are according to the expansions of my operating model, so they will only be hit when the market wants them.

The targets set are according to the expansions of my operating model, so they will only be hit when the market wants them.

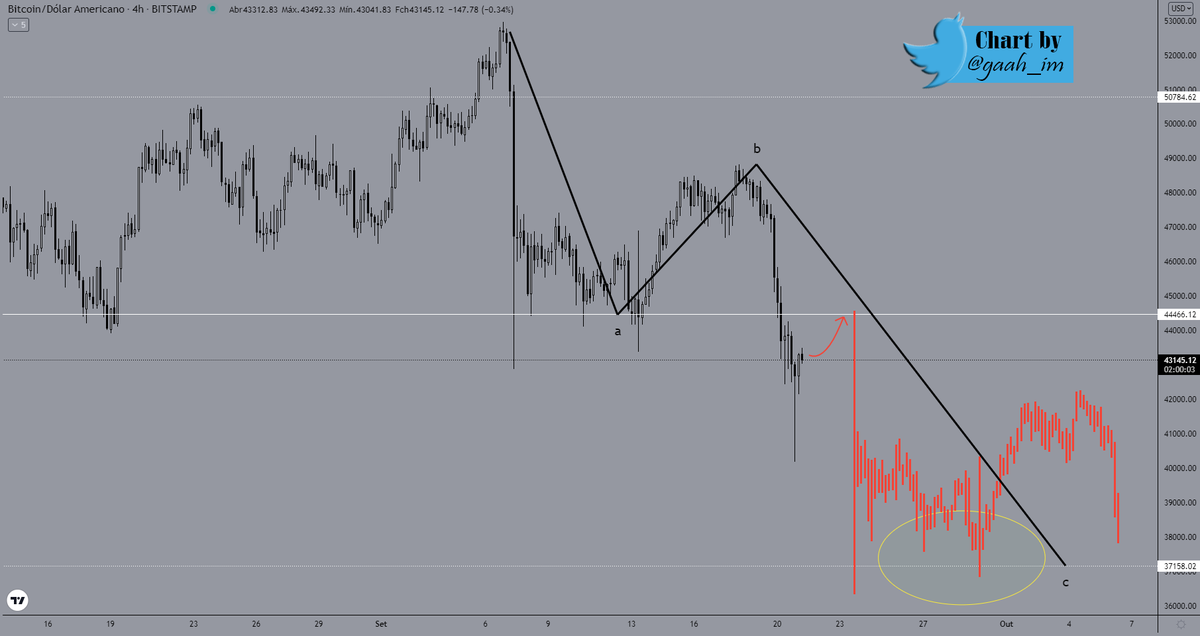

3. First target in 2 #Bitcoin operations were reached around $51,000 - $52,000

Still the Private Investment Fund has 45-50% of the dollar cash available for operational, plus that cash will go up if it needs it, as there is more liquidity in the Fund for this next leg up.

Still the Private Investment Fund has 45-50% of the dollar cash available for operational, plus that cash will go up if it needs it, as there is more liquidity in the Fund for this next leg up.

4. See that risk management in this market is more important than the technique itself. In a high volatility environment you should NEVER be 100% out or 100% exposed, but rather calibrate exposure according to cyclical momentum.

5. When #Bitcoin was being priced in April/May around $50k-$60k our exposure was 15-20%. After dropping levels down to $30,000 our exposure more than doubled, we literally bought the entire dip in various assets, including #BTC .

6. Now, time is on our side and we have the power to play at least 15-20% more liquidity in the market and increase positions.

7. On-chain analysis determines the direction of the market, not the up/down moves that will always occur. The focus should be on direction, so EVERY dip that comes along the way is a new opportunity to increase the position, as in our case!

8. There are odds #Bitcoin will test $37k (stealth point of the rebound) and should this happen, that is the level where most of the available liquidity will be consumed. If the market is not going to test it is no problem, ...👇

as we are also exposing ourselves at this current support region and $37,000 has already been part of our buying.

- Focus on direction so that in the short term you know what to do with volatility. 🙌🤜🤛

- Focus on direction so that in the short term you know what to do with volatility. 🙌🤜🤛

• • •

Missing some Tweet in this thread? You can try to

force a refresh